Merger and Acquisition Opportunities In The Metals Resource Stocks – Part 2

Excelsior Prosperity w/ Shad Marquitz - 07/07/2024

Here in [Part 2] of this series, we are going to start delving into other good potential takeover targets for future merger and acquisition (M&A) deals. In the first 3 segments [Part 1 – A, B, and C] of this series, we started off unpacking most of the key junior gold, silver, and a few base metals takeovers, takeunders, and mergers over the last couple of years. We discussed some key nuances to consider on each of these transactions, the shorter-term and longer-term effect on resource investors, and in what ways that the particular M&A transition may end up being a net benefit to the acquiree or the acquirer.

Here is Part 1A for quick reference:

https://excelsiorprosperity.substack.com/p/merger-and-acquisition-opportunities

Here is Part 1B for quick reference:

https://excelsiorprosperity.substack.com/p/merger-and-acquisition-opportunities-b46

Here is Part 1C for quick reference:

https://excelsiorprosperity.substack.com/p/merger-and-acquisition-opportunities-981

As mentioned in Part 1A, there have also been a steady string of “mega-mergers” between the senior precious metals and base metals producers the last few years, but those are too large and out of the snack bracket of the focus of this series. Moving forward, we want to review the junior producers, developers, and advanced explorers that could be next on the menu for the big boy miners to gobble up. This is always an exciting proposition to consider for the immediate rerating potential of takeover candidates, and the sudden intraday gains and investor exit strategies that can be made when these transactions hit the news wires.

I’ve got about 2 dozen different junior resource stocks in mind to cover initially throughout this series. However, more companies will emerge over the fullness of time that may also get included in this series. Additionally, we are going to periodically cover the new M&A deals that get announced in the sector, that deals that are in still in process if something changes, and also occasionally check in on the pro-forma combined companies after these transactions are completed.

For the last 15 years of investing in the resource sector, I’ve been in the crosscurrents of a handful of M&A deals every single year. At this point my personal investing history has included several dozen M&A transactions within my portfolio, either being positioned in the company being acquired or in the company doing the acquiring. This is an area where there can be sudden gains or losses, depending on which side of the transaction the company we hold is sitting. In the short-term period following a takeover announcement, the company being acquired jolts up closer to the fully realized value if the transaction were to go through, while the acquiring company usually sells down on the news, due to the dilution in cash or shares needed to make the purchase.

The investing relevance doesn’t end at the M&A transaction though, and really it is just starting. There are a number of considerations to make if somebody is invested in the company being acquired, in the company making the acquisition, or if it is a company merging with an equal for a new portfolio of assets makeup. Mergers or takeovers are absolutely an area of overall growth for the 2 or more companies involved, and that can also provide longer-term accretive gains if one sticks with the new combined pro-forma entity. There are a lot of weaknesses or blind spots I personally have with analyzing resource companies, (just like we all have), but one of my strengths is scouting out real value in real projects of interest, and the companies that could be acquired, or conversely, that are themselves looking to grow through acquisitions and mergers.

For example, in my portfolio at present, there are still 3 ongoing M&A deals (Argonaut/Alamos, Karora/Westgold, and Silvercorp/Adventus), after having just had 2 other M&A deals close earlier in the year (Calibre/Marathon and Mako/Goldsource). Really, the point could be made that 3 M&A deals already closed this year in my portfolio, if one counts Equinox Gold (EQX) acquiring the remaining 40% of their Greenstone project from Orion Mine Finance (which had other companies bidding on that partial ownership). Having 6 M&A deals taking place in my portfolio so far in 2024, with some of my heavier weighted positions of conviction, has been quite impactful. Out of the thousands of potential mining stocks that investors are waiving their arms about as the next company in play, we’ve been pretty good on this channel at picking the companies that actually are getting taken out, or that are actually doing the takeouts. Just to recap some of the recent ongoing or completed transactions we’ve been discussing this year:

I had written to readers here about getting positioned in Argonaut Gold (TSX: AR) (ARNGF) just a few weeks before the news broke that Alamos Gold (TSX: AGI) (NYSE: AGI) was going to acquire them. The plan was to discuss Argonaut as a growth-oriented gold producer of interest, but then weeks later they were being picked off for their Magino Mine. For this position I’ve elected to hold the Argonaut shares and let them convert over to Alamos Gold shares for the near-term as a quality growth-oriented producer in it’s own right. This also includes picking up shares in a new “SpinCo” where the Mexican and Nevada assets from Argonaut are being placed in a new company as an added kicker and value driver.

