Opportunities In Growth-Oriented Silver Producers – Part 4

Excelsior Prosperity w/ Shad Marquitz – 08/23/2024

We are continuing on with this series on growth-oriented silver producers, after having laid out the key framework and investing considerations for this niche of the mining stock sector in [Part 1].

We’ve reviewed 3 companies in this series, Avino Silver and Gold Mines (TSX:ASM – NYSE:ASM) in [Part 1], Guanajuato Silver (TSX.V:GSVR) (OTCQX:GSVRF) in [Part 2], and SilverCrest Metals (TSX:SIL) (NYSE:SILV) in [Part 3].

(In full disclosure, I have a reasonably heavy weighting inside of my own personal portfolio in a few of these growth-oriented silver producers that we are covering in this series. I’ve not been commissioned by these companies to write these articles on Substack, but they may sometimes be sponsors over at the KE Report. This is not investment advice, nor am I suggesting that anyone take a position in these stocks. Rather, this is simply an editorial on the value proposition these companies demonstrate to my mind, and why I got positioned in them in my own portfolio.)

As far as investing in junior gold or silver mining stocks, it should be pointed out that this is a risky sector, often having extreme moves to both the upside and downside, compared to the precious metals themselves. Riding these PM equities through bull markets and bear markets is definitely not for the faint of heart, and the stock price action can be wildly volatile. This means that with so much volatility comes multiple waves of price rises and then price declines to potentially capitalize on for either swing-trading or position-trading. This volatility also provides ample opportunities for value investors to accumulate positions for the longer-term, by layering into a position over several buying tranches during pullbacks. This layered approach to scaling into a position, via multiple partial purchases, is a great way to smooth out the volatility, while building a good overall cost-basis over time.

With all of that said, let’s get into it…

The next company we are going to look at in this series, is a smaller silver producer, that has recently grown through an acquisition bringing a new mine into production. This company has also recently restarted production at a previously producing mine, after dialing in how to improve the metal recoveries. In addition, this company has the potential for organic growth via all the exploration upside present on their district-scale land package. Since they are still a small-cap company, the exploration results can still move the needle for them in a significant way. For this reason I consider this company a hybrid company: Part growth-oriented producer, and part exploration company.

My personal investing journey with Impact Silver (TSX.V:IPT – OTCQB:ISVLF) began in early 2016, when looking for smaller silver producers that would have bigger torque to rising silver prices. In my experience, Impact Silver is one of the highest torque silver producers there is, because of how sensitive their margins are to metals prices, and how much exploration can have an “impact” on the stock.

As a result, I’ve been position-trading around a core position in this stock ever since then, trimming back 20-50% on rallies, and then accumulating back those partial positions on big pullbacks, taking it up to a full position again. Rinse and repeat… Impact Silver is a very volatile stock, which may vex traditional investors searching for gradual progress over time, but keep in mind that all that volatility can absolutely be an investor’s friend; providing ample opportunities to “buy low and sell high.”

We’ve discussed this before, but it is worth reiterating… When we see turns in the resource sector (regardless of the commodity) is typically the producers of that commodity that get the bid first. So whether it is oil, or copper, or uranium, or gold, or silver… the point is the same…. The producers are going to move first and get the bid, because they can immediately monetize the higher commodities prices with increasing margins. The producers are also where generalist investors turn to first, along with going into the ETFs (generally chock full of senior and mid-tier producers).

This is why it is so puzzling to me that more resource investors are not adequately exposed to the producers coming out of corrective and basing periods for a given commodity. It should stand to reason that just because a commodity turns, does not mean that XYZ drill-play is going to rip higher (because they don’t have resources defined yet in the ground, and thus don’t have leverage to rising prices). This is precisely why only being exposed to greenfields exploration companies is a risky strategy, and that approach completely misses the easy gains at sector turns that always show up first in the producers.

Please understand, I’m not saying I don’t like explorers, because I absolutely do, and love a good lottery-ticket on a potential new discovery. I’m just pointing out how strange it is when we are near a turn in pricing and sentiment and then investors complain their juniors aren’t moving yet. (huh?) They seem to miss the point that it will be the producers, developers, and advanced explorers with defined resources in the ground (and thus optionality) that get the bid for some time, before capital finally trickles down to speculate on drill plays.

