Opportunities In Gold Explorers and Developers – Part 1

Excelsior Prosperity w/ Shad Marquitz – 08-15-2024

In this new series on opportunities in Gold Explorers and Developers, we’ll dive into investment ideas on junior pre-revenue gold companies, potential upcoming catalysts, and under-appreciated value creation to capitalize on. Sometimes we’ll mash up a number of companies in one update, but then other times we’ll just take a deeper dive into just one company. In this [Part 1] we’ll do just that and kick things off with a look into one these junior gold advanced explorer / developer companies that I hold in my own portfolio, that is doing compelling work to build value.

(In full disclosure, I have a reasonably heavy weighting inside of my own personal portfolio in a few of these advanced exploration / early-stage development gold stocks that we are covering in this series. I’ve not been commissioned by these companies to write these articles on Substack, but they may sometimes be sponsors over at the KE Report. This is not investment advice, nor am I suggesting that anyone position in these stocks. Rather, this is simply an editorial on the value proposition these companies demonstrate to my mind, and why I got positioned in them in my own portfolio.)

As far as investing in junior pre-revenue gold stocks, it should be pointed out that this is one of the riskier subsectors and stage of resource stocks within the precious metals sector. Riding these equities through bull markets and bear markets is definitely not for the faint of heart, and the stock price action can be wildly volatile. This, of course, also means that with that kind of volatility comes multiple waves of price rises and then price declines to potentially capitalize on for either swing-trading or position-trading. This volatility also provides ample opportunities to accumulate positions for the longer-term, by layering into a position over several buying tranches. This layered approach to scaling into a position, via multiple partial purchases, is a great way to smooth out the volatility, while building a good cost-basis over time.

With all of that said, let’s get into it…

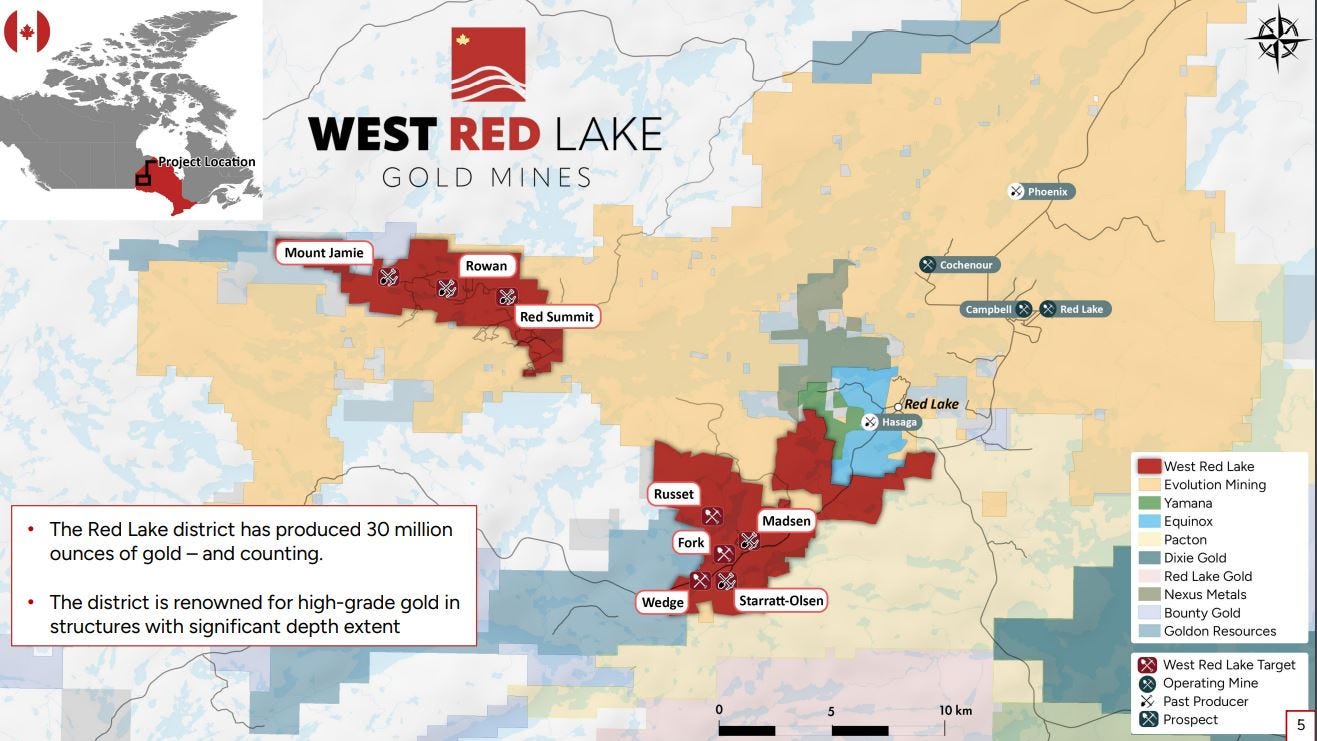

The first company I’d like to feature in this series is West Red Lake Gold Mines (TSX.V:WRLG – OTCQB:WRLGF), for a few different reasons. Now some readers with preconceived ideas may shake their head initially, but let me lay out my thesis, and the value proposition present in the here and now.

