Opportunities In Growth-Oriented Gold Producers - Part 10

Excelsior Prosperity w/ Shad Marquitz (03-29-2025)

I’m happy to report that we are diving back into more opportunities within the segment of “growth-oriented junior gold producers.” Throughout 2024 we covered some very interesting companies thus far in this series, and it turned out that they were very active with newsflow in the gold mining sector. This series will continue delving into many more active companies with catalysts like this here in 2025.

If one thinks about at the huge pool of over 1600 precious metals mining stocks, then it is validating that the 9 or so gold companies we’ve talked about thus far in this series have actually been a big portion of the movers and shakers for mergers and acquisitions in the sector over the last year.

Some of those featured companies were acquired: (Karora was bought by Westgold, then a few weeks after positioning in Argonaut it was scooped up by Alamos, and the Argonaut spin-co Florida Canyon was split up in acquisitions where Heliostar got their 2 Mexican mines, and Integra got their mine in Nevada)

Some of those featured companies have been the acquirers: (Calibre acquired Marathon, Equinox acquired the other 40% of it’s Greenstone Mine in a competitive bidding process from Orion, Mako took over both Goldsource and the Moss Mine from Elevation, and Minera Alamos took over Sabre. Then, most recently, two of these companies also announced a merger Equinox + Calibre).

In full disclosure, none of these companies are paying me to write them up in these Substack articles. These company writeups here are simply about the value proposition that I personally see in stocks held within my own personal portfolio, (so yes, I’m talking my book and am biased in that sense).

My goal here is to have these updates be informative and topical for readers of this channel; not just with the specific companies featured, but also in the broader way of thinking about doing due diligence, and the rationale behind positioning in these types of stories within the larger resource investing universe.

Similar types of approaches and key points made within them could also be applied for investing in other stocks within the sector.

So, while I believe these are quality companies, and compelling opportunities in their own right, don’t get hung up on if you like the specific companies discussed. Instead, consider the broader points of attraction and some of the nuances around investing in this turbulent, complex, and volatile sector of junior mining stocks.

In prior updates on this Substack channel, we have briefly mentioned the acquisition by Minera Alamos of Sabre Gold. In this article we are now going to take a deeper dive into Minera Alamos, as another up-and-coming junior gold producer, that also has excellent development projects and compelling exploration upside.

So, let’s get into it…

_________________________________________________________________________

I’ve been invested in Minera Alamos Inc. (TSXV: MAI) (OTCQX: MAIFF) since 2016, cycling through many trades in the stock, as the share price has zig-zagged higher since then roughly about 3-fold. Because I had been following Argonaut Gold for some time, it then came to my attention that Darren Koningen was a founding member and VP Mine Development of Castle Gold Corp. and he was integral in the development and commissioning of the El Castillo heap leach gold mine in Mexico. Castle Gold was subsequently acquired by Argonaut Gold Inc. in 2009 for C$130M. Darren had moved over to the helm of Minera Alamos, to repeat a similar business strategy, and that had my attention and got me into position initially.

In 2018, a transformative event in the company history transpired where Minera Alamos and Corex Gold merged to form a multi-asset, Mexican gold development company. This brought into the Minera Alamos portfolio the Santana Project, which was developed into the first producing gold mine for the company.

Santana is the current source of revenues being generated by the Company.

Minera Alamos and Corex Gold Combine to Create A Leading Mexican Gold Company - January 30, 2018

https://mineraalamos.com/site/assets/files/3665/2018jan30.pdf

Doug Ramshaw, the current President & Director of Minera Alamos, at the time of that merger was the CEO and President of Corex Gold. I thought it was fantastic that he and Darren split the roles after the merger, where Darren did more of the operations as the CEO, and Doug focused more on capital markets at the President. I had been following Doug’s work back since we were part of private channel on Ceo.ca that was focused on zinc. He posts as @TheGalvanizer on that platform, and he was Director of Vendetta Mining (a lead-zinc company) at the time. Doug was also a Director of Great Bear and is currently a Director of District Metals, both companies we had often on the KE Report over the years.

