Mining News Update In Portfolio Positions – DV, WRLG, DRY

Excelsior Prosperity w/ Shad Marquitz (05-08-2025)

In this article we are going to check in on a few portfolio companies that have had key news releases out that didn’t get the traction with investors that one would have expected. It seems some transformational news fell on deaf ears with market participants, or was even perceived negatively, even though it was clearly positive news.

I was actually working to put out a different article today focused on updates to the royalty stocks, and that is still coming soon, so stay tuned. However, one goal of this channel is to bring attention to key company milestones for stocks we’ve already introduced, and unpack how this may affect the investing thesis or valuation of that company. Some of these recent press releases have just been on my mind all day and evening, and they have also come up in multiple conversations with other investors. Therefore, it seemed worth doing a quick update for readers here.

[As a reminder, I’m not paid or even asked by any of these companies to produce these Substack articles, and this is not investment or financial advice. I hold shares in these companies in my own portfolio, so I’m biased in that sense. These articles are merely an outlet for sharing my own investment thesis and are for information and entertainment purposes, but should not be relied upon.]

So, let’s get into it…

We’ve had 2 back-to-back pressers from Dolly Varden Silver (TSXV: DV) (NYSE American: DVS) (FSE: DVQ1), that are both significant value drivers for the company.

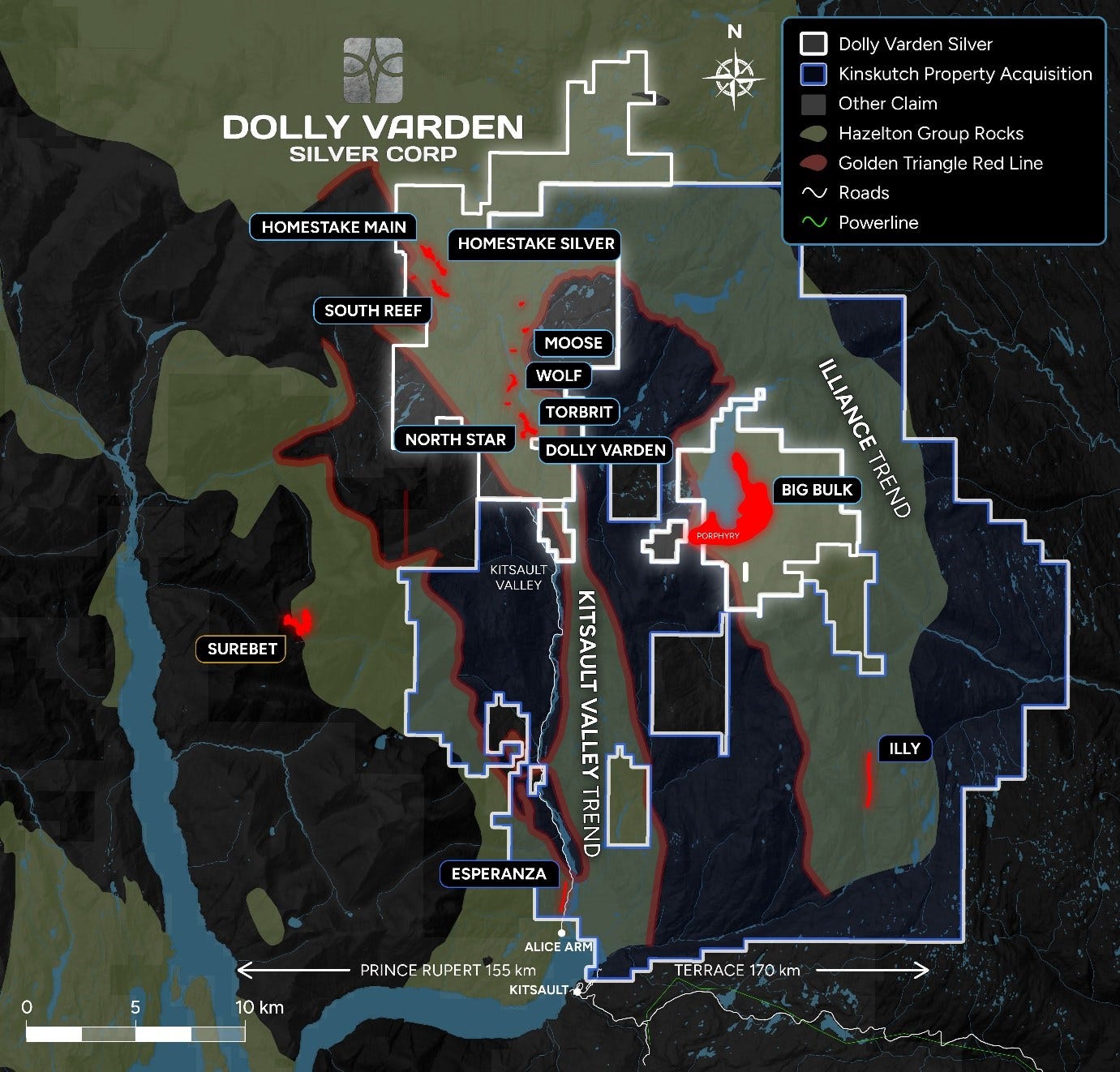

Dolly Varden Silver Announces Agreement to Quadruple Tenure Area in the Golden Triangle by Acquiring Hecla Mining Company's Adjacent Kinskuch Property - May 5th, 2025

“Dolly Varden Silver Corporation is pleased to announce that it has entered into a definitive agreement to acquire 100% of Hecla Mining Company's Kinskuch property in northwest BC's Golden Triangle. The Transaction will consolidate a district scale, contiguous claim package that includes the Kitsault Valley, Big Bulk and Kinskuch projects. This consolidation of Hecla and Dolly Varden's project areas dramatically increases the Kitsault Valley Project size to approximately 77,000 hectares, covering some of the most underexplored and prospective rocks for silver, gold and copper mineralization in the Golden Triangle.”

This was a mutually beneficial deal for both Dolly Varden and Hecla (who now owns a bigger chunk of DV and is the natural suitor, with members on their board and technical committee).

