Opportunities In Growth-Oriented Silver Producers – Part 6

Excelsior Prosperity w/ Shad Marquitz – 11/30/2024

We are continuing on with this series on growth-oriented silver producers…. The delay in getting this issue out to readers here was due to the scheduling pushing back by a week for the CEO interview with the company being featured in this episode. Hopefully it will be worth the wait!

Thus far we’ve reviewed a handful of companies in this series, Avino Silver and Gold Mines (TSX:ASM – NYSE:ASM) in [Part 1], Guanajuato Silver (TSX.V:GSVR) (OTCQX:GSVRF) in [Part 2], SilverCrest Metals (TSX:SIL) (NYSE:SILV) in [Part 3]… which is being taken over by Coeur Mining, Impact Silver (TSX.V:IPT – OTCQB:ISVLF) in [Part 4], and Sierra Madre Gold and Silver Ltd. (TSXV: SM) (OTCQX: SMDRF) in [Part 5]. Now it’s time to review a 6th junior silver producer for consideration.

(In full disclosure, I have a reasonably heavy weighting inside of my own personal portfolio in these growth-oriented silver producers that we are covering in this series. I’ve not been commissioned by these companies to write these articles on Substack, but they may sometimes be sponsors over at the KE Report. This is not investment advice, nor am I suggesting that anyone take a position in these stocks. Rather, this is simply an editorial on the value proposition these companies demonstrate to my mind, and why I got positioned in them in my own portfolio.)

As far as investing in junior gold or silver mining stocks, it should be pointed out that this is a risky sector, often having extreme moves to both the upside and downside, compared to the precious metals themselves. Riding these PM equities through bull markets and bear markets is definitely not for the faint of heart, and the stock price action can be wildly volatile. This means that with so much volatility comes multiple waves of price rises and then price declines to potentially capitalize on for either swing-trading or position-trading. This volatility also provides ample opportunities for value investors to accumulate positions for the longer-term, by layering into a position over several buying tranches during pullbacks. This layered approach to scaling into a position, via multiple partial purchases, is a great way to smooth out the volatility, while building a good overall cost-basis over time.

With all of that said, let’s get into it…

Before we launch into the next company in this series, I wanted to include a brief interview update from the very first company we ever covered in this particular series on growth-oriented silver producers -- Avino Silver and Gold Mines (TSX:ASM – NYSE:ASM). Last week I attended the 50th annual New Orleans Investment Conference, and got the opportunity to visit with a lot of friends in the industry, network with fellow resource investors, catch up with portfolio companies and with companies that we have interviewed over at the KE Report, and also to meet up with new company management teams (more on those companies in future issues).

Now, we normally record interviews with companies via Zoom calls, because we want to spend our time at the event networking, updating our notes, asking tough and even controversial questions off-mic, and getting all the gossip and scuttlebutt in a sector that thrives on momentum, investor narratives, story tellers, and a cast of quality characters mixed in with nefarious troublemakers. However, Cory and I will still end up sitting down with a few folks at these conferences and record a few updates from thought leaders or even the occasional quality company.

