Opportunities In Growth-Oriented Gold Producers - Part 9

Excelsior Prosperity w/ Shad Marquitz (03-11-2025)

I’m happy to report that we are diving back into more opportunities within the segment of “growth-oriented junior gold producers.” Throughout 2024 we covered some very interesting companies thus far in this series, and it turned out that they were very active with newsflow in the gold mining sector. This series will continue delving into many more companies like this here in 2025.

In full disclosure, none of these companies are paying me to write them up in these Substack articles. These company writeups are simply about the value proposition that I personally see in stocks held within my own personal portfolio, (so yes, I’m talking my book and am biased in that sense).

My goal here is to have these updates be informative and topical for readers of this channel; not just with the specific companies featured, but also in the broader way of thinking about doing due diligence, and the rationale behind positioning in these types of stories within the larger resource investing universe.

Similar types of approaches and key points made within them could also be applied for investing in other stocks within the sector.

So, while I believe these are quality companies, and compelling opportunities in their own right, don’t get hung up on if you like the specific companies discussed. Instead, consider the broader points of attraction and some of the nuances around investing in this turbulent, complex, and volatile sector of junior mining stocks.

In the recent February 26th article regarding the business combination of Equinox and Calibre, the point was made about just how active the companies featured thus far in this series have been with regards to growing via M&A deals; either by being the acquirer or being acquired. If one thinks about at the huge pool of over 1000 precious metals mining stocks, then it is validating that the 8 or so gold companies we’ve talked about thus far in this series have actually been a big portion of the movers and shakers for mergers and acquisitions in the sector over the last year.

Merger and Acquisition Opportunities In The Mining Stocks – Part 8

https://excelsiorprosperity.substack.com/p/merger-and-acquisition-opportunities-dbe

Some of those featured companies were acquired: (Karora was bought by Westgold, then a few weeks after positioning in Argonaut it was scooped up by Alamos, and the Argonaut spin-co Florida Canyon was split up in acquisitions where Heliostar got their 2 Mexican mines, and Integra got their mine in Nevada)

Some of those featured companies have been the acquirers: (Calibre acquired Marathon, Equinox acquired the other 40% of it’s Greenstone Mine in a competitive bidding process from Orion, Mako took over both Goldsource and the Moss Mine from Elevation, and Minera Alamos took over Sabre. Then, most recently, two of these companies actually merged Equinox + Calibre).

We’ve already discussed most of the companies from that list of M&A deals above. Having said that, while we have previously unpacked the Argonaut takeover by Alamos Gold, and Integra taking over the Argonaut spin-co Florida Canyon Gold for their Nevada mine, we never really unpacked in detail how Heliostar also snatched up 3 projects (including 2 producing mines) that were previously inside of Argonaut Gold from that same Florida Canyon Gold. So, in this article we are going to take a deeper dive into Heliostar Metals, as an up-and-coming junior gold producer, that also has excellent development projects and compelling exploration upside.