Dolly Varden has done an excellent job of consolidating this whole land package over the last few years. The biggest score was picking up the Homestake property from Fury Gold. Then there was acquisition of the remaining portion of the Big Bulk property they didn’t yet have from Libero Copper, for pennies on the dollar. Now we see a strategic move on the surrounding Kinskuch Property from Hecla.

That is also a smart play from Hecla (NYSE: HL), taking the shares in DV, and gaining a bigger stake in Dolly Varden’s future share price appreciation. Personally, I was expecting HL to acquire DV and be the ones to consolidate all that land; but Dolly Varden made the acquisition here, keeping with their strategy to be the consolidator of this whole mineralized district in the southern tip of the Golden Triangle. They have been in expansion mode for some time, and now they have the whole enchilada! (well except for Goliath Resources, which is nearby too)

Hecla will get more out of the appreciation in DV shares than if they’d just taken a cash payment. Again, in the longer term, they’ll likely take over the whole company and have this project back in the fold again regardless.

It also does make more logical sense to let the excellent exploration team at Dolly Varden keep derisking this whole area. Hecla is far too busy with all their producing mines to do much exploration at this earlier-stage project.

The team at Dolly Varden can now push the envelope on drilling and expanding some of the known deposits on the larger Kinskuch property, building an even larger value proposition. Then down the road, by continuing to grow the resources on a consolidated project, it likely makes the future acquisition of DV by HL much more attractive to their shareholders; because it will have become a project of significance.

Here is a video the company just put out featuring their VP of Exploration, Rob Van Egmond.

May 5, 2025 Dolly Varden Silver News Release Explained

I was a bit surprised that the market mostly yawned at this transformational acquisition from Dolly Varden. By the reaction in the share price this week, it seems like this news fell on deaf market ears for some reason… (which is odd)

The stock price barely reacted this week, going up and tagging the 50-day Exponential Moving Average, which acted as resistance, but then coming back off again. Apparently, the market is ascribing no value to the consolidation of this massive adjacent land package with known historical resources in place, and plenty of exploration smoke to follow up on. This is stunning market apathy.