I’ve been invested in Karora Resources (TSX: KRR) (OTCQX: KRRGF) for a couple of years, and wrote to readers here in the series on growth-oriented gold producers, that they were looking to either merge, buy, or get bought out when they initially mentioned some ongoing negotiations with 3rd-party (that ended up being Ramelius Resources). That deal fell through, but then in the same press release, they mentioned being in more 3rd-party discussions. I mentioned that something was going to go down where they acquired or were acquired, and then news broke shortly thereafter that they were tying the knot with Westgold Resources Limited (ASX: WGX) (OTCQX: WGXRF). That deal should go through soon with special meeting vote slated for July 19th. On this deal, I was conflicted on the value proposition for the new combined company, and thus sold half my Karora shares for the takeover premium, and kept half to be moved over into the new combined Westgold Resources. Additionally, there is a “SpinCo” kicker here, to capture the value of their lithium assets and strategic stake in Kali Metals Limited (ASX:KM1).

Earlier in the year we had also covered the 2 transactions that have since closed of Calibre Mining acquiring Marathon Gold (TSX: MOZ – OTC: MGDPF ) and also Mako Mining (TSX.V:MKO – OTCQX:MAKOF) just acquired Goldsource Mines (TSXV:GXS)(OTCQX:GXSFF). Both of those transactions made a lot of sense and were accretive.

If people want to read over one of the pieces that got into a lot of these M&A deals then this article touched upon a number of them (as did Parts 2, 3, and 7).

Special Alert: Opportunities With Growth-Oriented Gold Producers – Part 6

https://excelsiorprosperity.substack.com/p/special-alert-opportunities-with

One of the 3 M&A deals still ongoing in my portfolio seems to have run into a snag. Silvercorp Metals Inc. (TSX: SVM) (NYSE: SVM) just announced a potential fly in the ointment for their acquisition of Adventus Mining Corporation (TSX.V: ADZN) (OTCQX: ADVZF) for their high margin, polymetallic, advanced El Domo project in Ecuador.

This news just broke on July 5th, where it reads like they may be forced to pull out of the deal based on a Material Adverse Effect being triggered by the recent litigation to try and revoke their environmental license on the project. It’s a shame that opposition groups are at it again, potentially killing a project that would provide so many jobs, infrastructure, support to complimentary businesses, and increased taxes for this area of Ecuador. As of now, they have until the end of the month to have Adventus satiate their concerns on this litigation, so we’ll see how it goes, or if the transaction gets extended, but this could be a legitimate “deal-breaker.”

Update on the Acquisition of Adventus Mining Corporation – July 5, 2024

“The Material Adverse Effect arises from the litigation referred to in the Adventus news release of June 17, 2024, which seeks to void the environmental licence of the Curipamba-El Domo project. Since we became aware of this litigation and brought it to the attention of Adventus some weeks ago, Silvercorp has made continuous, diligent efforts to understand and analyze the litigation and its implications. As a result of the analysis Silvercorp has done, and having taken advice from its legal and other advisors, Silvercorp reached the conclusion that this litigation presently constitutes a Material Adverse Effect, as defined in the Agreement, in respect of Adventus.”

“The Company will continue to monitor and evaluate the litigation and its surrounding circumstances and remains open to working cooperatively with Adventus with a view to closing the Transaction if the conditions to closing for the benefit of the Company can be satisfied. The Arrangement Agreement specifies a deadline of July 31 for the satisfaction of all conditions to closing. Silvercorp has expressed to Adventus its willingness to discuss extending this deadline.”

https://silvercorpmetals.com/update-on-the-acquisition-of-adventus-mining-corporation/

My portfolio has had a heavier-weighted position in Silvercorp since late 2015, so I’ve been following the company closely for over a decade now, and this news really has my interest peaked. My initial thought is that Silvercorp just seems cursed when trying to make an acquisition for these last few years. First they tried to buy Guyana Goldfields, but were outbid by Zijin Mining. Then they tried to acquire Orecorp, but then Perseus Mining got all bowed up and blocked the deal by upping their stake and then paying much more than Silvercorp wanted for their assets. As a result, Silvercorp moved on and announced their plans to acquire Adventus Mining; which I think would be a fantastic acquisition for the project and the price they are paying. However…. now they have a permitting challenge and environmental pushback and litigation that could kill the deal.

I was really thinking that this was “3 times a charm” and that Silvercorp finally had a solid development project in Latin America to sink their teeth into and build into a new mine further diversifying outside of China. Maybe it still can be that project for them. However, if the Adventus team can’t demonstrate the viability to permitting confidence to develop the El Domo Project, then Silvercorp is completely right to back out of the deal, because what is the point in taking over a project that can’t be developed due to an environmental blockage or threat to the permit being revoked?