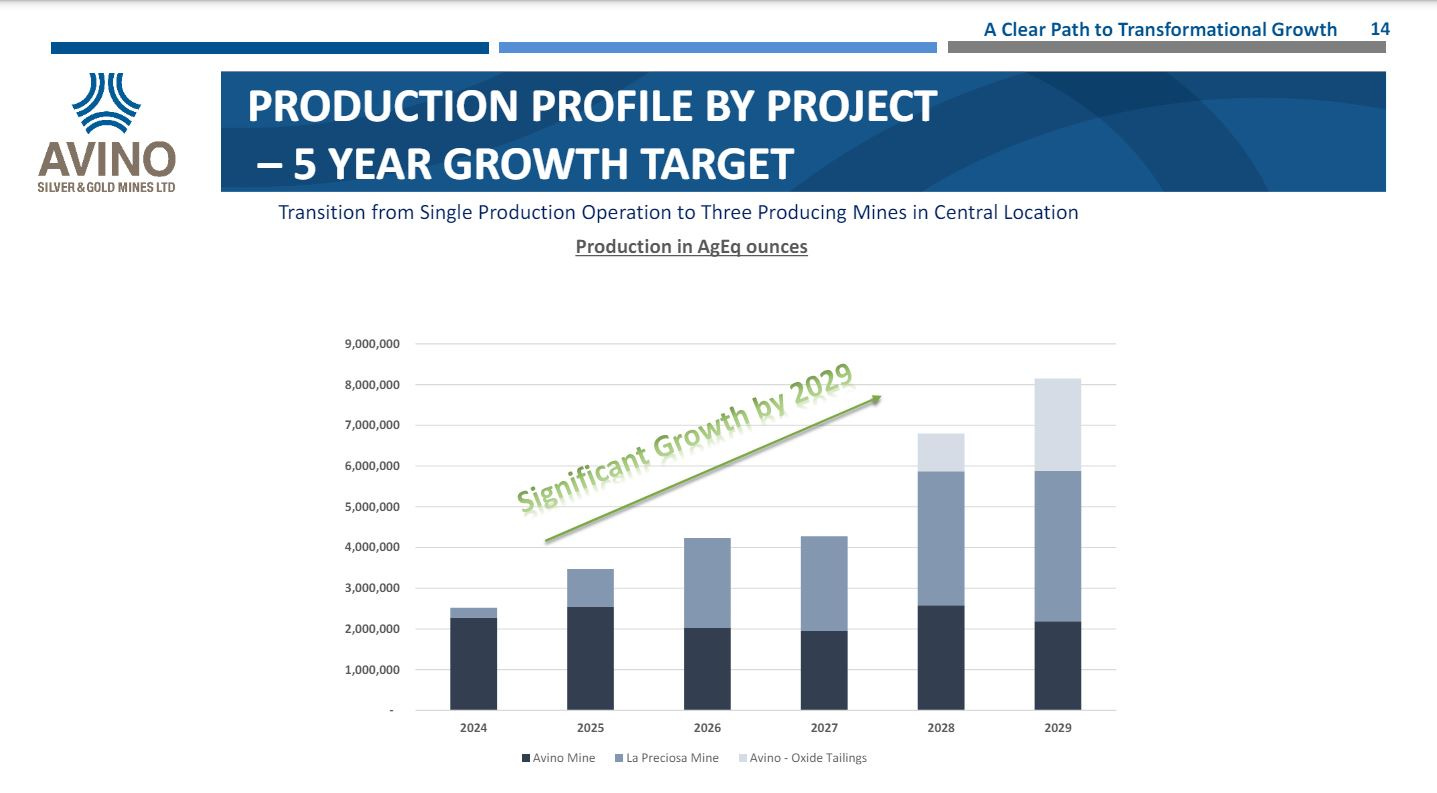

One of my favorite companies and management teams for years has been Avino Silver And Gold and so we have recorded an update with them at this conference the last 3 years in a row. This year we kept the tradition going and sat down with Nathan Harte, CFO of Avino Silver and Gold Mines, live from the floor of the New Orleans Investment Conference to recap the key takeaways from their Q3 2024 financials and operations. Then we take a deeper dive into the Company’s 5-year production growth plan, to become a Mexican intermediate silver producer, with the development of both the La Preciosa Project and the Tailings Project.

Avino Silver and Gold Mines – A Review Of Q3 Financials, And The Development Pipeline For Organic Growth With Both The La Preciosa And Tailings Projects

We’ll, continue to periodically check in on other companies in this series like this when other companies hit significant milestones, have key breaking news, and when we get them back on the KE Report for interview updates so you can keep getting exclusive hot takes on what it all means right from the management teams.

In this article we are going to take a deep dive into the next 6th company, Santacruz Silver Mining Ltd. (TSXV: SCZ) (OTCQB: SCZMF). I’ve been saving this stock for later in this series, because it is clear in talking with other investors that some consider this an “old” or “stale” story. Now, they state that only because they’ve not bothered to stay up to date on how this company has totally transformed itself over the last few years since 2021.

