Merger and Acquisition Opportunities In The Metals Resource Stocks – Part 7

Excelsior Prosperity w/ Shad Marquitz 01-02-2025

Looking back on 2024, it was one of the busiest years for mergers and acquisitions that we’ve seen in the metals resource stocks in quite some time with over 2 dozen transactions. We saw a couple bidding wars, a few associated spin-out companies coming from the M&A deals, a few multi-company transactions, some divestments from majors over to the mid-tiers, some mid-tiers buying juniors, some juniors merging with other juniors, and even 3 companies that did multiple M&A deals all in the same year. We covered most of them in this series starting with Part 1C and moving forward, but didn’t take deep dives into some of the biggest transactions with the majors as they were outside of the scope and focus of this channel.

There were 11 M&A transactions within my own portfolio this year, where I held either the company being acquired, or the company doing the acquiring. That tells me we are following the right kinds of companies here, that are either the predators or they are the prey. There are literally thousands of junior mining resource stocks out there, and the vast majority of them were not in mergers or acquisitions this last year. There are hundreds of companies that claim to be takeover targets and dozens that legitimately could be, and we’ll keep doing deep dives into the companies that seem like the best candidates. We have already dropped a number of names in multiple series here prior to them being acquired or them doing the acquiring, and others that seem like high probability candidates.

This M&A action literally carried on to the very last day of 2024, where on December 31st Mako Mining (TSX.V:MKO – OTCQX:MAKOF) moved on their 2nd acquisition of the year. The Company announced its intention to acquire the producing Moss Mine in Arizona, recently held by the mostly defunct Elevation Gold (TSX.V: ELVT.H). This is a fairly complicated transaction where Mako Mining announced entering into of a non-binding letter of intent to acquire 100% of the issued and outstanding common shares of EG Acquisition LLC (“EGA”), a recently created private corporation controlled by Mako’s controlling shareholder, Wexford Capital LP, established solely to acquire the Moss gold mine located in the historic Oatman District in Arizona.

Mako Mining Announces Its Intent to Acquire the Moss Mine in Arizona Expanding its Operations in the Americas - December 31, 2024

https://makominingcorp.com/news/index.php?content_id=695

“It is anticipated that EGA will complete the acquisition of the Moss gold mine on December 31st, 2024 through its acquisition of 100% of the common shares of Golden Vertex Corp. (“GVC”) which holds direct ownership of the Moss gold mine. Each of EGA and GVC will become wholly owned subsidiaries of Mako as a result of the Proposed Transaction. The purchase price for the Proposed Transaction is expected to be in the range of US$ 4.9 million up to US$ 6.4 million if certain royalties are extinguished, all payable in cash. The Proposed Transaction is expected to close by February 2025.”

“The Proposed Transaction will allow Mako to add a producing asset located in a top tier jurisdiction funded solely out of cash flow generated from the last quarter of Mako's current mining operations. The Moss mine has been producing gold throughout the Bankruptcy Process through its beneficiation facilities. Mining was temporarily suspended at the beginning of the Bankruptcy Process and Mako plans to restart mining operations upon completion of the Proposed Transaction once it has had an opportunity to optimize the mine plan and debottleneck the crushing plant. This is expected to be achieved within a few months of closing of the Proposed Transaction. Mako currently operates the high-grade San Albino Mine in northern Nicaragua and owns the Eagle Mountain project in Guyana. Over the last quarter, even after an extensive drill program at both properties, the cash and gold in sales receivables balance in Mako has increased by over US$ 6 million to nearly US$ 13 million at year end.”

As a refresher to the many new readers here in this channel, we discussed Mako Mining a few times earlier this year, first as a “growth-oriented gold producer” operating in Nicaragua, and then again, when they also grew through acquisition by making their first acquisition of the year of Goldsource Mines in Guyana, to bring in their Eagle Mountain development project.

