Opportunities In Growth-Oriented Silver Producers – Part 8

Excelsior Prosperity w/ Shad Marquitz – (03/24/2025)

There has been a lot of focus lately on the precious metals complex, mostly due to gold’s meteoric rise to higher levels. While gold has clearly been stealing the show, for obvious reasons, silver has quietly been ratcheting higher. The animal spirits have gradually been returning to quality silver stocks and the quality stocks with growth on tap and catalysts have been on the move.

At the end of last year, on December 28th, I posed a key question in an article released here on this Excelsior Prosperity channel on Substack:

Is This A Buy The Dip Moment In The Junior Silver Stocks?

https://excelsiorprosperity.substack.com/p/is-this-a-buy-the-dip-moment-in-the

I made the case in that article, a few months back, about the value arbitrage in the silver stocks. Silver prices were hovering around the $30 level, and yet many silver stocks were down around 40% in just a couple of months from their October highs (when silver was only down in price around 14-15% off its highs).

Those exact same silver producers, developers, and advanced explorers that people loved in mid-October had NOT become 40% less valuable in just 2 months by late December, so there was an opportunity presenting itself for accumulating quality silver stocks on the cheap. Clearly that was the right call as we’ve seen the silver stocks rally handsomely for most of the Q1 Run in 2025.

This was, once again, the inefficient market and herd sentiment on full display, and precisely why the market is not always right. Quite often, individual companies or whole sectors will become mispriced, to both the upside and downside, due to sentiment and momentum trading pushing things to extremes, even if nothing fundamentally has really changed. These moves can be even more magnified if something fundamentally does change for a sector or individual company. There is almost always an overreaction in pricing and valuation in either direction, and those can regularly be exploited by savvy investors that are paying attention.

Investors will get too bullish and full of hot air with upside blue-sky projections to infinity and beyond, and they’ll push whole sectors or individual cult stocks up to nosebleed levels that make no sense from a valuation perspective.

Then, conversely, often a short period of time later (several months) if there ends up being a normal consolidation in pricing after a good run, that same pool of investors will shift over to becoming too bearish, expecting corrections to extrapolate forever down into the abyss, and they’ll sell whole sector or bail on those very same stocks that they absolutely loved just few months ago.

Well, this is precisely what we saw in the move up in silver stocks during September and October of last year. Positive momentum was escalating, and people were piling on positions in popular companies as silver approached $32, then $33, and then blasted up to $35. The calls for imminent $50 silver prices came out of the woodwork, along with a fresh batch of online rocket ship emojis on chat boards. Then as we see so often, just a couple of months later, during the typical tax loss selling season from mid-November through late December, everything pulled back down swiftly. The sentiment switched from jubilation to despondency on a Mercury dime, and there was hardly anybody left banging the table to “buy low.”

At the time, I was doing a lot of interviews with sector thought leaders, influencers, and company management teams. People were saying things like “I guess this sector will never rally for more than a few months at a time,” or “this is the worst sentiment I’ve seen in 20-30 years in the business…” I would bite my tongue and shake my head on the other side of the conversations thinking to myself, “Really, this is the worst sentiment you’ve ever seen? Have you forgotten what the sentiment was like in late 2015 at the end of the PM bear market or during the ‘end-of-the-world’ pandemic crash from late February through early April of 2020? For goodness sakes, these PM stocks were just rallying all year long in 2024 since late February.”

So, with all of this pessimistic sentiment that arrived in the precious metals sector, on December 28th I poised my question here on Substack, and it was also carried in articles published by Banyan Hill and Streetwise Reports.

Is this a buy the dip moment in the silver stocks?

Well, lets look at the Amplify Junior Silver Miners ETF as a proxy. Despite its name, it is mostly made up of intermediate and smaller silver producers, with a few of the very best silver developers at lower weightings. Check out December 28th on the chart:

Clearly, the end of tax loss selling season in late December 2024, was, once again, a buy the dip moment for silver equity investors that were paying attention; and using logic over emotion, and valuations over sentiment.

We have covered some growth-oriented silver producers here in this series that have even responded better than most of their sector peers because they have had positive news catalysts giving them additional alpha.

For example, in [Part 6] of this series we dug into the value proposition for Santacruz Silver Mining (TSXV: SCZ) (OTCQB: SCZMF), and how they routinely offer more torque to the sector. They’ve had a few important news updates too, that underpin a more solid financial footing.

Santacruz Silver's Wholly Owned Bolivian Subsidiary, San Lucas S.A., Successfully Completes Oversubscribed Promissory Note Offering of 70 Million Bolivian Bolivianos in the Bolivian Market - Feb 27, 2025

“The offering was oversubscribed and sold out in a matter of 15 minutes, for gross proceeds of 70 million Bolivian Boliviano. The notes have a 6.25% interest rate, a maturity date of February 15th, 2026 and are unsecured.”

“The offering was executed on the Bolivian Stock Market (Bolsa Boliviana de Valores) and received strong demand from the Bolivian investor community, reflecting confidence in the San Lucas ore sourcing and trading business and the Company's solid financial position and long-term vision.”

Santacruz Silver Announces US$10 Million Initial Payment to Glencore under Voluntary Plan to Exercise Acceleration Option – March 20, 2025

“…the Company has structured and implemented a plan to exercise its Acceleration Option to satisfy the Base Purchase Price owed to Glencore, by making payments on a schedule that aligns the accelerated timing whilst meeting the Company's commitment to financial discipline and a strong balance sheet. The plan's primary objective is to save the Company US$40 million.”

“The Company successfully completed the first component of this plan, an initial payment to Glencore of USD$10 million, on March 20, 2025. Moving forward under the plan, Santacruz will make bi-monthly payments of USD$7.5 million commencing in May 2025 until reaching a total of USD$40 million, with all payments scheduled to be completed by October 31, 2025.”

So in addition to the torque of having a 4.5-4.8 million silver equivalent ounce quarterly production profile (bigger than many higher valued peers that have much lower quarterly production numbers), Santacruz Silver also demonstrated to the market that they have overwhelming positive support from Bolivian investors that wanted their notes, and they are escalating their debt payments back to Glencore to take the earlier option where they save $40 million dollars if they can do so before November of this year. That is a strong statement of the health of their revenues and improving balance sheet in this current high silver price environment.