If you are one of those people that thinks “you know all about it…,” then please check your biases for the next 5-10 minutes and consider taking a more informed look at their new portfolio of assets and growth potential with a fresh set of eyes. For those that haven’t looked into what the team behind Santacruz Silver has been working on the last few years, it will likely be a pleasant surprise to you.

My personal thesis is that there is a multifold rerating setting up in this stock as they get more properly valued like other peer mid-tier silver and zinc producers that they’ve legitimately grown into. (not investing advice… just my perceptions)

Now, let me briefly back up and mention that I’ve been following this company for a long time…(since 2015). By late 2015, when most precious metals investors were throwing up their hands in disgust, it was becoming increasingly obvious to people that had been observing the markets for while, that the sector was getting washed out to the point where either all mining stocks were going out of business or there was going to need to be a tidal shift. I remember in November and December of 2015 joking with fellow posters on the blog that it was “time to hold our noses and buy the stinking stocks in the sector” because surely a rerating was long overdue to more sane valuations.

In particular, I was focused on accumulating the most beat up stocks and higher cost silver producers like Americas Gold & Silver, Endeavour Silver, Santacruz Silver, and in early 2016 I’d also find Impact Silver, because those are the companies that have the most margin improvements when metals prices turn, and thus the most upside torque.

Well as anyone that was investing in this sector at that time vividly remembers, gold put in its Major Low at $1045, in December of 2015, marking the end of the precious metals bear market, (right after the Fed started its first rate hikes in over 8 years). The worm finally turned in the PM mining stocks several weeks later on January 19th, 2016. From there we saw a 7-month blistering move higher in most PM stocks through August of 2016.

With Santacruz Silver, the move was more truncated as it didn’t get the memo until February of 2016 and only ran big through April in a move from a low of $0.085 to a high of $0.63, for over 740% gains in just 2 months. While I had bought higher than that in late 2015, and didn’t get out of my partial position anywhere near the high (selling a big chunk that summer in early July 2016), I still had a multi-bagger return of over 4x personally for the portion traded, and left the rest in for the journey. This points out that nobody needs to catch the exact bottom or exact top in extreme moves like this. There is always plenty of meat in the middle of the move to capitalize on during revaluation periods.

To be fair other silver producers I held like Endeavour Silver, Americas Gold and Silver, Avino Silver and Gold, Silvercorp, and Impact Silver, and other explorer/developers like Alexco and Orex performed far better… (and for several months longer) for me back then in that 2016 rally, compared to SCZ. However, I never forgot the torque that Santacruz Silver showed over such a brief period of time when the silver and metals prices started to rip higher. That torque has resurfaced many times since then on multiple PM sector rallies.

Now back then in early 2016, Santacruz Mining was totally a Mexican-focused silver and base metals company, with completely different assets than what they have today. They had a producing project, the Rosario Mine; along with the right to operate a silver mine and mill facility (Veta Grande) where they received some production credit; the advanced-stage project (San Felipe); and an exploration project (Gavilanes).