So, let’s get into it…

_________________________________________________________________________

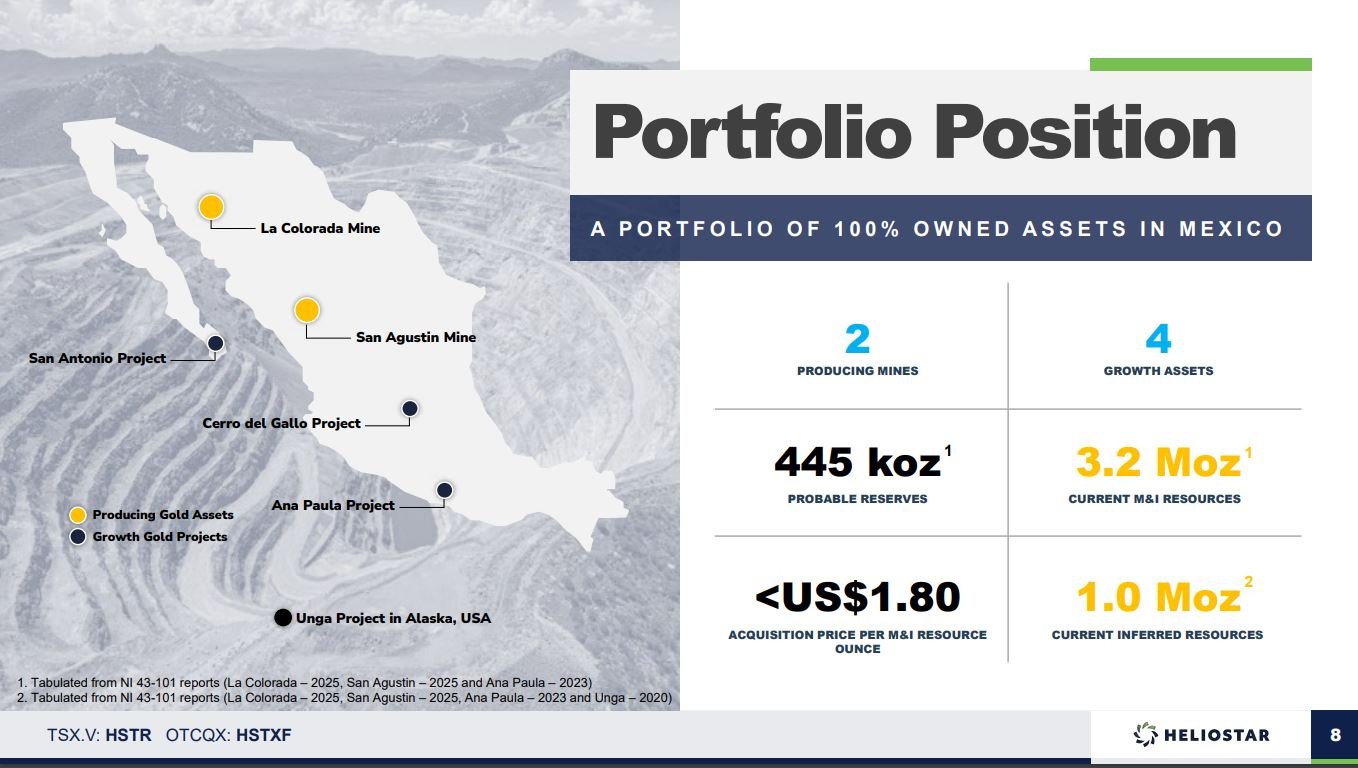

Heliostar Metals (TSX.V:HSTR) (OTCQX:HSTXF) is a company I’ve been following since January of 2021, back when the only key project they had was their Unga gold project in Alaska.

The company has reinvented themselves several times over the last couple of years, and acquired 5 different projects (directly and indirectly) from the old Argonaut Gold. In a way they’ve become Argonaut 2.0.

These projects include: the producing San Agustin and La Colorada gold mines, the flagship Ana Paula development project, and other promising development projects: Cerro del Gallo, and San Antonio. They also still have Unga.

Heliostar just graduated up to become a brand new gold producer in Mexico. We’ll get to that, but it’s important to first see their progression.

Over at the KE Report, we’ve regularly had updates from Heliostar CEO, Charles Funk, on their exploration efforts. I’ve followed their newsflow since those days in 2021, and would join in the pre-call discussions and periodically the interviews over at the KE Report as the company drilled a number of targets at Unga.

The key areas of exploration focus were the SH-1 and Aquila targets, both on the Shumagin Trend, and the drilling they did expanding mineralization around the former Apollo-Sitka mine. I always felt this Unga Project was a good one, but it has largely been forgotten about in the company’s current lineup of assets. I only point it out because they still have this prior flagship property in their portfolio of projects and it used to underpin the value of the company. None of that gold delineated in Alaska went anywhere, but the focus has since shifted down to Mexico.

By 2021 into early 2022 the team at Heliostar also started exploring at their La Lola, Cumaro, and Oso Negro properties in Mexico. These are now considered “non-core” exploration projects, and nothing game-changing was found with the limited exploration work conducted; but this is where the company started their focus shifting down to Mexico for opportunities. Again, they still hold these projects, and while they receive no current market value for them, maybe at one point down the road they can monetize them, option them to another company, or go back and drill test them.

Where the game did change in a transformative way for Heliostar, was when they dropped the news back on December 5, 2022, that they were going to acquire both the Ana Paula Project and San Antonio Project from Argonaut Gold.

Heliostar to Acquire a 1.4M Ounce, Permitted Gold Deposit and Option another 1.7M Ounce Gold Deposit in Mexico

I was very familiar with these projects from when I was invested in Alio Gold, when they morphed out of Timmins Gold to advance these projects.