Another company we have profiled is this series on growth-oriented silver producers, is Avino Silver and Gold Mines (TSX:ASM – NYSE:ASM). They have been firing on all cylinders so far in 2025, getting their permits in Mexico ahead of the pack to begin underground development of their La Preciosa Mine, along with putting out record metrics in Q4 and also record 2024 financials from operations.

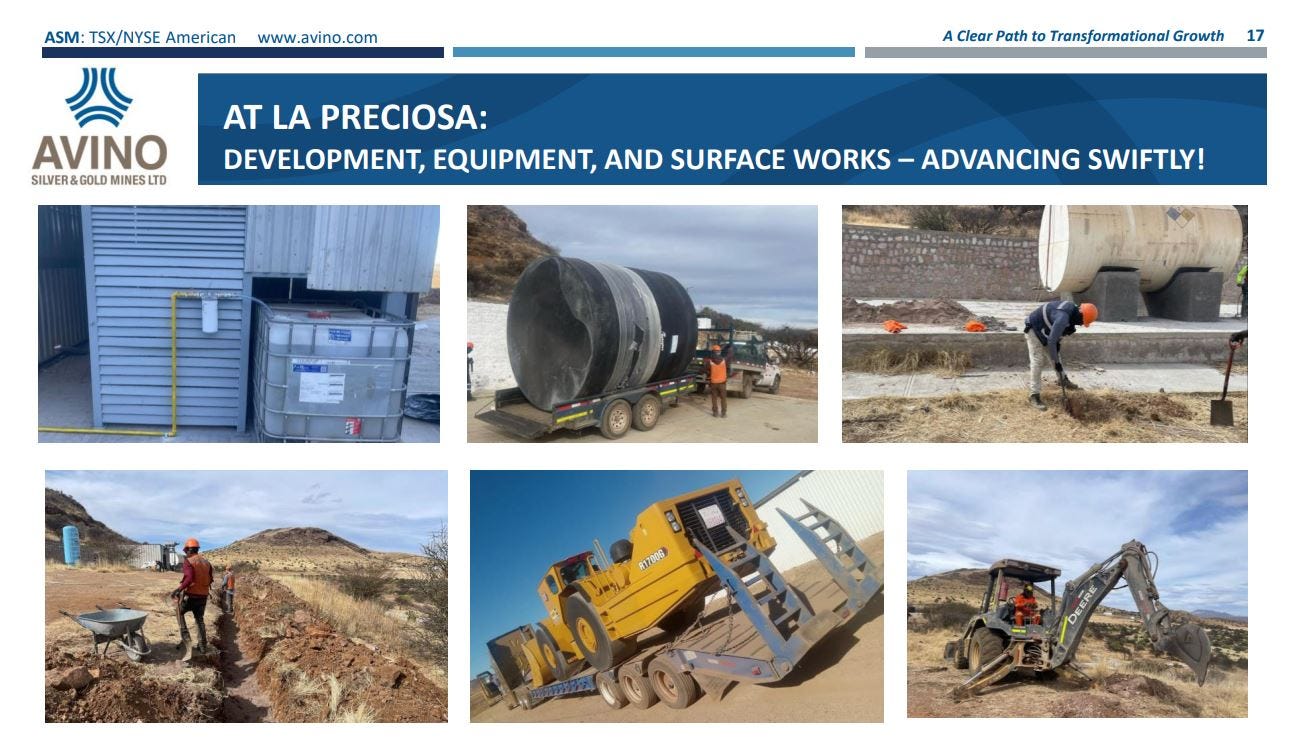

Avino Commences Underground Development at La Preciosa - January 15, 2025

“Avino Silver & Gold Mines Ltd. a long-standing silver producer in Mexico, reports that underground development at its 100%-owned La Preciosa Property has commenced following receipt of all required permits for mining operations.”

https://avino.com/news/2025/avino-commences-underground-development-at-la-preciosa/

Avino Highlights Strong Q4 and Full Year 2024 Production Results - January 21, 2025

https://avino.com/news/2025/avino-highlights-strong-q4-and-full-year-2024-production-results/

PRODUCTION HIGHLIGHTS – Q4 2024 (COMPARED TO Q4 2023)

Silver Equivalent Production Increased 32%

Mill Throughput Increased 26%

Gold Production Increased 76%

Avino Provides 2025 Outlook and Highlights 2024 Achievements - February 6, 2025

https://avino.com/news/2025/avino-provides-2025-outlook-and-highlights-2024-achievements/

Avino Achieves Record Financial Performance for 2024; Improvements across Key Financial Metrics, Treasury at All-Time High - March 11, 2025