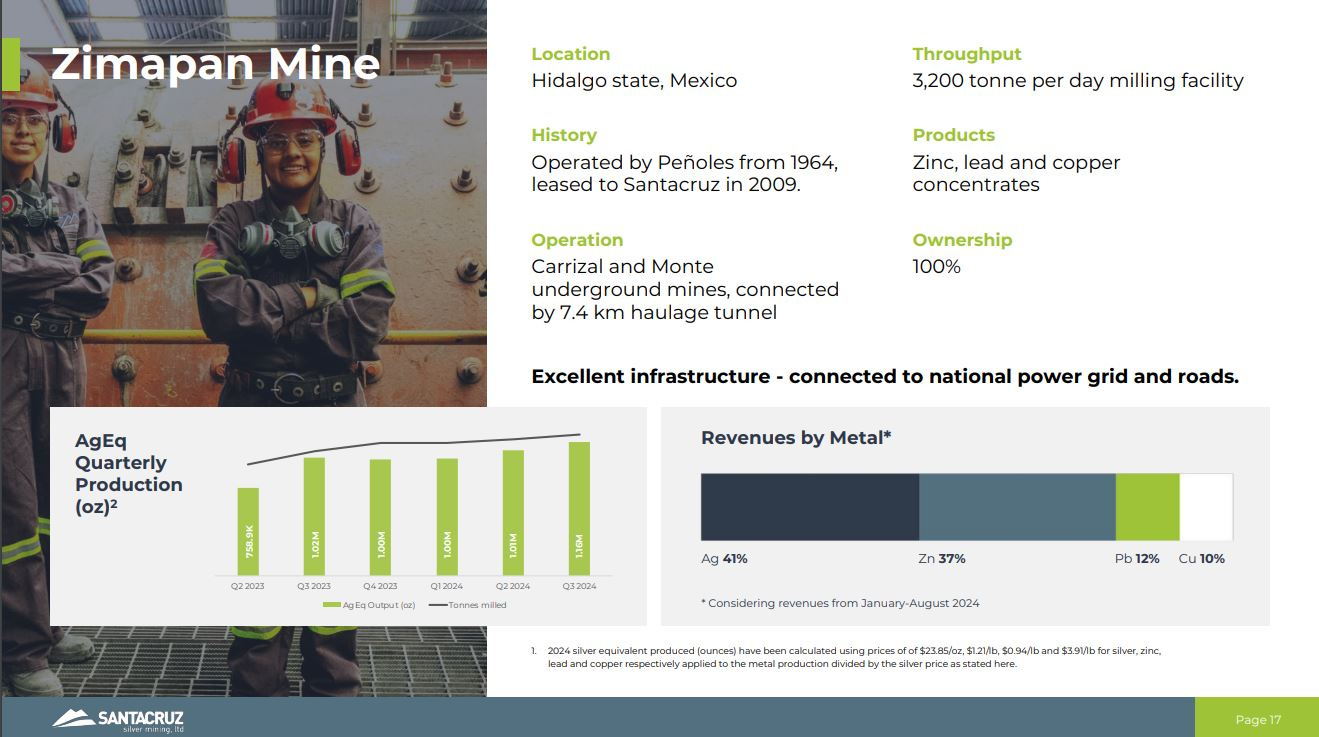

Fast forward to today: The Company doesn’t have any of those assets anymore, and started a major transformation of assets back in April of 2021, when they purchased the Zimapan Mine from Grupo Peñoles.

Santacruz Completes Acquisition of Zimapan Mine and Debt Financing

- April 26, 2021

“Santacruz Silver Mining Ltd is pleased to report that it has completed the previously announced acquisition of the Zimapan mine assets from Minera Cedros, S.A. de C.V., a wholly owned subsidiary of Grupo Peñoles. The transaction was funded in part by a US$17.6 million loan facility provided by Trafigura Mexico, S.A. de C.V.”

“Closing the transaction and acquiring outright ownership of the Zimapan Mine marks a new era for Santacruz that will help pave the road for the continuation of the Company´s growth. We have already identified several priority areas for exploration which we expect will allow the mine to maintain its historical yearly production levels of +5 million silver equivalent ounces for many years.”

https://santacruzsilver.com/news/santacruz-completes-acquisition-of-zimapan-mine-and-debt-financing/

Next, in October of 2021, their Rosario Mine was put on care and maintenance. I remember at the time being disappointed, as the company was now down to just 1 producing mine at Zimapan. While I was encouraged by results and potential at Zimapan, it just didn’t seem like the company had much upside potential left.

Santacruz Silver Places Rosario Project on Care and Maintenance - October 5, 2021

https://santacruzsilver.com/news/santacruz-silver-places-rosario-project-on-care-and-maintenance/

I was curious to see if they’d replace Rosario with another mine in Mexico, with one of their assets going down, but was totally unprepared for the size and scope of the announcement they’d make just a few weeks later in October of 2021.