Alio also had also picked up the Florida Canyon mine from Rye Patch Gold, and then Alio was taken over by Argonaut Gold, who wanted Florida Canyon, but hadn’t done much work on advancing Ana Paula or San Antonio. This worked out to Heliostar’s advantage for acquiring them on the cheap.

As we so often see in the mining sector, “One man’s trash is another man’s treasure.” What may be a non-core asset to one company, can be quite core to a smaller junior company.

Heliostar got one hell of a good deal here, picking up both projects in Mexico and 3 million ounces of gold in the ground for US$10,000,000. (There was a $20Million milestone payment that was due to Argonaut Gold that got canceled out when they later picked up La Colorada and San Agustin form Argonaut’s spin-co, Florida Canyon Gold in 2024)

What is still lost on the market is that around $120million had been spent on advancing Ana Paula up to that point by prior companies, and I don’t know how much was spent at San Antonio (but it had 1.7 million ounces of gold so it had received a lot of drilling). That is a lot of sunk cost, data, and optionality that Heliostar picked up in one transaction. To recreate all the work in today’s prices would be even more. I was very impressed that they pulled off this deal from Argonaut!

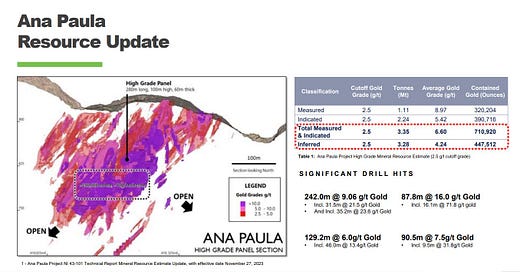

Over 2023 the company found a new Parallel Pane zone, and updated the resource to 1,158,432 ounces of gold in all categories. There was a total measured and indicated mineral resources of 710,920 gold ounces grading 6.60 g/t gold, plus the inferred mineral resources of 447,512 gold ounces grading 4.24 g/t gold.

Drilling commenced again in August 2024, to expand the underground resource. The goal is to get the shallow portion of the deposit up to 1.5-2 million ounces of gold.

A Feasibility Study is in progress throughout 2025, to make a construction decision by mid-2026

Ana Paula remains the flagship development asset of the company.

Fast forward to the summer of last year and Heliostar announced another amazing transaction acquiring more ex-Argonaut assets, from their spin-co Florida Canyon Mines. This is where they picked up the 2 producing mines (La Colorada and San Agustin) as well as another development project Cerro del Gallo.

At the time we discussed this transaction briefly on this channel. I had announced to readers here that I had bought into Argonaut Gold (because of how insanely undervalued it had become), only to see them get acquired a few weeks later by Alamos Gold.

So, I had just received the shares in Florida Canyon Gold only to see the Mexican assets raided a week or so later by Heliostar.

I was honestly a bit annoyed these assets were unloaded at such a cheap price as they were worth FAR more than what Heliostar paid for them; but congratulated Charles at the time for another amazing acquisition.

Upon mulling it over, it became clear that the best way of me getting further value out of these assets was to buy a position into Heliostar; as they were transitioning over to become a gold producer with those 2 mines.

Heliostar to Acquire Gold Portfolio of Producing Mines and Development Projects in Mexico for US$5M - July 17, 2024

The company now had a clear pathway to production in late 2024 and ramping things back up heading into 2025.

