Opportunities In Growth-Oriented Gold Producers - Part 8

Excelsior Prosperity w/ Shad Marquitz (01-05-2025)

It has been a while since we’ve had an update here with the “growth-oriented gold producers,” and it seemed like a long overdue topic for this weekend’s article. My intention was to do a deeper dive on a new company for this series; however, upon starting the writing process, and then reflecting on all of the newsflow and key transactions that we saw in 2024, that didn’t seem right. It really isn’t fair to this series on growth-oriented gold producers if we short-change all the key developments from the companies previously introduced. We really must do a comprehensive recap of the last year in this niche of the gold producers, before then launching forward with adding new companies to the roster for 2025.

2024 was really a very active year for these growth-oriented gold producers that we’ve already highlighted thus far, with operational wins and losses, lots of M&A transactions, exploration progress, and it was far from a dull niche. For the sake of a brief fundamental news recap, we’ll break things down wild west style into “The Good, The Bad, and The Ugly.”

THE GOOD:

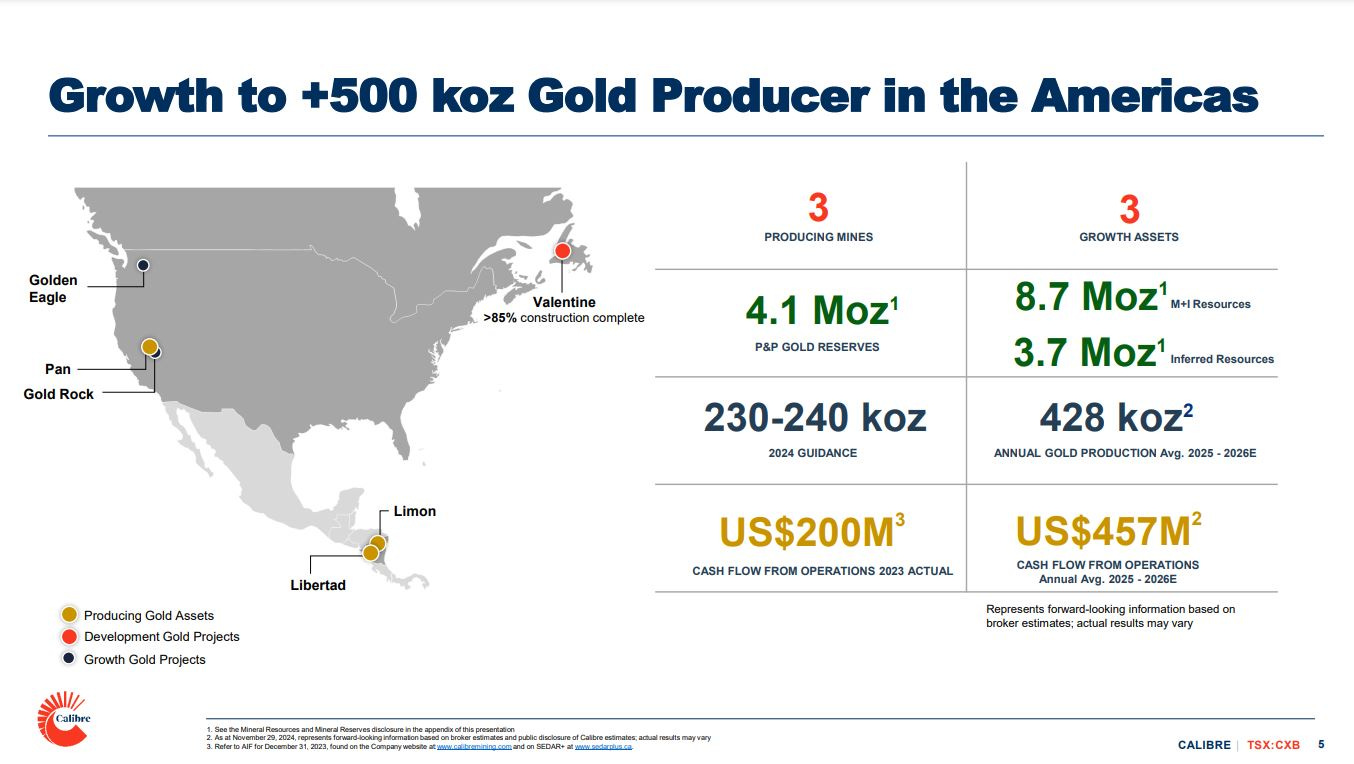

1) One of the heaviest weighted gold positions in my portfolio over the last couple years has been Calibre Mining Corp. (TSX: CXB; OTCQX: CXBMF). Not only did they excel at their multiple producing operations in both Nicaragua and Nevada in 2024, but they also closed a key transaction scooping up Marathon Gold Corporation (TSX: MOZ) on the cheap to bring their Valentine Gold development project in Newfoundland into their portfolio. Success leaves clues…

Calibre Completes Acquisition of Marathon - 01/24/2024

We’ve discussed this transaction a lot in the past, so I’m not going to belabor the point here. However, it is worth noting just how significant the grade profile of Calibre is going to increase in 2025, when production from Valentine starts coming into the equation in the 2nd half of the year. Of course, it will take time to ramp up towards commercial production on a project this large, so I expect the real operational fireworks and larger rerating in the stock to occur in the first full year of production in 2026.

