Opportunities In Growth-Oriented Silver Producers – Part 5

Excelsior Prosperity w/ Shad Marquitz – 11/02/2024

We are continuing on with this series on growth-oriented silver producers, after having laid out the key framework and investing considerations for this niche of the mining stock sector in [Part 1].

Thus far we’ve reviewed 4 companies in this series, Avino Silver and Gold Mines (TSX:ASM – NYSE:ASM) in [Part 1], Guanajuato Silver (TSX.V:GSVR) (OTCQX:GSVRF) in [Part 2], SilverCrest Metals (TSX:SIL) (NYSE:SILV) in [Part 3]… which was recently taken over by Coeur Mining, and Impact Silver (TSX.V:IPT – OTCQB:ISVLF) in [Part 4].

(In full disclosure, I have a reasonably heavy weighting inside of my own personal portfolio in some of these growth-oriented silver producers that we are covering in this series. I’ve not been commissioned by these companies to write these articles on Substack, but they may sometimes be sponsors over at the KE Report. This is not investment advice, nor am I suggesting that anyone take a position in these stocks. Rather, this is simply an editorial on the value proposition these companies demonstrate to my mind, and why I got positioned in them in my own portfolio.)

As far as investing in junior gold or silver mining stocks, it should be pointed out that this is a risky sector, often having extreme moves to both the upside and downside, compared to the precious metals themselves. Riding these PM equities through bull markets and bear markets is definitely not for the faint of heart, and the stock price action can be wildly volatile. This means that with so much volatility comes multiple waves of price rises and then price declines to potentially capitalize on for either swing-trading or position-trading. This volatility also provides ample opportunities for value investors to accumulate positions for the longer-term, by layering into a position over several buying tranches during pullbacks. This layered approach to scaling into a position, via multiple partial purchases, is a great way to smooth out the volatility, while building a good overall cost-basis over time.