Mako Mining to Acquire Goldsource Mines Creating a Scalable Diversified Gold Producer with a Platform for Growth - March 26, 2024

https://makominingcorp.com/news-media/press-releases/index.php?content_id=348

On New Years Eve over at the KE Report, I had the good fortune of jumping on a call with Akiba Leisman, President and CEO of Mako Mining, to discuss the details of the transaction and the strategy to acquire the Moss Mine in Arizona, and bolt on another producing mine to their asset base that will now be diversified across 3 jurisdictions in the Americas.

Mako Mining – Unpacking The Strategy To Acquire The Moss Mine in Arizona, Adding Another Producing Asset To Its Portfolio

We focused on the economic efficiencies with the elimination of over US$ 60 million of existing liabilities associated with the mine, the removal of the silver stream, and also discussed the status and 2 paths forward for the remaining royalties in place. Additionally, the base purchase price of US$ 4.9 million, can be further reduced by US$ 1.5 million through the release of certain collateral. Akiba reiterates that this acquisition is a testament to the knowledge base of their management team, the distressed investing expertise of the controlling shareholder Wexford, and the powerful platform Mako has built to continue making accretive acquisitions.

Wrapping up Akiba highlights that the when the Moss Mine has been debottlenecked and is producing at the grade and rate they believe is possible that it could almost double their current production profile. Mako currently operates the high-grade San Albino Mine in northern Nicaragua and owns the Eagle Mountain project in Guyana. Akiba points out that with a producing mine in the United States that this should expand their future options for funding the development of the Eagle Mountain project.*

[in full disclosure Mako Mining is a sponsor of the KE Report]

Over at Ceo.ca, on December 31st 2024 at 21:47, one user @goldpan noted:

“$MKO Accretive acquisition of Moss Mine, facilitated by Wexford ("EGA" takeover of $ELVT ). Move, slightly reminiscent of $MAI recent takeover of $SGLD. In both cases, taking on another Gold Mine, in a favourable jurisdiction.”