There was even more positive news out Wednesday by way of announcing their 2025 exploration program, and yet (DV.V) moved down by over -2% to close Wednesday at $3.72. Sure, let’s sell off an exploration company as it announces a new drill program… that makes sense right? (No, it doesn’t actually make any sense… but these are the markets we have.)

Dolly Varden Silver Announces 2025 Exploration Program Focused on High-Grade Silver and Gold at Kitsault Valley - May 7, 2025

“The aggressive drill program planned for the Kitsault Valley Project located in the newly emerging southern Eskay Rift sub-basin in northwest BC’s Golden Triangle, will consist of a minimum planned 35,000 meters of diamond drilling building on the success of the 2024 program. Drilling will focus on expanding high-grade mineralization at the Wolf and Homestake Silver deposits and will follow up on promising results from numerous exploration targets including Red Point and Moose. The program will also include deep drilling at the Big Bulk copper-gold porphyry target. Drilling will commence in mid-May with four rigs expected to be active throughout the season.”

Update to this article with even more DV news out on May 8th:

Dolly Varden Acquires High-Grade Silver Porter Project in Golden Triangle- May 8, 2025

“Dolly Varden Silver Corporation is pleased to announce that it has entered into a definitive agreement with Strikepoint Gold Inc. to acquire Strikepoint’s interest in the Porter Project, located in the Golden Triangle, British Columbia , further strengthening Dolly Varden’s position as a prominent precious metals exploration Company in the region.”

Like I said…. they have been the master consolidators in this southern area of the Golden Triangle for the last few years, and this recent newsflow just accentuates their strategy. Dolly Varden has continued growing and has so many exploration targets to now follow up on across their district-scale land package.

Next up there was a key milestone achieved recently at West Red Lake Gold Mines (TSX.V:WRLG – OTCQB:WRLGF) with the completion of their trial mining and bulk sample project. This may have been the most important press release in the company’s history, since acquiring the Madsen Mine & Mill. Investors shrugged it off though, and it was a sell-the-news event in the market. That’s nuts!

West Red Lake Gold Reports Positive Bulk Sample Reconciliation Results - May 7, 2025

https://westredlakegold.com/west-red-lake-gold-reports-positive-bulk-sample-reconciliation-results/

This was the last major step in the process, to demonstrate to the market and the board of directors, that the whole strategy deployed over the last 2 year was on target for a proper reconciliation of anticipated grades and recoveries. This means that with this data, the board can vote on moving forward with commencing production at the Madsen mine and mill.

The results of this bulk sample program were released to the market on Wednesday, and the data was undeniably positive…. The company executed on their major deliverable and it was like nobody even cared..

So, of course, this meant that traders should sell the company down, especially after demonstrating this major proof-of-concept and validation that this team can profitably mine and produce gold from Madsen. (Huh? Why is the stock not up double digits on this news?)

It almost looks like people with warrants to clip or hedge funds with short positions were playing games to absorb any interest and continue to sell the stock down on a good news day… (very weird, but that’s the market we have.)

Over at the KE Report on Wednesday afternoon, I was joined by Gwen Preston, VP of Communication at West Red Lake Gold Mines, to review the news out earlier in the day. We dove into the key metrics and takeaways in their positive reconciliation results from the bulk sample program at the 100% owned Madsen Mine located in the Red Lake Gold District of Northwestern Ontario, Canada. (In full disclosure, WRLG is a banner sponsor of the KE Report.)

West Red Lake Gold – Diving Into The Positive Reconciliation Results Of The Bulk Sample Program

The bulk sample included material from three main resource zones at Madsen – Austin, South Austin, and McVeigh – and followed the workflow and methodology to be implemented during regular mine operations.

Highlights of the bulk sample initiative:

The bulk sample carried an average grade of 5.72 grams per tonne (“g/t”) gold (“Au”), 0.7% above the average predicted grade of 5.68 g/t Au for six stopes across three areas.