What is also important to factor in is that Calibre Mining has continued to knock it out of the park with aggressive exploration programs in both Nicaragua and Newfoundland; where their progress operationally has been matched in kind with success from the drill bit. [I can’t post all the drill results from this year, but look at how they just kicked of the first 2 months of 2024. Quite impressive. ]:

It is a very rare thing to see a mid-tier gold producer have such a fast stride and so much healthy newsflow when it comes to the exploration side of the business. (Quite frankly it is refreshing to see a larger producer so focused on not just replacing ounces but truly making discoveries in new areas and expanding resources… something I wish we saw more of in the industry).

On November 18, 2024 over at the KE Report I was joined by Ryan King, Senior VP of Corporate Development and IR at Calibre Mining, to review the Q3 financials and operations in Nicaragua and Nevada, and the development progress and expanded exploration program at the Valentine Gold Mine in Newfoundland.

Calibre Mining – Q3 Financials And Operations Update In Nicaragua and Nevada, Valentine Gold Mine Development Progress And Upsized Exploration Program In Newfoundland

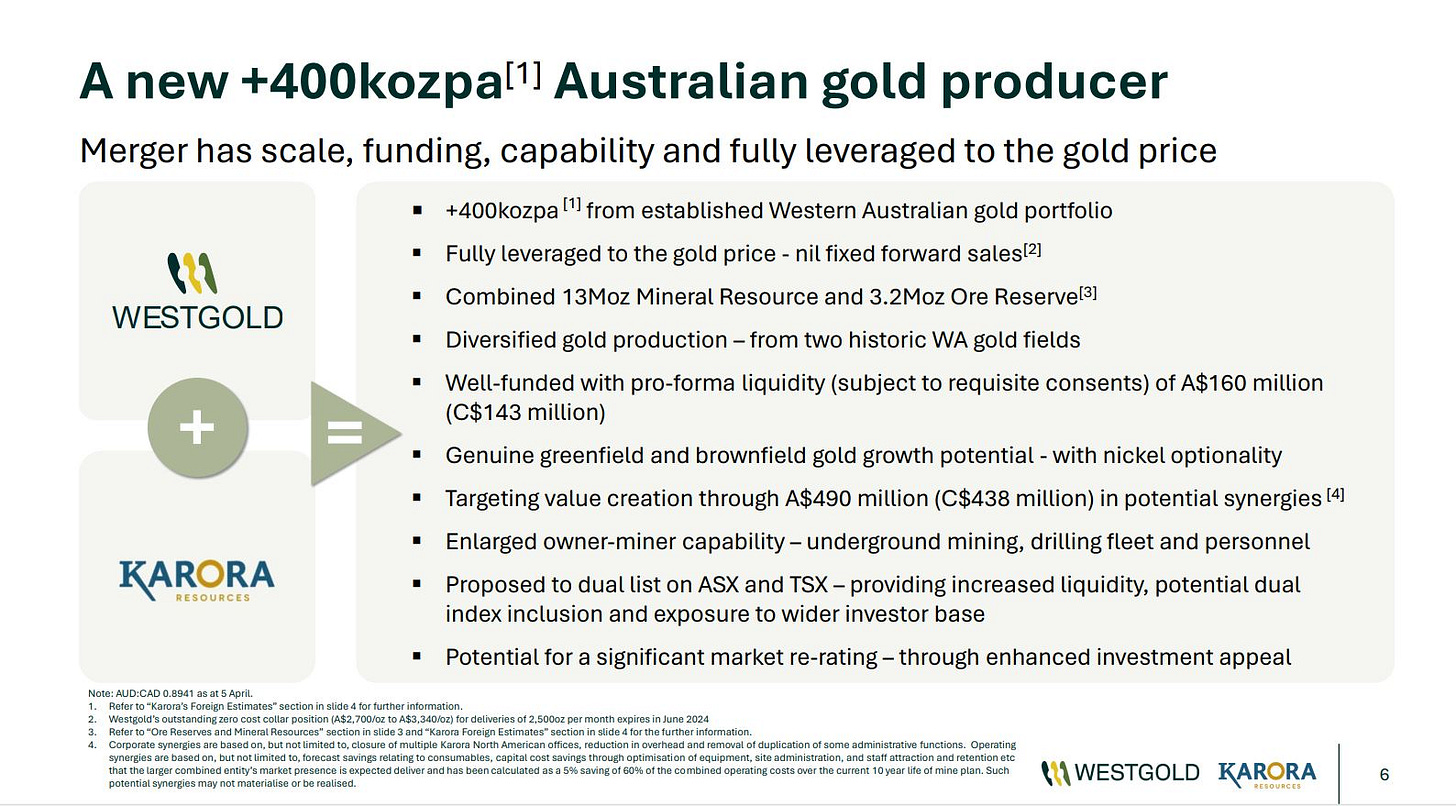

2) Coming into 2024, another one of my heavier weighted gold positions in growth-oriented gold producers was Karora Resources, and it was featured a few times earlier in this series as a company to watch. Well, it was a bang-up year for KRR, and maybe they did “too good,” because their success both operationally and with their continued exploration of both gold and nickel put a large target on their backs. Initially, I was thinking that they would be the company doing the acquiring, using their strength in operations and share price appreciation to their advantage.