With all of that said, let’s get into it…

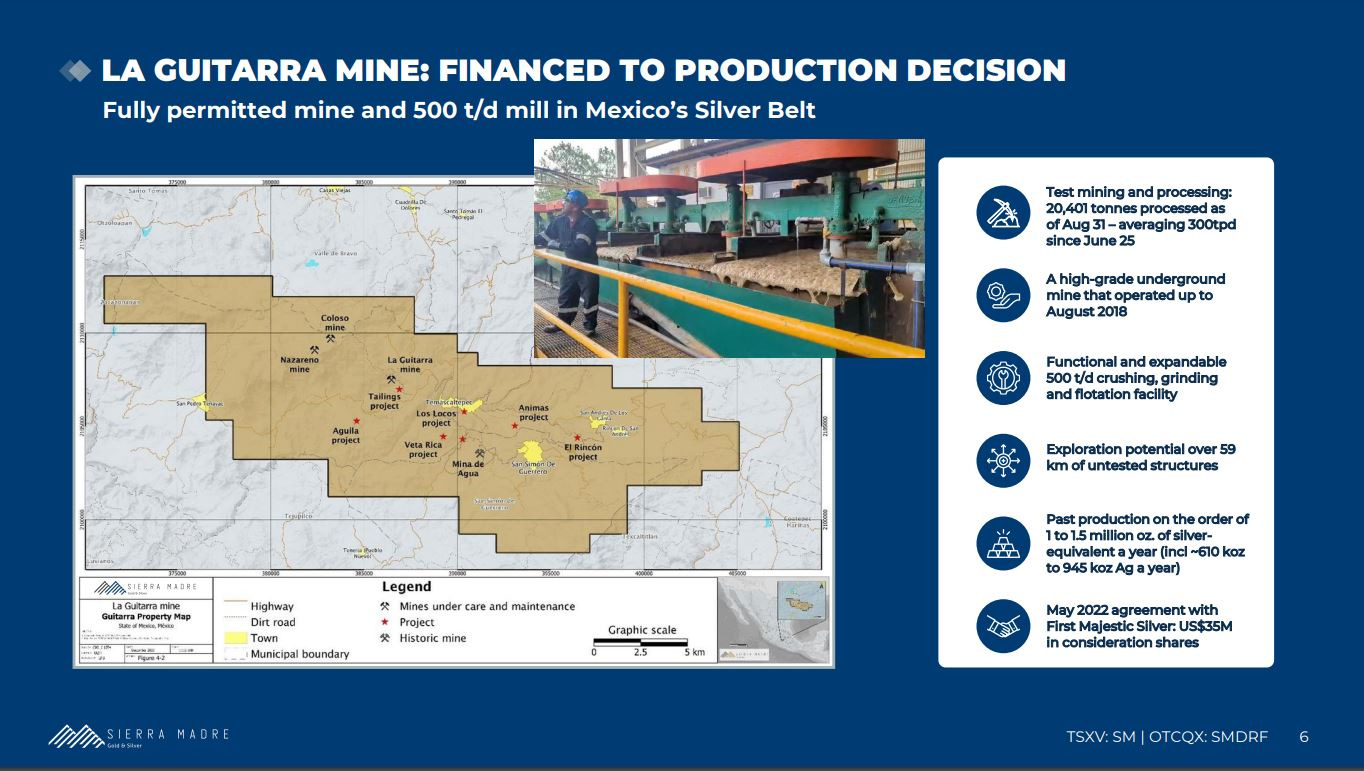

This next 5th company we are going to review, Sierra Madre Gold and Silver Ltd. (TSXV: SM) (OTCQX: SMDRF), is actually the newest “growth-oriented silver producer” minted in Mexico. At this point, they’ve been growing their production each of the last successive few months as they are in the process of ramping up to commercial production by year-end.

Personally, I love a silver company that has plans to grow their production over a couple years, just operationally. However, what really caught my attention when meeting with the CEO, Alex Langer, at the Beaver Creek Precious Metals Summit in mid-September of this year, was that they also have incredible exploration upside.

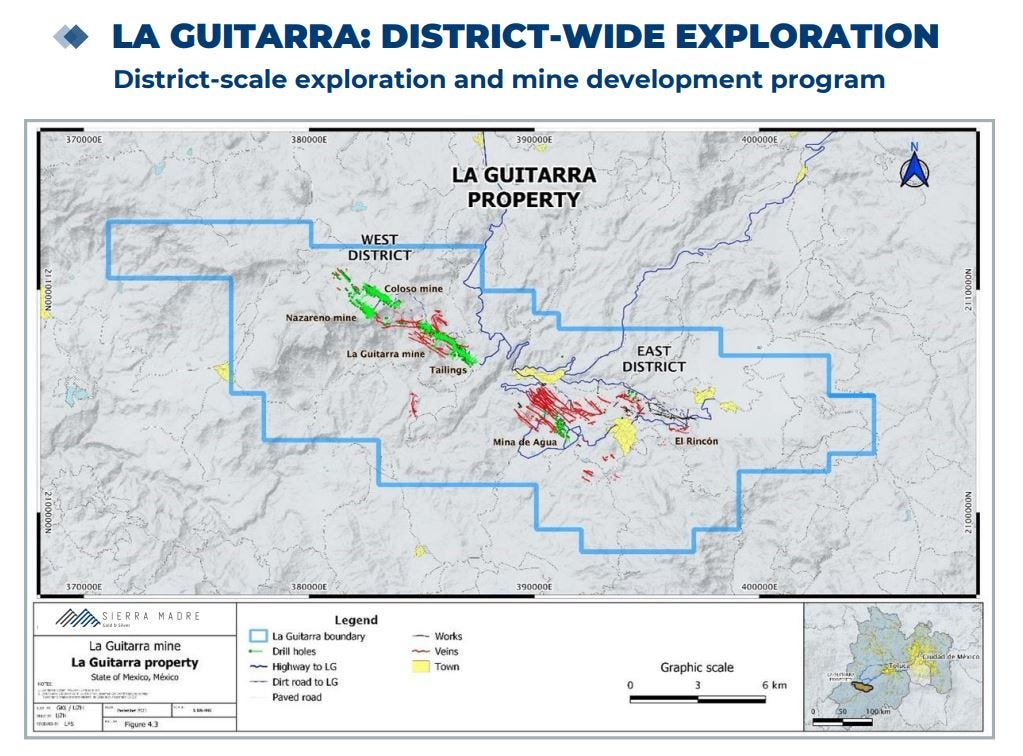

Now, ALL companies claim to have exploration upside on their projects, so sometimes that statement in and of itself can come off as a trite proclamation. In the case of Sierra Madre Gold and Silver though, this tiny junior miner has acquired a district-scale land package from First Majestic with 8 historic prior-producing artisanal mining areas (4 of them being modern mines). The management team and board has an eye to further explore, and then develop a hub and spoke approach to growing their resources across this land package. I see the potential for this team to eventually bring in several new satellite mines over the fullness of time, and that is why they are being featured in this series.