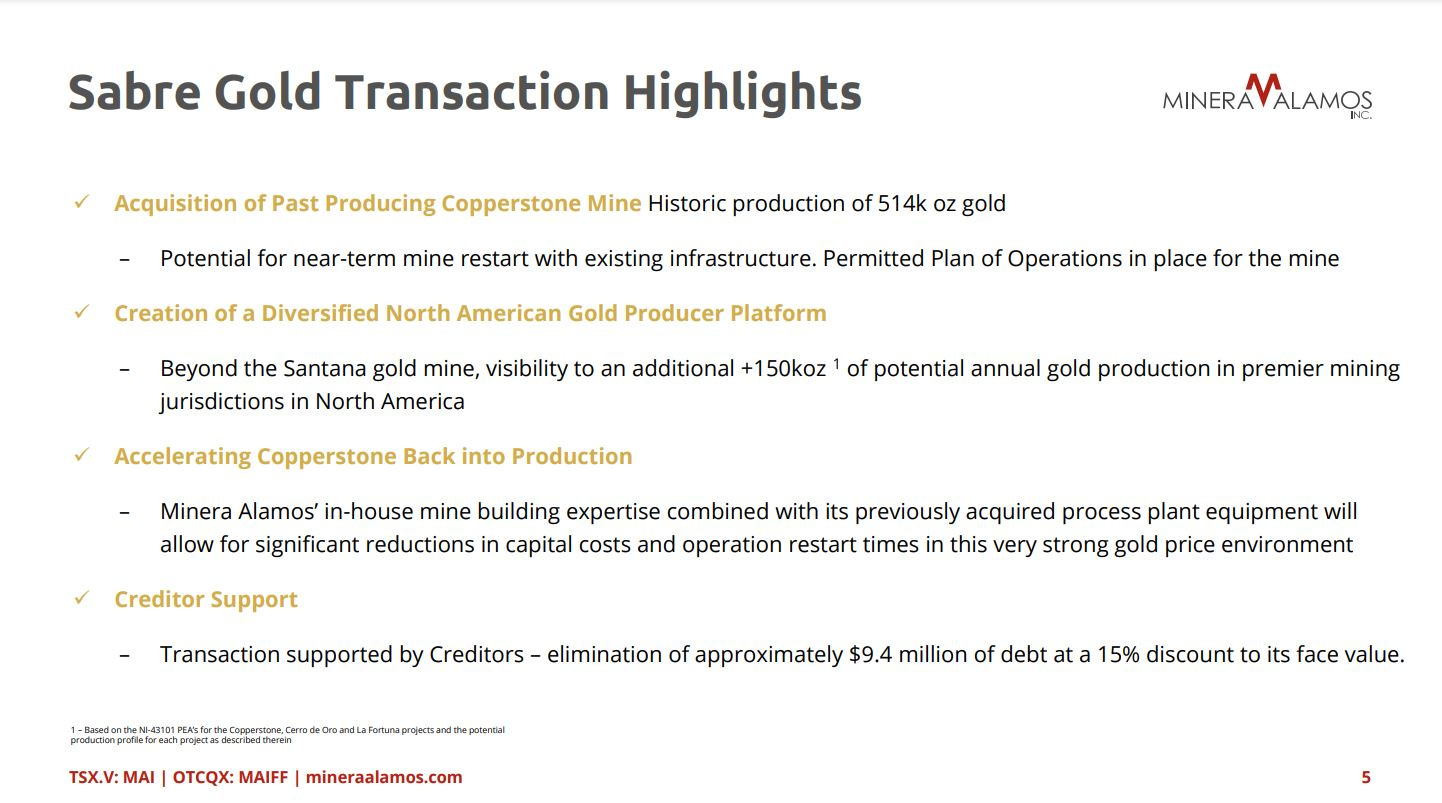

Personally, I’d agree with the point that @goldpan made about the similar acquisition that Minera Alamos Inc. (TSXV: MAI) (OTCQX: MAIFF) announced on October 28th, 2024 stating that it was acquiring Sabre Gold Mines Corp. (TSX: SGLD) (OTCQB: SGLDF), to bring into their portfolio the past producing Copperstone Mine in Arizona.

That marks the 2nd acquisition of a smaller producing mine in Arizona from a distressed junior company into the hands of a more competent operator in just the last few months.

In the case of both Mako Mining and Minera Alamos, they also achieved an improved jurisdictional profile by picking up US producing mines in the good state of AZ, to compliment their Latin American producing and development projects. This is a key point: In addition to growth of resources and production profile, or improving overall economics, the diversification of jurisdictions can be another compelling benefit and synergy from an acquisition transaction.

Another 2024 example: We saw that move to diversify jurisdictions with the acquisition that closed in early 2024 where Calibre Mining Corp. (TSX: CXB; OTCQX: CXBMF) took out Marathon Gold Corporation (TSX: MOZ) to bring their Valentine Gold development project into their portfolio.

Calibre Completes Acquisition of Marathon - 01/24/2024

Yes, the primary goal was to bring in a long-life development project, which is set to start production in the 2nd half of 2025, and move them into a true mid-tier gold producer. However, this M&A deal also simultaneously further diversified their Nicaragua and Nevada exposure, by bringing in this flagship asset located in the excellent jurisdiction of Newfoundland. This moved their profile up to 55% of their Net Asset Value into Tier 1 North American jurisdictions.

Ruminating further on M&A themes from 2024, there were a few transactions where junior explorers-developers made the move to acquire producing assets. This allowed these juniors to graduate into producers, alleviating the need for continuous future dilutive financings, and to bootstrap the organic growth which can help fund the derisking of larger flagship development projects within their portfolio.

In fact, I personally made 2 new additions to my portfolio in the second half of the year, (Magna Mining and Heliostar Metals) after these companies had completed transformative acquisitions to grow their businesses and they graduated into the role of producers.