We had teased that something was brewing in the weeks and months leading up to this deal, that either Karora was looking to merge with another company (and almost did so with Ramelius Resources Ltd (ASX: RMS) back in February/March). However, as we know now, then the news broke and they ended up getting acquired by Westgold Resources where things finalized in early August.

This was a bittersweet moment where, yes it is always exciting to see a takeover deal in one’s portfolio, but Karora had grown into a quality gold producer, that could have really stretched its legs in this bull market and with higher gold prices. In 2024 KRR.TO was taken off the gameboard and merged into another mid-tier Aussie gold producer, where the new much larger pro-forma entity will have less upside torque than the smaller components.

I elected to take half my position down and ring the register on that partial position, after the takeover premium news had been properly taken into account. Then, I kept half the remaining partial position, and let it convert over to Westgold shares, as there are some other growth assets within WGX.AX that also seem compelling to my eyes. At one point in 2025 we’ll do a broad update on Westgold Resources, and dive into the various assets in more detail.

Westgold And Karora Complete Merger – August 01, 2024

“Westgold Resources Limited (ASX: WGX) (OTCQX: WGXRF) and Karora Resources Inc. (TSX: KRR) (OTCQX: KRRGF) are pleased to announce the completion of the merger of Westgold and Karora to create a leading mid-tier gold producer and international gold company expected to be dual listed on the Australian Securities Exchange (ASX) and Toronto Stock Exchange (TSX).”

https://www.newswire.ca/news-releases/westgold-and-karora-complete-merger-812682937.html