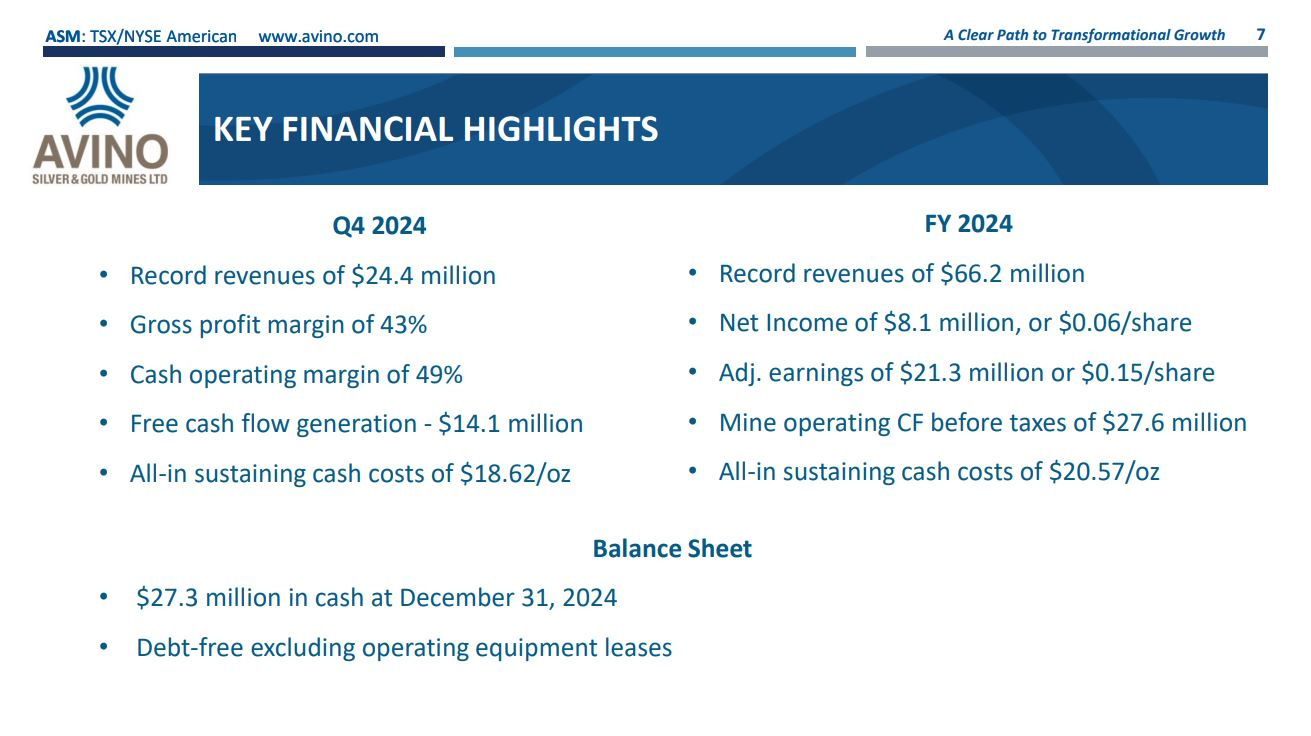

Fourth Quarter 2024 Financial Highlights (compared to Q4 2023)

Record Revenues: The Company realized revenues of $24.4 million, an increase of 95%, driven by increased production and higher realized silver and gold prices in the quarter.

Record Gross Profit: Gross profit, or mine operating income, was $10.5 million and represented an increase of 308%. The significant improvement was a result of items noted related to revenues, as well as meaningful unit cost reductions and currency movements between the US dollar and Mexican Peso.

Record Cash Flow Generation: The Avino Mine delivered cash provided by operating activities of $15.6 million, up over 2,000%, as well as mine operating cash flows before taxes 3 of $11.9 million, up 230%.

Record Earnings and Adjusted Earnings: The Company realized net income of $5.1 million, or $0.03 per share, up 804%, and adjusted earnings 3 of $10 million, or $0.07 per share, an increase of 405%. Earnings before interest, taxes, depreciation and amortization (“EBITDA”) 3 was $9.1 million, up 712%

Improved Costs per Ounce Metrics: Cash costs per silver equivalent payable ounce sold was $13.88 and all-in sustaining cash costs per silver equivalent payable ounce sold was $18.62, down 8% and 14%, respectively.

Full Year 2024 Financial Highlights (compared to FY 2023)

All-Time High in Cash Strength: Cash balance of $27.3 million, an increase of 916%. This represents the highest balance in the Company’s history and positions the Company to execute on its organic growth plans.

Record Revenues: The Company realized revenues of $66.1 million, an increase of 51%, driven by improved production and sales volumes, as well as higher realized metal prices in 2024

Record Gross Profit: Gross profit, or mine operating income, was $23.2 million and represented an increase of 197%.

Record Earnings and Adjusted Earnings: The Company realized net income of $8.1 million, or $0.06 per share, with adjusted earnings 3 up 364% at $21.3 million, or $0.15 per share. EBITDA 3 rose significantly and was $18 million, up 620%.

Improved Costs per Ounce Metrics: Cash costs per silver equivalent payable ounce sold came in at $14.84, down 5% and all-in sustaining cash costs per silver equivalent payable ounce sold was $20.57, down 6%.

Record Cash Flow Generation: The Avino Mine delivered cash provided by operating activities of $23.1 million, up over 1400%. Mine operating cash flow before taxes of $27.6 million, an increase of 150%