Then there is a further nuance within the category of producers that is rarely exploited by most resource investors. The higher-cost producers actually have the most torque (both to the upside and downside). This flies in the face of most of the advice that talking heads in the sector give to investors about “finding the best companies, best management teams, and lowest cost operations.” The truth is, sure, those “best of the best” companies will still do well, but they are typically already pricing in all that quality. Their lower risk makes them easier to flag to others, and they are more obvious to analysts that can only seem to think quarter to quarter. However, the big secret (that shouldn’t really be a secret) is that those best-in-class companies won’t typically have the best performance during big bullish sector rallies.

While it may seem counterintuitive, it is actually the “best of the worst” higher-cost producers that tend to have the outsized performance during really bullish periods. This is because the increase in the underlying commodities prices also increases their margins on a much larger percentage basis than it does a low-cost operator. Typically that move higher in margins was not previously being priced in by the street, because people tend to have recency bias and extrapolate the recent past out into the future infinitum. This is where the edge is for thinking investors to get in before the margin increases are more obvious to analysts or the rest of the retail herd.

This is such an important point to internalize for resource investors, but many struggle with it, believing they strictly need to be in the lowest-cost producers all the time, while shunning the higher-cost operators. That is just simply not true. There is actually a place in one’s portfolio for both types of companies, but with different investment objectives and risk/reward expectations.

The best-of-the-best companies and lowest cost producers are absolutely the safest bets, and they are more defensive in nature, so they’ll correct down less during bearish cycles. However on bullish cycles, they’ll do well, but also won’t run quite as hard. Conversely, the higher-cost producers will have the higher torque – falling much lower during bearish periods as they may be underwater on their cost of production, but then scorching higher during bullish periods as they suddenly go from not profitable or barely profitable to very profitable. THAT… is where their torque comes from.

Sometime, in a one-off article we’ll expand on this point in more detail and I can pepper in a ton of comparative charts of prior rallies to illustrate that point over and over again. However, for today’s article, this topic is quite germane for Impact Silver, and helps explain the earlier points made about (IPT) being one of the highest torque silver stocks for these very reasons. Then on top of that, IPT has the potential for drill results to still move the needle if a new discovery or zone is tapped into.

I had posted recent charts and company examples in a prior article on the silver stocks outperforming the rest of the PM complex in the rally we saw earlier this year. In that article it was noted that: Impact Silver rose 171% from late February to early April, because Silver bounced up higher and thus its margins increased at a much faster clip than most other companies.

Contrast that with a best-in-class silver producer like Mag Silver (NYSE American: MAG), with the lowest margins (around $9.18 per ounce AISC). Yes, (MAG) absolutely did great, but it only went up 74% from low to high in that same sector rally. Impact Silver yielded about an extra 100% in potential gains from low to high. However, as previously noted, with Mag Silver being a low-cost producer it is also more defensive in nature, and thus held onto most of its gains in the sector downside pressure following that period. Again, there is a place in one’s portfolios for both types of companies.