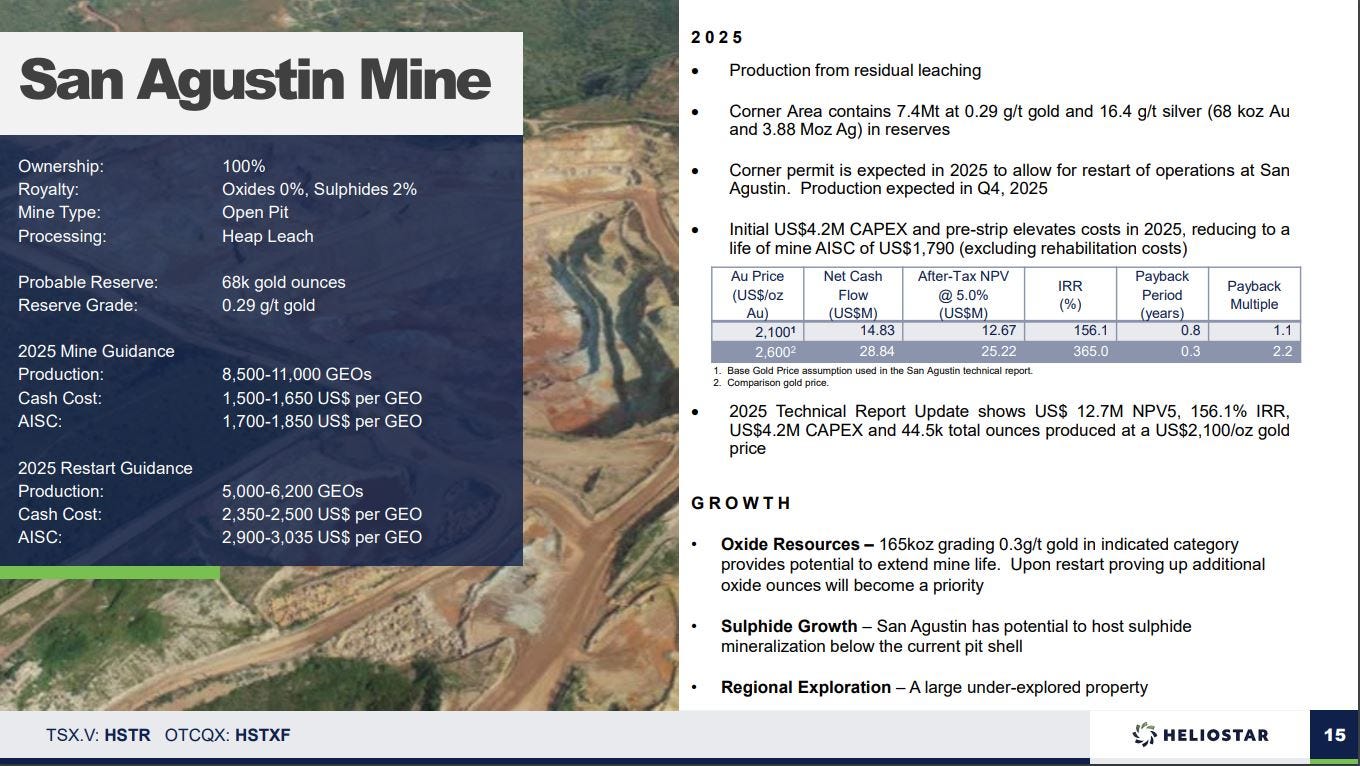

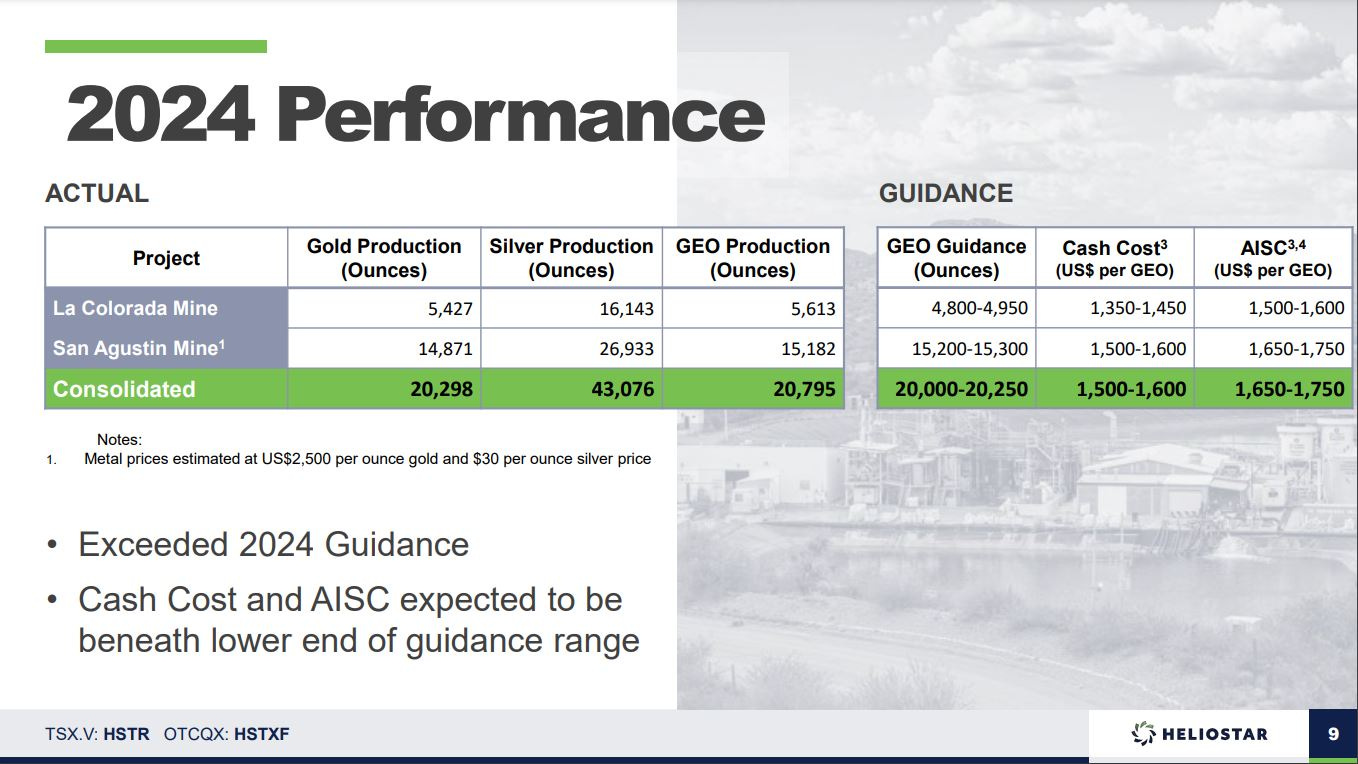

• Now keep in mind that the production profile from 2024 was based on residual heap leaching at both mines, where gold was still being produced as a result of material still being on the pads.

