One Day Does Not Make A Market, But The Silver Stocks Are Getting More Traction

Excelsior Prosperity w/ Shad Marquitz (06/02/2025)

We’ve been discussing the uptick in many precious metals stocks for some time now, but kicking off June trading on Monday the 2nd, we witnessed that even the smaller silver stocks were finally getting more traction with investors. It seemed like a noteworthy trading session, with a little something more going on under surface; compared to what we’ve been seeing lately, and that is what prompted this post.

Yes, silver futures did break up in the $34.80’s on Monday, and that really got the animal spirits going with resource stock investors pouncing all over the bid on the silver stocks.

SILJ was up 7.27% Monday to close at $14.01, putting in a higher close than he most recent last few peaks; which is bullish. Pricing is well above both the 50-day and 200-day Exponential Moving Averages, and that keeps it in a bullish posture. The SILJ price peak yesterday is still not up above that $15.18 level hit in October of last year; but it was nice to see this Amplify Junior Silver Miners ETF getting a solid price bid, and on higher than average volume (note down below on chart).

There was a lot of nice movement today in the silver stocks, I was struck by how well some of the silver junior producers, developers, and advanced explorers did on Monday’s trading session.

🔹 This has been a curious topic on the top of my mind lately. I’ve had a lot of discussions lately with investors at various conferences, and on the half dozen Zoom calls that we are on with different sector pundits and management teams every day over at the KE Report, and then in private messages with fellow investors. In conversation about investing in the sector, people will often ask what’s catching my attention.

For the last month or so I’ve been sharing with fellow investors that I’ve actually been starting to ring the register on some big moves in the intermediate gold and silver producers and PM royalty companies to rotate some of those funds down into the beat up junior silver producers and developers, {along with also cycling some funds down into the really beat up uranium producers and advanced uranium developers… but we’ll save a discussion on the U-stocks for another day}

When sharing both those resource investing strategies with folks (selling quality mid-tier PM stocks to rotate funds into silver and uranium small producers and developers) many of those other investors wrinkled up their noses in a look of semi-disgust. It’s like that look when someone orders a particular food item at a restaurant that someone else sitting there really doesn’t like.

Sometimes they would utter something like “Really? Man, those have been dead money for a while, and I just couldn’t consider touching those when gold is doing so well. Why not just stick with the better gold or silver stocks?” (then came the part after where they’d soft bash the companies I mentioned getting more animated to position in as tired dogs or laggards….). Classic missing the forest for the trees.

In my experience, that is precisely the kind of environment for contrarian positioning in the unloved, abandoned, or forgotten stocks.

This becomes even more the case when the sector becomes an echo chamber of people spouting off that “you only want to be in the biggest and best names and top quality companies.”

As we’ve discussed many times in this channel, I disagree with having that kind of tunnel-vision or bias, and the better past percentage gains from prior PM bull cycles actually occurred in the #BestOfTheWorst, and would disprove that bias towards the #BestOfTheBest, but hey to each their own…

Let’s just focus on the junior silver stocks in this current backdrop. I actually really love that there are so many PM investors that are still so negative on these small silver producers and still punishing them for their past underperformance, instead of skating to where the puck is going… for their future outperformance. Like the saying goes, “The past does not equal the future.”

For example just because a stock was going down for a quarter, or half the year, or a whole year, or even several years, does not mean that it can’t find a bottom, and then start trekking higher, maybe even substantially higher, in the right kind of environment. The only constant is change.

🔹 It is actually far easier for me to buy when a sector or asset class is out of favor; especially when people that critique it are incorrectly extrapolating past results out into the future forever, without doing more critical analysis on how things are changing or developing.

With the smaller and higher-cost silver producers, many PM resource stock investors will point out;

“They’ve still been losing money…”

“Their costs are still way too high…”

“They don’t have the management A-teams…”

While those points may be all be valid, from a staring backwards perspective, they are also the very same reasons why this tiny subsector of stocks interests me so much at the point we are at in this PM cycle.

These companies can start to move higher in big ways with relatively few people even paying attention.

Look, gold has been running in a bull market since bottoming back in December of 2015 at $1045, and has tripled in US dollar terms over the last decade. We’ve pointed out that many of the best-in-breed gold and silver stocks, with the lowest costs and best margins have already had good runs for years now. A handful of the best have actually been acquired over the last year by larger producers looking to lower their overall consolidated All-In Sustaining Costs or boost grades and resources.

This is why Calibre is being scooped up by Equinox… or why Silvercrest was acquired by Coeur… or why Gatos Silver was acquired by First Majestic… or why MAG Silver is being taken over by Pan American Silver, and so on…

They are or they were the best-in-class lowest quartile cost PM producers, but are now being absorbed by larger and less efficient senior producers, clearing the market gameboard of those options, and forcing investors to look at moving down the risk curve and food chain.