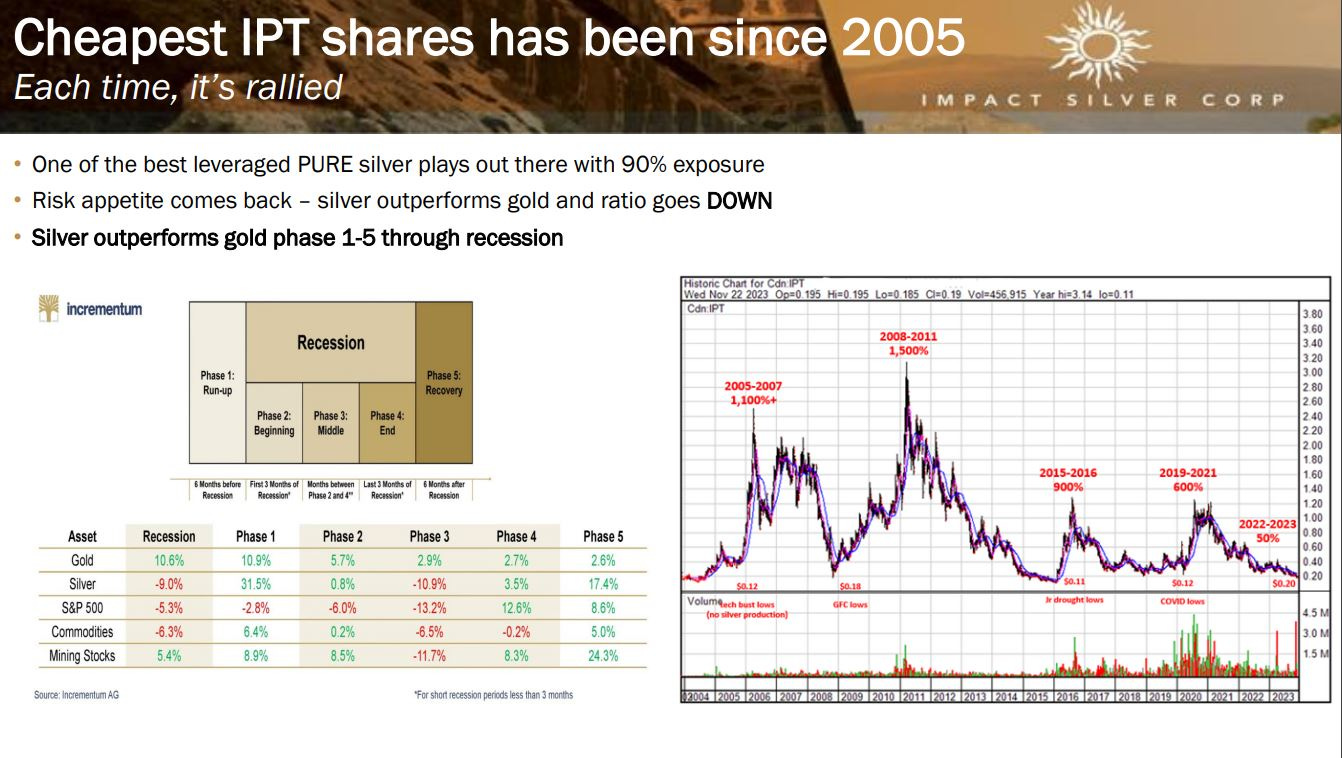

Keep in mind that the example above was just for a short amount of time over a couple of months rally. We have see this kind of outperformance in Impact Silver over and over again. I could back the clock up to to show the 1,100% rally from 2005-2007, or the 1,500% rally from 2009 to 2011, but many investors believe that this precious metals bull market is different. Many note that this PM bull, which kicked off at Gold’s Major Low in December of 2015, and the gold and silver stocks a month later in mid-January 2016 has been of a different tenor. People have been saying for the last decade that we aren’t going to see those kinds of gains anymore.

Well, let’s look at a chart of (IPT) since the major low in PM equities since January of 2016 then:

(IPT) has had a number of rallies since it’s major low of $0.11 back in January of 2016. That first 8 month rally up to $1.28 in August of 2016 was a 1,164% gain from low to high. Since then, we’ve still seen multiple tradable rallies over and over again, of which the recent 171% rally earlier this year was just another in a long string of rallies. This is obviously a very volatile price chart for (IPT), so it is a prime example of making volatility your friend, where one is rewarded through buying the dips and selling the rips. If silver goes to $35 or $40 where do you think this stock is going?

To be clear, Impact Silver is not Franco Nevada or a blue chip Dow stock where you “buy right and sit tight.” In fact, that Jesse Livermore quote is often used blindly as a broad-brush piece of advice; but it is actually terrible advice for investing in cyclical commodities, and even more so in the very volatile related resource stocks. Sure, one may sit tight for a few months or maybe even a year or two, but hanging out in junior mining stocks or even senior mining stocks for many years or decades has been a fool’s errand for a long time.

Having said that, I believe that we are going to see a run in silver into the mid to high $30’s that is sustainable, and that over the next 2 years we will even see silver challenge its all-time high in the $49-$50 area once again. As a result, my personal strategy will be reducing the amount of trading around some of these producers, in favor of accumulating and holding them for the larger run that I anticipate them going on, when the sentiment turns more bullish towards the precious metals equities.

As is clearly evident, Impact Silver offers excellent leverage to the underlying price movements in silver, and really this is the main point for consideration here, regardless of whether you factor in any of the fundamental growth factors. If someone knew absolutely nothing about the company, it would still be a relevant stock to follow or have in one’s portfolio during bullish periods for silver price appreciation. Having made that point, let’s now dive into the fundamentals for the company, which are steadily improving as of late.