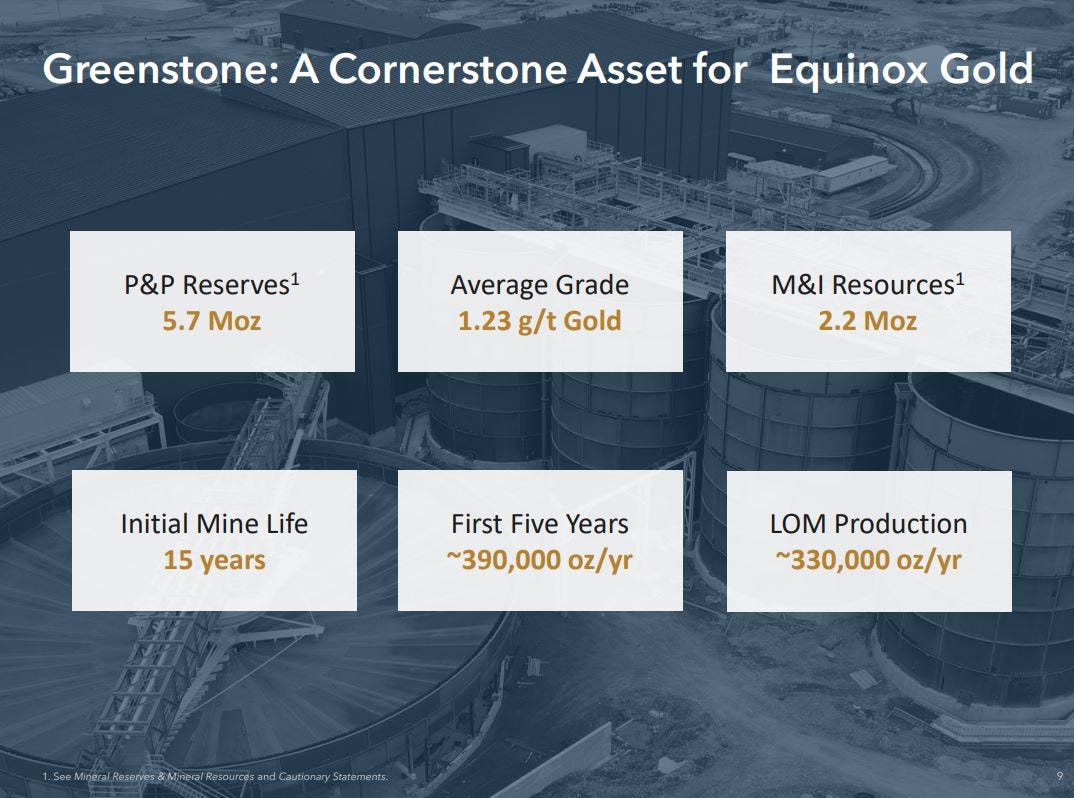

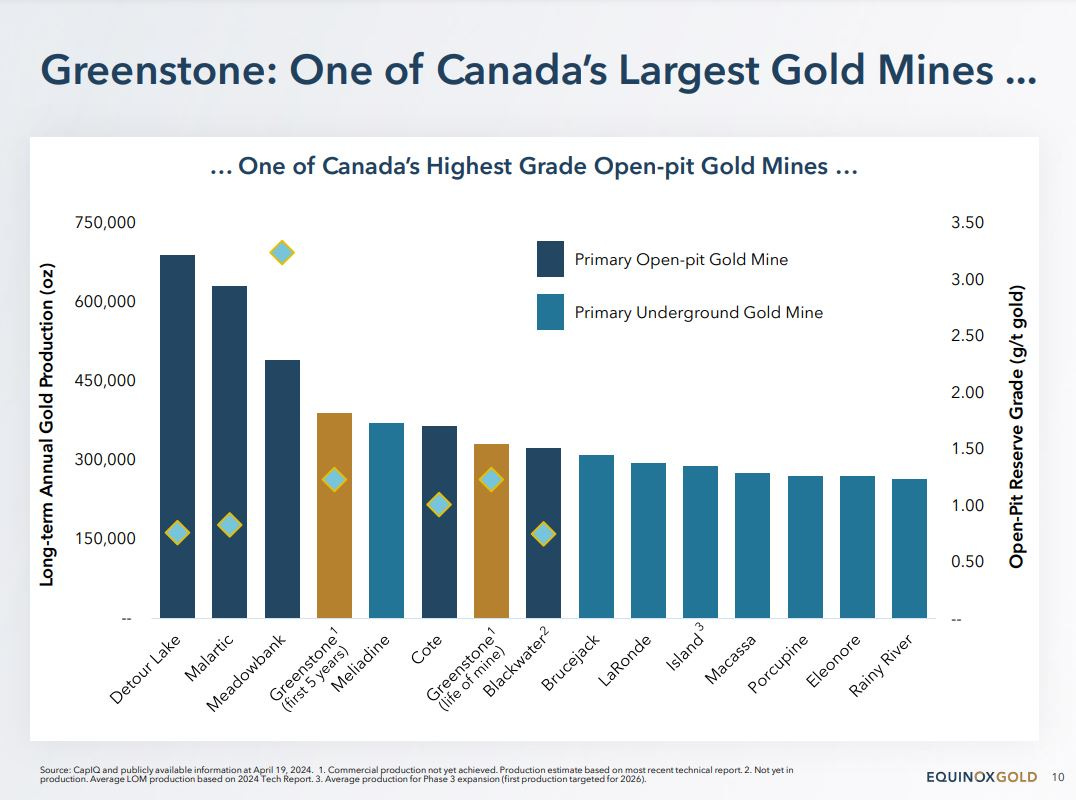

3) Equinox Gold (TSX: EQX) (NYSE: EQX) is another well-run growth-oriented gold producer we’ve discussed earlier on in this series, that had a mixed year, but I’d submit an overall good structural year. Most importantly, Equinox got its major Greenstone Mine built and into production relatively on time and on budget. This was no small achievement, when compared to some of its other Canadian peers that struggled trying to do the same thing – IAMGold’s Cote’, Argonaut’s Magino Mine, and Ascot’s Premier Mine all had onerous timeline pushbacks and cost overruns in comparison.

Following that up, Equinox also won a competitive M&A bid to acquire the remaining 40% project ownership of Greenstone from Orion Mine Finance. As of May, that now gives Equinox 100% exposure to the substantial production profile of this juggernaut of a mine (one of Canada’s largest gold mines), and into a rising gold price environment.

Equinox Gold Completes Consolidation of Ownership of the Greenstone Mine - May 13, 2024