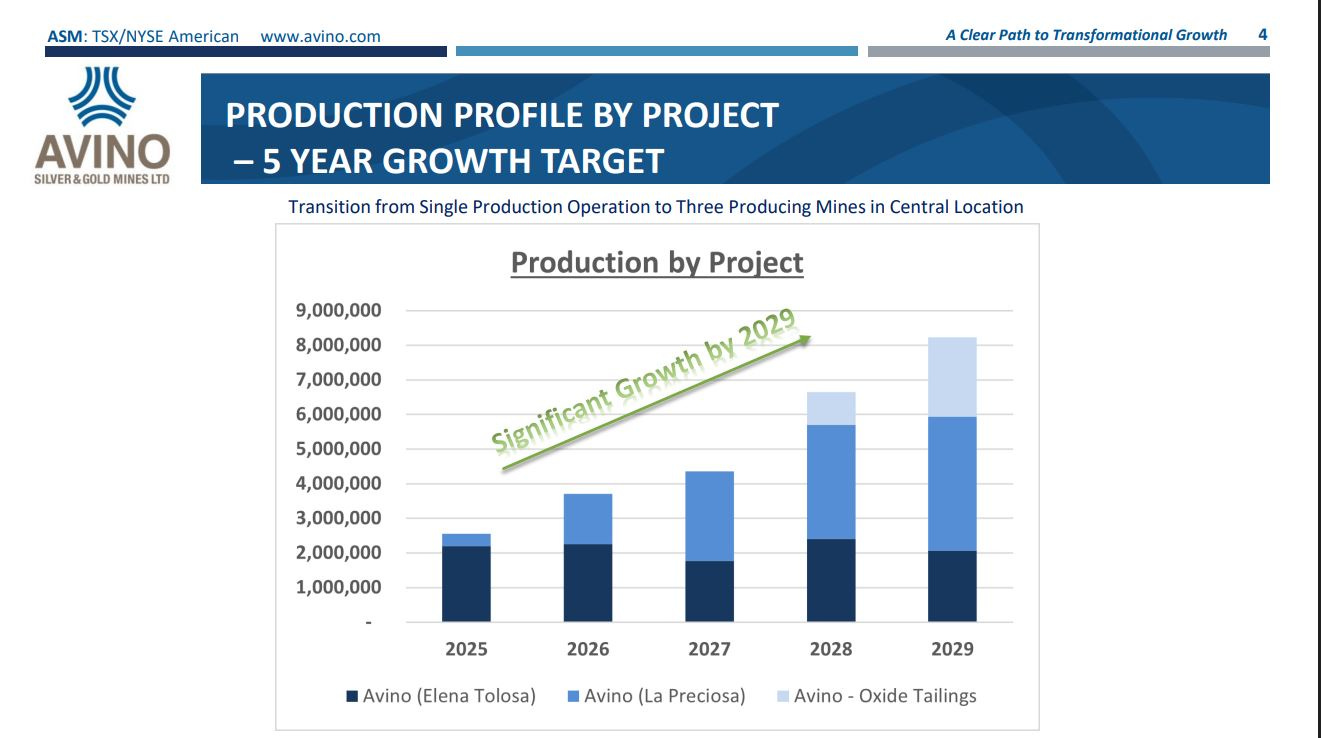

On Friday over at the KE Report (released on Sunday March 23rd), I was joined by David Wolfin, President and CEO of Avino Silver and Gold Mines, to outline the key metrics and takeaways from the record Q4 and record full year 2024 financials and operations. Then we take a deeper dive into the Company’s 5-year production growth plan, to become a Mexican intermediate silver producer, with the development of both the La Preciosa Project in 2025, and then the Tailings Project a few years out.

Avino Silver and Gold Mines – Record Q4 And Full Year 2024 Financials, Future Grade-driven Production Growth From La Preciosa

David outlines the consistent silver, gold, and copper production coming from the Avino Mine, where the Company delivered record financial performance driven by higher metal prices and increased production from their Avino Mine. With records set in revenues and cash flow generation, their operating margins were further strengthened, and with a debt-free balance sheet and over $27 million in cash to close out the year, they are well-positioned for the future. There is also a concerted effort in 2025 to invest in exploration around the Avino Gold Mine to spur on more organic growth.

For the balance of the discussion, we shifted over to the ongoing development work at the La Preciosa Project, now that the final permits were received to begin development, and the work on the underground decline has commenced and mining will get underway with first production expected in Q4 of 2025. We talk about the grade being about 3 times as high, and once in production it will start bringing AISC down into the high teens.

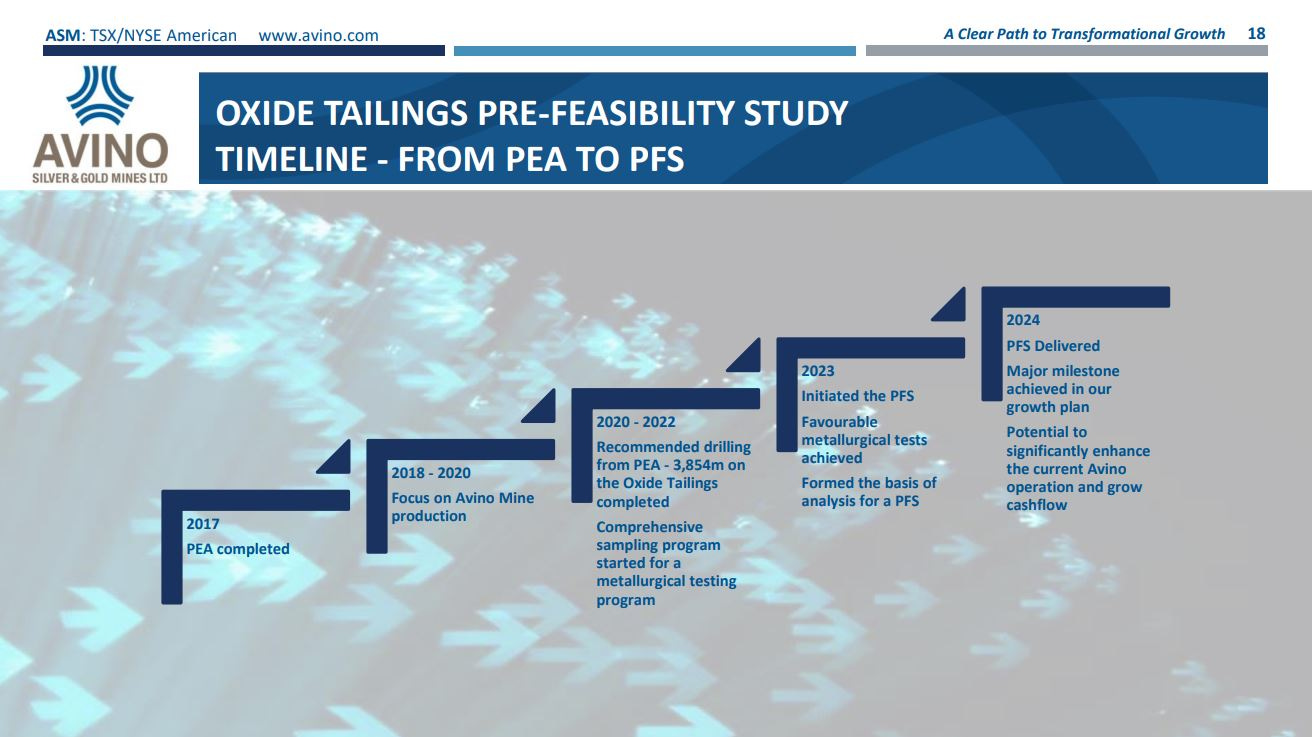

Then the Oxide Tailings Project is also in cue for development a few years out. With low ~$10 All-In Sustaining Cost, it will contribute to their 5-year production growth plan and lowering costs down into the mid-teens.

We’ve highlighted the projected growth profile for Avino before, but it was a while ago, and there are a lot of new readers here. I keep hearing calls from investor to find producers that are going to grow production, and so its worth pointing out that this is precisely what Avino plans to do.

