Liberation Day, Liquidation Week, And The Market Steamroller

Excelsior Prosperity w/ Shad Marquitz – 04/06/2025

As everyone reading this likely knows the Trump administration tariffs were enacted last Wednesday on what had been dubbed as “Liberation Day.” Unfortunately, I’d dub the balance of days after that as “Liquidation Week” as the stock markets sold off hard.

We witnessed a sea of red and almost every asset class (except for bonds and the US dollar). Another observation was how large the volume was in the selling and downward pressure, almost reminiscent of a market crash. It was a rough couple days in the market to end last week, and there was a loss of sentiment as well as technical damage done on the charts; as the “buy-the-dip” investors were crushed for trying to pick up pennies in front of a market steamroller.

Last week was a wild week. So, let’s get into it…

What seemed odd about the end of last week was how wrong-footed the markets were leading up to the tariffs being implemented. Even though these tariffs were well-telegraphed for months leading up to to last Wednesday, as the world awaited the specific percentages that would be put into place… it seems the market had not properly discounted these tariffs actually going into effect at all leading up to the actual news.

We’re constantly told how “forward-looking” the markets are and that “the markets are always right” -- but once again, apparently not…. Apparently much of the market was actually betting on the guidance from the White House just amounting to more “bluster” and “noise” and a negotiating tactic as part of “The Art Of The Deal.” There were so many articles and news outlets saying in advance that it would be “all bark but no bite” or “all hat and no cattle,” that now they will have to swallow crow pie.

The tariffs were implemented mid-week, just like it was mentioned they would be over and over again, and even though the global tariff was a base of 10%, it was more mild than prior estimates and messaging of 20%-25% tariffs. It didn’t really matter because it still blew people’s minds that they were actually put in place at all. (Yes, I realize there are some nuances and certain countries were faced with 15-20% tariffs when all the reciprocal factors were layered). As expected would be the case, some countries also responded back with retaliatory tariffs against the US; (most notably China) adding to the market uncertainty.

The markets saw this news as “tariff-ying” and had a series of “tariff tantrums.” Bizarrely the markets had actually been creeping higher leading up to the news, because so many buy-side bobble-heads on mainstream financial media outlets kept reassuring their viewers that even if global tariffs were enacted that they’d be mild. So, the message, (as it always is on main stream financial outlets), was to keep buying the S&P 500, Nasdaq, Dow, and Russell 2000.

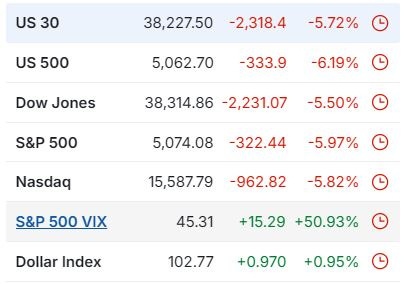

Well, the markets sold off hard on Thursday April 3rd, but then even harder on Friday April 4th. The S&P 500 plummeted -5.97%, the Nasdaq by -5.82%, the DOW by -5.50%, and the Ruessell 2000 by -4.37%. Those are big daily moves in these large and diversified US stock indexes.

• This was a prime example of the markets “buying the rumor” and “selling the news.”

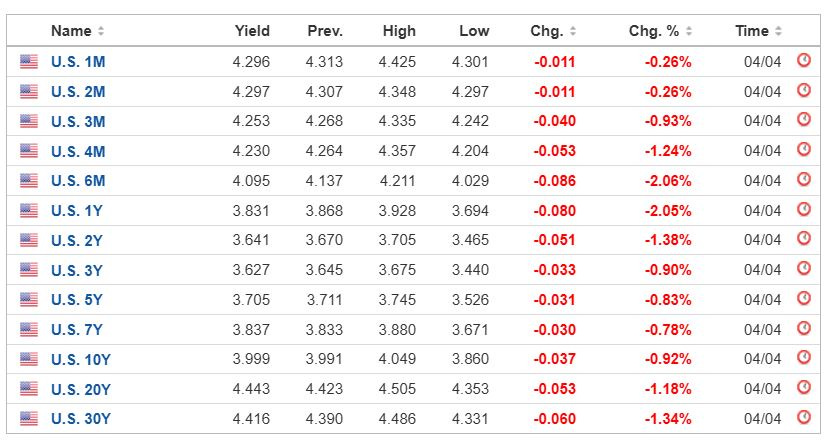

Volatility hedges, bonds, and the greenback were some of the only green on the screen.The S&P 500 VIX was up 50.93% on the day to 45.31 and the US Dollar Index was up mildly to 102.77 on Friday. There was also a continued bid for US bonds the end of last week, where inversely correlated bond yields corrected lower. So we can say that safe havens were back in vogue, with investors looking to find a place for their capital to hide.