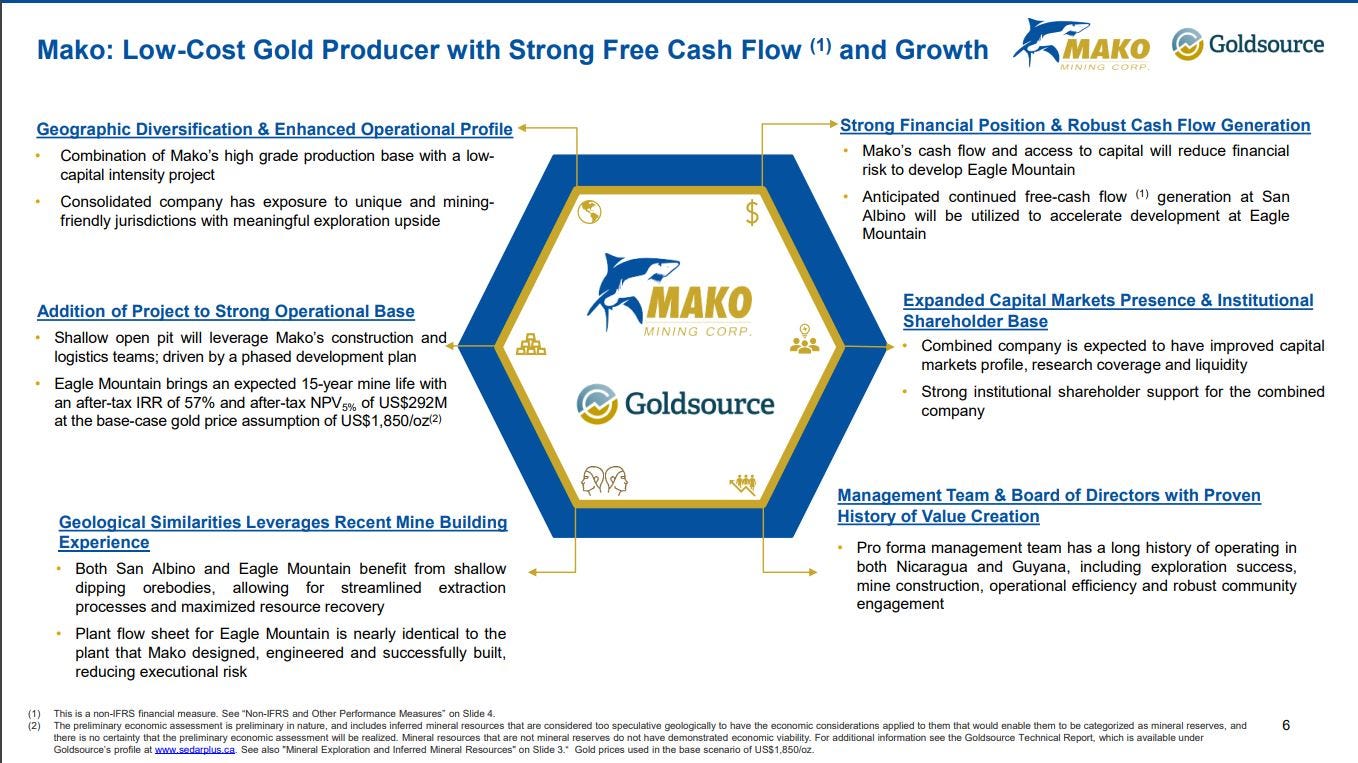

4) One more growth-oriented gold producer in “The Good” category, that we featured in (Part 7) of this series, is Mako Mining (TSX.V:MKO – OTCQX:MAKOF). Mako had a very busy 2024 both operationally and with exploration success at their flagship San Albino Project in Nicaragua. Then, as previously discussed earlier in this series, in late March Mako Mining press released their merger with Goldsource Mines (TSXV:GXS) (OTCQX:GXSFF), for their 100% owned Eagle Mountain Gold Project in Guayana, South America.

It was already a solid year of growth and progress, with lots on the go moving into next year, but then on the very last day of the year, Mako Mining rolled up their 2nd acquisition and the very last M&A deal for 2024. The Company announced its intention to acquire the producing Moss Mine in Arizona, recently held by the mostly defunct Elevation Gold (TSX.V: ELVT.H). This is a fairly complicated transaction where Mako Mining announced entering into of a non-binding letter of intent to acquire 100% of the issued and outstanding common shares of EG Acquisition LLC (“EGA”), a recently created private corporation controlled by Mako’s controlling shareholder, Wexford Capital LP, established solely to acquire the Moss gold mine located in the historic Oatman District in Arizona.

Mako Mining Announces Its Intent to Acquire the Moss Mine in Arizona Expanding its Operations in the Americas - December 31, 2024

https://makominingcorp.com/news/index.php?content_id=695

On New Years Eve over at the KE Report, I had the good fortune of jumping on a call with Akiba Leisman, President and CEO of Mako Mining, to discuss the details of the transaction and the strategy to acquire the Moss Mine in Arizona, and bolt on another producing mine to their asset base that will now be diversified across 3 jurisdictions in the Americas.

Mako Mining – Unpacking The Strategy To Acquire The Moss Mine in Arizona, Adding Another Producing Asset To Its Portfolio

THE BAD:

5) One of the companies that spent most of 2023 and early 2024 unraveling in value due to cost overruns, missed timelines, and repeated dilutive capital raises was Argonaut Gold (TSX: AR) (ARNGF). Argonaut wasn’t alone in struggling to bring a new large mine online and into production in Canada though. As mentioned previously in this article, both IAMGold’s Cote’ Mine and Ascot’s Premier Northern Lights Mine also had onerous timeline pushbacks and cost overruns (with Ascot’s mine going right into care and maintenance just shortly after being commissioned).

Earlier in this series in Part 5B, I had mentioned getting positioned once again into Argonaut Gold on February 28th, just 2 days after they had disappointed the market (once again) when the news broke on February 26th regarding challenges with selective mining, 5-10% lower grades expected for throughput, lower anticipated ounces in guidance, and the reality that they’ll need more money… I had mentioned in that update, with regards to getting back into Argonaut Gold, that Magino would still be transformative for the company… and it was…

“I’m happy to freely share my thinking and rationale behind the decision to accumulate shares this last week into the recent weakness and market carnage. I also acknowledge that while this is definitely risky, it may not be as risky as it is being currently perceived (especially after the recent waterfall decline).”

“Yes, their key new mine, Magino, has been a complete mess getting developed and constructed for the last 2+ years, with more problems surfacing again 2 weeks back. We’ll get into the big picture view of where things are going, and address some specifics in that recent news announcement that has led to the stock being essentially chopped in half in market cap valuation, once again, over the last 2 weeks.”

“That aside, Argonaut Gold is going to be a legitimate growth-oriented gold producer at the end of this saga. It is run by a much more solid management team and board now than in the past, and Magino is absolutely still going to be transformative to the company, in a similar way that Greenstone is going to be transformative for Equinox.”