1) First of all, I’ve been following their flagship Madsen Mine for about a decade now (from back when Claude Resources was the operator in 2014 and 2015). Then I watched it change hands to Pure Gold for many years (2015-2022), where they did a fantastic job with the exploration side of the business, along with the derisking and development studies. I actually did quite well investing in both Claude in their final year and initially with Pure Gold on their first few years of exploration and development phase, but made the mistake of getting back into Pure Gold after they had corrected hard 6 months after going into production as a potential turn-around story. As we all know now, they ultimately failed upon moving Madsen back into operation, and after 2 years of production pain they finally ran out of money due to onerous debt covenants and poor execution.

For over a year now, I’ve watched the new team at West Red Lake Gold Mines do a huge amount of definition drilling to better understand and get higher confidence on their mineral inventory to prepare for bringing the Madsen Mine back into production. I believe the gold market is finally in a solid place this time, with the right management team that understands engineering/production/processing, with the proper company capitalization, and all the lessons learned from the past operators mistakes to really make this project work this time. This really seems to be a prime example of the phrase “3 times a charm.”

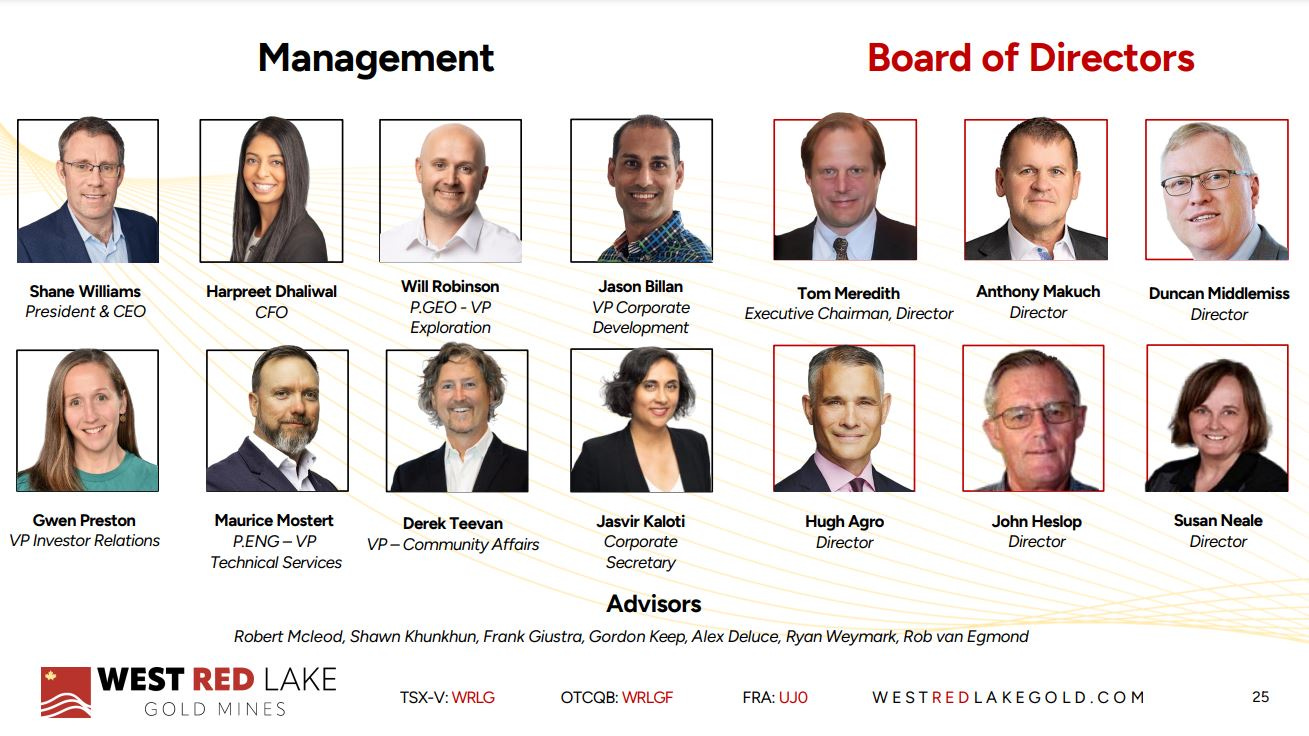

2) I like this asset a great deal for the exploration potential, both at depth for very high-grade gold zones for future underground exploitation, and then also at surface to find satellite deposits that could “feed the beast” at the Madsen Mill. We’ll get into the mineral prospectivity later in this article, and there will be exclusive embedded interviews with the VP of Exploration for the company, Will Robinson and the CEO of the company, Shane Williams. This company is also about to start finally doing true discovery exploration, in tandem with the remaining 30,000 meters of definition drilling, and that is clearly not priced in at all by the market.

3) Like Rick Rule has quipped in interviews lately… “I love hate… in investing.” There are so many investors that were burnt in the Pure Gold failure, and that struggled in Claude Resources before them, that hardly anyone believes that this strategy to put the Madsen Mine back into production is going to be successful. Ye of little faith… These jaded prior investors, or armchair critics watching from afar and hurling rocks and insults, are very vocal about how much they don’t think this is going to work. At best, they are very skeptical while scoffing at the company behind their backs. What I always find puzzling is that most of those critics have not even talked to the new management team to understand their strategy, nor do they understand the nuances between prior resource estimates and models versus the internal scoping studies the company is using to model their actual mine plan.