Magna Mining Inc. (TSXV: NICU) (OTCQB: MGMNF) was one of those active companies that actually orchestrated 2 different accretive M&A deals in 2024 for a very transformative year; moving them into one of the larger landholders of critical metals projects in the Sudbury Basin.

Magna Mining Acquires Producing Copper Mine in Sudbury from KGHM International Ltd. - September 12, 2024

“Magna will acquire the producing McCreedy West copper mine, the past-producing Levack mine, Podolsky mine, and Kirkwood mine, as well as the Falconbridge Footwall (81.41%), Northwest Foy (81.41%), North Range and Rand exploration assets.”

Magna Mining Acquires Additional Critical Mineral Exploration Assets in the Sudbury Basin Mining District - December 18, 2024

“Magna Mining Inc. is pleased to announce that it has entered into a definitive asset purchase agreement dated December 18, 2024 with NorthX Nickel Corp. (CSE: NIX) to acquire a portfolio of base metals assets located in the Sudbury Basin.”

In a similar approach, earlier in the year Heliostar Metals Ltd. (TSX.V: HSTR) (OTCQX: HSTXF) scooped up one of heck of a good deal when they acquired the 2 producing Mexican mines from Argonaut Gold, by way of the fledgling Spin-co, Florida Canyon Gold (TSX.V: FCGV) just days after it was spun out of Argonaut, during a related M&A transaction when Alamos Gold was taking over Argonaut to bolt on their Magino Mine.

Heliostar to Acquire Gold Portfolio of Producing Mines and Development Projects in Mexico for US$5M - July 17, 2024

Strategic Acquisition of former Argonaut Gold Assets in Mexico - transforms Heliostar into a gold producer with a robust development portfolio

Expanded Asset Base - adds two producing mines, the San Agustin Mine and the La Colorada Mine, and two advanced development projects to Heliostar’s portfolio

Increased Resource Base - Heliostar’s measured and indicated resources grow to 3.5 million ounces of gold in addition to the Cerro del Gallo historical resource. Acquisition cost of measured and indicated resources is less than US$1.80 per ounce of gold

Improves Ana Paula Economics - eliminates up to US$20 million in contingent milestone payments on the Company’s flagship Ana Paula Project

Immediate Production and Cash Flow

This acquisition where Heliostar scooped up those assets from Florida Canyon was necessary so that Integra Resources Corp. (TSX-V: ITR) (NYSE American: ITRG) could acquire Florida Canyon Gold Inc. (TSXV: FCGV) for the producing Florida Canyon Mine (the last of the previous assets from Argonaut Gold to be parsed out on the cheap, related to the Alamos takeover of AR.TO).

Again, this was yet another M&A deal where a junior explorer-developer purchased a producing mine to help with funding the further derisking of their flagship Delamar Project and further exploration work at their Nevada North development project.

Integra Resources Completes Transaction With Florida Canyon Gold, Creating a New Great Basin Precious Metals Producer - November 8, 2024

It will be very interesting to see if there are more M&A transactions in 2025, where junior pre-revenue explorers and developers, decide to graduate up to producers through acquisitions of producing revenue-generating mines, to fund further development of key projects… like what we saw with Magna, Heliostar, and Integra in 2024.

One other key M&A themes from 2024, (a little different that the usual mid-tiers taking over producing assets or big development projects), was that a couple of junior explorer-developers decided to merge with other junior explorer-developers to scale up in resources, size, and market caps in the attempt to gain more traction with investors and get a better cost of capital.

First we saw it with the creation of STLLR Gold from Moneta and Nighthawk, and then we saw it with the creation of NexGold from combining Treasury Metals and Blackwork Copper and Gold. NexGold then went on to make yet a 2nd M&A deal last year by then combining with Signal Gold to mass up even further.