-- March 3rd

Argonaut was definitely in “The Bad” camp coming into 2024, after a pretty rough 2023 before that. Looking back on things, (AR.TO) had an absolutely terrible 2022; and that is where they really fell out of bed from a valuation standpoint, when the first cost overruns at Magino and the wipeout in valuation began. What a saga…

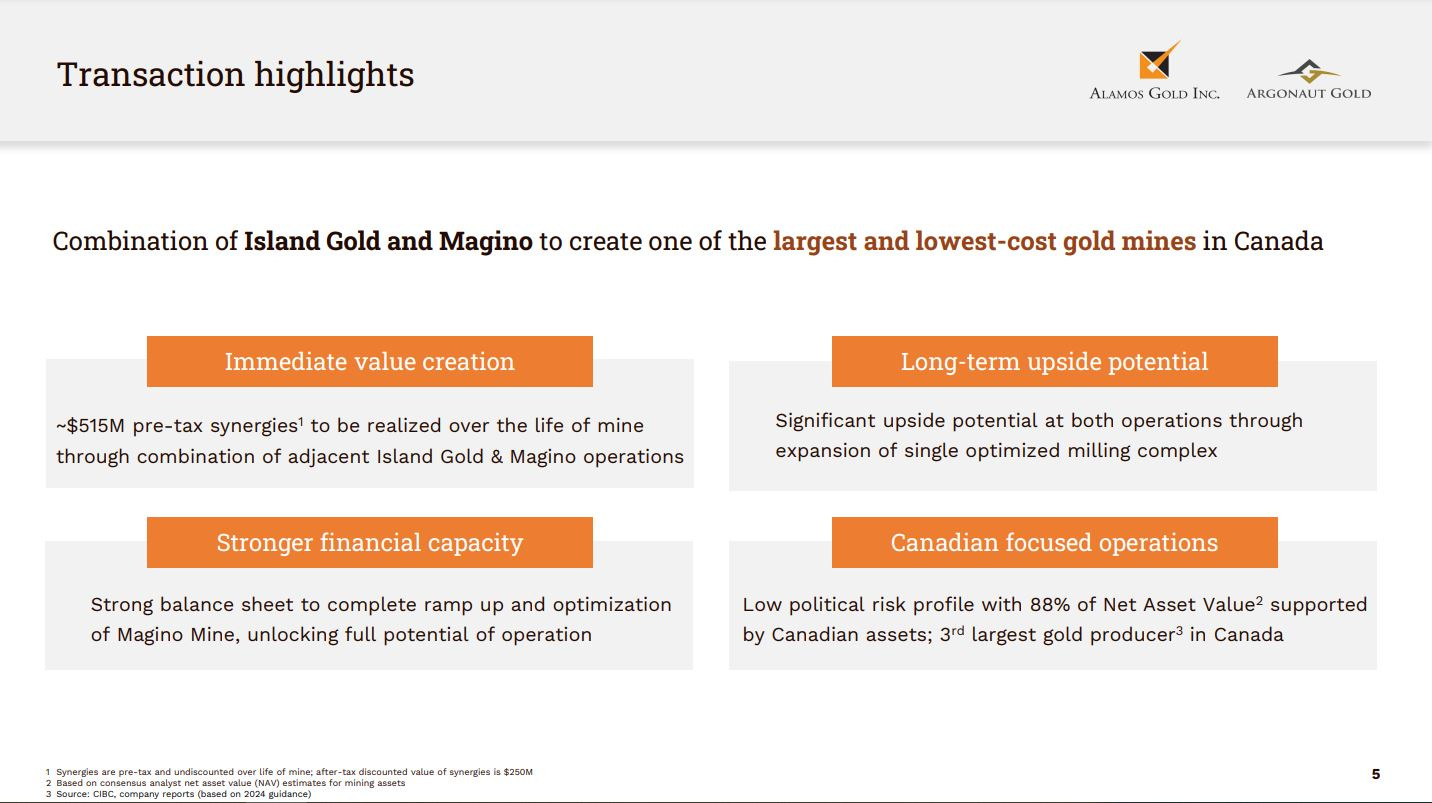

As we now know, the king of the mid-tiers, Alamos Gold (TSX: AGI) (NYSE: AGI), eventually stepped in several weeks later to stop the bleeding. Alamos gold acquired their Magino Mine, not just for the potential production profile growth at Magino, but also for all the potential infrastructure in place that could be utilized by Alamos’s nearby Island Gold Mine. It is a 1 + 1 = 3 scenario for (AGI).

Alamos Gold Announces Friendly Acquisition of Argonaut Gold - March 27, 2024

From one vantage point, it is nice to see Alamos Gold grow into an even stronger and larger mid-tier producer, and the synergies between the Magino Mine and its Island Gold mine are palpable as both merge into a larger mining complex.

However, on another level it was a shame to see Argonaut Gold picked off before it had a chance to spread it’s wings with Magino finally in production, as it likely would have been rerated higher in the rising gold price environment and expanding margins; digging out some from the hole they had fallen in over the last few years with the cost overruns.

That potential rerating was the thesis I had when getting back positioned in Argonaut in late February, but unfortunately much of that potential run higher was truncated by the takeover by Alamos Gold. I guess it was still a short-term win, and that is still a positive, but sometimes M&A deals steal the glory from the smaller company, and embed it in a larger slower moving pro-forma entity.

