Opportunities In Growth-Oriented Silver Producers – Part 10

Excelsior Prosperity w/ Shad Marquitz – (06/05/2025)

It’s an exciting time to be invested in the growth-oriented silver producers, especially as silver futures price breached the $35 resistance again today for the 3rd time since last October, and went up earlier today and tagged $36.26 (a level not seen in 13years). As previously postulated, this is potentially going to be a “3 times a charm” moment where $35 silver starts acting more like a support level than a resistance level, and after minor resistance at $37-$38 is cleared, then there really isn’t much technical resistance until the all-time highs from both 1980 and 2011 at the $49-$50 level.

In light of this bullish breakout in Silver today, it seemed appropriate to publish an article on yet another growth-oriented silver producer held in the portfolio, that has had a fair bit of substantive recent newsflow.

Thus far in this series, we’ve reviewed a solid list of junior and mid-tier silver producers held in the Excelsior Prosperity portfolio:

Avino Silver and Gold Mines (TSX:ASM – NYSE:ASM) in [Part 1]

Guanajuato Silver (TSX.V:GSVR) (OTCQX:GSVRF) in [Part 2]

SilverCrest Metals (TSX:SIL) (NYSE:SILV) in [Part 3]… which was taken over earlier this year by Coeur Mining, Inc. (NYSE: CDE)

Impact Silver (TSX.V:IPT – OTCQB:ISVLF) in [Part 4]

Sierra Madre Gold and Silver Ltd. (TSXV: SM) (OTCQX: SMDRF) in [Part 5]

Santacruz Silver Mining Ltd. (TSXV: SCZ) (OTCQB: SCZMF) in [Part 6]

Endeavour Silver Corp. (NYSE: EXK) (TSX: EDR) in [Part 7]

Silvercorp Metals Inc. (TSX: SVM) (NYSE American: SVM) in [Part 8]

GoGold Resources Inc. (TSX: GGD) (OTCQX: GLGDF) in [Part 9]

Now it’s time to take another deep dive into a 10th silver mining stock for consideration.

In full disclosure, none of these companies are paying me to write them up in these Substack articles. These company writeups here on this channel are simply about the value proposition that I personally see in stocks held within my own personal portfolio, (so yes, I’m talking my book and am biased in that sense).

My goal here is to have these updates be informative and topical for readers of this channel; not just with the specific companies featured, but also in the broader way of thinking about doing due diligence, and the rationale behind positioning in these types of stories within the larger resource investing universe.

Similar types of approaches and key points made within them could also be applied for investing in other stocks within the sector.

So, while I believe these are quality companies, and compelling opportunities in their own right, please don’t get hung up on if you like the specific companies discussed. Instead, consider the broader points of attraction and some of the nuances around investing in this turbulent, complex, and volatile sector of junior mining stocks.

In this article we are now going to take a deeper dive into Americas Gold and Silver Corporation (TSX: USA) (NYSE American: USAS), as another growth-oriented silver producer, that also has excellent development projects and compelling exploration upside.

So, let’s get into it…

Americas Gold and Silver is a stock I’ve been following and trading for over a decade now, and I remember back when Scorpio Mining had spun out it’s Nevada assets into Scorpio Gold, and then combined its Mexican assets with U.S. Silver & Gold’s Galena mine and assets in Idaho back in 2014 to form what eventually became known as Americas Gold and Silver. (The official name change didn’t happen until May of 2015).