It was back in 2016 (or maybe 2017) and I had a lot of questions about base metals, specifically zinc, which is not historically a widely-discussed area of the resource investing sector. Doug took time, via commenting through ceo.ca to educate me and answer some of my questions directly in that private zinc community, along with many other investors questions through his posting there. Topics would get into the nuances of metals recoveries in different concentrates, deleterious elements in some concentrates, clean concentrates versus dirty concentrates, smelters that blended concentrates, etc… it was immensely helpful and very kind on his part and many other wise mentors there to share their insights with us plebs.

I’ve never forgotten how down-to-Earth and genuine that Doug was towards people that were essentially anonymous online forum members. He took time to respond to questions that were asked in earnest, in the hopes of helping people to be better-informed investors. This really stood out to me, that someone on the management team and boards of public companies was fielding questions and comments from us in the peanut gallery. That earned my respect…

I wish more company executives would spend maybe just an hour or two per week on public platforms, helping resource investors learn and grow in their knowledge in this sector; because it is information rich, dense material, and at times somewhat opaque for outsiders looking in. I think this was the original vision of “CEO”.ca, that CEOs of public companies would mix and mingle with retail investors, like they would at a conference. Of course, that is not for the meek of heart, as those chat forums can be overly confrontational at times. Doug has contributed greatly to many investors’ journeys by sharing his insights, clarifying confusing topics, and keeping it real. This has been greatly appreciated by many.

Over the years, we’ve also interviewed Doug over at the KE Report to give us periodic updates on Minera Alamos around important news and key milestones achieved along the journey. I find Doug to be a class-act, and one of the good-guys in the mining sector, and the kind of candid and transparent corporate officer that more management teams should aspire to emulate.

Doug also has purchased a very large amount of (MAI.V) stock in the open market, and put himself in alignment with other shareholders (putting his money where his mouth is). The point being: We hear all the time about filtering through companies looking for quality management teams. Well, if having a quality management team that you can trust to make decisions that they believe are in the best interest of shareholders is so important, then I personally rest easy knowing that Doug Ramshaw and Darren Koningen are guiding the direction of this company. Enough said.