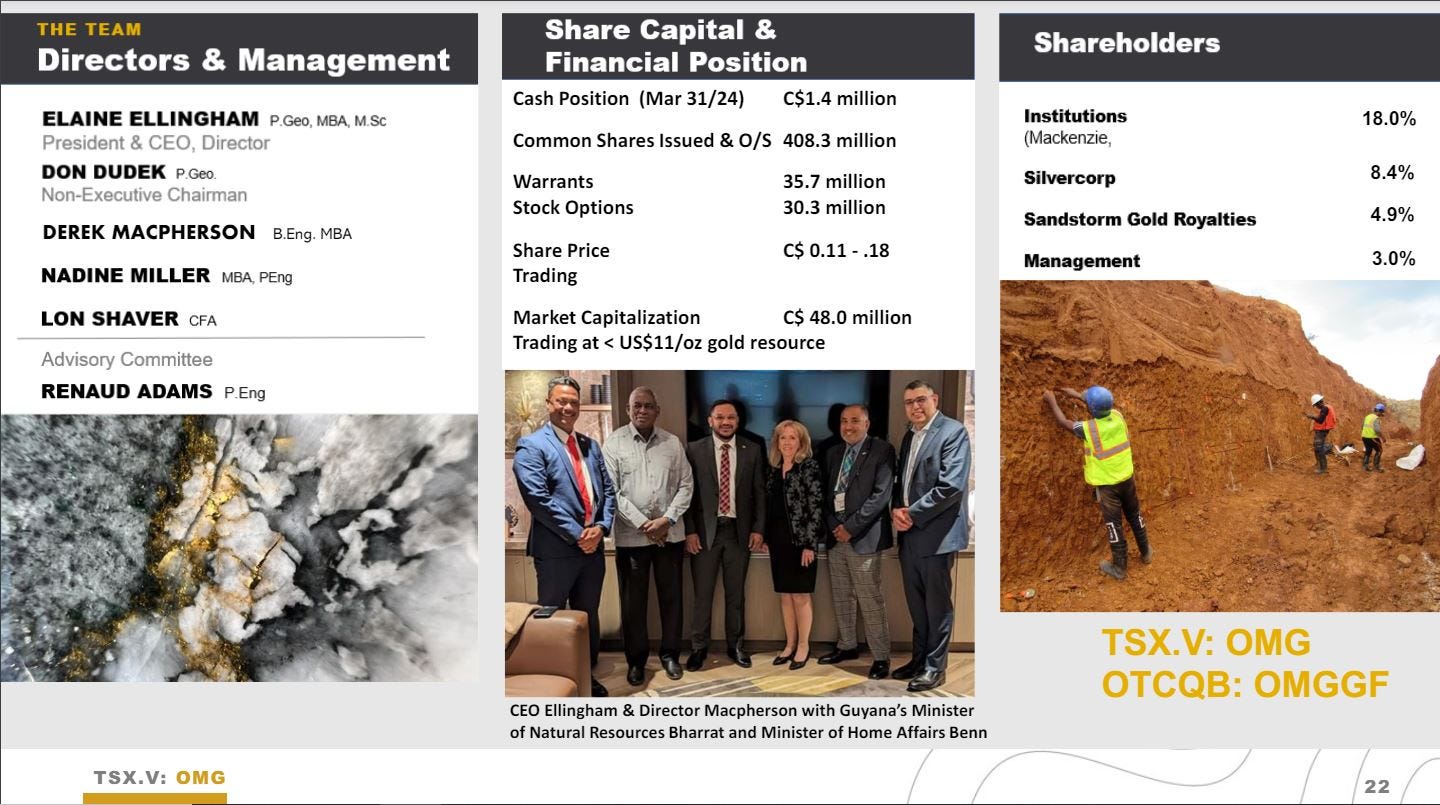

This is definitely a M&A deal that we we’ll keep following to see how things unfold, but it is clear that Silvercorp is looking to growth through acquisitions. If this Adventus Mining deal falls through, then I’d like to see Silvercorp make a run at Omai Gold Mines Corp. (TSXV: OMG) (OTCQB: OMGGF) in Guyana. Silvercorp already has a solid 8.4% strategic stake in Omai, from when they invested their incoming funds from the break fee on the Guyana Gold Mines takeover deal, where they were outbid by Zijin.