There were plenty of outlets leading up to the mid-week tariffs which featured goldbugs parroting a similar message that suggested that all these tariffs could only be good for gold and the precious metals complex…. and maybe in the longer-term they will be.

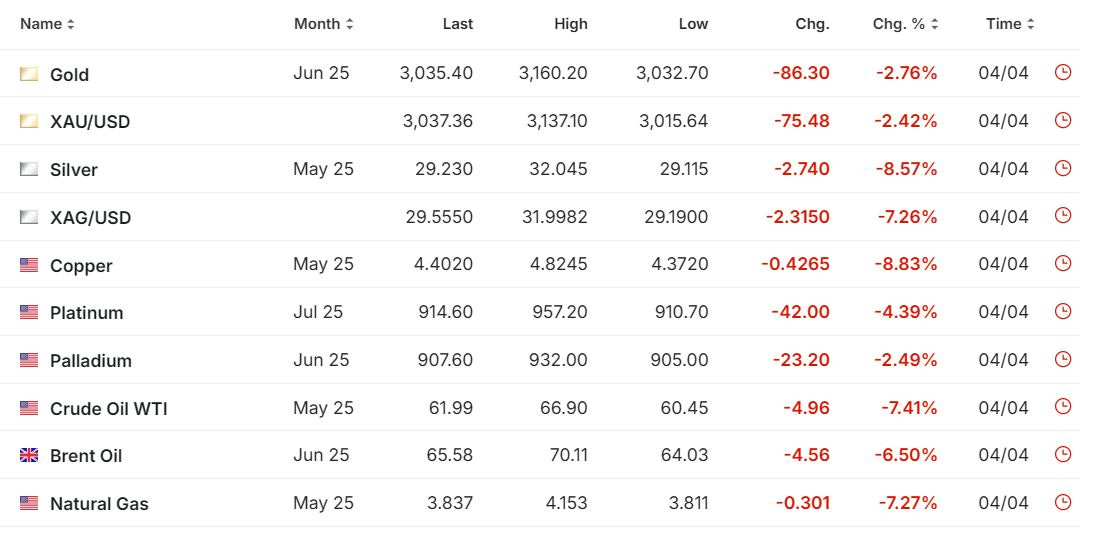

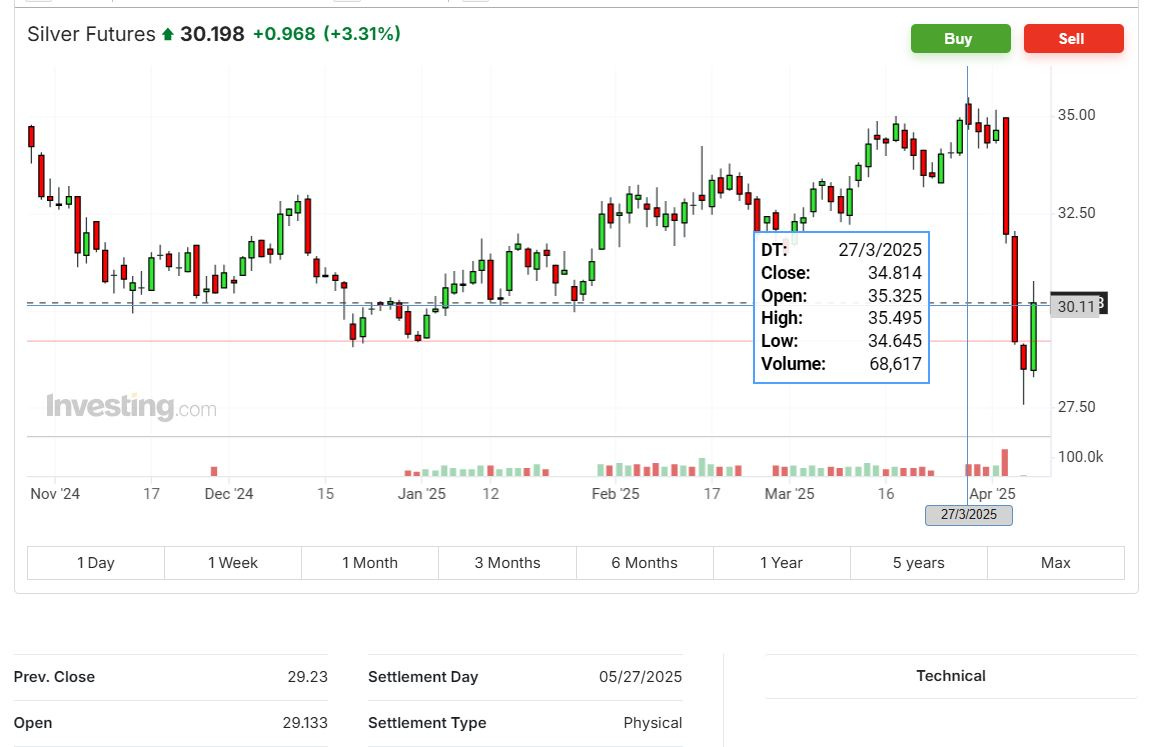

Regardless, gold futures sold down on Friday by -2.76% to $3,035.40 and Silver futures sold down by a whopping -8.57%.

Also notable, WTI oil pulled back by -7.41% to close at $61.99. The falling oil prices will actually help lower inflation, without the “drill baby drill” initiatives. That is a net positive for the economy, for companies, and also for consumers… just not so much for the energy companies.