🔹It’s not a secret that 2 of my largest silver positions at the end of last year were Gatos and Silvercrest, so I’m not opposed to being the best-in-class mid-tiers. I sold out of Gatos, before the takeover by First Majestic, and sold my Coeur, letting my Silvercrest convert over to CDE, but then reduced down the position-size a little bit after the merger was complete.

👉 I had capital to deploy for silver production exposure, and needed to beef up some of my other silver stocks. As a result, I decided to weight Santacruz Silver Mining Ltd. (TSXV: SCZ) (OTCQB: SCZMF) most heavily in my portfolio coming into 2025.

This was due to its annual production of 18 million silver equivalent ounces being in the range of a larger mid-tier silver producer, but with its market cap of less than US $200million being priced like a junior stock.

It has actually been producing more silver equivalent than Gatos or Silver Crest, or Mag Silver, or Endeavour Silver, or Aya Gold and Silver and those were all $1Billion-$2Billion valuations.

Santacruz is only valued at a fraction of those companies market caps, and it is a really glaring disconnect. Additionally, it has a Price to Earnings (P/E) ratio of less than 2. So it’s hard to believe one is over-paying for that valuation. Haha!

So for me that is a prime example of betting on the #BestOfTheWorst, because technically it has been one of the higher cost operators (ie… one the worst for costs) but it has also been producing far more AgEq ounces than most peer junior to mid-tier silver producers, (ie… the best in that category).

My friend and colleague, John Rubino, was asking me one day what my favorite silver producer was? Well, I sent him back a really long email (big shock eh?) parsing out why I don’t have a “favorite,” but have many silver producer positions that I like for different reasons:

ie… lowest cost operators like Silvercorp, most production growth on tap like Avino Silver and Gold, most potential silver exploration upside like Sierra Madre or Impact Silver, most silver optionality through resource size (but now it’s a gold producer) like Discovery Silver, or best turn-around stories like Guanajuato Silver, Americas Silver and Gold, and Silver X.

I also mentioned in passing that my largest silver position was now in Santacruz Silver. No, it wasn’t the lowest cost, didn’t have the most growth on tap, didn’t have the most exploration upside, and got a jurisdictional penalty for operating in Bolivia, but it was the most undervalued on many metrics in its snack bracket of mid-tier silver producing peers (which is why other companies don’t use it in their slide deck peer comparisons).

I told him at the time that if he really wanted the “best of the best” safe pick, then MAG Silver was probably the best operator, with the best deposit, lowest costs, and was probably a high contender to be taken over next… but mentioned that I didn’t own it personally. (that was prior to the takeover news)

John sent me back a question curious about why I didn’t own MAG Silver if it had all those things going for it? I explained it was because everyone else had already piled into it over the years, and knew it was a big low-cost producer and best-in-class deposit with the A-team. For those reasons it had so many analysts following it, and so many technicians charting it, and so many pundits touting it, that it was actually more fairly valued as a result.

I ranted to him like I am here in this article that you don’t necessarily want to only be invested in the biggest or the best, and that those types of names don’t typically have the most torque. If that was true then everyone would pile only into Fresnillo as the largest silver producer with decades of operating experience.