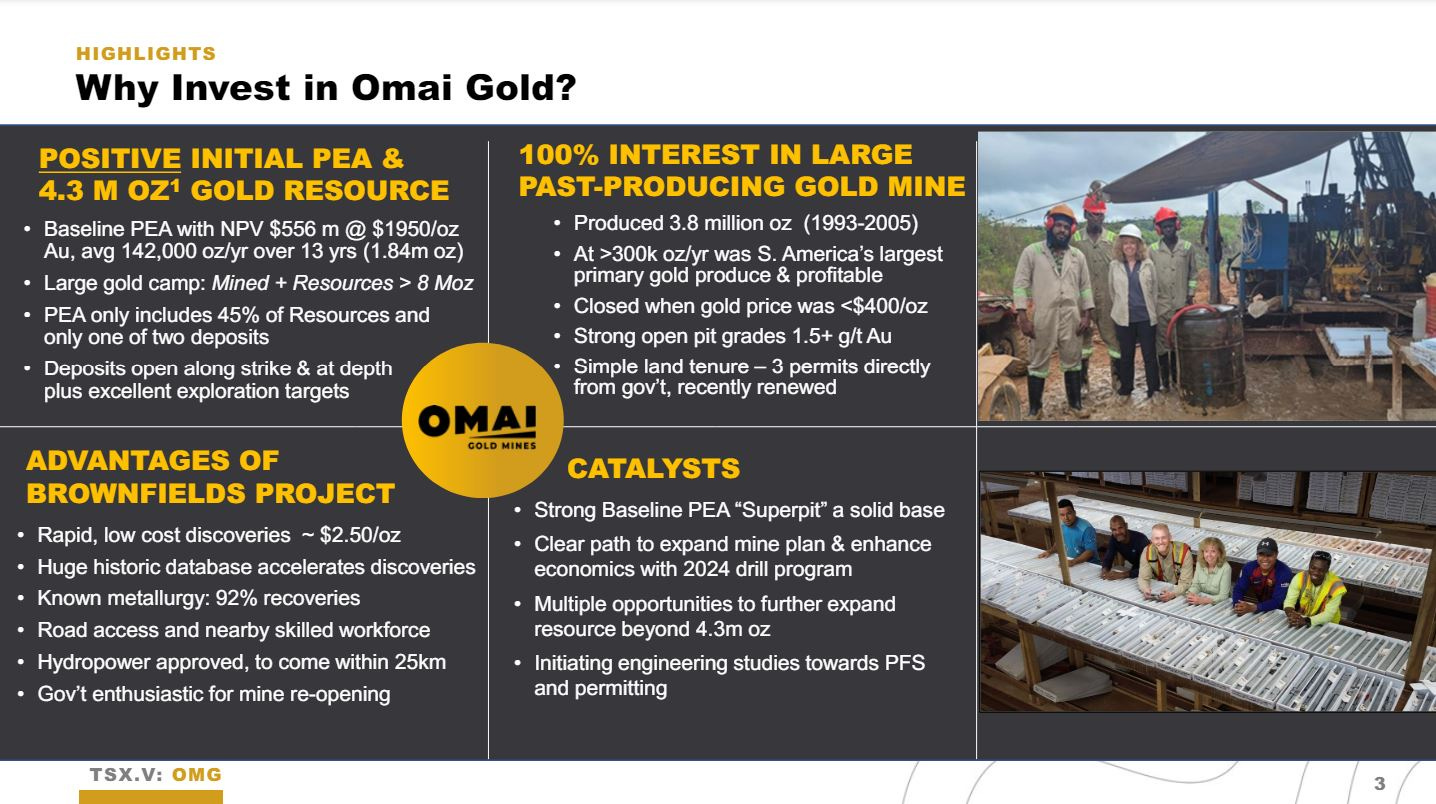

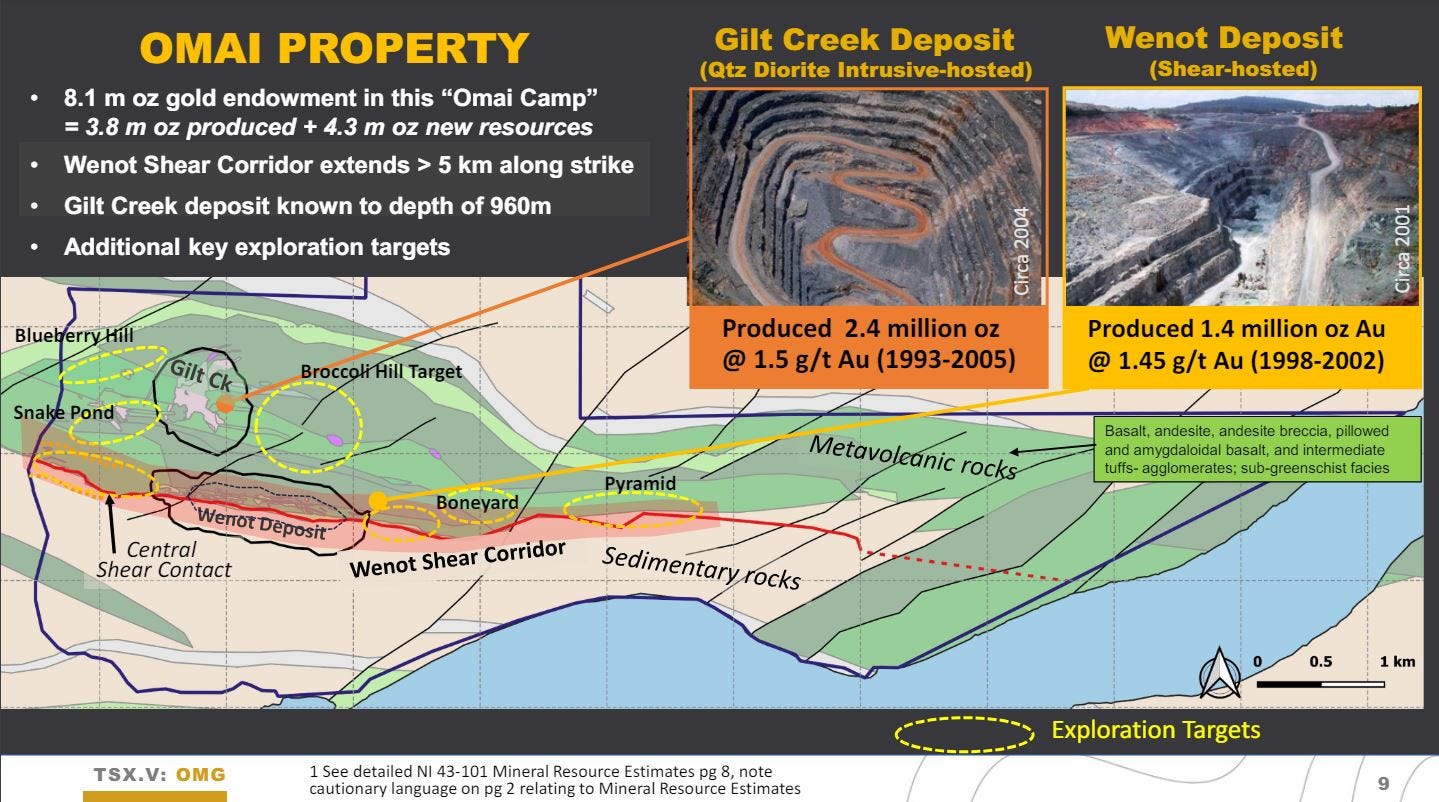

Omai already has over 4.3 million ounces of gold in the ground and just did a big capital raise of $13 million to fund their next stage of exploration and derisking. What is important to note is that we’ve seen 2 other M&A deals in Guyana just in the last 6 months with Mako taking over Goldsource, and with G-Mining taking over Reunion Gold. If Silvercorp doesn’t move on Omai Gold in the somewhat medium-term, then I’m concerned another senior producer will.

It is interesting to note while writing this, that I had no initial thought to make this next M&A article about Omai Gold Mines as a viable takeover candidate, because there is already a long list of companies to get to in this series. I was actually working on making the next article on “Merger and Acquisition Opportunities” about Skeena Resources (TSX:SKE) (NYSE:SKE), after seeing them release a very attractive US$750 Million Project Financing Package. I had already started writing that article, and wanted to get it out when there was an initial muted reaction to the news release dropping. However, life got in the way, and since then SKE has now shot up higher as more people have digested the good terms in that diversified capital stack. I’ll still highlight some of the key takeaways from that news and more thoughts I have on Skeena as a potential acquisition target in the next article in this series.

However, all of this recent news from Silvercorp about a potential hitch in their acquisition plans with Adventus was also too topical to ignore. Someone had asked me about what I thought about this transaction potentially unraveling, and it really got me thinking that if it does then I’d like to see Silvercorp go