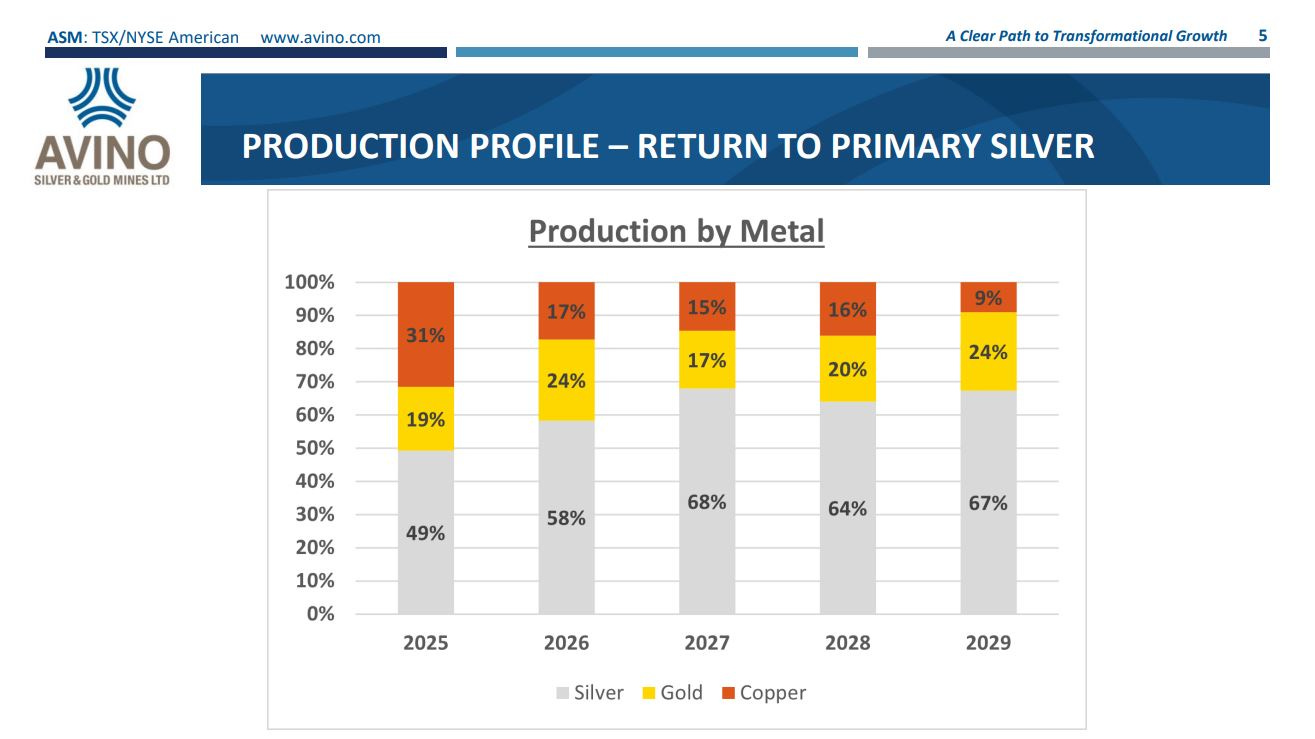

It is also worth noting that over the next few years, Avino will see their silver production grow on a percentage basis in the overall mix.

In 2025 they are guiding about 49% silver, 19% gold, and 31% copper… and hey, with copper prices over $5 its not a bad time to be producing copper and making hay while the sun is shining.

By next year in 2026 the silver percentage jumps up to 58%, and then in 2027 the silver percentage jumps up to 68%. There are not many “silver” producers with that kind of pure exposure to the metal as a percent of production.

Now let’s look at another growth-oriented silver producer here in this series.

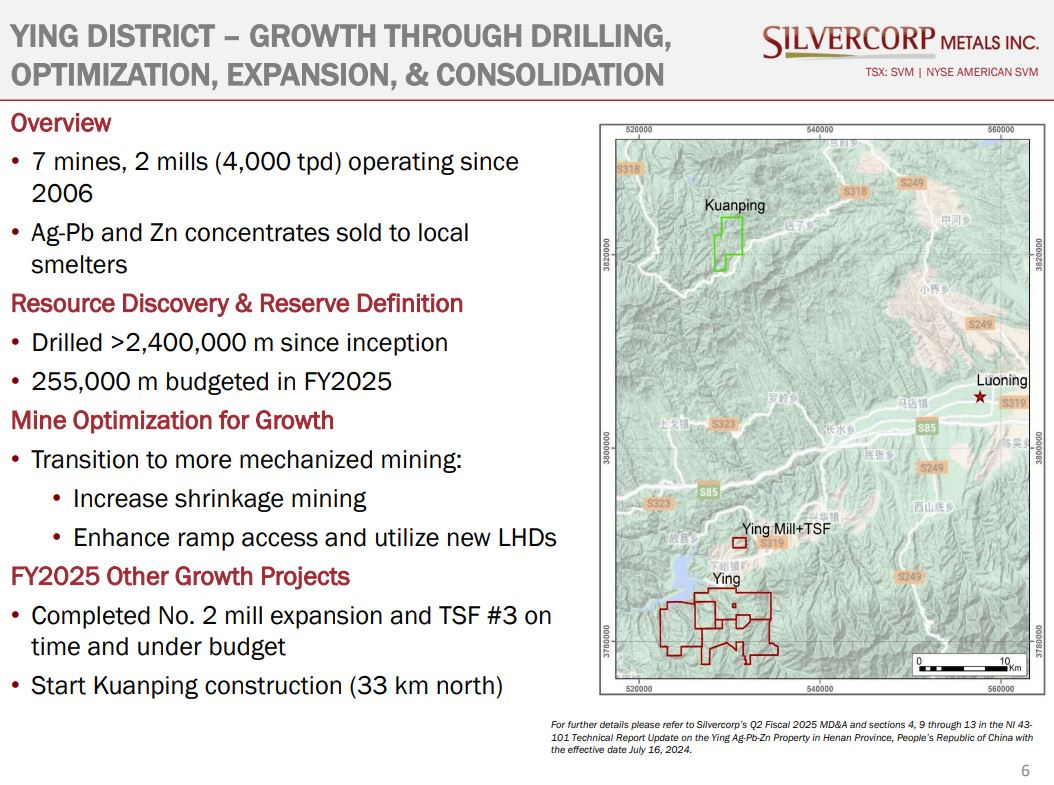

Silvercorp Metals Inc. (TSX: SVM) (NYSE American: SVM) is a company I’ve been trading around in my portfolio since late 2015 through present day. Silvercorp has remained one of the lowest cost operators out there on a silver equivalent basis, because it has a lot of metals co-credits along with the silver, like zinc, lead, and a little gold. So as discussed many times in this channel, many of these “silver” companies are really polymetallic producers. I’m totally fine with that, knowing that they’ll still have good leverage to the price moves of silver, and having a zinc, lead, and gold kickers to keep the equivalent costs down is an added advantage.