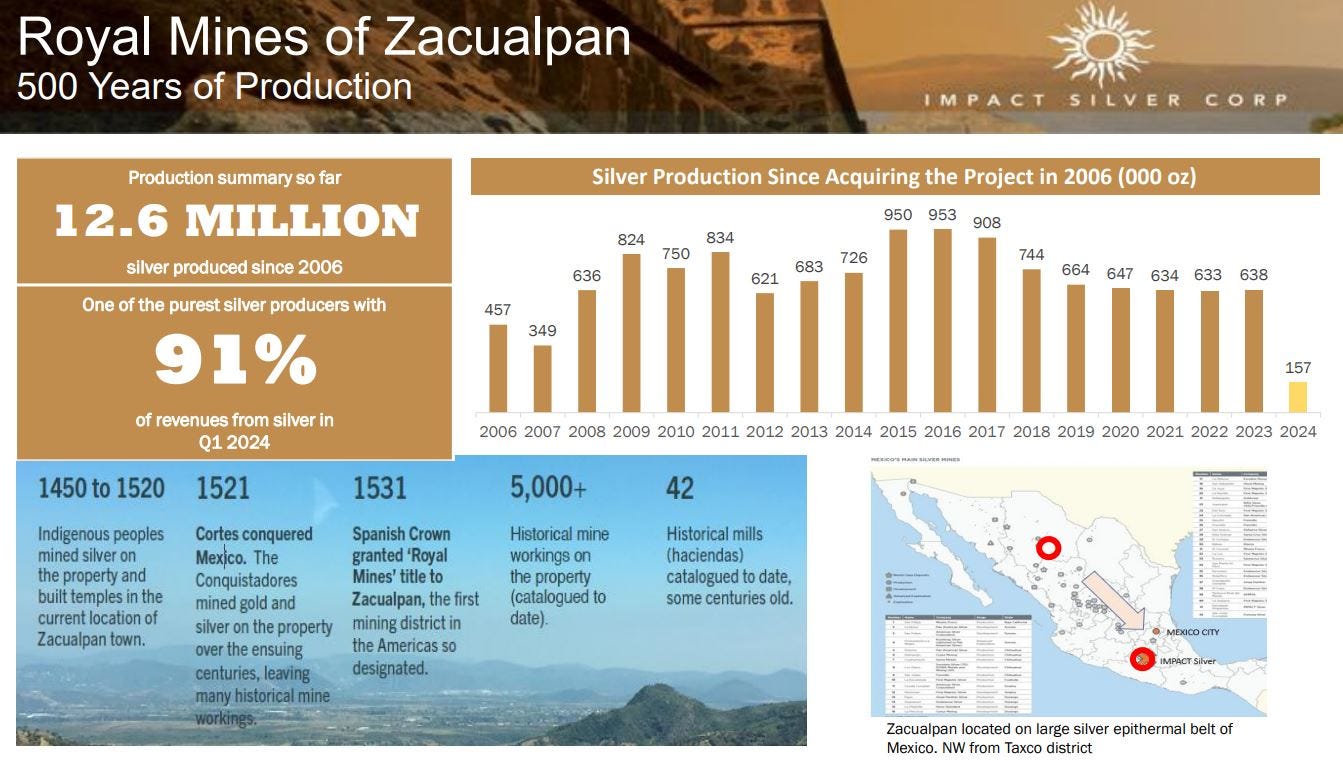

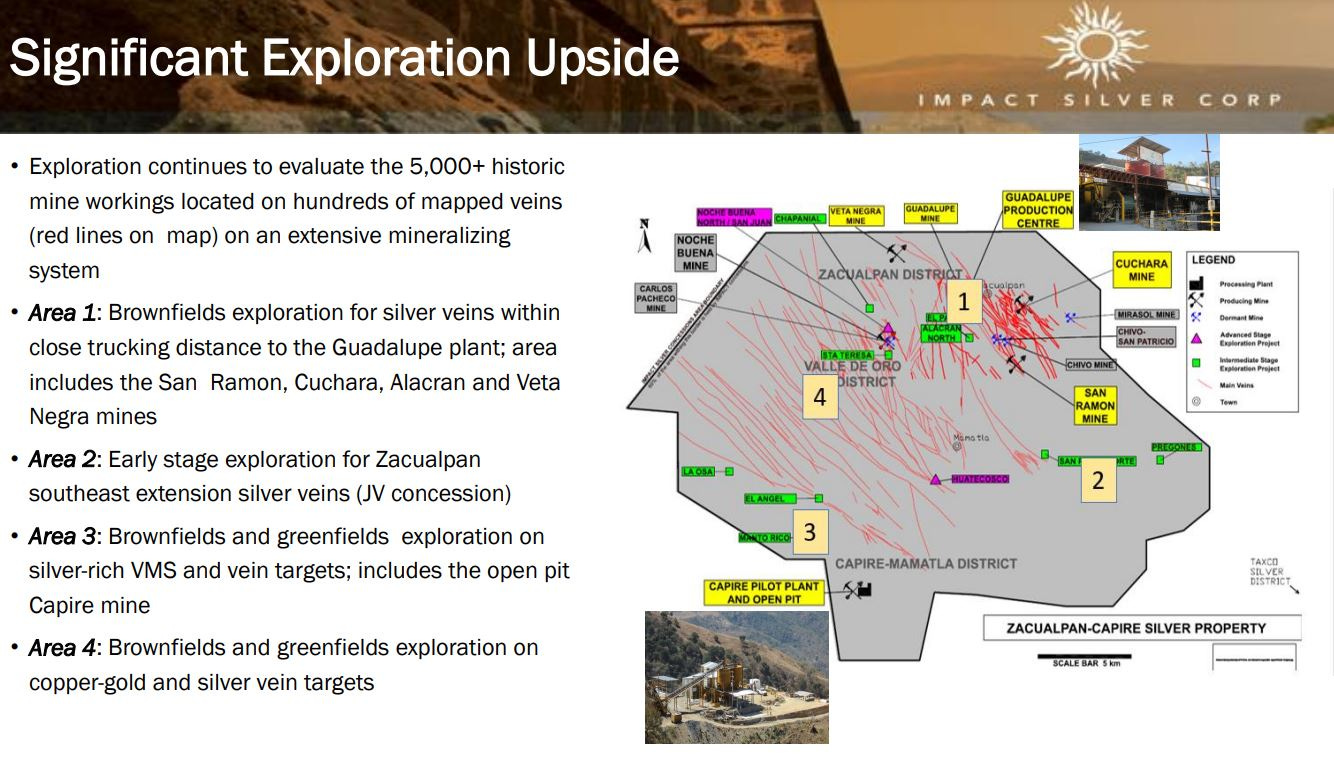

The company has an 18-year history operating in the Zacualpan Silver-Gold District where the Company has 4 underground mines (Guadalupe, San Ramon, Cuchara, and Alacran) and 1 open-pit mine (Veta Negra) all currently feeding into the Guadalupe processing plant. Their operations team has had a solid history of turning on or turning off multiple mines based on metals pricing trends. For example, they have recently improved on the metallurgy and gold recoveries at their Alacran Mine, so they recently turned it back on and are now mining from it once again giving the company exposure to the yellow metal. That is another area of growth for Impact Silver.

Silver has been mined in this district for about 570 years now, so it’s a very prolific area that will keep giving and giving for decades to come.

As far as the production profile for Impact Silver, they’ve been averaging in the 630,000+ oz range the last few years, and have been 91% silver production focused. So one may wonder where the “growth” is going to come from and why they are being featured in this series on growth-oriented producers? Well, we mentioned Alacran coming back online with a nice gold credit, but there is something more significant to their growth to review.