Moneta Gold and Nighthawk Gold Complete At-Market Merger to form STLLR Gold Inc. - 6 Feb 2024

“STLLR Gold Inc. (TSX: STLR) {formerly Moneta Gold Inc.} (TSX: ME)(OTCQX: MEAUF) and Nighthawk Gold Corp. (TSX: NHK) are pleased to announce the completion of their previously announced at-market merger by way of a court-approved plan of arrangement. In connection with the Transaction, Moneta Gold Inc. changed its name to “STLLR Gold Inc.” and effected a 2-for-1 consolidation of its common shares.”

Treasury Metals (TSX: TML; OTCQX: TSRMF) and Blackwolf Copper and Gold Ltd. (TSXV:BWCG; OTCQB: BWCGF) to Create New Growth-Focused North American Gold Platform – May 2, 2024

https://treasurymetals.com/news/treasury-metals-and-blackwolf-to-create-new-growth-2874042/

NexGold Mining Completes Name Change and Consolidation · July 9, 2024

“NexGold Mining Corp. (TSXV: NEXG; OTCQX: TSRMF) is pleased to announce that effective as of today, the Company has changed its name from “Treasury Metals Inc.” to “NexGold Mining Corp.”

https://nexgold.com/nexgold-mining-completes-name-change-and-consolidation/

NexGold and Signal Gold Announce Merger to Create one of Canada’s Most Advanced Near-Term Gold Developers with a Combined 4.7 million Gold Ounces of Measured and Indicated Resources and a Plan to Achieve 200,000+ ounces of Annual Production - October 10, 2024

These types of business combinations are utilizing the strategy that growing in size, number of projects, overall contained resources, and market capitalization will give them more visibility and will attract investors that may not have been interested in just one of the single projects. Whether or not this ends up being a winning strategy will come down to how successfully these companies can then show that they can move 1 or more of their projects forward in a more compelling way and attract a better cost of capital as as a result.

We saw something similar in mid-2023, when Thesis Gold Inc. (TSXV: TAU) (OTCQX: THSGF) finalized its merger with Benchmark Metals Inc. (TSXV: BNCH) (OTCQX: BNCHF), in a rollup strategy. https://thesisgold.com/2023/08/21/thesis-and-benchmark-merger-approved-by-court/

While I believe the synergies between the assets in that merger transaction actually had more apparent synergies, consolidating their land and assets in the Toodoggone Mining Camp of British Columbia, it has not been richly rewarded by investors thus far. Frankly, neither have the business combination deals in STLLR or NexGold as we wrapped up 2024.

Regardless, this is an interesting trend that we are seeing within the junior pre-revenue companies. Will investors wake up to the value creation and scale from these M&A deals, and will we see more juniors companies emulate this process?

For what it’s worth, I believe that Thesis Gold would make an excellent acquisition target for a larger producer based on the size of their defined gold and silver resources and the more advanced nature of their economic studies. Maybe that can be a company we take a deeper dive into in a future article in this series on opportunities with M&A.

In summary, 2024 was a chock full of mergers and acquisitions, and we only touched on some of the outlier junior deals in this article.

As mentioned at the onset there were plenty of other larger producing gold, silver, and copper mines that got acquired by the larger producers as bolt-on operations. We covered many of them in prior articles.

There were also a slew of significant development projects taken over by the larger companies that have the access to capital and more importantly the experience to build out those projects into new mines over the fullness of time.

We even saw a few Billion-dollar deals this last year, which are the kinds of transactions that get on more generalists radar screens.

All of this M&A action, from the small deals up to the Billion-dollar transactions are positive for the sector; freeing up stuck investment capital, and getting that money circulating into new companies. Most importantly, it gets the animal spirits going as investors then speculate on which companies will be next on the M&A menu.

We’ll keep following along with the key junior M&A news in this channel, and continue to look for potential takeover candidates that would be of interest to the larger companies in the sector.

Happy New Year, thanks for reading, and wishing you all prosperity!

- Shad