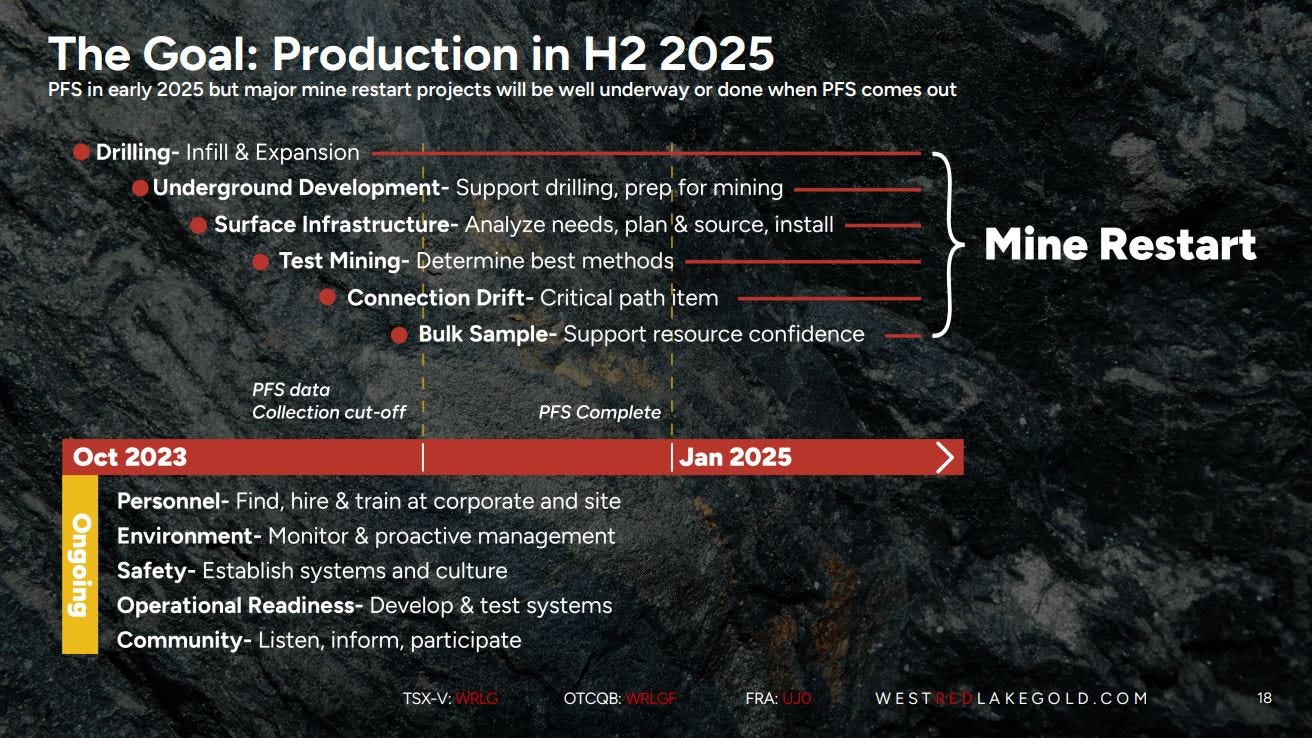

I look forward to seeing this team prove those doubters wrong, squeeze the shorts, and eventually watch people tripping over each other trying to get positioned as the value creation becomes more obvious. I believe this company will start to climb the wall of worry… Of course, they still have to execute on their plan to launch into production in H2 2025 and get escape velocity.

4) By the middle of next year, (WRLG) will graduate from being an advanced explorer/developer, and then move into being a full-fledged gold producer. This means that they’ll start having actual incoming revenues like a real business (a novel concept in the junior mining sector). The company will be able to plow those revenues into expanding mineralization at Madsen and at their secondary satellite project Rowan. I like seeing organic growth in exploration funded through production, much more than endless pre-revenue equity dilution. Maybe down the road we’ll be able to move West Red Lake Gold Mines into the series on growth-oriented gold producers.

5) Typically there is a “Golden Runway” or “Pre-Production Sweet Spot” with development companies the final year moving into production. Those terms were dubbed by newsletter writer and former protégé of Doug Casey, Lobo Tigre, after he did an exhaustive study into the average gains that developers experienced on the year leading up to first gold pour. https://independentspeculator.com/PPSS-Discovery-2023

Most companies out of the dozens studied, went up in the high double-digits to even low triple-digits in percentage terms. The most recent example we have of this in the PM sector is the solid trajectory higher that G Mining Ventures went on from last year into this year during it’s pre-production sweet spot. As a result, it does not seem like very much of a stretch to my mind anticipating a doubling of the valuation in (WRLG) over the next 12 months, as the company moves into it’s Golden Runway… (This is not investment advice. I’m just laying out my personal thesis)