14,490 tonnes of bulk sample produced 2,498 ounces of gold

Gold recovery in the Madsen Mill averaged 95%

Gwen reviewed that this close reconciliation between predicted and actual grades and tonnages highlights the effectiveness of definition drilling and detailed stope design in informing accurate modelling of gold mineralization. The fact that the estimated grade from their stope design and actual gold recoveries align almost exactly with expectations, really validates all the geological and engineering work the West Red Lake Gold Mine teams have been doing for the last 6 months. This bulk sample has demonstrated that their strategy is sound for estimating expected grades, recoveries, and that they can unlock value by moving the Madsen Mine back into production.

Next we discussed that the current stope design has changed from a cut and fill method to a long hole stoping approach, in order to maximize the economic benefit in today’s high gold price environment. This approach differs from the Prefeasibility Study (“PFS”), which used a gold price of US$1,680 per ounce when designing stopes, and instead is now using a long-term consensus gold price of US$2,350 per oz. which allows for mining the halo of lower-grade mineralization around the higher-grade tonnes. This long hole stoping mining method will allow for mining more overall gold ounces at Madsen, potentially lowering operational costs, increasing production, and enhancing overall economics relative to the PFS mine plan.

Wrapping up, we reviewed that the company will be getting paid for the 2,498 ounces of gold produced in this bulk sample work program, and so those revenues combined with the $12.5 million left undrawn in the Nebari Natural Resources Credit Fund facility will have the company cashed up to proceed towards production in the near future.

{Update to this article on May 8th:}

West Red Lake Gold Reports on Bulk Sample Gold Sales - May 8, 2025

https://westredlakegold.com/west-red-lake-gold-reports-on-bulk-sample-gold-sales/

To date the Company has sold 2,350 oz. of the 2,498 oz. that were produced in the bulk sample.

The gold was sold at a weighted average gold price of US$3,293 per oz. in sales that took place between late March and early May, for proceeds to date of US$7.7 million.

The remaining gold will be sold on final settlements with the refiner.

One other highly-anticipated press release that hit the market on Wednesday May 7th was the drill assay results from some of the first holes from a new hanging wall discovery from the current exploration program from Dryden Gold [TSXV: DRY, OTCQB: DRYGF]. They had announced visible gold hits in the drill core last month and now we are seeing the high grades those carried.

Dryden Gold Reports 301.67 g/t Gold over 3.90 meters including 1,930 g/t Gold over 0.60 meters in a New Hanging Wall Discovery