Santacruz to Acquire Glencore’s Producing Silver Mines in Bolivia Creating a New Significant Latin American based Silver Producer - October 13, 2021

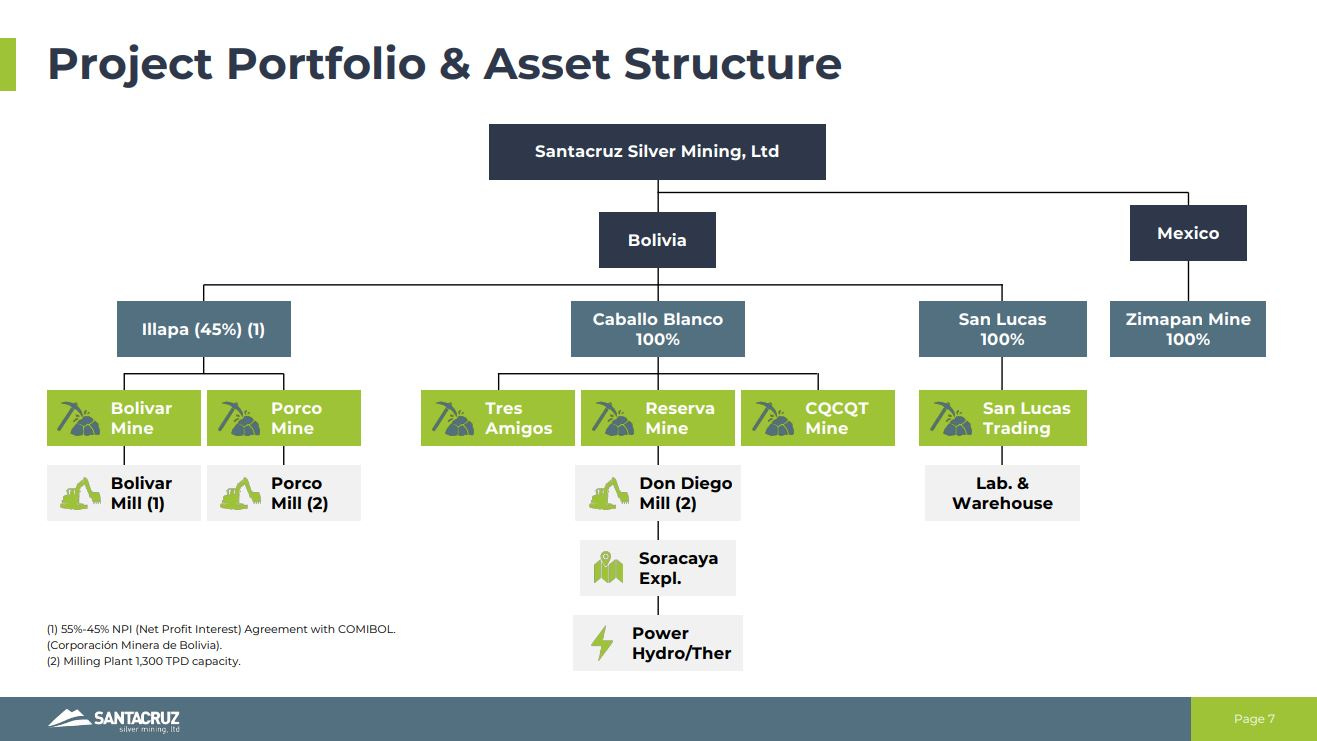

“Santacruz Silver Mining announces that it has entered into a definitive share purchase agreement with Glencore whereby Santacruz will acquire a portfolio of Bolivian silver assets from, including a 45% interest in the producing Bolivar and Porco mining operations held through an unincorporated joint venture with Corporación Minera de Bolivia (COMIBOL), a Bolivian state-owned entity, (the "Illapa JV"), a 100% interest in the Sinchi Wayra business which includes the producing Caballo Blanco mining complex, the Sorocaya project located in Bolivia, and the San Lucas ore sourcing and trading business and certain related properties and assets.”