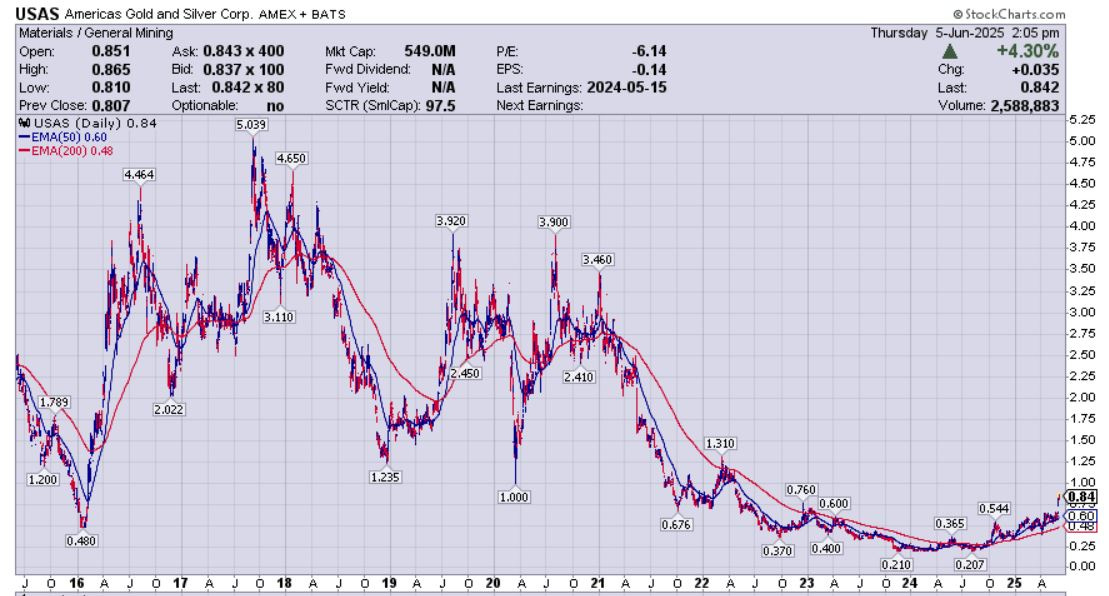

This this was a stock that I went into heavily towards the end of that year when the precious metals sector was absolutely in the full pain and despondency point of a real bear market. It was one of the stocks I mentioned holding my nose and buying in December of 2015, January of 2016, and February of 2016 over on the KE Report blog at that time.

I remember some posters heckling those of us that were discussing acquiring various PM stocks at that time for being fools and “throwing good money after bad.”

BTW - That is usually a good contrarian signal that one is on the right track and “buying low” when others are ridiculing you for buying a “hopeless sector that has lost investors money for years.”

Buying near the lows is always lonely (because the herd consensus is max bearish at that point), and it doesn’t ever feel good buying when prices are low. There is always that nagging feeling that prices could just keep going lower (and it is easy to get psyched out and believe “This stock or sector will never go up again…”)

Americas Gold and Silver was one of a handful of first big multi-bagger returns on a silver stocks that played out over those next 7 months in that 2016 sector surge.

I had done well in my first foray into the mining stocks in that move from 2010 into 2011, coming out of the Great Financial Crisis from 2008-2009, but that was nothing like what happened in 2016. It wasn’t just Americas Silver that was surging at that time… most PM stocks were surging… especially the silver stocks.

Truth be told… I had also scaled out of so much of that USAS position along its journey higher, that I had only a tiny amount of the initial position left that actually got roughly an 8-bagger. (but there were 2x, 3x, 5x, and 6.5x gains in different tranches and those are big wins in a stock people considered a low-quality producer at the time)

There was actually the potential for a full 10-bagger from the low at $0.48 to the high of that move to $4.46, so that was a nice big price range for investors to jump in and catch at least the meat of the move.

Further truth be told… I rotated those gains into other stock positions that were close to peaking out shortly thereafter in August of 2016. When those pulled back down for the next 2 years, it erased most of the gains I’d achieved in good trading. As the saying goes: “It’s not what you make; it’s what you keep.”

I actually would have been better served to have kept them in Americas Gold and Silver because it had a second wind in 2017, unlike most of the PM stocks.

Personally, I just wasn’t expecting the consolidation of that move in the precious metals sector to take the balance of 2016, all of 2017 (although there were tradable rallies along the way), and most of 2018. At the time in the summer of 2016, nobody was really warning about a 2-year corrective consolidation period across the sector.

I’m leading off with that historical story to illustrate a few key investing lessons I learned the hard way:

These torqued up smaller silver producers can run much higher than most people (even PM bulls) are expecting in a hot market

It is difficult to let your winners run while holding onto a full position, when in the thick of the bull market. I know of incredibly few people that actually do it. (BTW - the ones that have held from lows to takeover highs were company management teams that were forced to hold their share through the buyout as their exit strategy. Most of the traders in their stock had exited long before they could, and so it was their inability to sell, not their trading savvy, that gave them life-altering returns.)

The other side of that point though, is that most junior resource stocks don’t go up forever, and what goes up also comes back down. So pulling profits early is still far better than watching paper profits evaporate in a “round trip” trade.

If you make a winning trade that gives you multi-bagger returns, don’t feel compelled to immediately deploy it right back into a sector rally that may be getting long-in-the-tooth. It’s OK to move those funds to cash and keep it there to be opportunistic at a later date.

Back to Americas Gold and Silver though, I’ve position-traded the stock for many years since that time period, but would note that was much easier in 2017-2020, but then starting in 2021 it became a very challenging stock to trade, and was in a general downtrend for the last few years.

I had a mixed journey in USAS, where I made lot of money in the stock for a number of years, but then ended up making a couple bad trades and had to sell those for tax loss purposes in 2022 and 2023.

In 2024 I got reallocated to USAS in March, but had reduced it down to just swing-trading and position-trading around small positions.