propose a deal to acquire Omai. The company has a great resource in place, on a prior-producing brownfield project, and in a jurisdiction that has just seen 2 other M&A deals this year in Guyana. My concern is that if Silvercorp snoozes, that they may lose the opportunity to pick up Omai while it’s valuation is so cheap. They are the last company with any meaningful resources defined in Guyana, now that Reunion and Goldsource have been scooped up, and if Silvercorp doesn’t go after them, then I believe another company will.

As previously stated, (SVM) already has a nice 8.4% stake in (OMG), and it is interesting to note that Lon Shaver, the President of Silvercorp Metals, is also a Director of Omai Gold Mines. https://omaigoldmines.com/about/directors/

Just three months back on April 8th, I interviewed Elaine Ellingham, President and CEO of Omai Gold Mines, and she shared that Lon is one of the people in the industry that she greatly respects and turns to for running ideas by him. For the benefits of readers, here is that interview I had with Elaine, over at the KE Report. She provides a great company overview, and dives into the prior and ongoing exploration and derisking the both the Wenot and Gilt Creek Projects across a vast mineralized gold trend in Guyana, South America.

Omai Gold Mines – Introducing The Preliminary Economic Assessment On The Wenot Project In Guyana

We start off discussing the large resource in place between the 2 Projects, at over 4.3 million ounces of gold, across this brownfields and past-producing site. Then we dive into the key metrics on the first pass Preliminary Economic Assessment, that is just on the open pit Wenot Project, and does not yet incorporate the Gilt Creek underground project economics at this point.