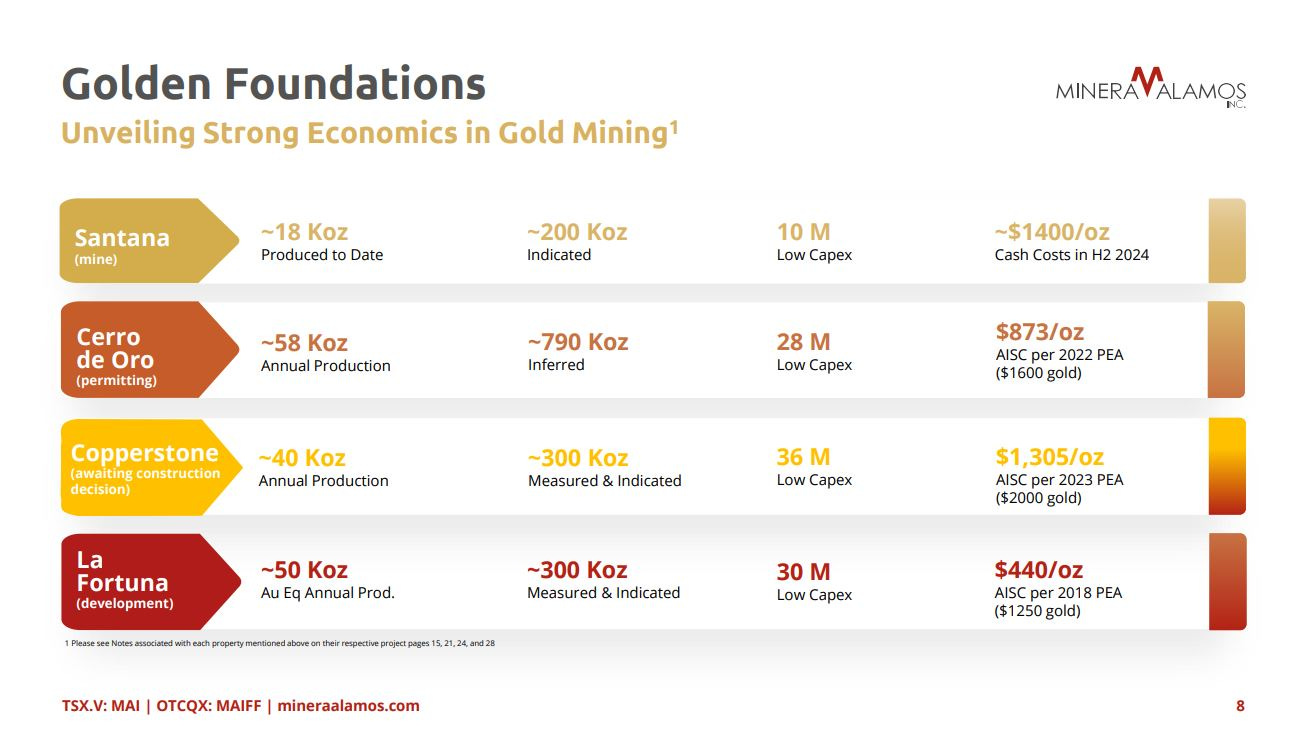

Now let’s dive into the pipeline of production and development projects, the mineral resources in place, and the projected timelines to grow production over time from the current production profile of 20,000 ounces of gold per year, with a sightline to 150,000-170,000 ounces of gold per year just a few years out. This aggressive future growth strategy is precisely why Minera Alamos is being featured in this series.

There have been 3 primary assets in Mexico (Santana, Cerro de Oro, and La Fortuna) that have made up the foundation of Minera Alamos, since the Corex merger in 2018.

Their 4th asset, the past-producing Copperstone Mine in Arizona, was just recently acquired through the merger with Sabre Gold Mines Corp. (TSX: SGLD) (OTCQB: SGLDF), in early February of this year.

It’s important to note that these 2 transformational acquisitions are indicative of the initial resource growth of the company, but now they are focused on translating that into production growth. Growth on growth….

Their business model is to now grow organically through low capex intensity development and builds for mines #2, #3, and #4.

· (Santana) - 1st mining operation, currently in production, heading to Phase 2.

· (Cerro de Oro ) - 2nd planned mine in development stage, awaiting final permits (PEA was completed 2022)

· (Copperstone ) - 3rd planned mine, permitted and pending construction decision (updated PEA just released in March 2025). It is possible this could be developed 2nd if the permits for C.d.O are delayed. They may also be developed in tandem.

· (Fortuna) - 4th planned mine with permits, awaiting resource expansion prior to construction decision. Likely still a few years out.

Let’s have a look at the first mine into production – Santa.

This is currently a smaller mine, but it was a very inexpensive mine to bring into production, and the first domino to fall, in a larger plan.

We don’t have the Q4 and full-year 2024 numbers yet (and I’ll update this article once we do), but for now we can review the dense about of information shared in the Q3 operations update. For context the mining operations had been scaled back some with residual leaching in place, and were ramping back up the middle of last year. So, the third quarter was the first time we saw a full 3-month period of operations from the Nicho Main Zone.