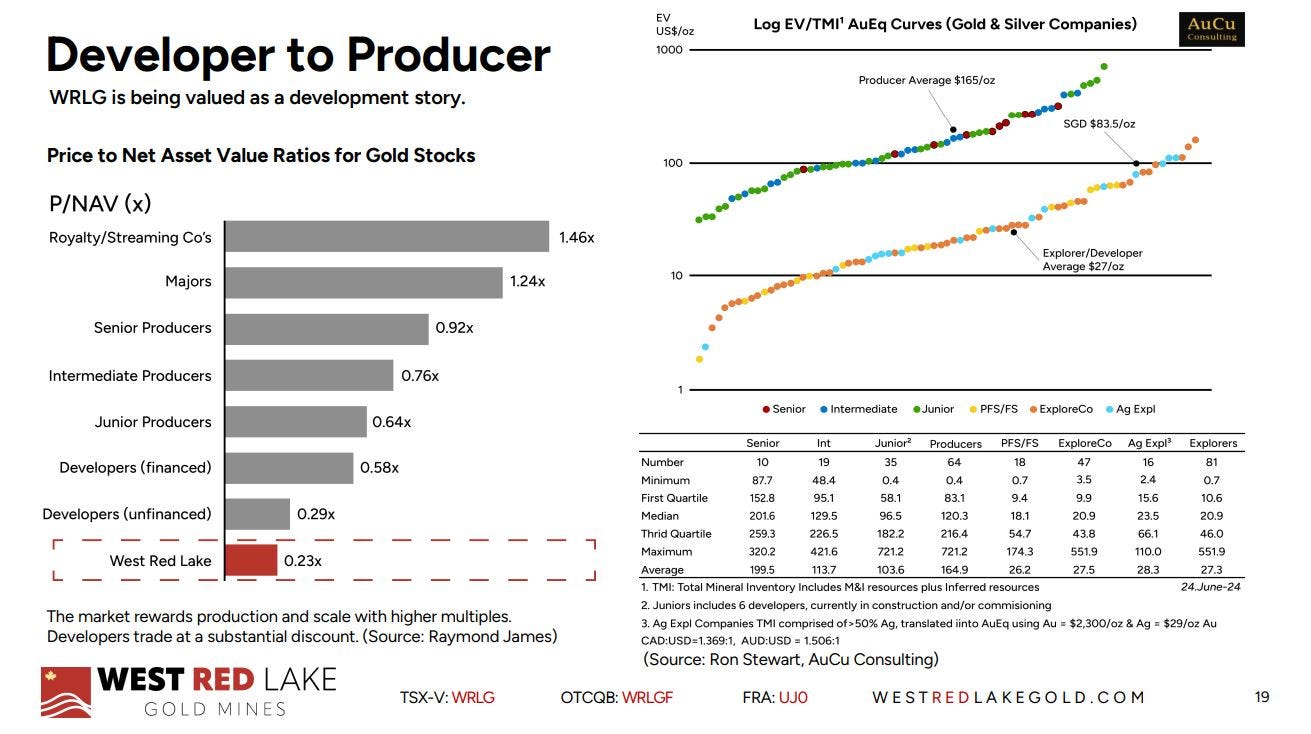

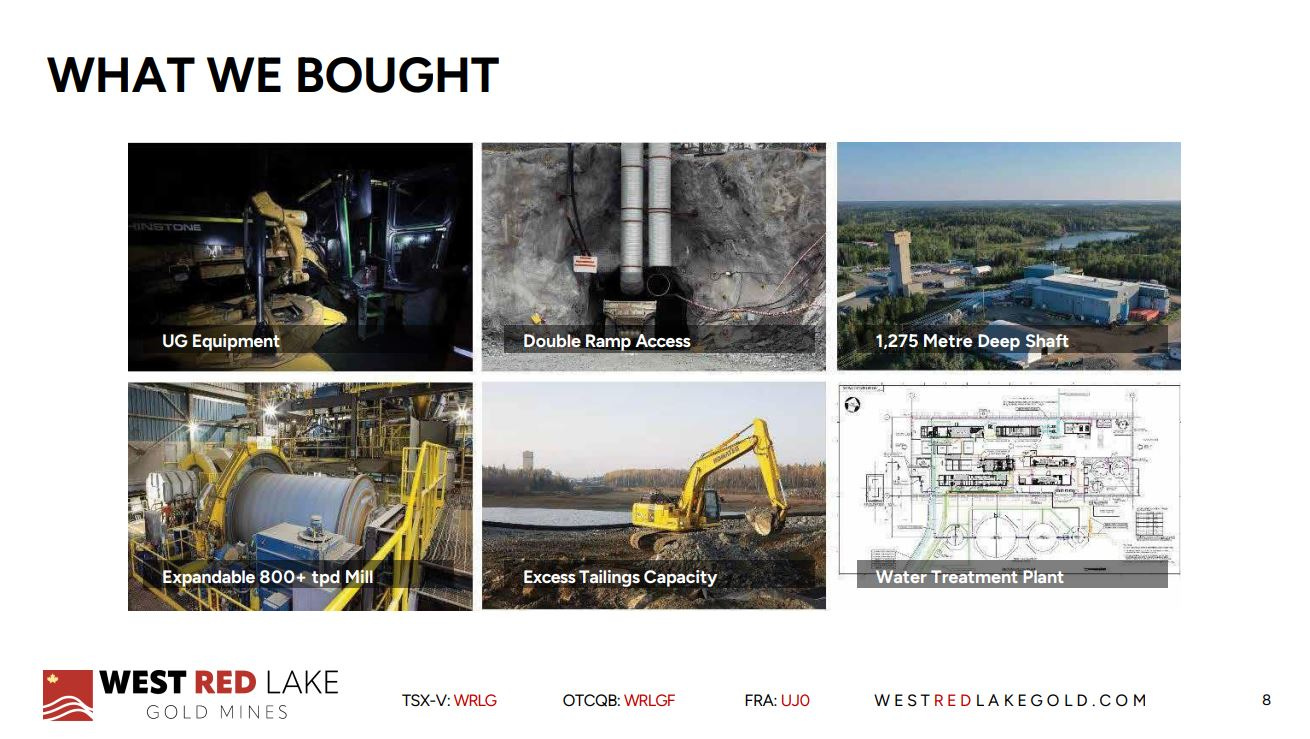

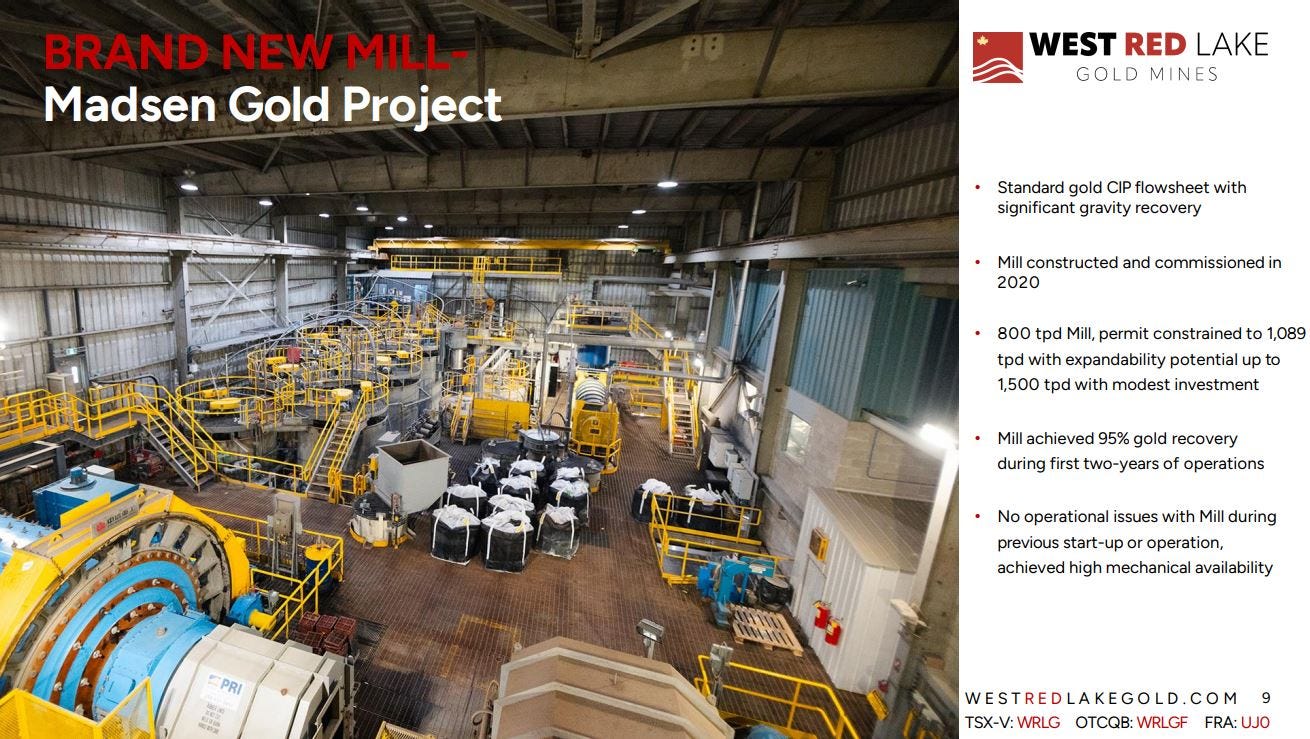

6) They don’t have to build a mine and mill because they were already built by prior operators. Again, Claude Resources and Pure Gold have already operated from the Madsen Mine previously, and Pure Gold commissioned a brand new mill in 2020. The West Red Lake Gold Mines team now gets to capitalize on all the sunk costs and infrastructure already in place. $350Million has already been spent by prior teams, and that is double the WRLG market cap of ~$175Million at the time of this writing.

That is a stunning value arbitrage that is not being factored in at present by the market, because their current valuation is not only half of the sunk costs already invested into this project, but also gives zero value to the 1.7 million ounces of gold already defined historically at the project (not counting all the drilling they’ve done over the last year), and it gives no value to the ~200,000 ounces of gold resources at Rowan. Clearly there is room for a rerating higher. Pure Gold at one point had a $1Billion market cap, and that was before all the drilling that the new WRLG team has done over the last year, or their additional drilling and exploration work at Rowan.

Is the value proposition starting to crystallize?