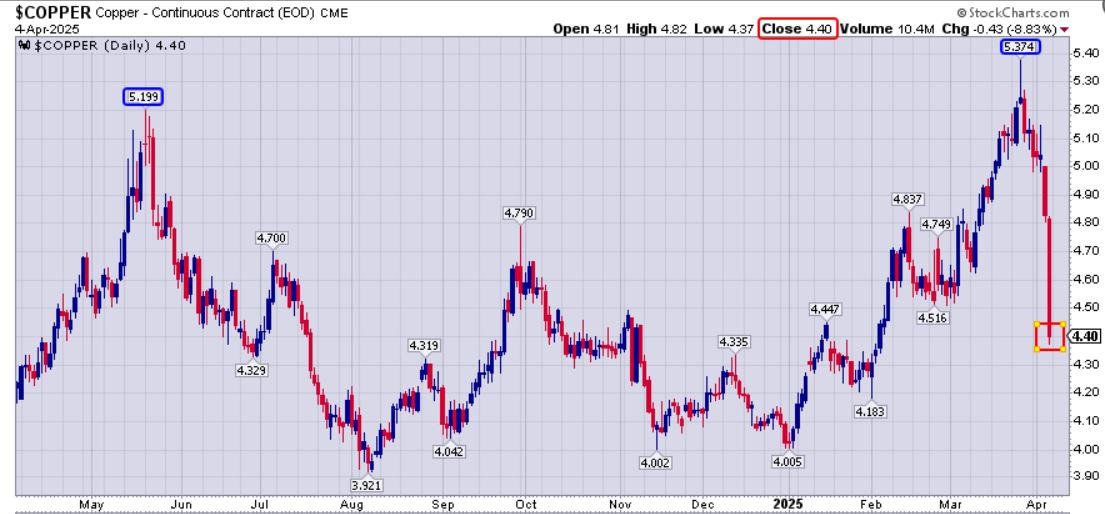

Copper plummeted by 8.83% to close at $4.40 a pound, putting a real damper on the recent break to new all-time highs just 2 weeks back on March 26th to $5.374 a pound.

Doctor Copper had been dancing like nobody was watching for most of March making steady progress to the upside to new all-time highs, after breaking out of a large & small w-shaped double-bottom patterns.

Then the calendar turned over to April as price was consolidating those gains, but then a market mosh-pit broke out on tariff mania, and the good doctor got nailed in the face by a boot and crashed down onto his back on the dancefloor.