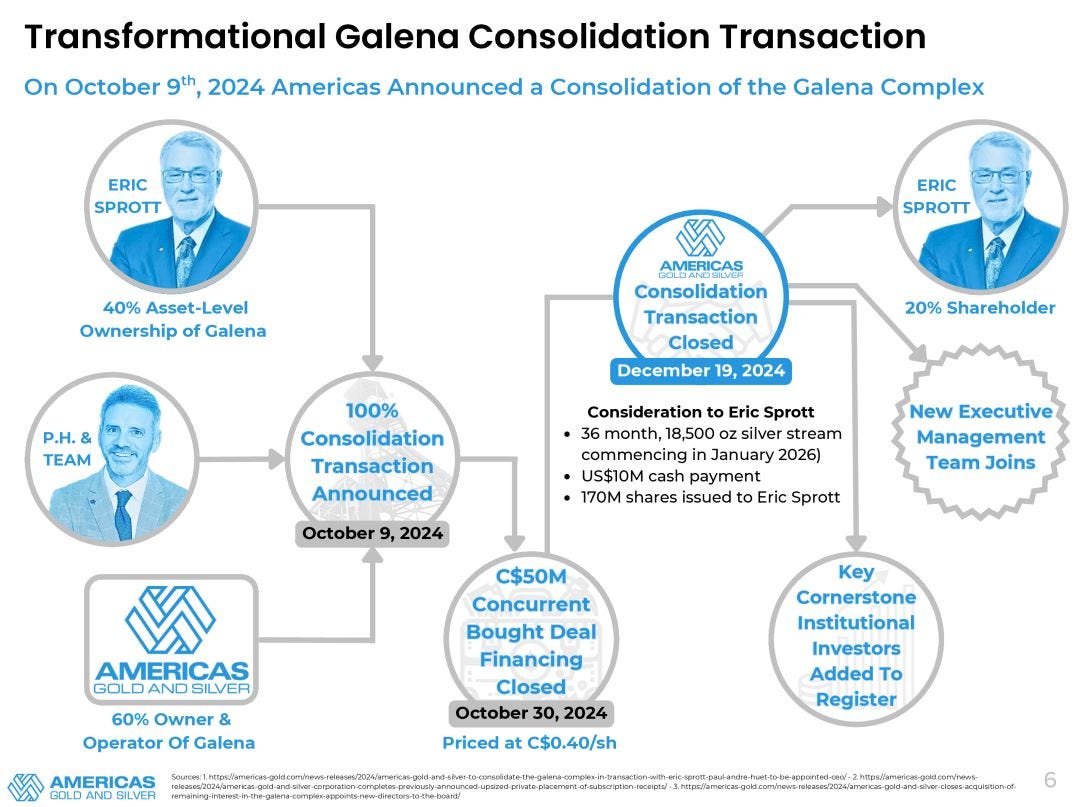

Overall, I’d mostly lost interest in it, that is until I saw a key news release from the company on October 9, of 2024, announcing a transaction unwinding Eric Sprott’s 40% stake in Galena under different terms, and the addition of Paul Huet as the CEO, (due to Eric’s insistence).

Americas Gold and Silver to Consolidate the Galena Complex in Transaction with Eric Sprott; Paul Andre Huet to be Appointed Chairman and Chief Executive Officer

“Americas Gold and Silver Corporation is pleased to announce that it has entered into a binding agreement with an affiliate of Eric Sprott and Paul Andre Huet under which Americas will acquire the remaining 40% interest in the Galena Complex in Idaho, USA to consolidate the current Galena joint venture.

Upon the closing of the Acquisition, Paul Andre Huet will be appointed Chairman and Chief Executive Officer of the Company.”

With Paul Huet at the Helm I had done really well 2 times previously. The first time getting into Klondex Mines back in the day before it was acquired by Hecla Mining, and then a second time in Karora Resources ’s big run up until their eventual takeover by WestGold Resources last year. If he was coming in to right the ship in Americas Silver then that had my attention. People talk all the time about backing winning jockeys, and I was ready to do so once again with Paul.

I do really respect the ability of Paul to assemble a winning team, to restructure a company, and to put in systems within a business to optimize operations.

The other part of that October 9th news that really stuck out to me was that Americas Gold and Silver was buying back that 40% of Galena from Eric Sprott. I wanted to see the Company control 100% of that high-grade silver and base metals asset in Idaho, if they were going to have bigger leverage to the silver price moves in this coming cycle.

Inside that press release they did a great job of summarizing why the consolidation of Galena made sense, and it’s a good primer on the project:

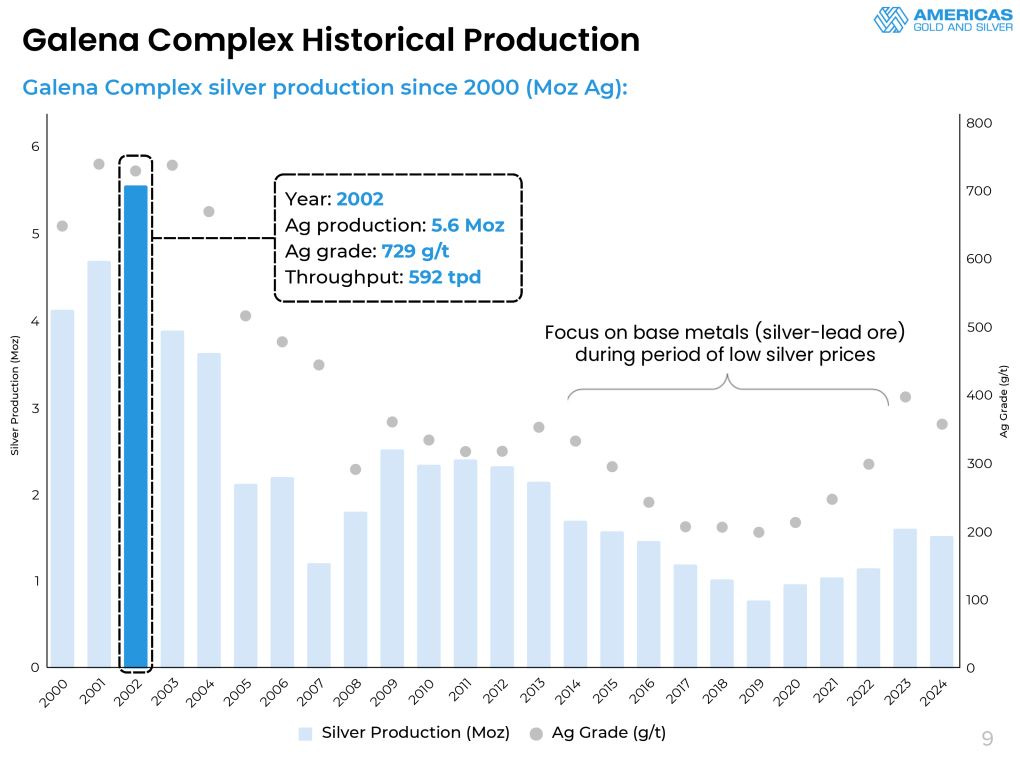

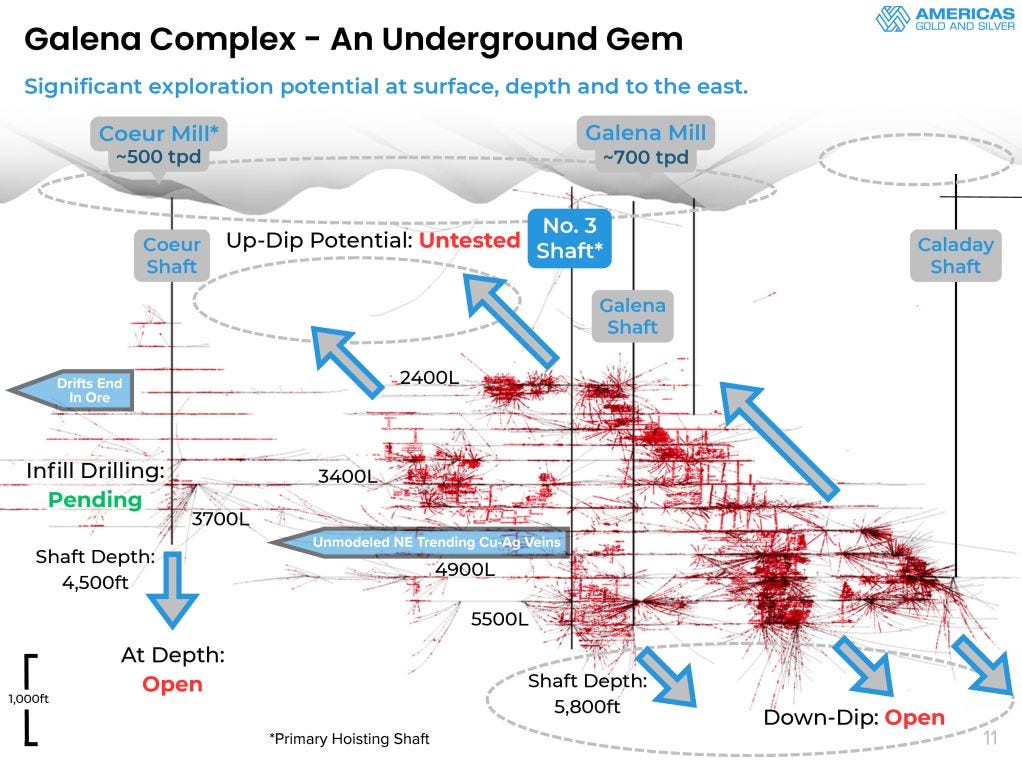

“Consolidation of Galena: Galena is located within the prolific Silver Valley in Idaho and is one of the largest underground, high-grade, operating silver mines in North America, having produced over 240 million ounces of silver with peak production in excess of five million ounces of silver per annum in the early 2000s. Consolidation of the joint venture will streamline operational and financial decision making, providing for a focused vision at Galena centered around optimizing and expanding the operation through the utilization of existing infrastructure. Galena is expected to be a long-term cornerstone asset supported by a robust reserve and resource base, excess mill capacity, and opportunity to grow through future exploration success both underground and potentially at surface where limited exploration drilling has been completed.”

I view this Galena consolidation, while keeping Uncle Eric involved as a strategic shareholder, as a seminal moment for Americas Gold and Silver. Now it can really stretch its legs as a silver producer in this evolving precious metals bull market that is really starting to pick up the pace.

If the company can either keep raising the average grade or increase the throughput to go from 1.7 million ounces with approximately 3.7 million ounces of silver equivalent (with the lead and zinc co-credits), up to somewhere like 3-5 million ounces of silver and maybe 1-2 million more AgEq ounces from the base metals, then I could see this stock really start to rip.