When sitting down with Alex at the conference to better understand the project, I was anticipating only parsing out the grade, throughput run rates, and anticipated production metrics on their current flagship La Guitarra Mine. This mine was previously operated by First Majestic up until 2018, and is ramping back up towards commercial production. However, over half of the meeting was actually dedicated to the larger vision of where their team sees multiple projects coming to life through the drill bit as they plow organic incoming revenues from production into a district-scale exploration strategy.

I was so impressed with the bigger picture vision, that upon returning home from the Beaver Creek conference a starter position was immediately put into place in my portfolio, so that I’d start following the company more closely. (There’s nothing like putting a little money on the line to move from mildly interested to fascinated). I intend to keep adding to this position on pullbacks in the stock, and as I see more milestones completed and a proof of concept playing out in real time.

This has been a unique situation ever since May of 2023, when they purchased the mine on care and maintenance from First Majestic Silver for $35Million - totally in Sierra Madre shares [a bold statement in itself as Keith and the team at First Majestic wants the upside leverage in the (SM) equity valuation]. One year later they are now moving it right back into production, in concert with a backdrop of fantastic underlying precious metals pricing for silver and gold producers.

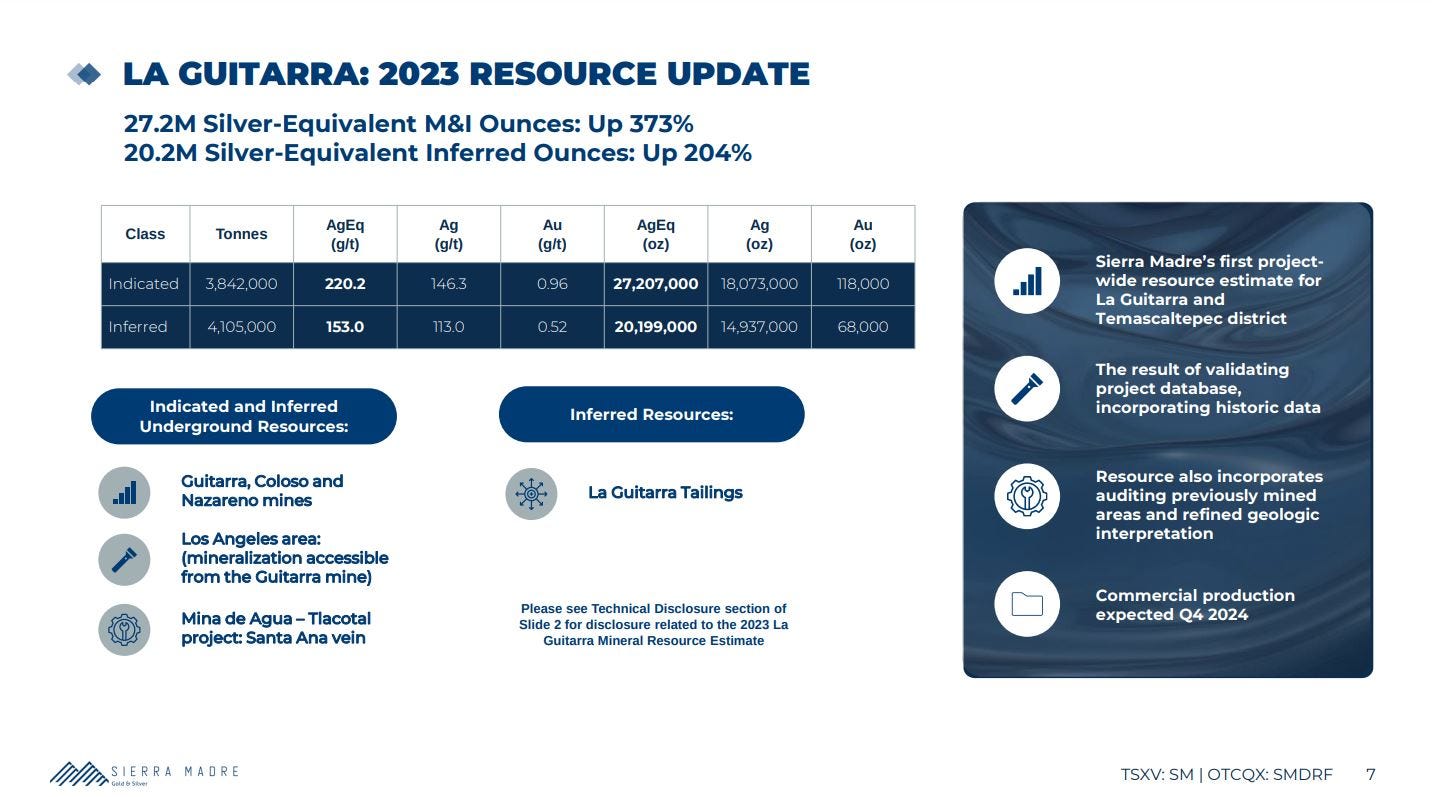

While they do have an updated 2023 Resource Estimate, they don’t have an NI-43-101 economic study in place like a Preliminary Economic Assessment (PEA) or a Pre-Feasibility Study (PFS). It should be pointed out though… in many ways the hard data that they already have from First Majestic, from when the mine was operated, is much more germane as they know precisely what their anticipated costs (labor, reagents, energy), ore grades, metals recoveries, and a rough idea of what the projected production will be from the first-hand experience of the prior operator, and real-life current experience operating it.

I actually like that they have a handle on all the metrics and variables, but aren’t blowing money and spending years going through all that red tape and hassle just to put out economic studies, which often are little more than marketing documents…. Instead, they are just blazing into production and will let the numbers speak for themselves.

They aren’t allowed to officially project market guidance without the NI-43-101 economic studies, but once they go into commercial production by year-end, we’ll be able to see how things are going at the slated production throughput of 500 tonnes per day for all of Q1 and then Q2 of 2025. I expect there to be a catchup re-rating in the stock when those figures come out next year (this not investment advice, just sharing my own personal thesis).