Operations Update and Q3 Financials - December 2, 2024

https://mineraalamos.com/news/2024/operations-update-and-q3-financials/

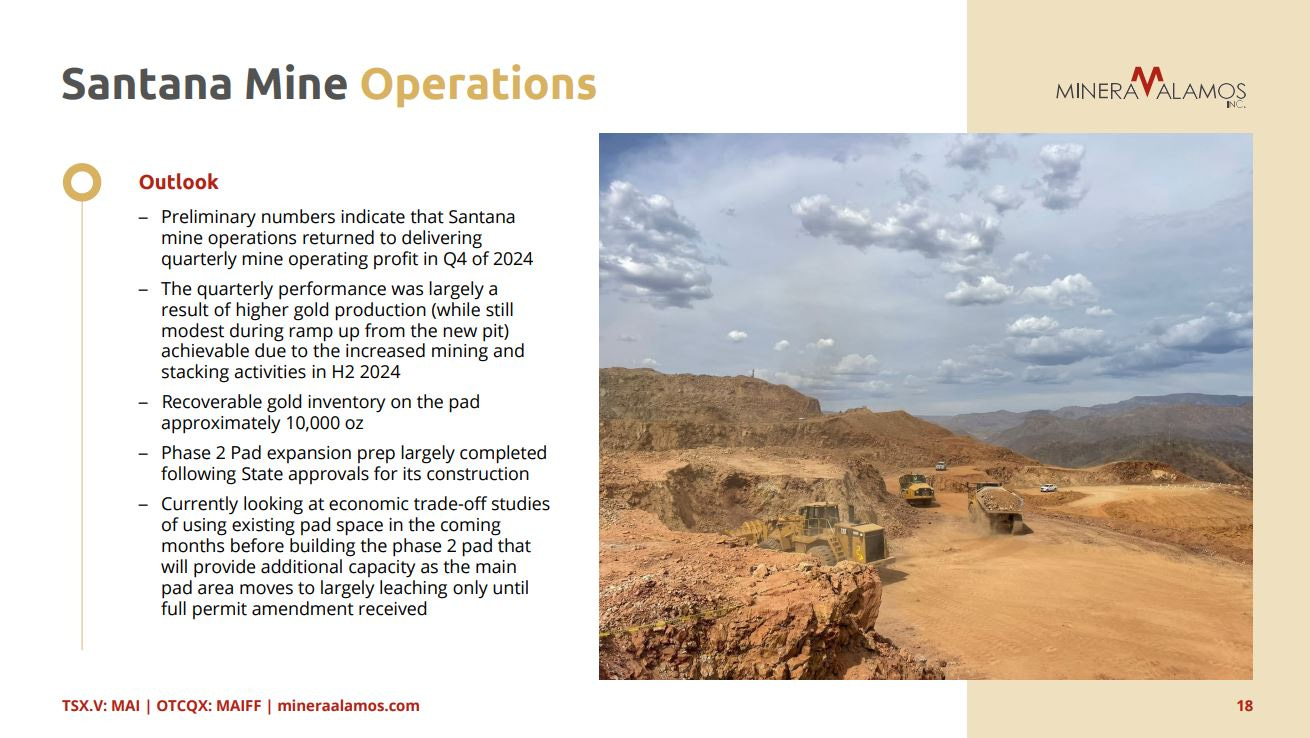

The third quarter of 2024 represented the first full quarter of the restart in mining operations at the Santana gold project’s Nicho Main Zone. The focus of the new mine plan was primarily to open up the areas of operation at the new pit so that mining and stacking activities can be increased at the Santana mine. In the Q3 period this led to 3,800 ounces of mined gold being stacked on the leach pad from the new Nicho Main Zone pit, surpassing the total mined and stacked gold for the entire 2023 year.

As of September 30, 2024, recoverable gold inventory on the leach pad totaled 8,199 ounces, an increase of 2,041 ounces of recoverable gold since June 30, 2024, net of the gold produced and sold.

Subsequent to the quarter end, mining and stacking activities continued to increase with a total of 1,788 ounces mined in the month of October, of which 1,585 ounces were stacked on the heap leach pad with the remainder stockpiled for crushing prior to placement on the heap leach pad. Total mining rates approached our baseline target of 7,000 tpd (waste and mineralized material) during October, as the benefits of the expanded mining fleet were realized and the pit areas available for equipment access continued to increase. Projections for mining rates in November are trending at a similar level.