Key Transaction Highlights

Creation of a significant Americas-focused silver producer approaching senior status, with additional significant leverage to the zinc market

Assets include five producing mines, two exploration projects, three milling facilities, one trading company and two power plants (thermo and hydroelectric) among the most relevant

Immediately accretive to cash flow and all key metrics

Majority of consideration deferred and to be funded by cash flows resulting in limited upfront dilution compared to an all-share transaction

I was stunned… The deal was far bigger than almost anyone was expecting from a tiny junior like Santacruz Silver, and impressive to see the transaction with the juggernaut senior mining and metals smelting company Glencore. I immediately liked that it was going to be funded through future cash flows, versus seeing an extremely dilutive share transaction, and noted at the time, that they just became a mid-tier silver and zinc producer overnight with that transaction.

This brings us to the current lineup of assets in the Santacruz Silver portfolio as of today:

The market responded… but not really….

Most of the feedback was poking at the transaction that Glencore was riding herd on another junior company. Many detractors kept bringing up the implosion of Trevali Mining (TSX: TM) as the cautionary warning of what would happen to Santacruz Silver. Trevali bought a few of Glencore’s zinc mines but failed bigly.

Hardly anyone though was looking at this as a hugely transformative deal for the company that just leap-frogged them over many of their silver-producing peers in an instant. The basket of assets was quite impressive… but most just shrugged.

Even today, it really doesn’t seem like most silver investors truly appreciate the production profile that is building within Santacruz Silver, nor what their future balance sheet and growth in revenues are going to look like heading into 2025 and beyond. Part of that is because they’ve spent the last 3 years getting the operations optimized, digesting the huge meal they scarfed up in this acquisition, and paying back some of the debt and payments to Glencore and Trafigura.

It is critical in investing to restate the adage “The past does not equal the future.”

So many times, investors make serious errors in judgement assuming that the past actions, or past experiences at other mines or exploration/development projects, or past quarters results (good or bad) are going to extrapolate out to infinity in the future. This is rarely the case… Sometimes management teams did great in prior ventures and companies, but fall right on their faces in a new company or project or operation. Other times, management teams that struggled previously, turn a corner and dial it in with a new drill campaign, development project, or producing asset, blowing away past performance.

Another good truism to consider is that “The only constant is change.”

Yes, of course, “Success leaves clues…”, but there is no guarantee that a successful individual or team, (be it in business or sports), is going to have a great next season, just because they had a great last season. Conversely, just because an individual or team struggled last season, doesn’t mean that they can’t surprise, like a dark horse from behind, and win the race this season. As investors we want to skate to where the puck is going to be…

So then, what we want to do when speculating, is to throw away outdated assumptions from the past, and look at the setup in the here a now from a fresh perspective. Yes, we should be appropriately critical of past errors, to make sure the individual or team has learned valuable lessons and that they have adjusted course accordingly. We should likewise recognize smart plays or transactions from the past, to see if they are still building upon those experiences for future success.

What I’m personally most interested in are management teams and boards that can be self-reflective, and harness their strengths and things that are working well, while also admitting when mistakes were made, and then quickly correct that behavior for a better anticipated experience moving forward.

After following Santacruz Silver for almost a decade now, I truly believe that is where things are with the current management team, portfolio of assets, operations, and financials moving forward into the next few quarters. I see a real growth trajectory setting up for next year, and we should even see evidence of that in Q4, now that the lion’s share of the payments to Glencore and Trafigura have been satisfied.

Let’s have a quick look at the Q3 2024 operations and financial results and look at how things are trending.

Santacruz Silver Produces 4,644,013 Silver Equivalent Ounces in Q3 2024

- October 24, 2024

https://santacruzsilver.com/news/santacruz-silver-reports-third-quarter-2024-results/

Silver Equivalent Production: 4,644,013 silver equivalent ounces

- Silver Production: 1,703,387 ounces

- Zinc Production: 23,143 tonnes

- Lead Production: 3,027 tonnes

-Copper Production: 270 tonnes

Clearly most of the metals produced are in the silver and zinc categories, with only small contributions from lead and copper. Santacruz Silver is undeniably a company leveraged to silver and zinc prices.

The Q3 2024 silver equivalent (AgEq) production of 4,644,013 ounces was a bit lower than Q2 2024 AgEq at 4,819,552 ounces, but a bit more than Q1 2024 at 4,478,122 ounces of AgEq and about the same as Q3 2023 of 4,695,999 ounces of AgEq.