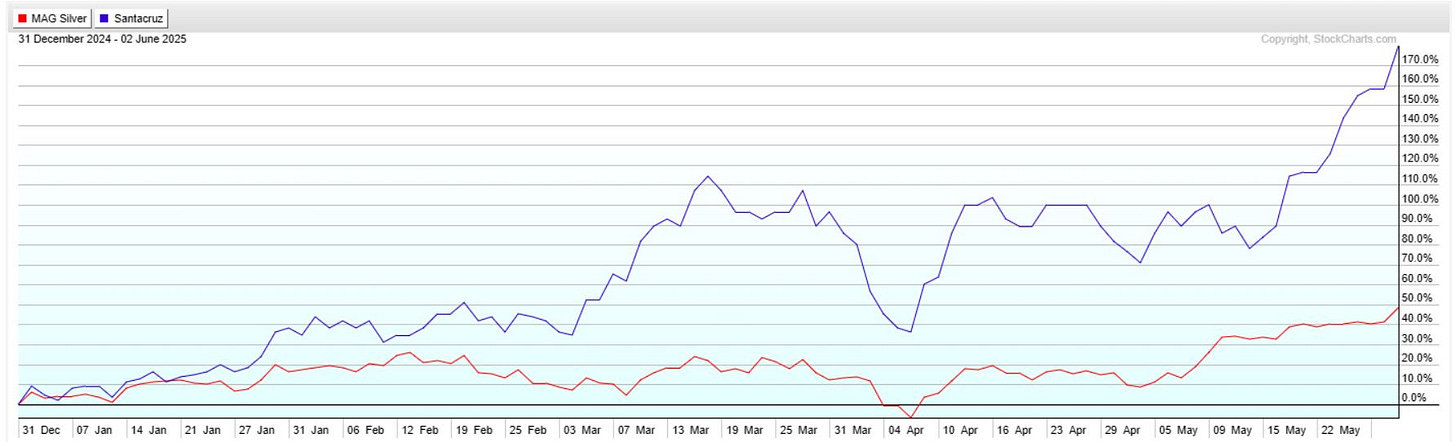

Then I sent him over this chart of the year-to-date performance of MAG Silver #BestOfTheBest versus Santacruz Silver #BestOfTheWorst. I explained that MAG had mostly channeled sideways this year where Santacruz has been ripping higher, which flies in the face of all conventional investing wisdom that one would assume.

The reasons stocks like Santacruz Silver tend to outperform in the more bullish phases of a silver rally is precisely because they are a higher cost operator. They’ll see far more margin improvements on a percentage basis, than a lower cost operator like MAG Silver will for each $1 rise in the price of silver.

SCZ went from underwater, to parity, to profitability in just a few bucks of silver price appreciation, where MAG was already profitable and just became slightly more profitable on those same few dollar increments higher in the silver price.

In Santacruz’s case, they are also working hard to start bringing down their costs through mine optimization, and they are working to save $40 million by paying off their loan to Glencore early. They should have it completely paid off by late October, so they’ll be improving their financial picture over the course of this year.

That’s just one example, but the reality is that a lot of these smaller silver producers are in the same boat, and have higher costs, lower production metrics, aren’t best-in-class operators or tier 1 deposits, but they have some of the most improvement on tap.

At least to kick off June on Monday, we started to see more investors wake up to how most of these smaller and higher-cost silver producers are actually at an inflection point, and it is likely that Q2 is going to be another step change higher for them.

What remains perpetually interesting, and also what makes a market, is that most resource investors (even those that like silver stocks or are looking to deploy capital into silver companies) have refused to get positioned in these “ugly duckling stocks” when their prices were low and when they could buy their value at a deep discount. Most of the herd was turning up their noses to these stocks, mostly based on backward looking quarterly results and recency bias.

They often would ignore the messaging from the CEOs and board of directors about how things were setting up for better results coming into 2025 in the quarters to come.

Look, I totally get being skeptical as a default as a mining stock investor; however, one should not be completely close-minded to company guidance or legitimate improvements being made that are communicated to the market.

In mining, sometimes it just takes a fair bit of time to see these optimization initiatives show up in the numbers (typically a few quarters).

When bigger groups of PM investors do finally start waking up to what is going on with the operations, balance sheets, and optionality of these smaller silver producers, then they are going to be left chasing these stories higher for the next 12-18 months.

Just on Monday June 2nd some of these smaller and higher-cost silver producers were up handsomely on the day making outsized moves to the upside.

· Guanajuato Silver (GSVR.V) was up 16.7%

· Sierra Madre Gold and Silver (SM.V) was up 10.2%

· Endeavour Silver (EXK) was up 10%

· Impact Silver (IPT.V) was up 9.5%

· Silver X Mining (AGX.V) was up 7.7%

We haven’t even really touched yet upon the silver developers and advanced explorers, but they had a bang-up day as well. My top portfolio mover in this category on Monday was Aftermath Silver (AAG.V) up 16% on Monday.

These are all stocks we’ve discussed on this channel a number of times for various fundamental reasons, so stock picking in this sector isn’t an insurmountable quest. Some of these stocks may look like ugly ducklings in their more recent quarters, but as they optimize costs and see their margins expand, then they’ll be able to reinvest in their businesses and exploration and transition into attractive junior mining swans.

It appears that silver is getting whacked again here earlier on Tuesday morning, so after such big runs yesterday, many of these companies will likely pull back down again, offering investors a better price-point than yesterday. What is curious is that many investors will struggle much more internally and emotionally to buy a dip on a down day, compared to paying up to a higher level on a rip like yesterday.

{This is not investing advice, and I’m not an investment advisor. You should talk to a qualified investment advisor for reviewing those kinds of financial decisions, and consider your own risk/reward tolerance levels and investing goals. I’m merely sharing my own investing thesis here and what I’m doing in my own portfolio for entertainment purposes}.

Thanks for reading and may you have prosperity in your trading and in life!

Shad