The average grade of mineralized material mined during Q3-2024 (and October) was 0.60 g/t, which remains in-line with forecast levels.

The Company anticipates beginning the Phase 2 leach pad expansion at Santana towards the end of Q4 which will increase the area available for site leaching operations by 40%. This leach pad expansion will allow for more efficient leaching activities as the ramp up of mining operations continues into 2025 with a better separation of the active leaching areas from the stacking of newly mined material. The larger Phase 3 pad expansion is awaiting Permit Amendment approval and will allow the Company to execute on the larger future planned expansion of activities at Santana.

I’ll be keenly interested to see how the Q4 numbers come in, but as of this last operations report, it looks like October and November were on-track and things were humming right along. Another area of growth at Santana, is the Phase 2 leach pad expansion project, where the early-stage preparation commenced the end of last year. They’re currently evaluating trade-off studies to keep using existing pads from Phase 1 until they get permit amendments. Then there is even the further Phase 3 expansion on tap after that, also still awaiting permits. From the immediate past we do have a basic outlook in their current slide deck for Q4 with recoverable gold inventory on the pad being approximately 10,000 ozs.

With a rough plan to do around 20,000 ounces per annum at present from Santana, I like that their Phase 2 and Phase 3 initiatives could take that up further to 30,000 ounces per annum, and then possibly even 40,000-50,000 ounce per annum respectively.

That will be substantial growth on a percentage basis over the next few years, and the company will also benefit from these higher gold prices we are seeing. However, that would still be too small of a production profile to get most investors interested in positioning in Minera Alamos if that is all there was.

Santana will be a nice production foundation to build off, but it is really the organic growth strategy of bringing on mines #2 and #3 over the next 1-2 years, and then eventually mine #4 several years out, that will raise the production profile up over 100k ounces, and eventually up to 150k-170k ounces.

So let’s look at was is slated to be Mine #2: Cerro de Oro

With a plan to produce 60,000 ounces of gold per year, at the low All-In Sustaining Cost of $873 per ounce, we can see what a nice profitable mine this will be, adding to the production profile at Minera Alamos in a significant way.

The 8-year mine life is good, but that will likely be extended a few more years, via both exploration and the potential to process sulphide mineralization.

The overhang with Cerro de Oro has been the long wait on its permits to proceed. This permitting delay by the prior Mexican political administration has kept this company in the penalty box for over a year now. Many investors though remain very encouraged by the new administration in Mexico, under President Claudia Sheinbaum, which has begun issuing a number of mining amendments and permits throughout 2025. I expect to see the permit come in this year.

Now that the new administration is working through the permitting backlog, we are starting to see improving sentiment and more action in Mexican mining stocks.

When more underground and open-pit permits are announced in Mexico, it will be a tide that starts rising all boats in the jurisdiction; as there plenty of companies waiting on permits to proceed with their respective projects.

This permitting process will likely be a substantial re-rating event for most of the gold and silver and copper stocks operating in Mexico.

Then there will be a multiplier factor when each company receives their specific permits. I see that being very much the case here for Cerro de Oro, when its permit is announced. Q2? Q3? We’ll see…

In the interim, the company is marching forward towards a construction decision on the newly acquired and already permitted Copperstone Mine in Arizona. It’s possible that this project leapfrogs Cerro de Oro to become Mine #2, but it is more likely that both projects end up being ramped up towards production on a dual-track of development.