Their updated 2023 resources are 47.4 million ounces of silver equivalent in all categories (being made up mostly of silver with a nice gold co-credit).

It is difficult to find many quality primary silver producers that mostly have gold as a co-credit. So many so-called “silver” companies are far more gold than silver, or they are far more zinc-lead-copper than silver.

Over the last few months the company has done what they said they would do and has ramped up their mine throughput from 300 tonnes per day (tpd) in August, then 350tpd in September, and then 425tpd in October, and appears to be on-track for 500 tpd by the end of the year as anticipated.

Sierra Madre Announces Test Mining Throughput in Excess of 425 Tonnes per Day at La Guitarra - October 23, 2024

“Test mining and processing has been ongoing since June 25th, 2024. Beginning in October, the company began testing the operation of all three ball mills simultaneously and in various combinations. Daily throughput in the grinding and flotation circuits has been as high as 504 wet metric tonnes per day (WMT/d). From October 1st to October 18th, throughput has averaged 428 WMT/d. This average includes scheduled downtime to reline one mill and normal rainy season power outages. The Company expects commercial production to begin before the end of the year.”

https://sierramadregoldandsilver.com/read/auto-news-1729681332

At 500tpd throughput, the La Guitarra Mine historically produced roughly 1 million to 1.5 million ounces of silver equivalent annually from 2013-2018, when in operation. Below is a good video showcasing the mine presently and back in 2017 when in production.

Sierra Madre - La Guitarra Main

https://vimeo.com/user26736725/review/842670617/dff91f182e

On October 3rd over at the KE Report, Alex Langer, President and CEO of Sierra Madre Gold And Silver, joined us for an introduction to this brand new precious metals producer, their ramp-up strategy, and the larger vision of the company.

Sierra Madre Gold And Silver – Ramping Up Towards Commercial Production By Year-End At The La Guitarra Mine

Alex shares with us that the plan is to incrementally move it up to 400 TPD next month, and then up to 500 TPD by year-end, where commercial production can be declared. He also shares the pathway forward to growth, where after a full year of 500 TPD production slated for 2025, that there is a process and equipment updates needed to grow the mill throughput to 650 TPD in 2026, and then all the way up to 1,000+ TPD by the end of 2027. That’s a growth-oriented silver producer for you.