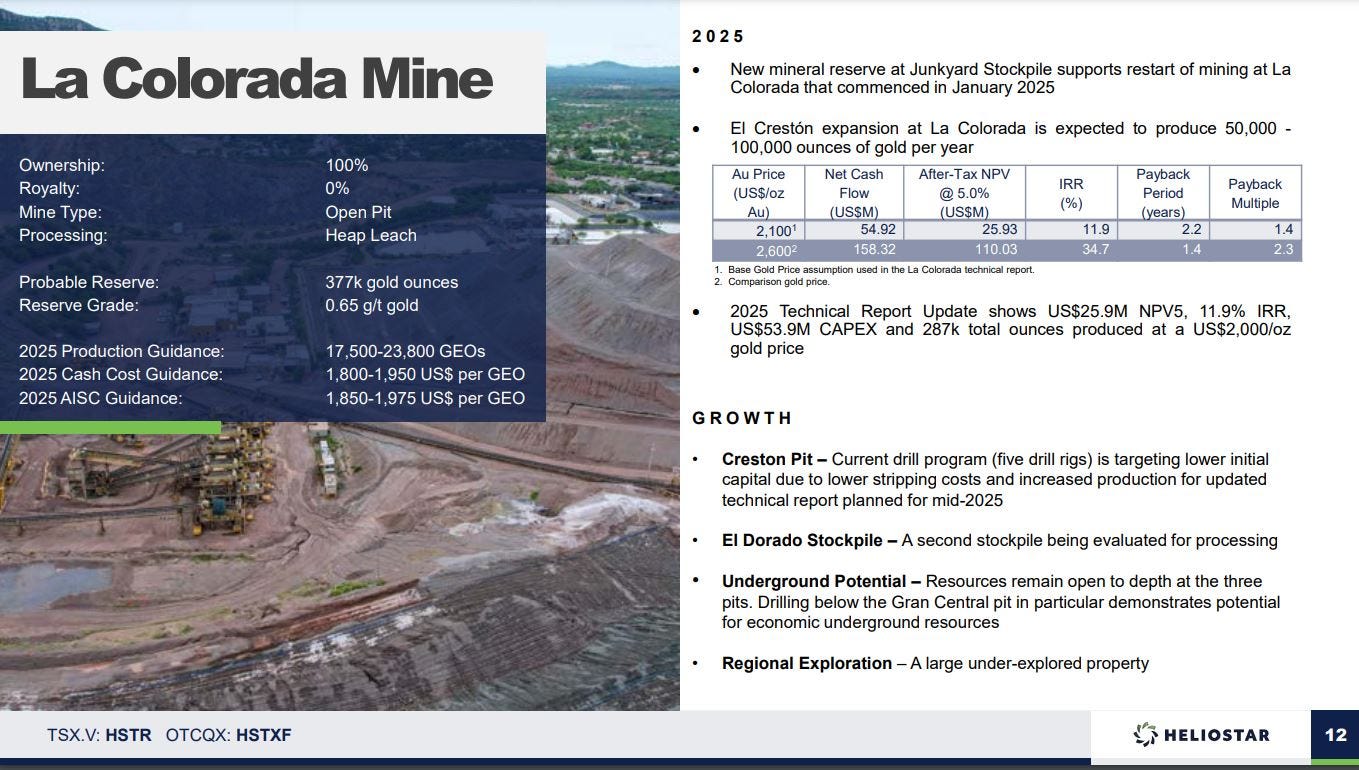

• The mining is going to be starting back up at La Colorada and that will feed more material onto the leach pads for 2025. Anticipated gold & silver production this year at La Colorada combined will be 17,500 – 23,800 gold equivalent ounces (GEO).

• Looking ahead to 2025 guidance at San Augustin, the plan is for 8,500-11,000 ounces to be produced from residual leaching, and then the Q4 mining restart will produce another 5,000-6,200 GEOs. This will make for a combined production of 13,500 – 17,200 GEOs at San Agustin.

• This will make the total production targeted for 2025 at both mines to be in the range of 31,000 – 41,000 GEOs. Not a huge amount of production, but lucrative.

On March 3rd, 2025, over at the KE Report, Charles Funk, President and CEO of Heliostar Metals, joined us to discuss the Company’s recent Q4 financial results. We focused on their transition into a gold-producing company with cash flow from operations. Highlights of the financial performance include generating over $9 million in cash from production and growing their cash position to $7.7 million. Additionally, we discussed plans for increased production and lower costs in 2025.

Heliostar Metals – The Transition To A Cash Flow Producer: Q4 Financial Results, Drill Results From Ana Paula

The conversation also covered repayment of the Company’s significant debt, acquired during asset purchases including the Mexican assets from Florida Canyon Gold. Alongside these financial updates, we delved into drill results from the Ana Paula Project, showcasing some high grade hits that highlight the potential of this flagship project.

Looking ahead, Charles outlined production goals, including doubling gold production to 30,000-40,000 ounces by 2025, and further expanding operations into 2026 and 2027. We also addressed future cost management, aiming to bring down the All-In Sustaining Cost (AISC) while maximizing cash flow.

Looking ahead to production over the balance of this decade, one can see:

next year in 2026 they expect a bump up to 47,000 GEOs, and a similar amount in 2027

Then a step up to 63,000 GEOs just from La Colorada in 2028 and the potential for 100,000 GEOs from Ana Paula (163,000 GEOs potential)

Then 85,000 peak GEOs from La Colorada in 2029, with again the potential for 100,000 GEOs from Ana Paula (185,000 GEOs potential)

Then 73,000 GEOs from La Colorada in 2030, with again the potential for 100,000 GEOs from Ana Paula, and potentially another 80,000-100,000 GEOs from San Antonio (253,000+ GEOs potential)

Hopefully it is becoming more clear why Heliostar Metals is being featured in this series on growth-oriented gold producers. That is going to be a nice step-change higher in gold equivalent ounce production over the next 5 years!

Most of the revenue-generating action is clearly going to be coming from La Colorada and San Agustin in the next 3 years. However, it is going to be a big deal to get Ana Paula into full commercial production by 2028. All those assets alone should see the company be able to double or triple in value, just based on their net asset value and production margins at something around today’s spot gold prices. {That is not investment advice. I’m merely sharing my own personal investing thesis}

What I think is still very much lost on the market, especially when I talk with other investors about Heliostar is the hidden value of their 2 other development projects.

Even the company is not really highlighting the resources at San Antonio and Cerro Del Gallo in a big way in their presentations. I do like how they included the potential for 80,000-100,000 GEOs of production from San Antonio in 2030, but I’m very curious to see if they may not be able to expedite this move back into production sooner than the market is expecting.