Sabre Gold Acquisition Closed - February 6, 2025

https://mineraalamos.com/news/2025/sabre-gold-acquisition-closed/

Creation of a Diversified North American Gold Producer Platform - Beyond the Santana gold mine operations (Sonora, Mexico), the addition of Copperstone (Arizona, US) helps provide visibility to a further 150koz of annual gold production in premier mining jurisdictions in North America

Acquisition of Past Producing Copperstone Mine - Sabre’s flagship asset produced a total of 514,000 oz of gold from 1987 to 1993. Along with existing infrastructure, the project contains significant additional resource ounces and is at advanced stage permitting for a near-term mine restart

Accelerating Copperstone Back into Production - Minera Alamos’ in-house mine-building expertise combined with Minera Alamos’s previously acquired process plant equipment will allow for significant reductions in restart time of the Copperstone mine in this very strong gold price environment

This was a really smart acquisition by Minera Alamos, and yet it has been very underappreciated by the market. It won’t stay that way once they pull the trigger on the construction of this project. Sure, the MAI stock price and market cap have crept up higher during 2025, but is coming off a silly valuation, and most of that move has been on the back of the rising gold price and improving margins. Despite the recent move higher in 2025, the share price and market cap are both still lower than where they were BEFORE the acquisition of Sabre was first announced in late October.

One would have thought that adding in more resources and a permitted project ready for development in the US would have increased the valuation. Then add to that the move higher in gold prices this stock should be up multiples higher than where it’s trading today.

Copperstone is slated to produce around 40,000 ounces per year. So if that is added to the 20,000 gold ounces of production from Santana, and the 60,000 ounces of gold from Cerro de Oro, once it is up and producing at full capacity, then one can see the case for 120,000 ounces of gold production per annum from these 3 mines (a 6-fold increase compared to where things are at today).

A new Preliminary Economic Assessment was just released earlier this month for the Copperstone Project; which confirms and updates the 2023 PEA, but still hasn’t factored in some other tradeoff studies that the company is still reviewing to optimize this project.

Minera Alamos Copperstone PEA - March 12, 2025

https://mineraalamos.com/news/2025/minera-alamos-copperstone-pea/

Highlights from the Preliminary Economic Assessment ($1,800/oz base case)

Consistent Production – Models an underground mine operation that will process 198,000 tonnes of ore at an average of 544 tonnes per day (“tpd”) over the 5.6-year mine life (“LOM”).

Excellent Payback Period – The mine plan sequences the high-grade portions of the resource in early years to optimize grade and cash flow resulting in a payback period of 1.7 years and generating approximately $92m in after-tax cumulative undiscounted cash flow.

Low Initial Capital – Significant site infrastructure, such as pre-existing tailings and partial processing facilities, surface buildings and rehabilitated underground development allow for reduced upfront construction cost and low initial capital per payable gold ounce produced over the LOM.

Fully Licensed and Permitted – Permits are in place for initial construction and subsequent operation of the project as well as the necessary water and surface rights. Minor modifications required for a better optimised processing flow sheet as a result of the PEA and the Companys’ plans will be addressed as required in the coming months by the Company.

One thing that sticks out to me is the metals sensitivities table below. While the project economics are attractive at the base case of $1,800 per ounce gold price assumptions, check out where the valuation moves at the current spot price. At $3,000 gold the NPV with a 5% discount of this project swells up to $226,890,000 with an Internal Rate of Return of 171%. Even if one feels that a higher discount percentage should be used on the NPV to reduce down the $227million, keep in the mind that the entire market cap of Minera Alamos at present is CAD$189million. That means that just this Copperstone Project underpins the entire valuation

On November 15th over at the KE Report, Doug Ramshaw, President of Minera Alamos, joined us outline the key takeaways from the news announced on October 28th about the acquisition of Sabre Gold Mines Corp. He unpacks the potential of dual-track development for both the Copperstone Mine in Arizona and the Cerro De Oro Project in Zacatecas, Mexico.

Minera Alamos – Acquisition Of Sabre Gold, Dual-Track Development Of Copperstone Along With Cerro De Oro

Wrapping up with Mine #4, waiting in the wings:

The permitted La Fortuna Mine, which will add in another 50,000 gold equivalent ounces per year to the production profile.

That would be 170,000 ounce per year production if all 4 mines were to be in production at the same time.