Copper bulls should root for pricing to rebound back up higher in a snapback rally, versus seeing continued follow-through pressure in the coming weeks of April. It got pretty ugly pretty fast in the copper pricing, as concerns about global trade being severely impacted put copper in the penalty box.

By late into Friday’s trading session, I think most investors got to the point where it was clear that the red was going to stick and they were not going to stick around to continue watching the bleeding. I actually watched the last 30 minutes of trading live, because sometimes in later part of the final “power hour” of trading for a day, and especially for a weekly close, there can be some big changes in capital flows. Friday didn’t really have any wild reversals, and it just remained steady selling pressure for the balance of the trading session and some really ugly daily and weekly closes.

A number of my email subscriptions started firing off reactionary pieces right away. There as was a barrage of negativity hitting my inbox in articles about “the largest selloff since XYZ….”, “market meltdowns” and “the sky is falling” editorial pieces. As a result, I decided to spare the audience here and not to weigh in on the gloom and doom in the markets with the rest of the herd on Friday. There was at least one response that was a more measured macro response in the last email I decided to read on Friday before signing off - from my friend and colleague, Peter Boockvar. His first 2 lines said it all…

Succinct Summation of the Week's Events - Peter Boockvar – Substack Apr 04, 2025

“Positives,”

“1) The market is closed for the next two days.”

_______________________________________

That line really made me chuckle. It was a somber note, but I imagined it in my mind’s eye in Peter’s almost deadpan delivery of humor at times, and he had just made a really good point. I’m not sure how things would have degraded if the markets were open the following day, but having the weekend off for 2 days, with the markets closed, would allow everyone to reset and reflect on things in a much-needed intermission. As I write this on Sunday afternoon, I do wonder how markets are going to open up this next week. It is going to be fascinating to see how things develop from here.

Will we see a snapback rally to the upside that will fill some of those gaps on the charts, or will we see a continuation pattern of even more selling and even more red?

Let’s now take a few moments here to reflect on the technical damage that was inflicted on the charts of the resource stocks, stripping away all the media narratives and just look at what the pricing action is telling us.

Let’s look at the primary gold stocks by way of the ETFs GDX and GDXJ:

GDX closed at $41.68 to end the week on Friday, below its 50-day Exponential Moving Average (EMA), which is currently at $42.22. That shifts the posture more bearish.

It should be noted that this reversal down in GDX pricing the last 2 weeks comes after going up to new recent highs in the $46’s (with an intra-day peak to $46.94 in late March).

GDX pricing finally eclipsed the August 2020 peak at $45.78, to levels not seen in a dozen years, which is medium-term bullish.

Having said that, to witness the pricing in these large gold producers make a new pricing peak, but then see them immediately recoil downwards by 11% right afterwards isn’t great.

Despite the elevator ride down in prices, the RSI, CCI, and Slow Stochastics on the GDX chart are still in neutral territory, and they are not even at oversold readings yet. So, things could sell off even further before getting so oversold that a rally is more expected.

This chart looks very similar to the GDX chart, where the recent move higher in GDXJ was quickly reversed downwards in a waterfall decline to close on Friday at $51.38, below the 50-day EMA (currently at $52.62).

The difference is that GDXJ’s recent peak at $58.60 was unable to breach the prior August 2020 peak at $65.95, so this index of mid-tier to smaller gold producers didn’t perform as well as the larger senior producers.

The RSI with a reading of 39.17 is still in neutral territory, where the CCI at -117.76 has just shifted into an oversold reading.

Gold equity bulls will want to see pricing reverse sharply and get back above the 50-day EMA, and make last week’s plunge levels another “higher low” on the chart.

Key fundamental questions for consideration:

How much do the tariffs imposed (in which PMs were clearly excluded from them) really impact gold producers?

Sure it was a “sell everything” environment on Thursday and Friday March 3rd-4th, but was that a rational assessment of the impacts of these policies on this particular sector?

Some have stated that since the US tariffs were not on gold, silver, platinum, or palladium that this has unwound the arbitrage trade between London and New York. Fair enough, but why should that nuance in physical metals trading tank gold producers operating profitably all over the globe?