When we look to the slide in corporate presentation showing their global 3.2 million ounces of measured and indicated and 1 million ounces of inferred, they aren’t even including any of the ounces from either San Antonio or Cerro del Gallo in those figures. Again, this is a hidden opportunity to pick up extra optionality.

I remember how valuable both San Antonio and Cerro del Gallo used to be considered inside of prior companies like Argonaut and Primero. Again, investors picking up Heliostar Metals today are not paying anything for this optionality, nor the optionality of Unga for that matter.

Note on the slide below that the Net Present Value (NPV) at a 5% discount of San Antonio at a $2,600 gold price is $715 million!

Let’s say you think that it too high, and maybe San Antonio is only worth $500 million or $300 million. Keep in mind that gold is not at $2,600, but rather has been hovering up at $2,800-$2,900. Surely at spot prices San Antonio could command a $400 million NPV.

Now consider Heliostar’s current market cap of CAD $200 Million. Just San Antonio’s NPV more than underpins their current valuation. That doesn’t even include their 2 producing mines or their flagship development project at Ana Paula. That is a really wild market cap valuation mismatch!

Now, as far as Cerro del Gallo, it is hardly even given a mention on the corporate presentation. I’ve not seen anyone talking about the value it brings to the table down the road. Personally, I’ve never forgotten that it used to be part of Primero Mining a decade ago.

For those not familiar with Primero, it was a gold and silver producer that got over it’s skis financially and ran into trouble, and was also raided for it is assets back in 2017-2018 – where First Majestic got their San Dimas Mine, and Argonaut Gold picked up Cerro Del Gallo for $15million, which was an incredibly cheap deal and an amazing pickup for (AR), touted as a win.

At the time of the acquisition I was very curious the rationale for it, as I was an Argonaut shareholder at the time. Check out the press release below for a bit flavor of how they were viewing Cerro del Gallo (CDG) at the time.

Argonaut Gold Announces the Acquisition of the Cerro del Gallo Project in Guanajuato, Mexico for US$15 million - Nov 14, 2017

“A Definitive Feasibility Study ("DFS") for CDG was completed in May 2012. The DFS outlines an initial 7.2 year mine life, which could be extended to 14 years through a Second Stage Carbon-in-Leach (CIL)/Heap Leach mill expansion. The Project has been planned as conventional open-pit truck and shovel operation coupled with a 4.5 million tonne per annum processing plant. The flow sheet design is broadly based upon a conventional cyanide heap leach and gold on carbon recovery technologies but will incorporate a SART processing stage to facilitate copper removal prior to gold recovery. The plant design is based on the treatment of both fully and partially oxidised ores, producing an average of 95,000 ounces of gold equivalent annually at estimated cash costs of US$700/oz.”

Now, that study was completed 13 years ago, so it is clearly out of date, and so is the cash cost of US$700 per ounce. However, it is very likely that that 95,000 GEOs is still in the ballpark of what the mine could produce for over 7 years, and then again, an expansion that could add on another 7 years.

• What would that production profile be worth in today’s gold price environment?

• 95K GEOs is roughly the same amount of production at Ana Paula’s anticipated 100K GEOs or San Antonio’s 80K-100K GEOs per year.

• Why in the world is nobody even discussing the potential value at Cerro del Gallo then?

I believe in the fullness of time, as the team at Heliostar digests these transformative acquisitions they’ve made they could very well see the company move to over a $1 Billion valuation; when one adds up the intrinsic value of La Colorada + San Augustin + Ana Paula + San Antonio + Cerro del Gallo + Unga.

This is not a stretch to my mind, as Heliostar Metals has essentially transformed itself into Argonaut 2.0. Argonaut used to command a valuation north of $1 Billion back in the better sentiment period of 2011-2013.

Again, with a current market cap of CAD $200 Million or US $137 Million, there is a clear case in my mind that Heliostar Metals could rerate up higher multiple-fold (5x-6x) just based on its current portfolio of assets.