Then Elaine walks us through the key PEA Highlights for Wenot Open Pit. (note again that these economics don’t even include the Gilt Creek property yet, so there is so much further upside beyond just these metrics on the overall combined project)

· After-tax NPV5% of $556 million and after-tax IRR of 19.8% based on $1,950/oz gold with a sensitivity case at $2,200/oz gold giving an after-tax NPV5% of $777 million and IRR of 24.7%

· Initial capital (“Capex”) of $375 million and sustaining capital of $172 million LOM

· Projected average gold production of 142,000 oz per year over a 13-year mine life

· After-tax payback of 4.3 years at base case $1,950/oz gold (3.5 years at $2,200/oz gold)

· Average cash operating costs of $916/oz gold and all-in sustaining costs of $1,009/oz

· Cumulative cash flow of $1.07 billion after-tax over 13 years on base case assumptions

· Total payable gold production of 1.84 million ounces

· Average head grade of 1.51 g/t Au and 92.5% process recovery

· Average strip ratio for the open pit life-of-mine estimated at 7.8:1

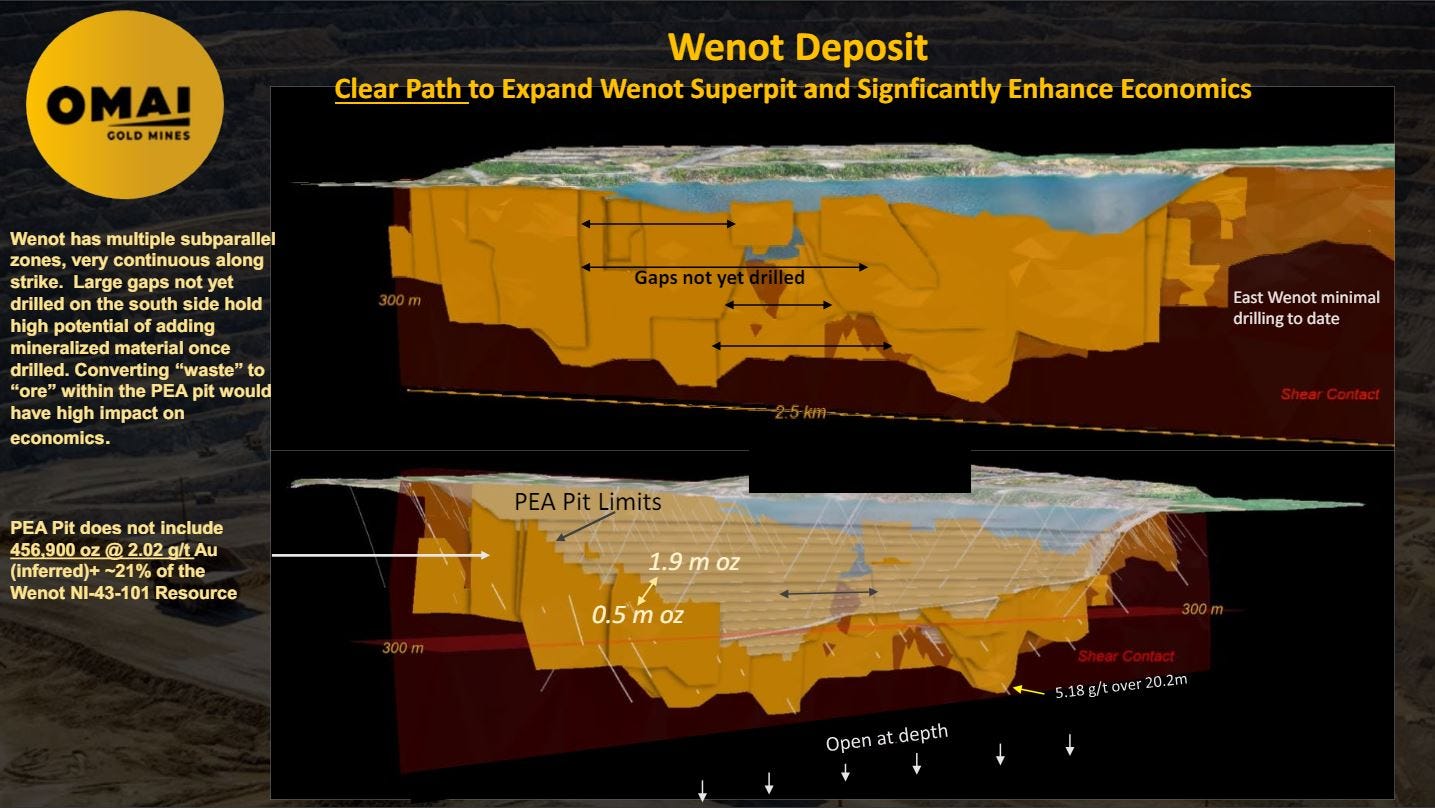

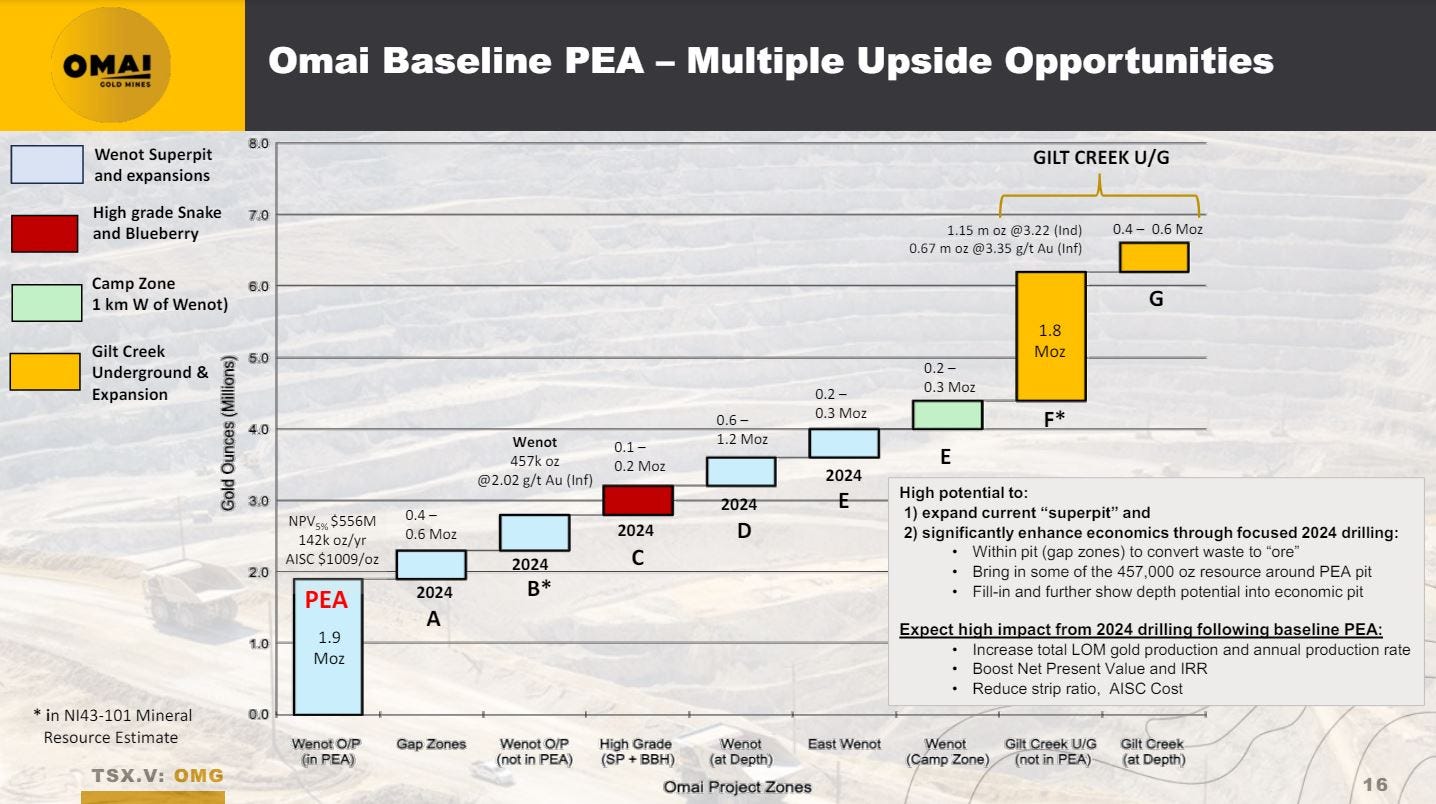

There is an envisioned “Super-Pit” potential at the project, where existing drilling has shown mineralization outside of the existing planned pit, and also at depth under the proposed pit shell.

Further drilling will be done delineating the extent of mineralization, and also testing many of the gap zones. It seems quite likely, and the team at Omai seems quite encouraged that the pit will grow larger once more of this area is drilled and the data analyzed, and thus lead to improved economics.