Gold producers are not nearly exposed to the same kinds of impacts as say automotive producers, that really need that aluminum or steel for the production of new vehicles.

Additionally, the pullback in oil prices should actually be a net positive for most mining companies costs; offsetting any ancillary upticks in other areas affected by tariffs to their supply chain.

Has this recent price action in the gold equities now wiped out the market’s forward-looking expectations for a record Q1 earnings season?

GDX fell from its recent peak by over 11%, and GDXJ fell from its recent peak by 12%, just in the last few days of trading in the prior week. Fundamentally, are these tariffs really more germane to the valuations of the gold equities than their actual massively expanding margins from last quarter?

Did the pricing valuations in these gold stocks, prior to this sell-off, even properly reflect the coming record revenues, free cash flows, and record margins just experienced in Q1 2025?

The average price of gold sold was up a couple hundred dollars higher in Q1 than in Q4, and definitely outpaced any uptick in underlying All-In Sustaining Costs.

That means margins for gold producers expanded to their highest levels ever in the history of the gold mining industry, which should correspond with surging valuations in companies maximizing this environment on their balance sheets.

Again, the fact that the GDX only just recently pierced up through its 2020 peak, and that GDXJ couldn’t even do so and was still trading lower than its 2020 peak, could not have properly factored in the record margins the gold producers have been experiencing. The underlying gold price and the associated margins are much larger today than they were in 2020 or in 2011 for that matter.

Now, as we know, the markets are inefficient at times, and not always rational. As that old trading adage goes: “The markets can stay irrational for longer than you can stay solvent.”

It just seemed worth pointing out that this recent selling in the gold producers, effectively erasing their recent revaluations higher, flies square in the face of the record quarter in Q1 they just had. Their valuations before last week were still nowhere close to properly reflecting that record high margin reality or their price to earnings valuations even before the selloff.

Now, after last week’s fishing line selloff, the value arbitrage just got even wider. Over the fullness of time, one would expect to see that valuation gap narrowed and closed, which spells potential opportunity for contrarian investors that are willing to start accumulating these gold produces into the market panic-selling.

Let’s look at charts of silver stocks by way of the ETFs (SIL) and (SILJ):

Both (SIL) and (SILJ) had really big selloffs the end of last week as well. Just on Friday’s trading action alone both silver ETFs sold off by over 10%. Still, this is a bit less surprising and actually tracks a bit more with the corresponding selling seen in the underlying silver price; compared to the selling we saw in the gold stocks compared to the pullback percentage in the gold price.

Silver futures dropped 17.6% from a pricing peak of $35.49 on March 27th to a close on Friday down to $29.23. One could understand why the silver stocks got slammed more as a result. They didn’t have the extreme historical record margins in Q1 like the gold producers did, so there was less insulation for company valuations due to record expected revenues and free cash flows.

Having said that, the selling in many silver stocks still seemed indiscriminate and overly extreme last week. Take for example the chart of a silver producer that we’ve talked about in this channel a number of times, Santacruz Silver Mines (SCZ.V). Just 2 weeks ago in late March the stock price was up to $0.60, but then it suddenly corrected down by 33% to $0.40 on Friday’s close. That’s a bit ridiculous…

Did the company seriously just lose 1/3 of its total value in 2 weeks.

(clearly not, but that is how wild the volatility has been in these markets)

Last week, over at the KE Report, I had a nice discussion and company update with Arturo Préstamo Elizondo, Executive Chairman and CEO of Santacruz Silver Mining Ltd. (TSXV: SCZ) (OTCQB: SCZMF). Arturo recapped key financial and operational updates for the company from newsflow during the first quarter, and the company is firing on all cylinders and executing well on their strategy. This flies in the face of their stock price action from last week.

Santacruz Silver Mining – Successful Bolivian Promissory Note Offering, Early Repayment Plan To Glencore, Strong Q4 Production Metrics

I guess the key takeaway here is that one doesn’t want to risk picking up pennies in front of a market steamroller when the selling pressure is swamping the fundamentals. However, at one point, those contrarians that accumulate quality companies into an overblown extreme weakness in valuations (when many are panic-selling out of positions in fear) will be setting themselves up for future appreciation if the bull market is not truly over.

Thanks for reading and may you have prosperity in your trading and in life!

Shad