Next we got into the even larger growth vision of the company, as it will turn it’s it focus to exploring this district scale land package the end of next year; funded through organically generated revenues. The property hosts 8 different past-producing mines, with the first 2 priorities being to explore around the El Rincon and Mina de Agua mines. Additionally, there is a non-compliant 17 million ounce historic resource at the Nazareno Mine, and also solid underground infrastructure at the nearby Coloso Mine, that First Majestic had put quite a bit of sunk cost into already that will be an area of future expansion.

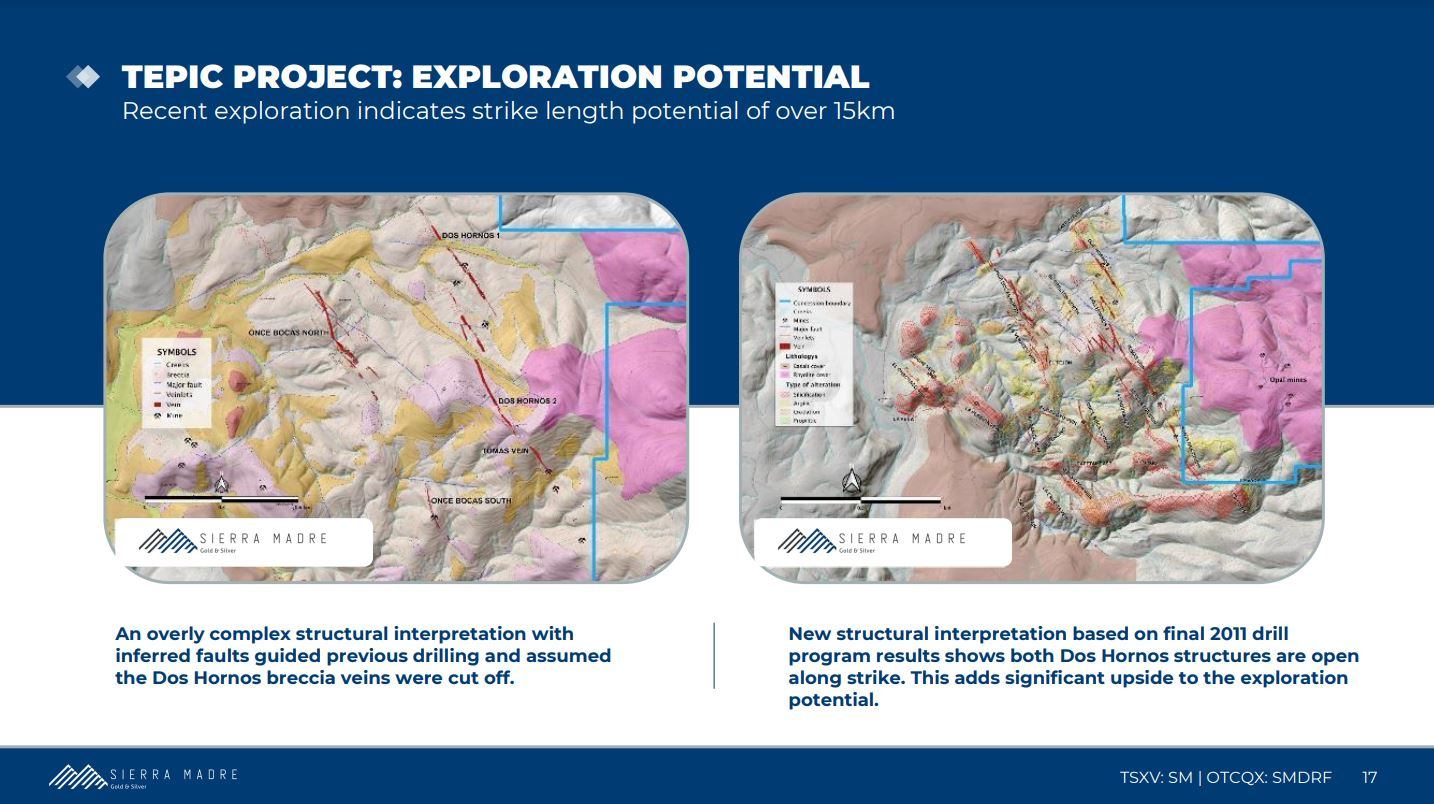

The company does have a secondary Tepic Project, where there is an upcoming resource estimate planned, and some metallurgical work slated. I believe this is getting no credit in their valuation. Their valuation is based solely on expectations for the La Guitarra Mine at this point. Maybe over time, the rest of the exploration projects and also this Tepic Project will garner some more value for the company.