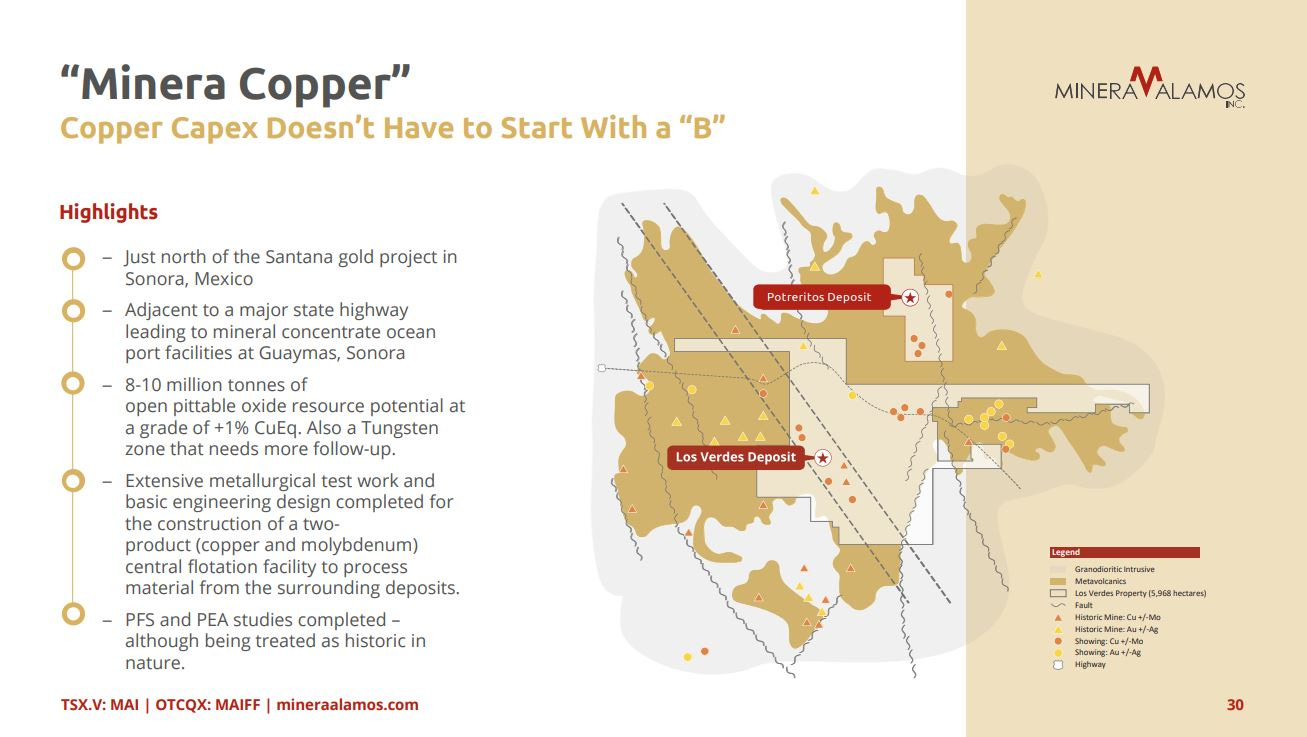

So after 4 gold projects, working their way through the development pipeline, we’ve still not even talked about the 2 other copper assets yet… likely being spun out into a new company Minera Copper.

With copper prices north of $5 again, these lower capex build copper projects will likely receive more value in a spin-co, as right now they aren’t receiving any value. This is just another pathway to further growth and value creation for the company.

Well, that wraps us up for another deep dive into opportunities in the growth-oriented gold producers. With 1 producing mine that is expanding, and 3 more advanced development projects lined up for mines 2, 3, and 4, my thesis is that Minera Alamos has a lot of growth on tap over the next few years, and if that growth happens in a rising metals price environment, then that will be even more growth to margins and revenues.

Thanks for reading and may you have prosperity in your trading and in life!

· Shad