Silvercorp Reports Operational Results and Financial Results Release Date for the Third Quarter, Fiscal 2025 - 15 January 2025

Silvercorp Reports Adjusted Net Income Of $22.0 Million, $0.10 Per Share, And Cash Flow from Operations Of $44.8 Million For Q3 Fiscal 2025 - 11 February 2025

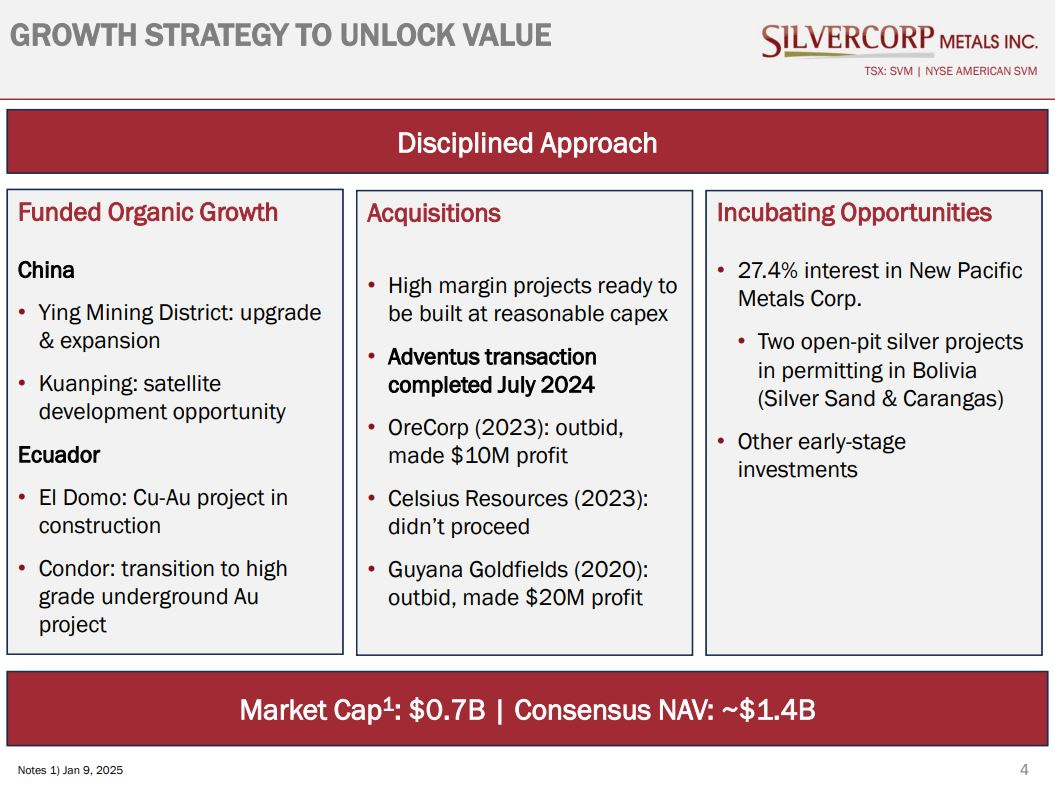

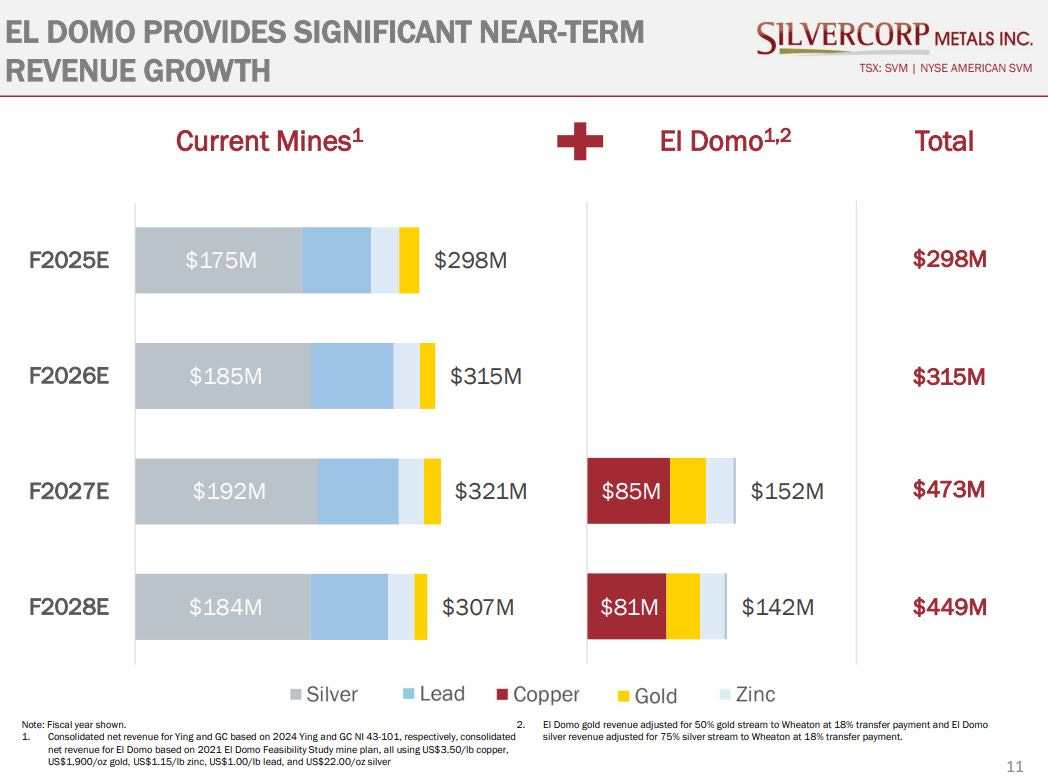

One of the big milestones for Silvercorp over the last year was the acquisition of Adventus Mining in July of 2024, operating in Ecuador.