It is unclear whether that is probable at this point, but I do believe the case could be made to increase production over the next few years. This is the primary reason I’m including this company here in this series on “growth-oriented silver producers.”

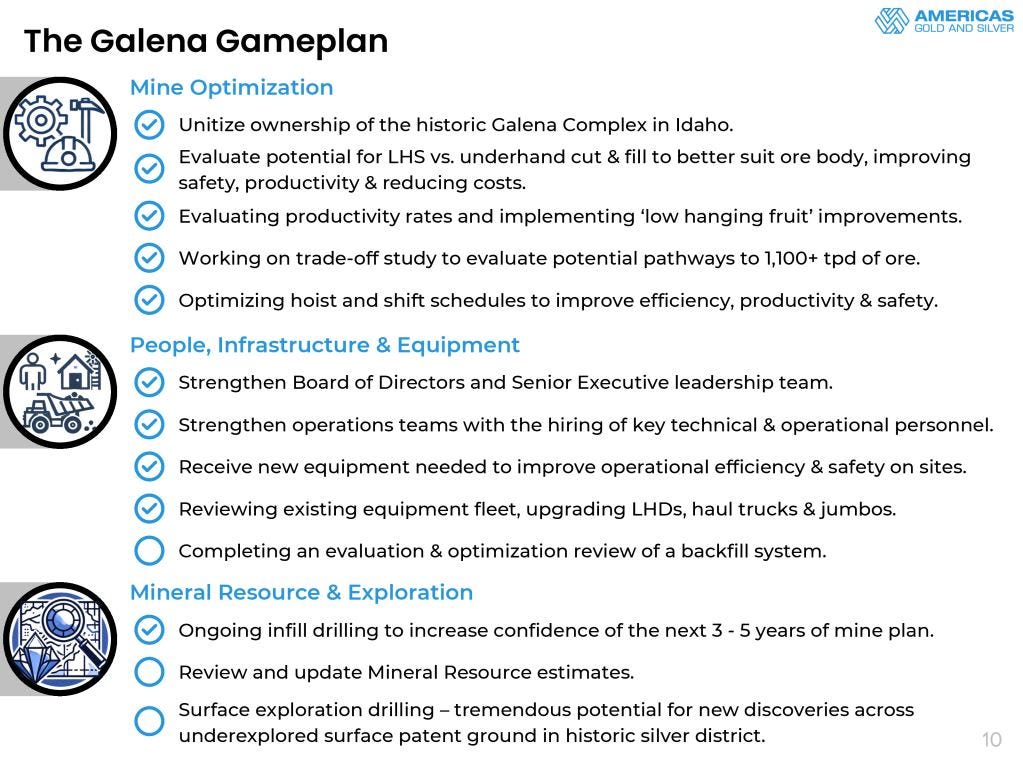

In addition to the mine optimization through potentially more effective mining approaches, better hoist scheduling, and increased throughput, I like that the company is investing in the right kind of people and equipment necessary to properly execute on this plan.

The other area for potential growth is exploration. It is nice to see a focus being put on new discoveries on surface and at depth, in addition to the infill drilling they need to do for resource definition and mine planning confidence.

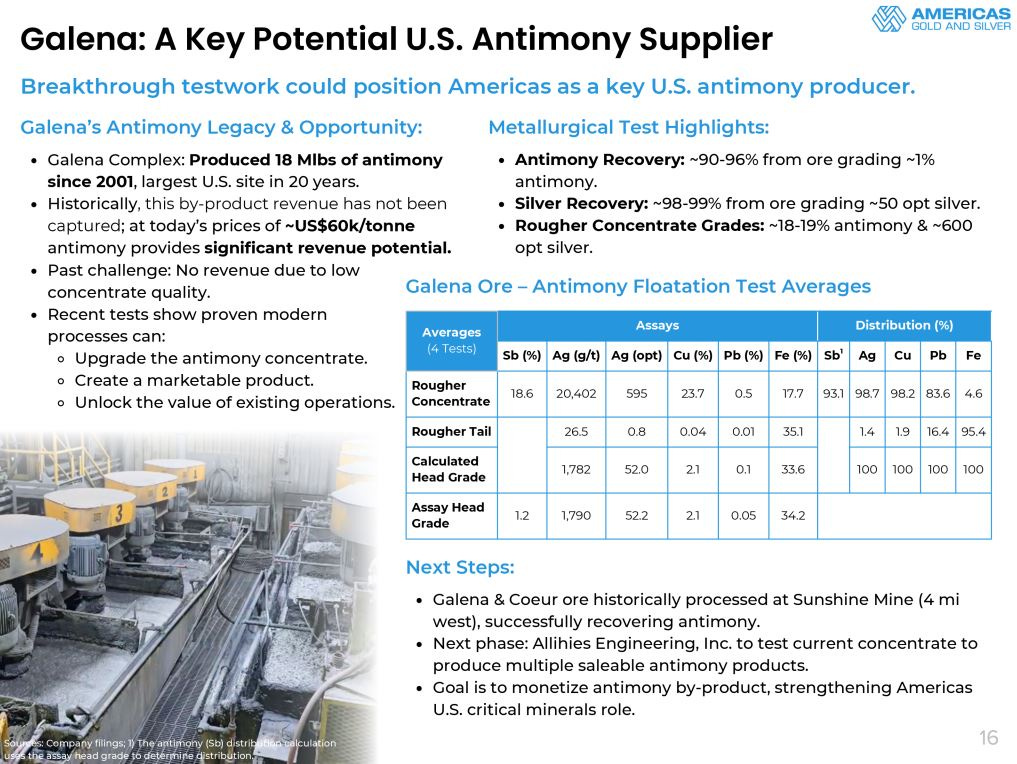

But wait…. there’s more… Now they are considering going back into Antimony production:

This antimony production angle is not factored into my current investment thesis, as I’m here for the silver upside. Having said that, I absolutely recognize how it could be a nice co-credit metal, along with the zinc and lead.

Antimony also puts it on the radar of both the government and investors seeking out domestic sources of critical minerals.

Metallurgical Testwork at Galena Complex Demonstrates Over 90% Antimony Recovery Supporting Potential Near-Term Primary Antimony Production in the United States - May 15, 2025

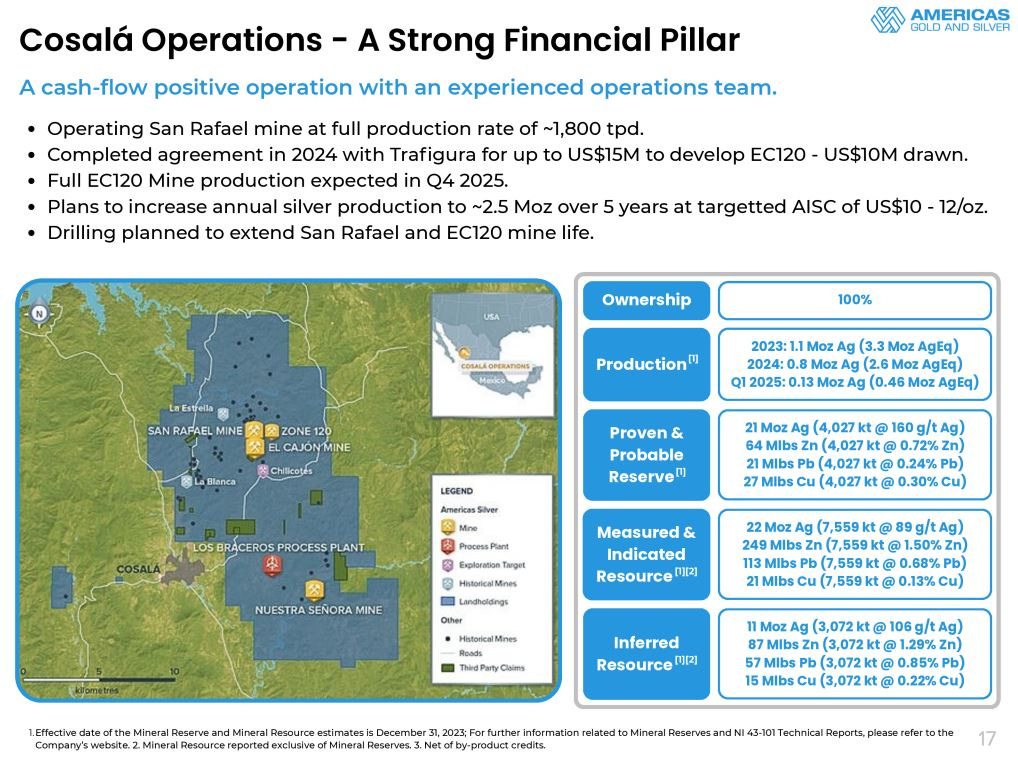

Now let’s pivot down to the mining operations in Mexico:

The Mexican production and development assets as the Cosalá Operations represent consistent production for the company, with upside growth.

The other area of growth here is at the The El Cajon Mine & Zone 120 ('EC120'). This silver-copper rich deposit is projected to have all-in sustaining costs (“AISC’) of $10.80 per silver ounce, by utilizing some other existing infrastructure already in place at the larger Project.