(AGI) is clearly a fantastic company, and one of the best run gold producers in the sector. However, it has already become quite richly valued over the last 2 years; peaking just a bit higher, right after the August takeover in September and October, and then channeling mostly sideways for the last quarter of the year. It is my belief that if Argonaut had not been picked off near it’s lows, that it could have had a roaring comeback and held onto all its assets, using them as vehicle for further growth.

Still, one has to tip their hat to the team at Alamos for waiting until max pain in Argonaut, and then striking fast when most longer-term investors were giving up in despair. Very well played… and a top-notch acquisition.

Many people had forgotten all the good years leading into the Argonaut multi-year implosion, where their operations team had actually done an excellent job extending the mine life at their 2 Mexican producing assets, the San Agustin Mine and the La Colorada Mine, and in finally getting their Florida Canyon Mine optimized (acquired from Alio Gold years previously). As readers of this channel will remember, those assets were all spun out into Florida Canyon Gold Inc. (TSXV: FCGV) (OTC: FCGVF), from Argonaut Gold, but they didn’t stay in there but for a brief moment in time… All those mines almost immediately got liquidated on the extreme cheap side, which didn’t bring much more value to long-suffering Argonaut shareholders.

As highlighted in the most recent article here on Opportunities in M&A, Heliostar Metals Ltd. (TSX.V: HSTR) (OTCQX: HSTXF) picked up the 2 Mexican mines for a song and a dance, and Integra Resources Corp. (TSXV: ITR) (NYSE American: ITRG) also picked up the Florida Canyon Mine from Argonaut on the cheap, by gutting the assets of the newly formed Florida Canyon Gold; shortly after it was created.

I hadn’t seen a raid on company assets like the one we witnessed on Argonaut Gold in 2024, since back when Primero Mining was dismantled by First Majestic for San Dimas, and then Black Fox was sold to McEwen Mining for pennies, and Cerro del Gallo actually went to Argonaut on the extreme cheap (which now ironically was picked up by Heliostar for even cheaper). As the saying goes, “One man’s trash is another man’s treasure.”

Heliostar to Acquire Gold Portfolio of Producing Mines and Development Projects in Mexico for US$5M - July 17, 2024

Integra Resources Completes Transaction With Florida Canyon Gold, Creating a New Great Basin Precious Metals Producer - November 8, 2024

THE UGLY:

6) It’s a tossup which company management teams most disappointed the market and destroyed more shareholder value on a percentage basis in 2024 -- i-80 GOLD CORP. (TSX: IAU) (NYSE American: IAUX) or Lion One Metals Limited (TSXV: LIO) (OTCQX: LOMLF)?

From a sheer nominal market cap valuation implosion perspective, i-80 Gold is the winner of the ugly contest. I’m not going to campout here too long speaking negatively about the trainwreck of missed opportunities and failed guidance issued to the marketplace. Afterall, the company’s new team and new CEO are about to unveil their restructuring plan by March. We’ll just have to wait and see how things shake out at that time.

We should spend a minute though to analyze the carnage and wreckage for how the component parts can still emerge as value creators, and learn from the mistakes of the prior management team that made a number of critical missteps to erode shareholder confidence and their associated valuation.

The company’s Nevada assets have always been quite impressive. The initial spinout of i-80 Gold was announced during the takeover of Premier Gold by Equinox Gold back in December 2020, and was finalized in early April 2021, including the 40% stake in South-Arturo (in a JV with Nevada Gold Mines) and the McCoy-Cove property. (anyone else noticing how incestuous all this M&A has been within these growth-oriented gold producers? We just talked about Equinox earlier in this piece.)

https://www.i80gold.com/equinox-gold-announces-friendly-acquisition-of-premier-gold-mines/

Then in April of 2021 the Getchell Project was acquired, more land was added, drilling was done, and the name was changed to the Granite Creek Project in June of 2021. Then in September of 2021 came a big announcement where i-80 Gold was acquiring the Lone Tree Processing Center and autoclave and Buffalo Mountain gold deposits from Nevada Gold Mines. They were horse-trading with NGM (Barrick/Newmont) their 40% interest in the South Arturo asset and option to acquire the adjacent Rodeo Creek exploration project.

This was quite an early score for a junior to lock down 1 of only 3 US processing centers that can handle refractory ore and the replacement cost on the Lone Tree facility to rebuild in today’s dollars would be worth around $1.3 Billion (according to Ex-CEO Ewan Downie). In the same press release the company also announced the acquisition of the Ruby Hill Mine and processing center from affiliates of Waterton Global Resource Management. https://www.i80gold.com/i-80-to-acquire-lone-tree-processing-facilities-buffalo-mtn-ruby-hill-to-create-nevada-mining-complex/

So by the end of 2021, the assets had mostly been assembled. Now, the company did acquire Paycore Metals in 2023 to add in the FAD Deposit in concert with their polymetallic exploration targets that were part of the Ruby Hill Project.

https://www.i80gold.com/i-80-gold-completes-acquisition-high-grade-fad-deposit/

The issues that arose in 2023, and further escalated to the downside in 2024 are not and have never been with the quality of these project’s mineral endowment and resources of 14.5 million ounces of gold and 100 million ounces of silver, or the quality of the infrastructure in place at their 2 processing centers.