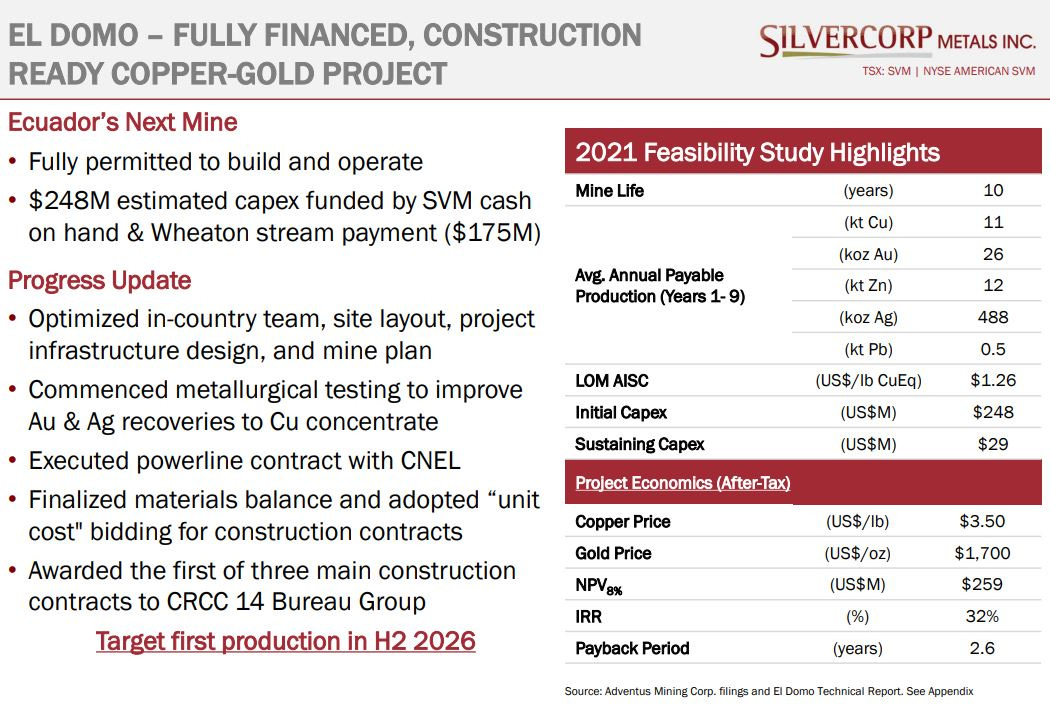

The El Domo Project is in development to be a copper-gold forward mine with plenty of zinc, silver, lead metal co-credits, and it is slated to be in production by the 2nd half of 2026.

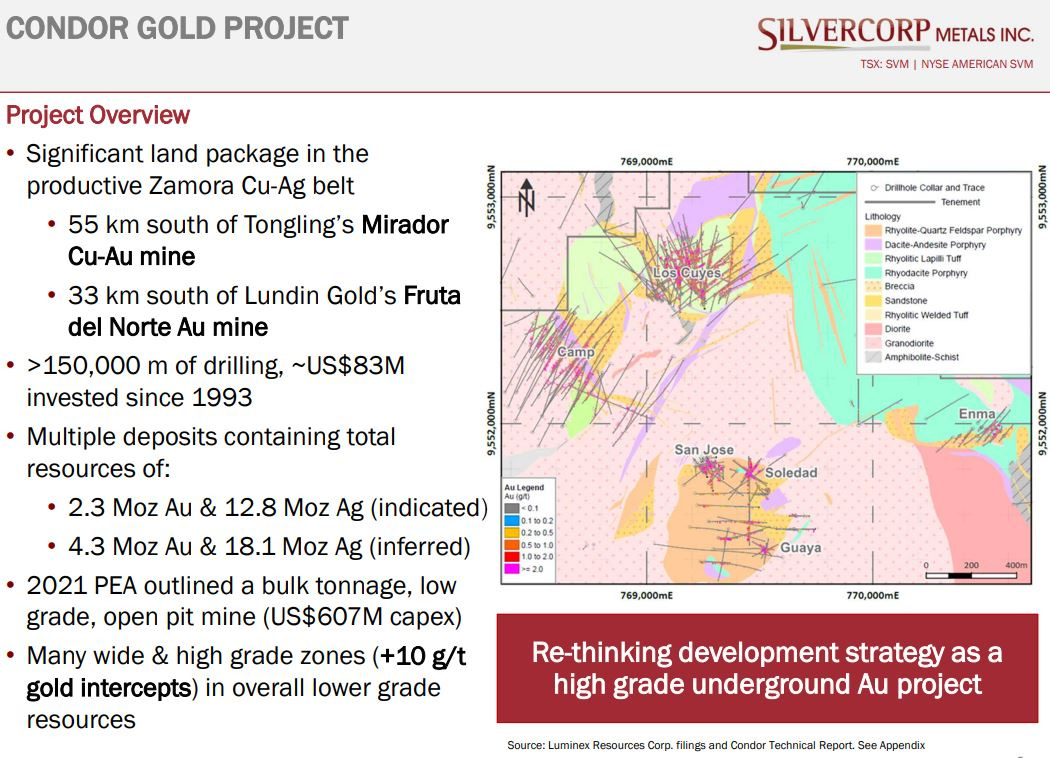

In addition to El Domo, the Adventus Mining acquisition also gave the company an advanced exploration project, the PEA stage Condor Gold Project.