As previously mentioned, one has to be careful extrapolating out the past into the future, but in general, the production profile is about 4.6+ million ounces of AgEq per quarter.

They’ve already produced 13.94 million ounces of AgEq year-to-date, and if they add another 4.6 million ounces of AgEQ that should put them ~ 18.5+ million ounces of AgEq for the annual production in 2024.

In a conversation I just had with the CEO, Arturo Préstamo Elizondo, at the end of this week, he indicated that 2025 guidance is not released yet, but that it should be slightly more than 2024’s production. So I think it is safe to assume that, barring no mine shut downs or major issues, that 2025 production will be about 18-20 million ounces of silver equivalent production. That is a significant amount of production!

Let’s put that production profile into context with peer silver equivalent producers then:

Silvercrest Metals – Market Cap $2.14 Billion

Q3 2024 2.6 million oz AgEq; 2024 revised guidance of 10.0 – 10.3 million oz AgEq

Gatos Silver – Market Cap CAD$1.5 Billion

Q3 2024 3.84 million oz AgEq; 2024 guidance of 14.7 - 15.5 million oz AgEq

Endeavour Silver – Market Cap CAD$1.53 Billion

Q3 2024 1.6 million oz AgEq; 2024 guidance 7.3-7.6 million oz AgEq

Aya Gold and Silver – Market Cap CAD$1.72 Billion (a curious valuation for the lowest production profile in this group of peers. Yes, it is pure silver with good costs… but still pretty richly valued at this point comparatively)

Q3 2024 355,927 oz Ag; 2024 guidance of 1.6-1.8 million oz Ag

Fortuna Silver - Market Cap CAD$2.1 Billion

>> I’d have done the comparison here but they now report in “Gold equivalent ounces,” so one can’t really consider them a “Silver” company in the traditional sense. Still, they would likely produce less silver equivalent than Santacruz Silver.

First Majestic – Market Cap CAD$2.62 Billion

Q3 2024 5.5 million oz AgEq; 2024 guidance – I couldn’t find guidance in recent materials, but with Q2 2024 production of 5.289 million oz AgEq, and Q1 2024 production of 5.162 million oz AgEq…

I think it is fair to estimate about 21+ million oz AgEq for the year.

Santacruz Silver – Market Cap CAD$110 Million

Q3 2024 4.6 million oz AgEq; 2024 guidance of 18+ million ounces AgEq

THAT IS A STUNNING DISCONNECT IN MARKET CAP VALUATIONS VERSUS PRODUCTION PROFILES WITHIN THEIR PEER GROUP!

Yes, I realize there is more that goes into the valuations like the costs, revenues generated, and makeup of the silver equivalent ounces, where gold is going to be more highly prized than zinc, copper, lead, along with other development assets and reserves to consider. I get all that… I really do…

….but still, Santacruz Silver is coming in at 1/10th to 1/20th of the valuation of it’s peers, and it is smoking all of those companies on annual silver equivalent production, and is only a few million ounces behind First Majestic. THAT is why SCZ is conveniently left off all the peer comparisons I saw on all those company’s corporate slide decks! :-)

So yeah… I'm fairly constructive that Santacruz Silver has PLENTY of room to rerate higher multiple-fold, just to get valued more like the mid-tier producer category that they've grown into. They could go up 5x, 8x, or 10x, and still be valued in line with peers at that point in time. I can’t think of a more undervalued silver producer.

The elephant in the room for Santacruz Silver is that they are a higher-cost producer, which impacts their margins and revenues. Are they 10-20 times higher costs…? NO. Clearly not. So again, their valuation is wacky and way underdone.

Like we have discussed on this channel so many other times though… the reality of them being a higher cost producer is precisely why they can take off like a scalded cat if we see rising silver prices. They have the most leverage to margin growth.

Their current Q3 All-In Sustaining Costs (AISC) were $27.40. That is very high.