7) What really gets me personally animated by West Red Lake Gold to hold through any volatility is their longer-term vision to get the Madsen Mine up and producing and generating revenues, but then to use that a platform for rolling up other assets. This is one of the points that I really don’t think most drive-by investors have fully considered in the long game, and where major shareholder and advisor Frank Giustra wants to see this company grow. They are going to use this mine to acquire more projects and more mines, until it is a multi-mine producer. So many are hung up just viewing this through the lens of a mine in Red Lake that has been difficult in the past, that they are missing the forest of growth, due to looking at a couple old dead trees.

Frank Giustra had a great interview over on Rick Rule’s channel, where he was sharing his history building many successful companies, but then towards the end he shared his high-level plans for a few of his current companies like Aris Mining and West Red Lake Gold. He wants to use them both to accumulate other projects and companies until they are mid-tier producers. This makes all the sense in the world, but I think this roll-up vision is lost on so many investors that can’t get past their initial disbelief and skepticism that they’ll be able to successfully get the Madsen Mine back into production; much less grow into a mid-tier producer with other mines in Canada over the fullness of time.

This link should take anybody interested directly to that part of the discussion with Frank and Rick, and people can hear it directly from his own mouth of what his larger plan is for WRLG.

Alright, so with those main points made on the investing thesis, and the value proposition; let’s now do a little more digging into the fundamentals of the company, the ongoing exploration, and remaining derisking work on the pathway to production.

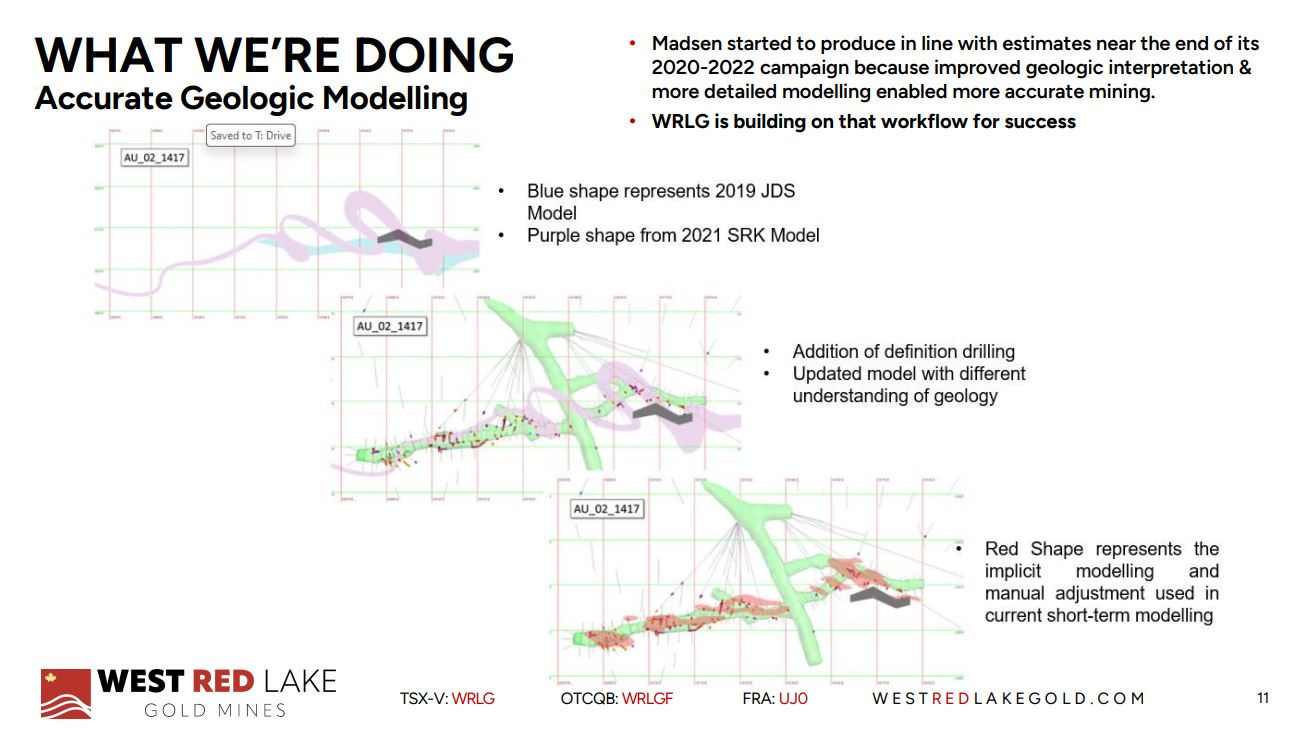

Let’s start with their strategy of really honing in on an accurate geological modelling of the Madsen Gold Project deposit. What many of the haters fail to realize is that the team at Pure Gold actually did finally start getting the modelling figured out right at the end of their journey. As the saying goes, “It was a day late and a dollar short.” However, the exploration and engineering teams at West Red Lake Gold Mines retained a number of prior staff members that were part of this new understanding, and everyone has had time to marinate on the prior mistakes made, and collectively have a better understanding moving forward.

A knock against West Red Lake Gold Mines is that they’ve raised a lot of money over the last year. That is true, but also demonstrates that they have access to capital. People are somehow forgetting when taking that swipe against the company that they’ve also done a lot of drilling with that money raised. That was kinda the whole point as to why they raised it.