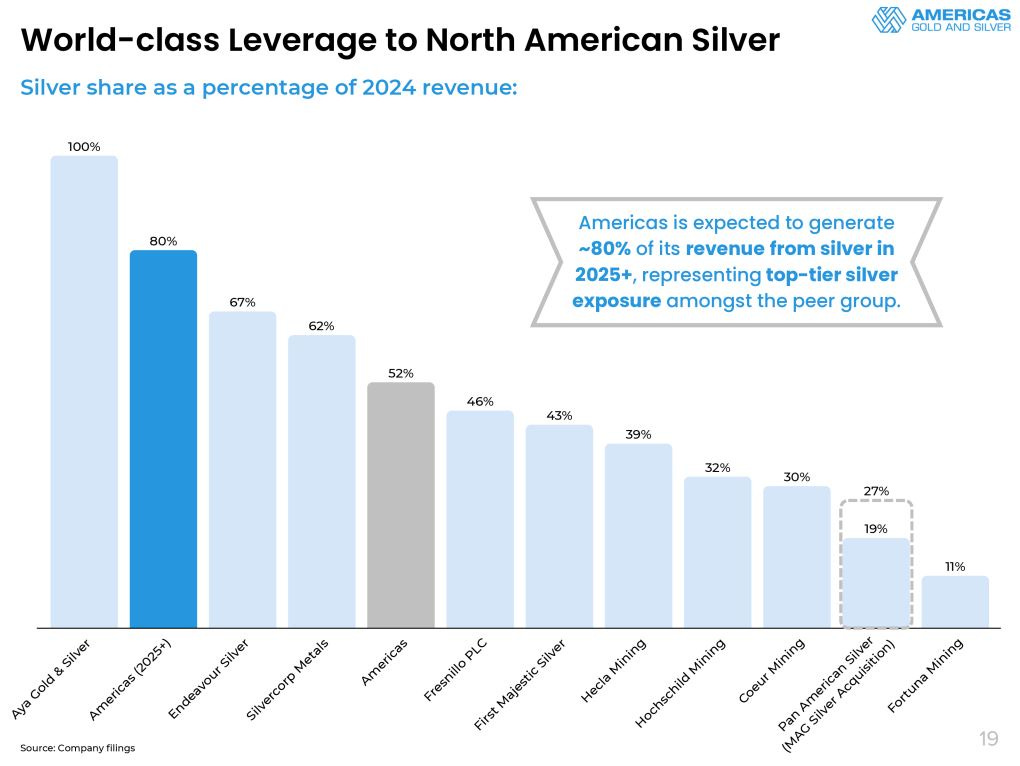

I also like that by flexing up the silver production at Galena and having 100% control of that project, in tandem with the EC120 zone at Cosalá, that it takes the silver production up to close to 80% of the overall metals mix for this year.

That is the kind of leverage to silver that I want to see in a “silver stock.”

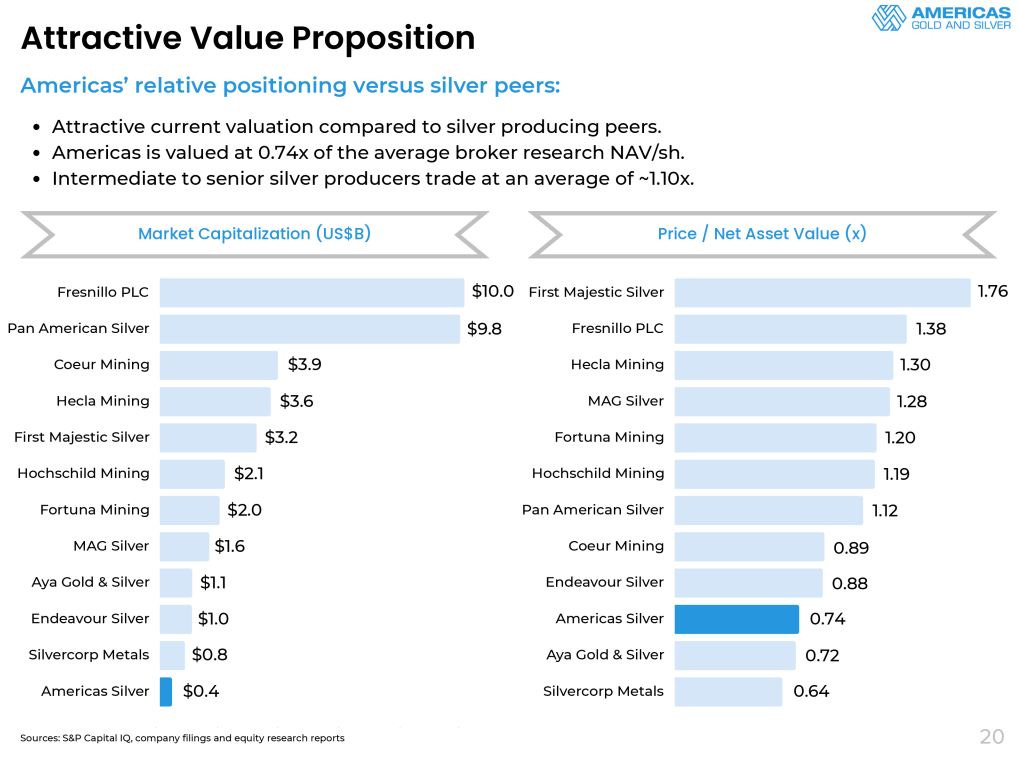

As for a rerating value proposition, I do believe a domestic primary silver producer, with zinc, lead, copper, antimony credits can fetch a higher multiple in the P/NAV than what USAS currently has, even if they didn’t have any production growth or exploration success. The growth initiatives will be the accelerant though.

As a final cherry on top, the Company announced a transformational restructuring of the debt and balance sheet, along with an offtake agreement just earlier this week.