- May 7, 2025

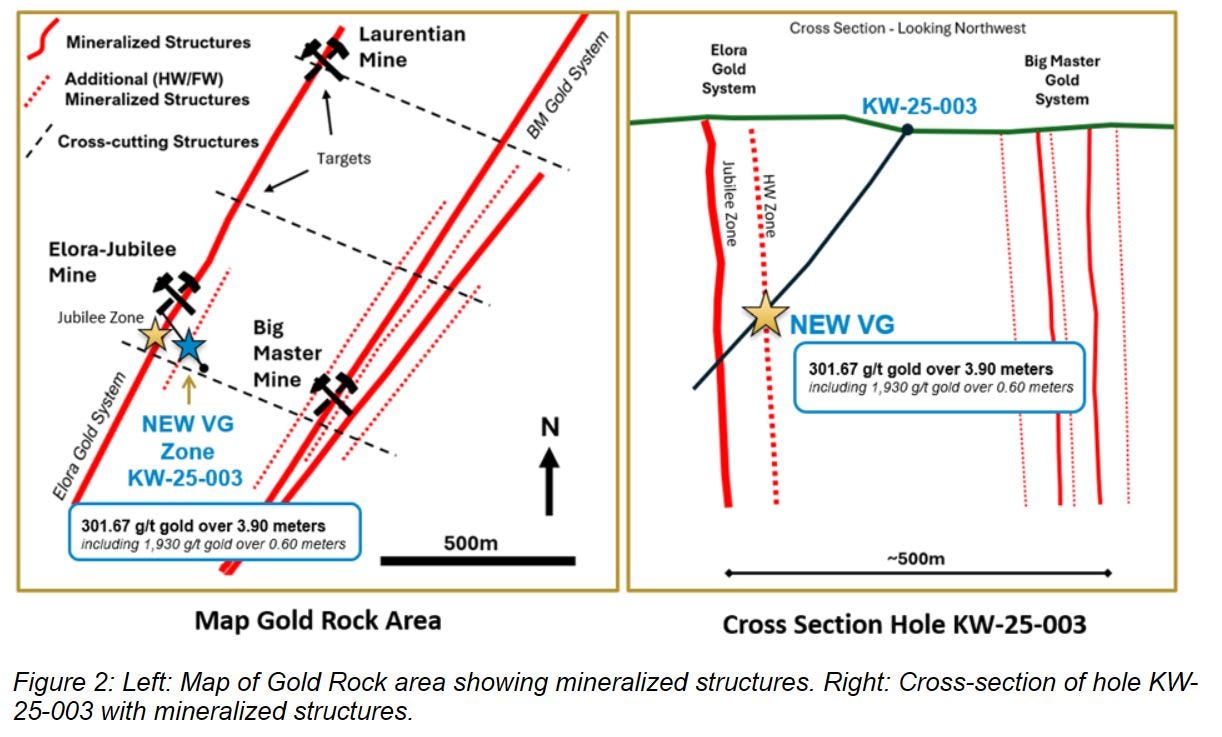

“Dryden Gold Corp. is pleased to announce drill results for the new hanging wall discovery on the Elora Gold System in the Gold Rock Camp. The Company first announced this intercept with significant visible gold (“VG”) on April 8. Assays have now confirmed results of 301.67 g/t over 3.90 meters including 1,930 g/t over 0.60 meters and represent a newly discovered hanging wall zone with folded quartz stringer veins hosted in sheared basalts (Figure 1). This newly intercepted hanging wall gold mineralization in hole KW-25-003 is approximately 80 meters from main Jubilee high-grade zone at a true depth of 250 meters (Figure 2).”

“301.67 g/t over 3.90 meters including 1,930 g/t over 0.60 meters” is clearly a bonanza-grade gold intercept (it is a 1,176 gram per meter hole)

That’s a world-class gold drill hit, and it will be one of the better ranked drill holes in Q2 seen across the universe of gold explorers.

I didn’t see anything in the press release not to be incredibly encouraged by, and yet DRY was down nearly -17% on Wednesday’s close. (-16.7% to be exact). Why?

Some are bemoaning that the hits on the Jubilee vein weren’t bigger. Does that really matter? It’s like ordering ordering a couple of beers and having someone bring over a bottle of top-shelf whiskey along with the beers. You take that deal!

They’ve clearly made a game-changing discovery in this hanging wall zone that warrants more follow up drilling and gives their exploration team a new interpretation to consider for all future drilling along this trend.

Why was the stock not up 17%? I thought gold explorers were typically rewarded for hitting great gold intercepts on new discoveries?

If any investors were disappointed by these drill hits, then what in the world were they expecting to see come back? Were there lots of other gold explorers, out of the nearly 1,000 in existence, that put out better results this week or month?

I’ve got a call set up for late Thursday afternoon to interview the CEO Trey Wasser, so we can get an update over at the KE Report from the boss of Dryden Gold directly. Today’s trading action made no logical sense at all. Maybe now that some of the warrants are in the money, some larger funds or investors were selling the shares to clip the warrants and this swamped the market with selling. Who knows?

On April 8th, I did interview Maura Kolb, President of Dryden Gold Corp, to have her outline their interpretation of this new zone with significant visible gold (“VG”) intersected from deeper drilling at the Elora Gold System at the Gold Rock Camp, at the early onset of this 15,000 meter drill program. We discuss the exploration plans for multiple targets at Elora for this year, as well as drill programs for later in the year at both the Sherridon, and Hyndman areas across their Dryden Gold District, in Northwestern Ontario, Canada. (In full disclosure, DRY is a banner sponsor of the KE Report.)

Dryden Gold – Significant Visible Gold Intercepted At New Hanging Wall Discovery - Elora Gold System

We’ll wrap it up here for this article on bizarre stock moves in relation to overwhelmingly positive newsflow from 3 portfolio positions. I guess the theme here is that old trading adage:

“The market can remain irrational longer than you can remain solvent.”

Thanks for reading and may you have prosperity in your trading and in life!

· Shad