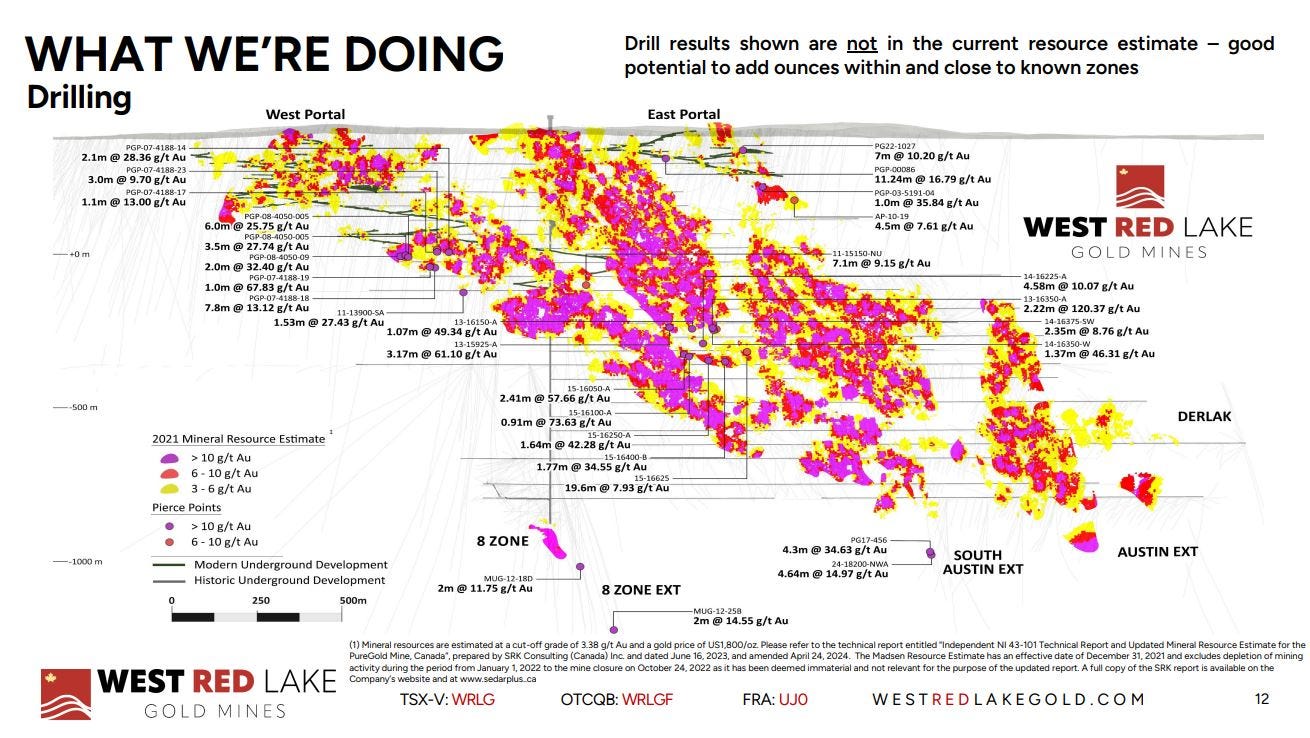

This is a good spot to bring in a discussion we just had with Will Robinson, VP of Exploration for West Red Lake Gold Mines, over at the KE Report. Will joined us on August 14th to review some of the recent wide high-grade gold drill intercepts returned from the Main Austin Zone and McVeigh Zone. These exploration results feed into the delineation of resources and to continue building an inventory of high-confidence ounces to support the restart of production at the Madsen Mine.

The Austin Zone currently contains the majority of the mineral inventory with an Indicated mineral resource of 914,200 ounces (“oz”) grading 6.9 grams per tonne (“g/t”) gold (“Au”), with an additional Inferred resource of 104,900 oz grading 6.5 g/t Au. The McVeigh Zone currently contains an Indicated mineral resource of 79,800 oz grading 6.4 g/t Au, with an additional Inferred resource of 14,300 oz grading 6.9 g/t Au.