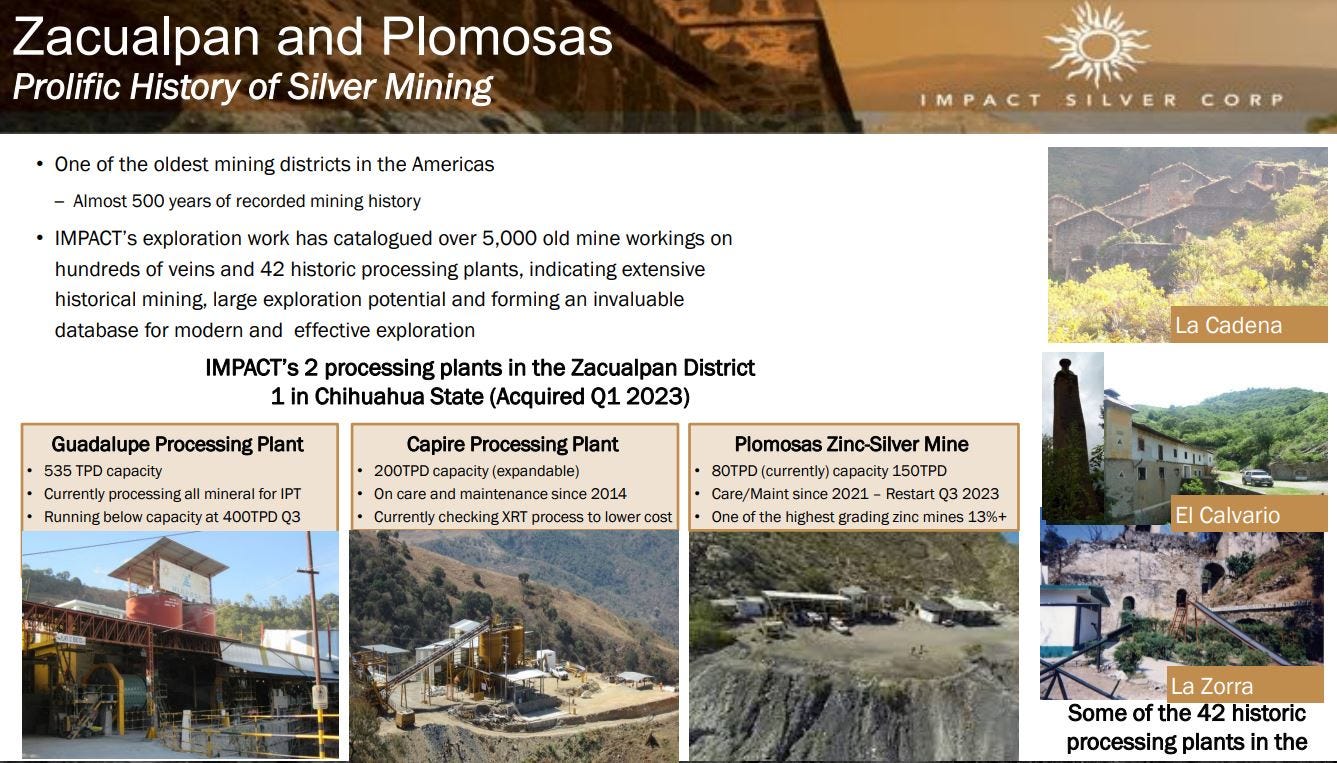

As noted in the introduction to this article, the company made a transformative acquisition back in Q1 of 2023, when they purchased the Plomosas Zinc-Lead-Silver mine.

Short-term thinkers gave the company a lot of grief for the equity dilution via a capital raise to make this acquisition; but it was a fixer-upper project, and required a lot of work and reinvestment. The reason they got such a great deal was because the mine needed substantial improvements, along with updates to the portable mining equipment and vehicles, which has now mostly been completed. This was an example of short-term pain, for longer-term gain, and a wise use of dilution.

Some market followers also did not like that Plomosas was more of a zinc-forward mine, with lead and silver co-credits. However, most retail investors don’t really track zinc pricing, or understand it’s significance to manufacturing or even to silver mining globally. The reality is that many “silver” stocks are actually zinc/lead stocks in drag. Much of the silver produced in the world is a byproduct of base metals mines, most commonly coming from zinc and copper mines.

In this case, Plomosas is averaging 14% zinc and 8.7% lead in many of the key areas that Impact Silver is mining, which is really high grade for those metals, and it is one of the higher-grade operating zinc mines in existence. What this means is that the zinc and lead cover all the costs of mining it, while generating a profit, and the company gets all the silver for free. The CEO, Fred Davidson, has estimated around an additional 100,000 ounces of silver per year from Plomosas. That’s a pretty smart way to increase their exposure to more silver, while also diversifying their mix of metals.

Again, some critics won’t like that they are going to augment their current 90% exposure to silver by growing and bringing in more zinc and lead; but again at Alacran they are also starting to bring in more gold. It was inevitable to become more polymetallic to grow. To add one more metallic layer to it, they have a lot of copper-gold exploration targets and VMS targets with copper and base metals on their massive land package that they are going to start exploring next year, which will bring in the red metal to their overall mix a well. The reality is that Impact Silver is still one of the more silver-dominant producers for getting leverage to silver prices, and a little diversification into gold, zinc, lead and copper gives them flexibility and exposure to more mineral wealth. If they end up also having a lot of gold and copper on their land package should they just ignore it, or should they exploit it?

The company just released their Q2 operations and financials, and it shows Plomosas ramping up in production profile and revenues, and it will continue to do so. Again, Q2 revenues were up 40% with a big piece of that being the inclusion of the production from Plomosas. It should be noted that Q2 of 2024 also had some one-off write-downs from all the prior costs of mine refurbishment that needed to be taken in this period in conjunction with the move into production. With that now behind them, there should be a continued steady ramp up in revenues and cashflows in Q3 and Q4 coming out of the Plomosas mine, adding to the growth of the company.

I’m very curious to see how their Q3 financials will look with most of the Plomosas refurbishment write-downs taken care of and with solid silver and gold prices thus far in the quarter. It could surprise many on the upside.