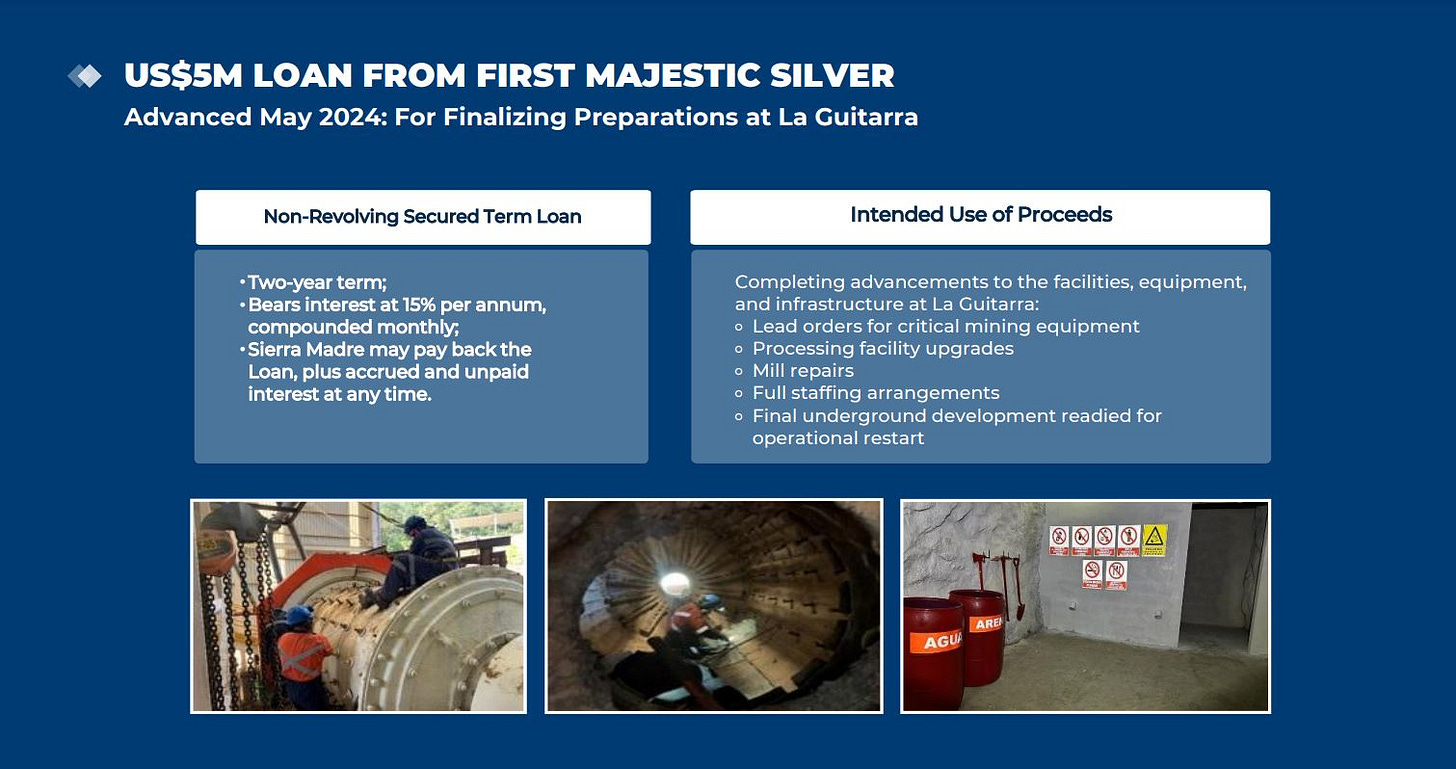

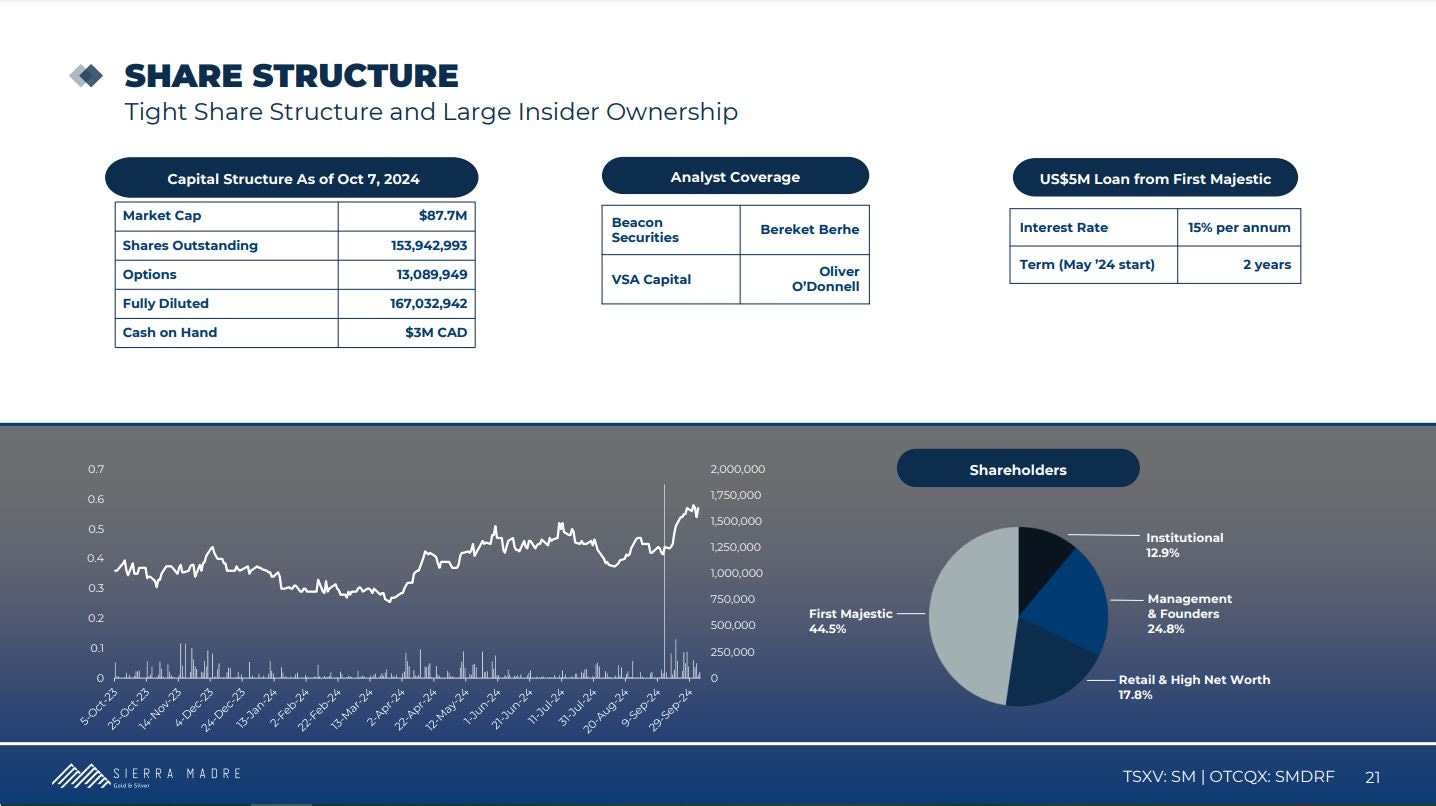

We wrap up discussing the benefits of having First Majestic as a key 44.5% stakeholder, where they have provided data, employees, and a small loan to the Company at favorable terms.

Management and insiders hold a heavier 24.8% stake in the company, with no outstanding warrants, and with several key members of the management team that have worked at and operated the La Guitarra mine in the past = Solid.

From a technical charting perspective, Sierra Madre Gold and Silver, has been in a general uptrend this year since bottoming in March at $0.25, making as series of higher highs (noted in blue rectangles) and higher lows.

After hitting the intermediate peak of $0.70, the stock has sharply reversed course back down, closing this last week at $0.57, just a few pennies above the 50-day Exponential Moving Average (currently at $0.547). As we see pricing approach the 50-day EMA, or even briefly dip below it, then I’ll be personally looking to that as a period for further accumulation in my own portfolio (so any pricing dips below $0.55 is attractive to me for nibbling and adding to my position).

Well that’s it for this next installment in this series on growth-oriented silver producers, but rest assured that there will be many more of these to come.

Thanks for reading and may you have prosperity in your trading and in life!

- Shad