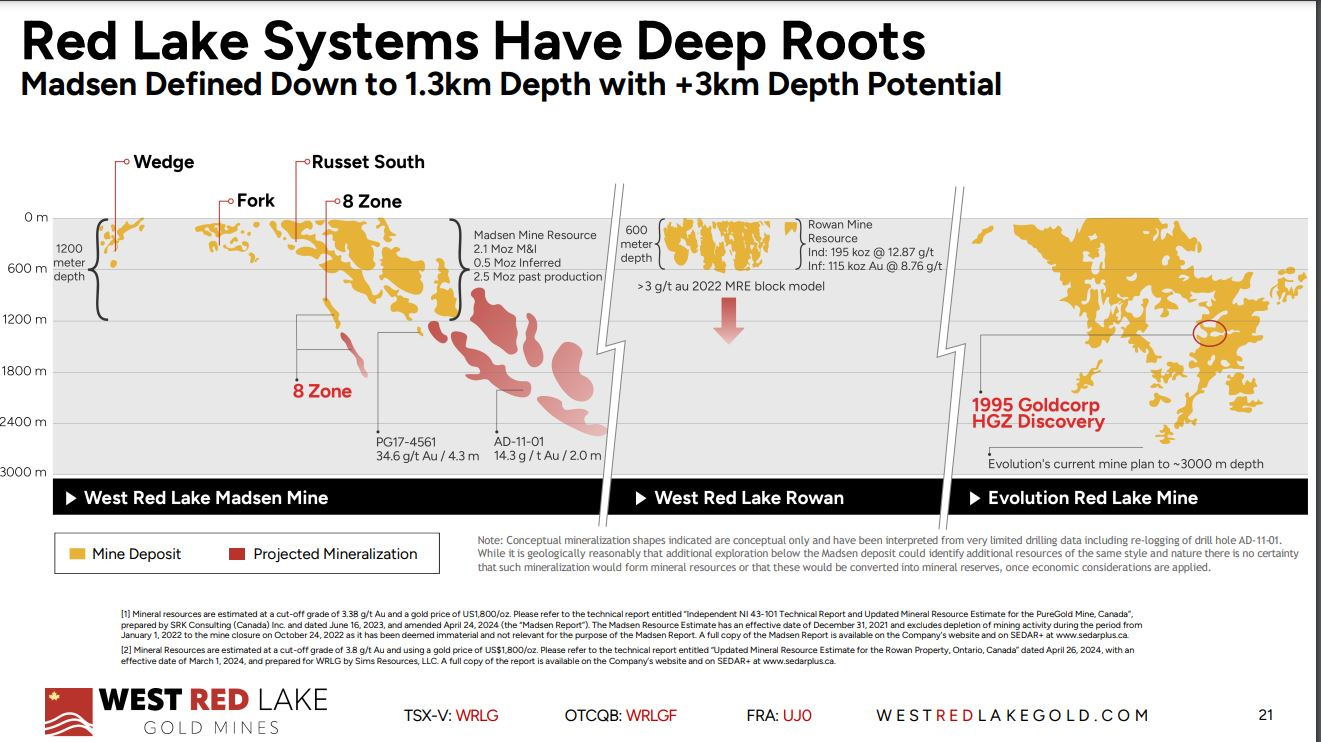

We also review the potential at depth at Madsen with both the South Austin Zone still open, at a new target called the Upper 8, at the Wedge/MJ area, and then also some underground drilling work planned for this Q4 at the 8-Zone. Red Lake systems go very deep, and what really put Goldcorp on the map back in the day, under Rob McEwen’s tenure, was when they made their HGZ discovery at depth. There are many indications that the 8-Zone and other targets at depth will hold the same types of high-grade potential.

There will also be a lot of regional exploration work on surface testing the thesis of periodicity of the mineralization and overlaying soil work with geophysical surveys. The mineralization at the Madsen Gold Project may actually have both the potential for bonanza grades at depth (like the Red Lake Gold Mine nearby) and then also the Great Bear type of mineralization in their “Confederation Assembly” package of rock types closer to surface. The “Balmer Assembly” package of rocks is where most of the gold mineralization has historically been looked for, but Great Bear changed the game in Red Lake with their exploration work into the Confederation Assembly mineralization. I don’t think most investors have factored in this potential blue-sky upside yet, but the company is drilling to test this thesis for the balance of this year.

When I interviewed the CEO, Shane Williams, of West Red Lake Gold a few months back, he also got into the Great Bear analogies in their similar rock types and was pretty animated about it. Here is a hotlink that should take you to that part of the interview where Shane is discussing those opportunities:

Let’s wrap up with the team, because in addition to Frank Giustra, Shane Williams, and Will Robinson, there are a host of other interesting household names involved with West Red Lake Gold Mines. Tony Makuch is a Director, and he is the old boss of Kirkland Lake - an undeniable success story in the gold space (now owned by Agnico Eagle). Duncan Middlemiss was the old boss of Wesdome Gold Mines – another undeniable success story in the gold space. Shawn Khunkhun, Rob Mcleod, and Rob van Egmond are all advisors for WRLG and blazing their own trail of success presently over at Dolly Varden Silver. Also friend of the KE Report, and publisher of the Resource Maven for about a decade, Gwen Preston, is now their VP of Investor Relations. These folks are not all involved to be part of a flop or failed mine launch. Is it possible they’ve done more due diligence on this project than all the online haters and critics? (clearly yes, they have) Success leaves clues…

Here is one more interview with Gwen Preston, that we recorded over at the KE Report, when we got word that she was joining the management team at West Red Lake Gold Mines, and where she provides her journey in WRLG from skeptical to a full-on endorsement of the company strategy.

I’m going to tack on some additional recent interviews with the team over at West Red Lake Gold Mines for anyone that comes across these articles in the future.

West Red Lake Gold Mines – Mine Restart Activities Underway, Bulk Sample & Trial Mining Commencement - September 24, 2024

West Red Lake Gold Mines - More High-Grade Gold Assays Returned From South Austin And Austin Main - September 27, 2024

West Red Lake Gold – The Capital Stack Has Been Raised And Restart Activities Are Underway To Put The Madsen Mine Back Into Production

November 1, 2024

Well that wraps us up for this first article on some of the opportunities presenting themselves in the gold exploration and development-stage stocks, with PLENTY more of these to come in this series over time.

Thanks for reading and may you have prosperity in your trading and in life!

- Shad