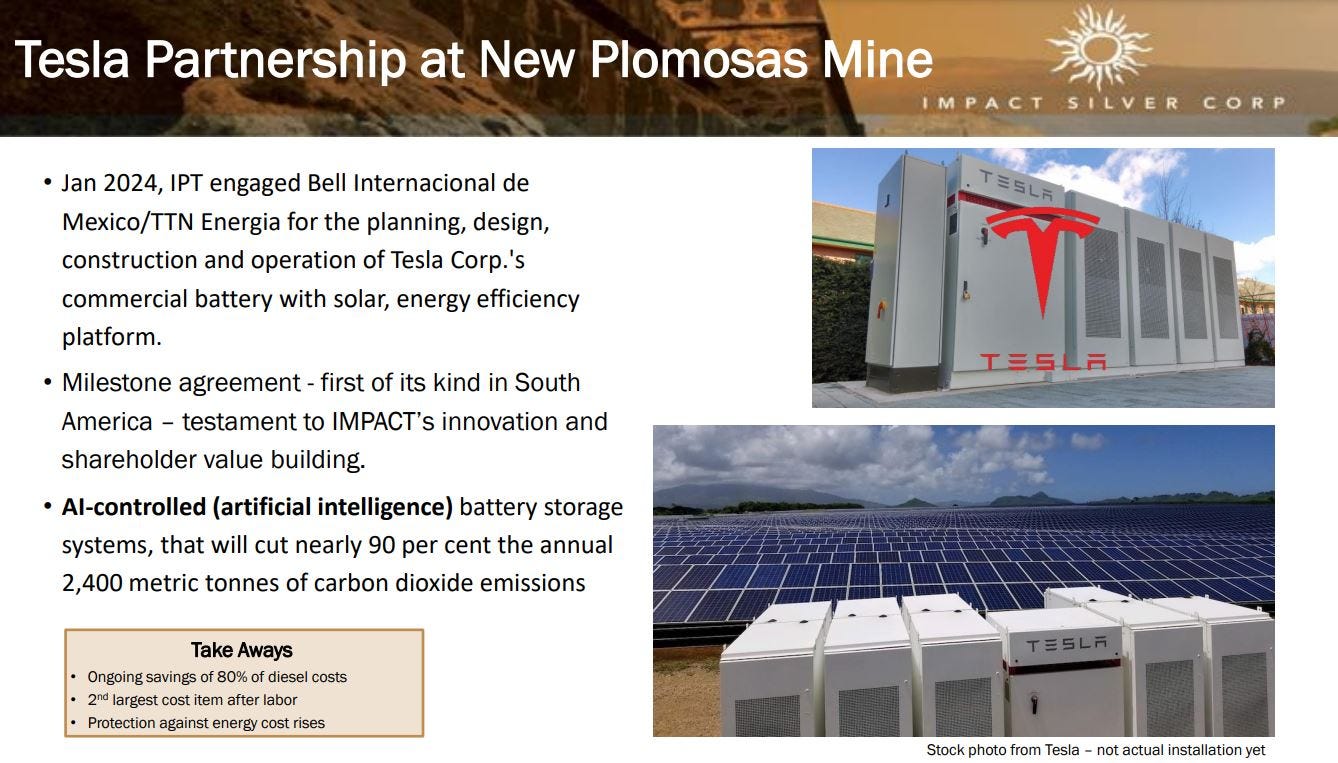

Another initiative worth flagging at Plomosas is the partnership between Impact Silver and Bell Internacional de Mexico/TTN Energia for the design, construction, and eventual operation of Tesla’s commercial battery, utilizing solar power. When this is implemented it is expected to reduce diesel costs by up to 80%, and insulate the company from rising energy costs. It’s nice to see Impact Silver utilizing technology and innovation to improve the mining industry.