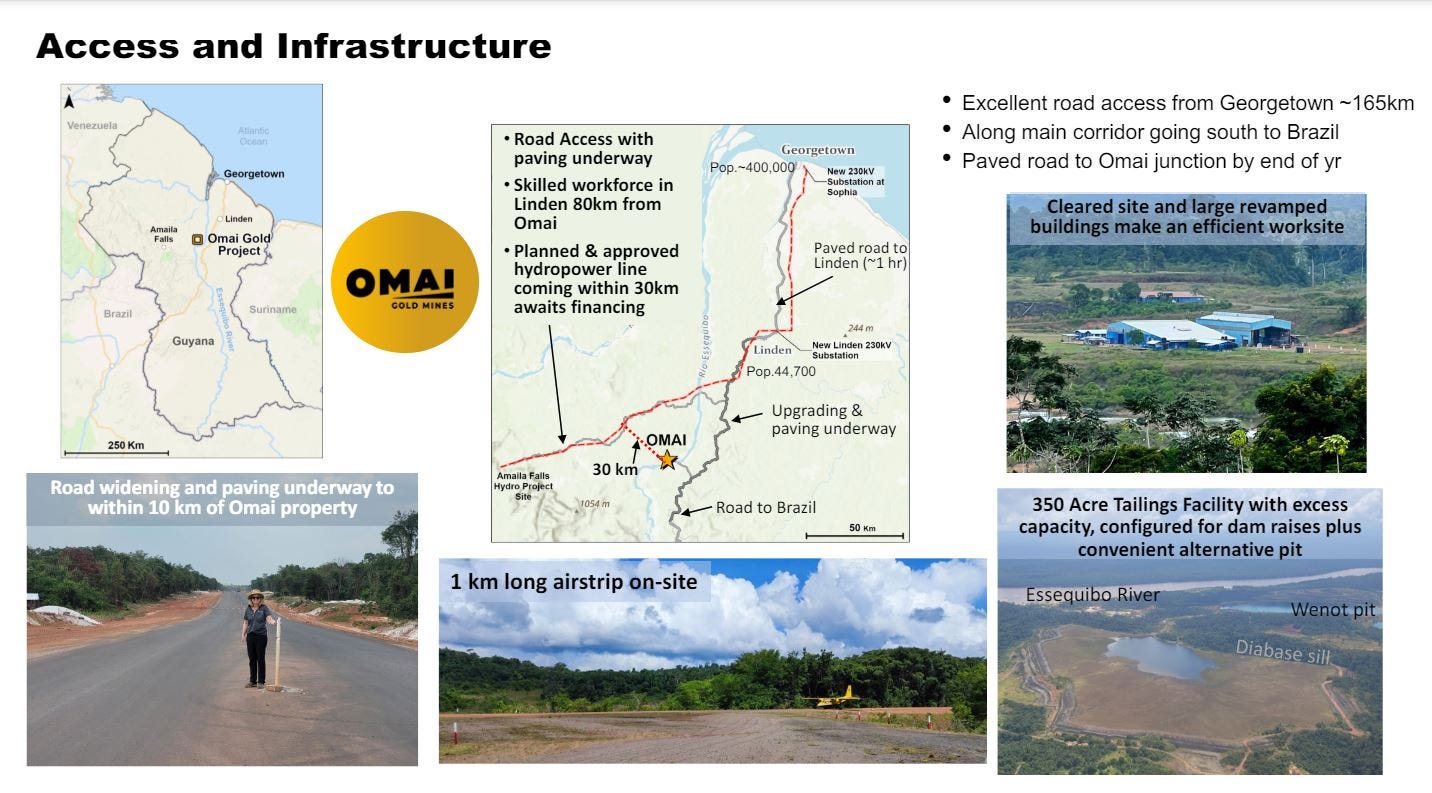

Next we talked about the infrastructure and social advantages of this brownfield site in Guyana, and the support of locals and the government to move this mine back into production.

We touch upon the ongoing permitting, metallurgical work, and other derisking work the company is doing in the background, in addition to the exploration upside at both the Snake Pond and Blueberry-Gilt areas that could bring more shallow high-grade ounces into the front end of the mine plane and further improve the project economics.

These Snake Pond and Blueberry-Gilt deposits will get more exploration focus, and when combined with the known resources at Gilt Creek, it really presents a large growth opportunity and valuation upside that few investors are properly factoring into the overall project. This slide below articulates that upside that Elaine eludes to in our interview, and it is significant.

So this already seems like a compelling advanced exploration and development project that can expand in a substantial way. I would think more mid-tier producers are now following along with keen interest to see how this project grows, now that they are cashed up with $13million for this year and next year, to really do some meaningful work.

Omai Gold Mines Corp. Announces Closing of $13 Million Brokered Private Placement – June 20, 2024

https://omaigoldmines.com/site/assets/files/5924/2024-06-20_omg_closing_of_13million_financing-1.pdf

I’ll leave you with an interview literally just done on Friday and released today on Sunday over at the KE Report, with my friend and colleague Doc Jones. Starting at the (15 min : 39 sec) mark, we discussed the recent financing Omai had completed, and then he laid out the value proposition he sees in the company moving forward.

Doc Jones – Energy Transition Changing Commodities Focus – Updates On Surge, Emerita, Magna, & Omai

Thanks for reading and may you have prosperity in your trading and in life!

Shad