Look, I don’t want to get all “pie-in-the-sky” on readers here, but we haven’t even talked exploration upside yet at their properties. I’d submit that there is serious exploration upside potential still at La Colorada and San Agustin to extend their mine life, and clearly their exploration upside at Ana Paula as evidenced by their recent drill results:

Heliostar Drills Wide Intervals Within The High Grade Panel and Hits Satellite Zones at Ana Paula, Mexico - February 20, 2025

• High Grade Panel - 161.0 metres @ 4.26 grams per tonne (g/t) gold including, 30.0 metres @ 10.1 g/t gold, and 15.7 metres @ 10.4 g/t gold

• Parallel Panel - 3.0 metres @ 21.4 g/t gold

• Satellite hit (over 150m below High Grade Panel) - 24.0 metres @ 5.10 g/t gold

Can you imagine what would happen to a junior exploration company if they put a drill result like that of 161.0 metres @ 4.26 grams per tonne (g/t) gold? (people would be doing cartwheels in the aisles…)

Well, I hope that folks enjoyed taking a deeper dive in Heliostar Metals as another growth-oriented gold producer. They appear to have solid trajectory of increasing production in the years to come, and a lot of ounces in the ground that aren’t even being discussed in their current global numbers of resources. I am long this stock and biased, but it sure seems like the current market cap is way below where it should be for all the assets they have now brought under one roof.

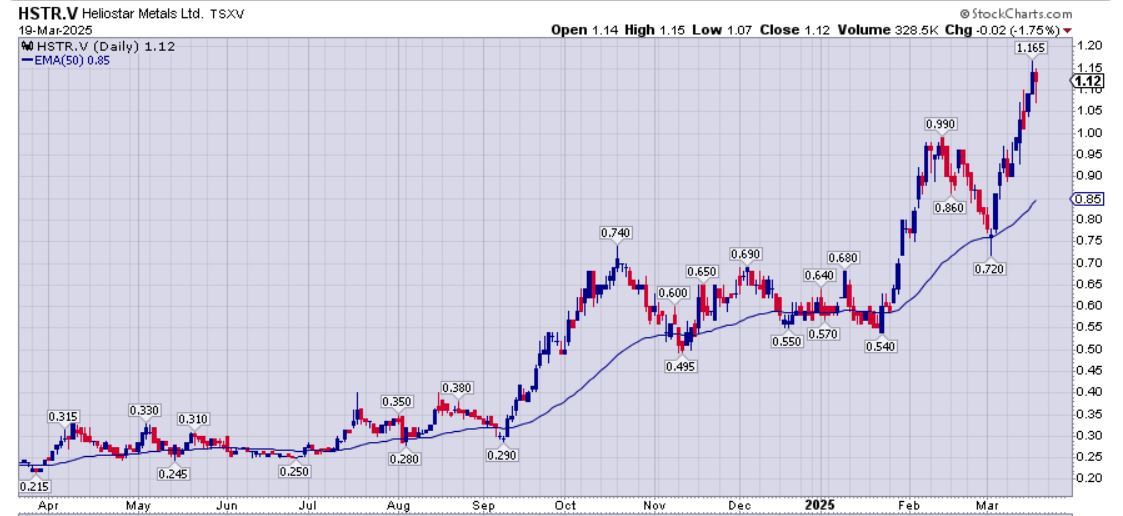

Technical Update - 1-year daily chart of Heliostar Metals

Just a quick technical update a few days after publishing this article.

It is very significant that (HSTR) resumed its pricing uptrend, after going down in late February to early March and testing support at the 50-day Exponential Moving Average, putting in a bull hammer reversal candle, and then rallying.

Also significant is that on Thursday March 13th a new higher daily close was achieved at $1.03, eclipsing the early Feb peak at $0.99 by a few pennies.

This keeps Heliostar Metals in a bullish posture with a strong underlying gold price as a tailwind.

A further technical update:

As of Wednesday 03/19/2025 we saw (HSTR.V) close at $1.12, after putting in an intraday high of $1.165, yesterday on Tuesday March 18th.

The pricing trend did continue to break higher following last Thursday’s new daily high close at $1.03 about a week ago.

Will PM stocks like Heliostar, that have been garnering a consistent investor bid, take a break soon giving investors on the sidelines a chance to get in? It’s hard to know; because the gold stocks seem to keep defying the trends in the general markets downturn and gravity itself with many gold stocks melting up, with gold blasting to higher levels each week, and a rising investor sentiment.

On solid gold equity charts like Heliostar, my perspective is to view future corrective moves down to the rising 50-day EMA as buying opportunities for accumulating further tranches. For now, I’m happy to see that many gold stocks are rerating higher, as that process has been long overdue.

Thanks for reading and may you have prosperity in your trading and in life!

• Shad