I saw one commentator giving them grief because it rose 10% quarter over quarter from Q2 where it was $24.91. Of course, they didn’t bother to ask why the costs went up, which had a lot to do with the big capital reinvestment the company made at their Zimapan Mine in Mexico, paving the way for future growth. It will be far more instructive to see where the AISC comes in for Q4 of this year, and then again where it comes in to kick off next year in Q1.

Let’s just deal in the here and now though with that $27.40 AISC.

At $30.50-$32.50 silver they are still making a nice $3-$5 margin as a crude example. However, if silver goes back up to $35.50 then they are suddenly making an $8 margin, approximately doubling them up. If silver goes to $37.50 then they are making a $10 margin. You see the point… Of all the Silver producers, Santacruz Silver has the ability to see the most explosive growth in margin expansion in a higher metals price environment.

Some investor suggest that part of the reason for the valuation disconnect is because Bolivia is “too risky.” I don’t have the space left to get into this topic in this article, but I’ll say this: Bolivia is not without challenges, but it is not nearly as risky as it flippantly denounced by most retail investors, (even many of seasoned ones in this sector). Personally I'm still far more concerned about Guatemala, or Ecuador, or Colombia, or even Mexico or than I am Bolivia. In the case of SCZ, their Mexican and Bolivian mines are well established and producing for many years now and grandfathered in at this point, so that jurisdiction risk swipe seems really overblown.

Again, This company is trading for 1/10th or 1/20th of their peers, and neither their higher costs and lower revenues, nor the perceived jurisdiction risk come anywhere close to explaining away that discrepancy in valuations… and thus the potential for growth.

They will see balance sheet growth and improving revenues and margins in a rising metals environment, and they have all the bluesky exploration and expansion potential at their 6 mines. Additionally, their San Lucas ore feed-sourcing operation from the various smaller regional miners in Bolivia is another unique area of growth for the company. As more relationships are developed to source the feed stock, then that is more ore that can be processed at one of their 3 mills and processing centers. That feed-sourcing and metals trading division of the Santacruz Silver asset base is a revenue and profit center that is underappreciated by most retail investors. It is a true win-win-win between the Company, the local miners, and the Bolivian government.

One other asset in the SCZ portfolio is the Soracaya Exploration Project in Potosi, that has 34 million ounces of silver, along with a fair bit of zinc and lead mineralization. This is the next development project in cue for increased organic growth within their portfolio of existing projects.

Wrapping up, here is an interview I just recorded last Friday with Arturo Préstamo Elizondo, Executive Chairman and CEO of Santacruz Silver Mining. Arturo recaps the key takeaways from the Q3 2024 financials and operations at their 1 mine in Mexico, and 5 mines, 3 mills, hydro and nat gas power plants, and ore feed-sourcing and metals trading business in Bolivia. Please take the 20 minutes and hear their outlook directly from the CEO!

Santacruz Silver Mining – Q3 Financials, 6 Mines, 3 Mills, & Ore Feed Sourcing In Mexico & Bolivia

Trading The Whipsaw:

One last thing I wanted to point out to readers here is the extremely volatile nature of the pricing movement in (SCZ). Below is a 5-year chart that has been whipsawing back and forth for as long as I can remember. This has not been a slow an steady incline or decline, but rather gut-wrenching drops, followed by turbo-charged pops, then more drops, then more pops. There are 2-4 good trade setups each year in Santacruz Silver, where it puts in an intermediate low, and then rallies up to double or triple in price.

Eventually, I do anticipate this stock starting a longer trajectory to the upside as more market participants and silver bugs start to better appreciate their production profile. So once again, the past does not equal the future… but still, there has been a periodicity to these rally periods every few months.

We’ve already seen 3 such rallies just in 2024, and on the chart it would seem to appear we are gearing up for the next upward jolt higher for a few months.

I added 2 more tranches to my position this month, most recently on November 13th in anticipation of a move to higher levels in the months to come. (Again, that is NOT investment advice, and I’m simply sharing what I’ve been doing in my own portfolio for information and entertainment purposes only).

Thanks for reading and may you have prosperity in your trading and in life!

Shad