Americas Gold and Silver Announces Transformational US$100 Million Debt Financing and Secures Multi-Metal Offtake Agreement for Galena Concentrates - June 3rd, 2025

Paul Andre Huet, Chairman and CEO, commented: “Today’s announcement represents a major milestone for Americas Gold and Silver shareholders. The culmination of months of work, the $100 million in non-dilutive debt financing will allow us to both aggressively pursue our capital development spending at the Galena Complex and further strengthen our balance sheet. The debt financing is critical to our major growth plans at Galena which include the reintroduction of Long Hole Stoping and associated underground development, continued major equipment purchases and upgrades to the No. 3 shaft. The projects to be executed are driven by the results of our materials handling trade off studies completed over the course of the year to date, all focused on boosting productivity underground and efficiency in our hoisting schedules. Alongside our lender, we carefully structured the Term Loan Facility into three tranches to match the pace of our capital plans over the growth period.”

“Regarding our future offtake strategy, I am very pleased to have closed a strong agreement at very competitive terms with Ocean Partners for treatment of up to 100% the precious and base metals concentrate produced from our Galena Complex at Teck’s Trail Operations. The Agreement reinforces a robust strategic relationship to recover a wide variety of metals from the polymetallic concentrates produced at our operations at a world class facility in close geographic proximity to our operations. Guaranteeing processing capacity at a nearby smelter is critical as the Company executes its plans to significantly increase silver and by-product metal production over the next several years.”

The company released a nice summary “Highlights In 2025 So Far” linked below:

https://mailchi.mp/americas-gold/newsletter

The market seemed to really like this news of the debt refinancing, investment into the Galena assets, and the future clarity from the new off-take agreement.

I don’t know if this stock can do another 10x move, like back in 2016, but a move from the August 2024 low of $0.2075 up to a level of $2.075 over the next 18 months doesn’t seem out of the question to me.

Now at $0.84, where it closed this afternoon, the stock has clearly already kicked off the next phase of it’s run. While it has already moved a lot, I think it has a lot of room to keep on running.

My personal thesis is to hold a position in USAS over the next couple years, until it makes a move towards that $2 level… especially if we see silver make a run at the all-time high level of $50 over that period of time.

{This is not investing advice, and I’m not an investment advisor. You should talk to a qualified investment advisor for reviewing those kinds of financial decisions, and consider your own risk/reward tolerance levels and investing goals. I’m merely sharing my own investing thesis here and what I’m doing in my own portfolio for entertainment purposes}.

UPDATE on 06/24/2025:

Paul Huet, CEO and Chairman of Americas Gold and Silver, joined me for a comprehensive overview of their producing Galena Complex, located in Idaho, USA; and the Cosalá Operations, located in Sinaloa, Mexico. We got into their plans for growth in both areas operationally and through exploration, the ability to add in antimony, copper, and gold credits to their primary silver production, new investments in equipment at site, and new members of the management team and board.

Americas Gold And Silver – Key Transactions To Transform The Growth Of Silver and Critical Minerals Production At The Galena Complex and Cosalá Operations

We started off unpacking the big news on October 9th, (that closed in December of 2024), that the Company acquired 100% ownership at the Galena Complex, in a transaction with Sprott. This was a key transformation for the company giving it the full torque to higher silver prices, now that it has 100% ownership at Galena.

The company has many ongoing initiatives to ramp up production here investing in a fleet of new mobile equipment, an upcoming project to upgrade the hoist at the No. 3 shaft in Q4, the move to Long Hole Stoping as a mining method, the capacity at their 2 mills to accept larger amounts of throughput as mining expands, and the incorporation of new management and operational personnel.

Then we got into the news from May 15th where the Company also announced promising results from recent metallurgical testing, confirming high recoveries of antimony alongside strong silver and copper recoveries from ore currently being processed. Until recently the company was not getting paid for antimony or copper or gold, but that will be changing based on a new off-take agreement recently signed.

This transitioned the conversation over to the news out on June 3rd, which announced the arrangement of a US$100 million of senior secured debt facility to be provided by a third party to be used primarily to fund growth and development capital spending at the Galena Complex. Paul outlined how this will allow the Company to both aggressively pursue their aforementioned capital development spending at the Galena Complex and further strengthen their balance sheet.

Next we shifted down to the Cosalá Operations in Mexico, with the operating San Rafael and El Cajon mines, which has been critical to getting the company through tougher markets over the years. The Company is investing in exploration to extend the San Rafael mine, and importantly tunneling over into a new area of the El Cajon mine called the EC120 mine, which will now see increased silver production in the years to come. This brought up the point that this company is one of the few North American silver-focused producers with the objective of over 80% of its revenue generated from silver by the end of 2025.

We reviewed a number of other key management and board members backgrounds, many of which having been part of the successful turn-around and expansion of Klondex Mines and Karora Resource before they were taken over by senior producers. We also touched upon the new financial strength of their balance sheet, the influx of strong institutional support, and the key catalysts on tap for the balance of this year and moving into next year.

Well, that wraps us up for this article on yet another growth-oriented silver producer, that to my eyes has a very bright next 2-3 years in front of it.

Thanks for reading and may you have prosperity in your trading and in life!

Shad