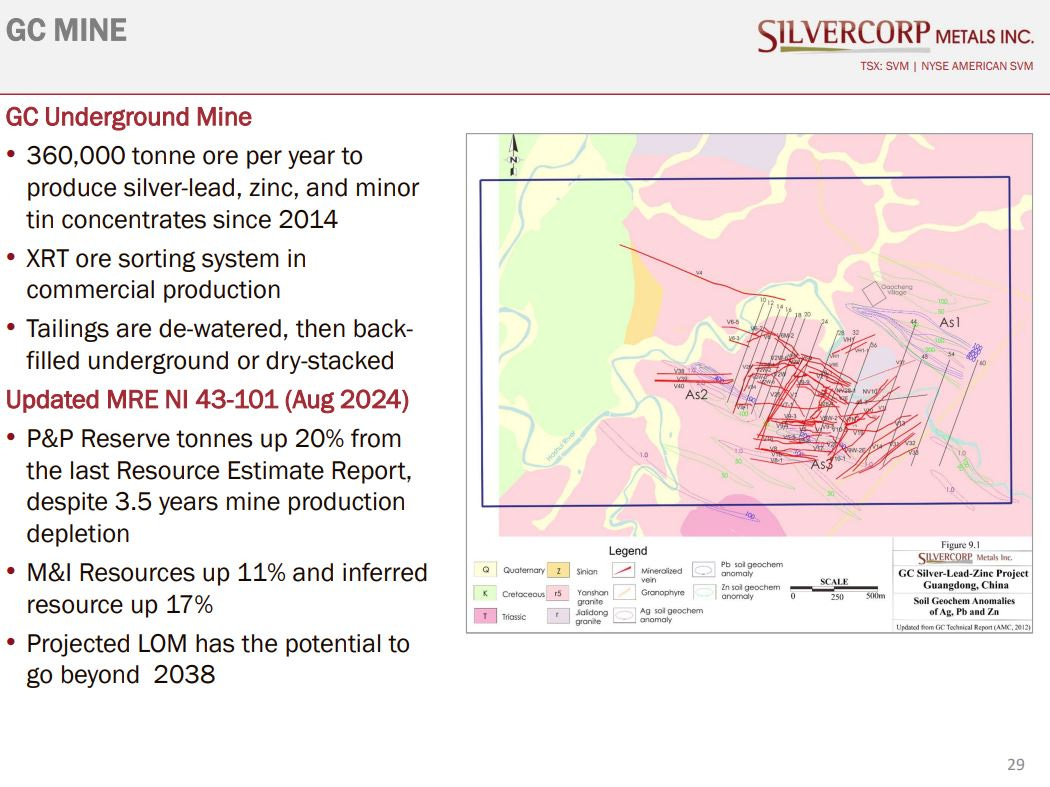

These 2 Ecuadorian assets will further diversify both the operational and jurisdictional risks of the company, which is currently producing primarily from China with 2 mining complexes, 8 mines (7 of them at their Ying Mining District and then the large GC Mine), and 2 mills.

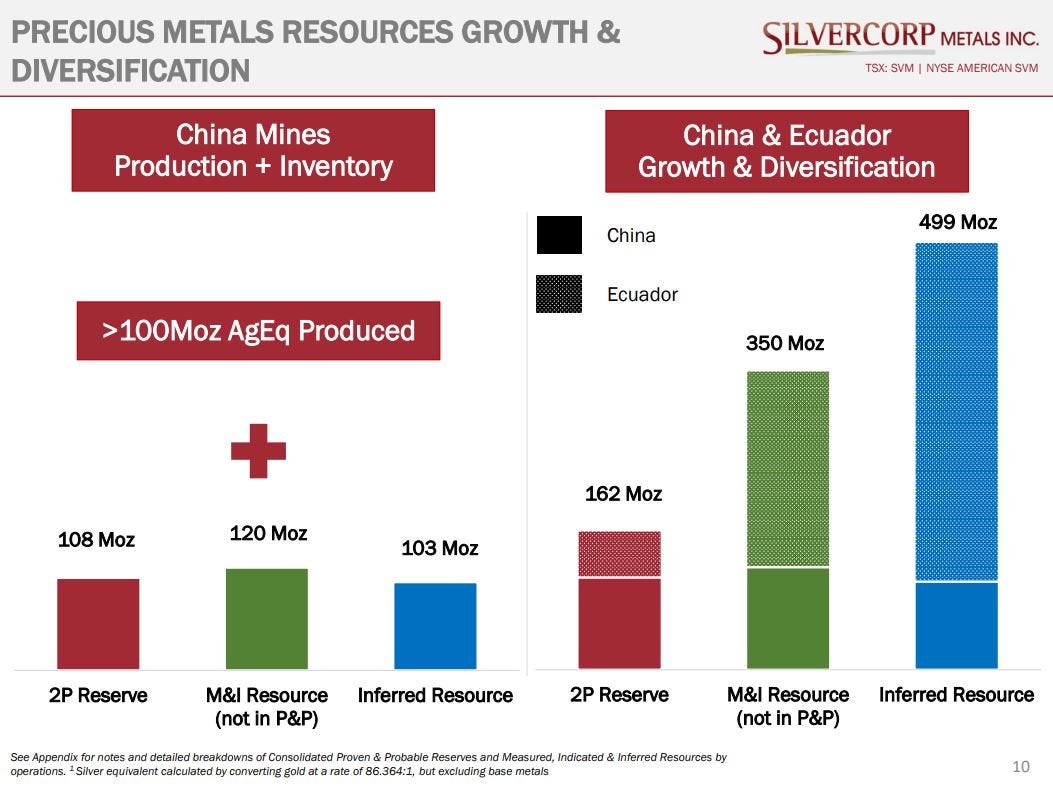

When one factors in all the resources in China and combines them with the acquired resources in Ecuador, then I still don’t think Silvercorp Metals is getting credit for just how much they’ve grown their mineral inventories.

Silvercrest also has a 27.4% stake in New Pacific Metals Corp. (TSX: NUAG) (NYSE American: NEWP), with 2 attractive development stage projects in Bolivia. While there is significant value in just this strategic position, I believe the long game is a future acquisition by Silvercrest of New Pacific; once they get their necessary permits and advance economic studies a bit further.

Well, that wraps us up for this review of Silvercorp Metals another growth-oriented silver producer, and we’ve seen it have a nice lift in pricing since bottoming in late December of last year. It’s one we will follow in this series moving forward.

Thanks for reading and may you have prosperity in your trading and in life!

· Shad