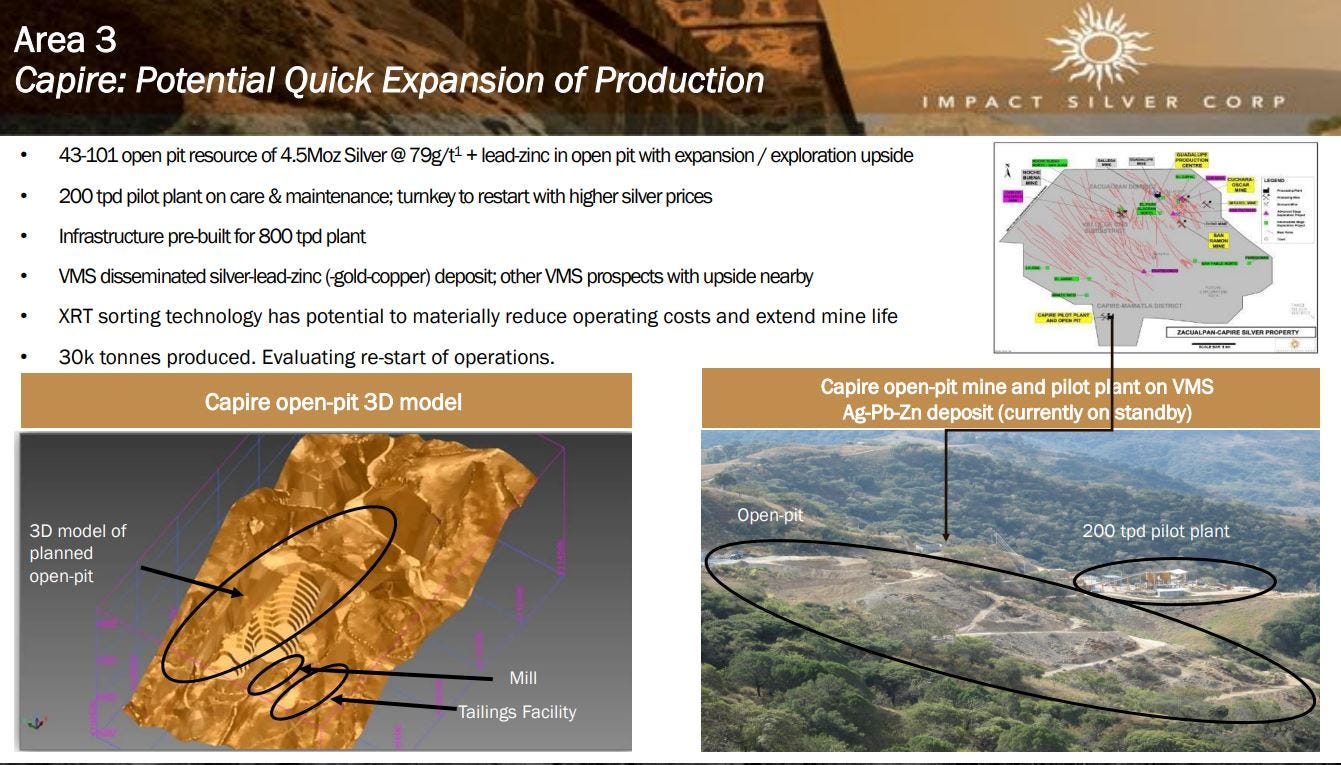

Another unrecognized potential value center could come from their Capire Processing Plant that has been on care and maintenance for the last decade. If the company can generate more revenues through the higher silver, gold, zinc, and lead prices and the addition of the Plomosas Mine production, then it is possible that some capital finds it way back over to Capire to get it refurbished and back into processing once again. It will likely take seeing silver in the mid $30s and staying there for a few quarters, but it is another potential area for production growth, that would need to be paired with more mine development.

They are also looking at XRT ore sorting as a potential solution for upgrading the material they’d put through their processing center, improving economics.

One more large driver of growth for a small-cap junior silver producer like Impact Silver, will be if they can continue plowing some revenues into exploration. Their land package is quite prolific with hundreds of prior artisanal workings, and over 40 old history processing centers over the last 500+ years. The exploration team has already drilled 20,000 meters around their 2 mining areas in the first half of the year, and plans to do around the same amount of meters over the 2nd half of the year. ~40,000 meters a year is far more drilling than most exploration companies offer companies, but it’s back-stopped by production.

There are a lot of different exploration targets that could create more growth in resources and be further value drivers. Their team is very efficient at converting new exploration success into mining initiatives to feed the production profile.

Some of the key ones the company is working on that has their team’s attention is the expansion drilling around their Guadalupe Mine (especially around the new discovery at the Kena Vein) and at depth at their Alacran Mine. In addition there are few different Volcanic Massive Sulphide (VMS) targets, copper-gold targets like Carlos Pacheco, more high-grade silver vein targets in Zacualpan, and even their Valle de Oro (Valley of Gold) targets that will get more attention in 2025.

Just a few days ago, on August 21st over at the KE Report, I conducted an interview with the CEO of Impact Silver, Fred Davidson. We got into the ramp-up of production, how he anticipates Q3 and Q4 this year to be more robust that even Q2 (which already saw a 40% increase in revenue growth), and of course – all the exploration work and blue-sky upside across their district scale land package.

Well that’s it for this next installment in this series on growth-oriented silver producers, but rest assured that there will be many more of these to come.

Thanks for reading and may you have prosperity in your trading and in life!

- Shad