The loss of investor confidence really didn’t have much to do with the exploration work either, except for the dilutive capital raises and costs of doing it; because the actual drill intercepts that I-80 Gold kept hitting at multiple projects were very impressive indeed.

The issues were with the corporate strategy going into production at Granite Creek not working as planned, and with the specifics of how the management team and board both raised and managed their capital for the last couple years, in concert with growing financial liabilities and concerns.

The inability of the company to reach a satisfactory agreement on the Ruby Hill Base Metals JV with a strategic partner, after messaging that this was going to be the solution stakeholders were looking for, was also a HUGE miss with market expectations and messaging.

The guidance in late 2023 was for 50,000 ounces of gold production to come from Granite Creek in 2024. Then there was the stated goal and plan to double that in 2025 to around 100,000 ounces, bringing in more ore from the South Pacific Zone, and possibly augmenting that with some gold material from the Ruby Hill project to also be shipped over to the nearby Nevada Gold Mines processing facility. They failed bigly in this endeavor.

On August 12, when they put out their Q2 operations results, they had only produced 1,636 ounces of gold in the quarter, with year-to-date gold sales of 4,122 ounces. (WTF happened?) They needed to be producing 12,500 ounces of gold per quarter to meet their stated goal of 50,000 ounces in 2024, and clearly it was not going to happen. That affected expected revenues and costs, and put a real wrinkle in the production growth engine narrative.

https://www.i80gold.com/i-80-gold-reports-q2-2024-operating-results/

Even before that news had surfaced, there lurked a larger elephant in the room. The company had messaged many times since late 2023 that their whole plan to bring in some much needed capital, (and placate those market concerns), would be when they consummated a joint-venture with an unnamed entity at their Ruby Hill Base Metal Project, including the Hilltop, Blackjack, and FAD assets.

Ewan and the management team had proclaimed this to the marketplace in press releases since November of 2023, and in public appearances for months afterwards (including on the KE Report in December of 2023), and yet the deadline for this announced JV came and went by June without another word from the company.

I knew something had gone wrong and smelled fishy when they raised that massive CAD$115million (at both a discount to market and with a ½ warrant kicker to boot) in May, right before this polymetallic strategic JV deal was supposedly going to be announced as the solution to their immediate capital needs. Why even do a huge dilutive financing like this if the strategic joint venture deal was actually going to happen imminently, which would inject the company with new capital?

As we all learned in the recent “mea culpa” press release from Nov 12th, regarding the need now for a complete 2-part recapitalization process and restructuring: https://www.i80gold.com/i-80-gold-reports-q3-2024-operating-results-and-new-development-plan/; they simultaneously also finally broke their radio silence about the Ruby Hill Base Metal Joint Venture stating that: “i-80 Gold’s Board and Management have elected to no longer proceed with joint venture discussions. It is noteworthy that the period of exclusivity with the counterparty has expired.” [Well, no duh… the JV clearly was not happening, and had expired in the summer and everybody already knew that.]

It was totally nuts and pretty opaque to all existing shareholders that it took them until November to finally update the market on the restructuring and finally publicly announce that they were not going ahead with bringing in the strategic partner into the JV at the Ruby Hill Base Metals Project.

The i-80 management team and board had ample opportunity to be more transparent and explain this to the market before or at least when they were launching into that incredibly dilutive CAD$115 financing in May (which really blindsided market participants). Yet, they didn’t say a peep about this mission critical JV that was supposed to have brought in such an important financial lifeline to the company for about 6 more months! (Why such a long wait??)

When they finally did come clean in the news they released after the market close on Nov 12th, it was preceded by the stock gapping down by around 60% on the following day Nov 13th. The market could smell the blood in the water.

The stock price wreckage has been inflicted at this point, but the company did bring in sector “cleanup man” Richard Young as the new CEO, (who I personally have a lot of respect for). Richard successfully sold Teranga Gold to Endeavour Mining a few years ago, and was the very same person that Argonaut Gold brought in for the last chapter to facilitate the sale of Magino to Alamos Gold, and Florida Canyon’s assets to both Heliostar and Integra… and that really brings us full circle in this article.

Many investors are very curious about what the two-step recapitalization process for i-80 Gold will look like when announced over of the next few months, how dilutive it will be at either the equity, debt, or project level, and what the path forward will be for the assets inside of i-80 Gold. The new CEO did some big purchases of stock in the open market on November 18th and 19th according to SEDI filings, which got some beat up i-80 Gold bulls a bit more encouraged that something positive is in the works. We’ll see how it goes…

(IAUX) opened 2024 at $1.77 and closed the year on December 31st at $0.49, for a crash of 72% over the calendar year. IAUX was up near a $3 stock coming into 2023. The management team and board at i-80 Gold has a lot of work to do to rebuild investor confidence and get most longer-term investors back to parity again, much less a return on their investment.

I am rooting for new CEO, Richard Young, and the team at i-80 Gold to find the best pathway forward for all stakeholders; but that doesn’t make the 2024 performance of the stock any less ugly than it was.

Well, that wraps up the good, the bad, and the ugly in the growth-oriented gold producers featured in this series from last year. There is a lot to look forward to in the year ahead, and a number of new companies that will be introduced to readers here in this series.

Thanks for reading and wishing you all prosperity in your trading and in life!

- Shad