Just Some Brief Fundamental And Technical Thoughts On Silver Tiger Metals

Excelsior Prosperity w/ Shad Marquitz (01/06/2025)

I’ve been working hard within this channel to create compelling articles that touch upon multiple sectors or facets within the commodity sector. My goals are to draw upon recent news, technical charts, and exclusive interviews with company management or sector thought leaders to provide unique content to like-minded resource investors. Quite often my head is filled with so many different ideas, that many of them get shoved aside or completely bypassed due to the pace of everyday life and drinking online information out of the proverbial “fire hose” every day.

Moving forward, in conjunction with the longer format articles, I’m occasionally just going to publish some more consolidated thoughts and ruminations for readers here on a given sector or specific stock, not tethered to any particular series. This will allow me to get a bit more frequency of touches with the audience here, and to post ideas in a more stream-of-consciousness programming format. As ideas emerge, like waves on the surface, I’m just going to start publishing them. Not every idea is going to be a winner, but I hope it provides further value to readers here.

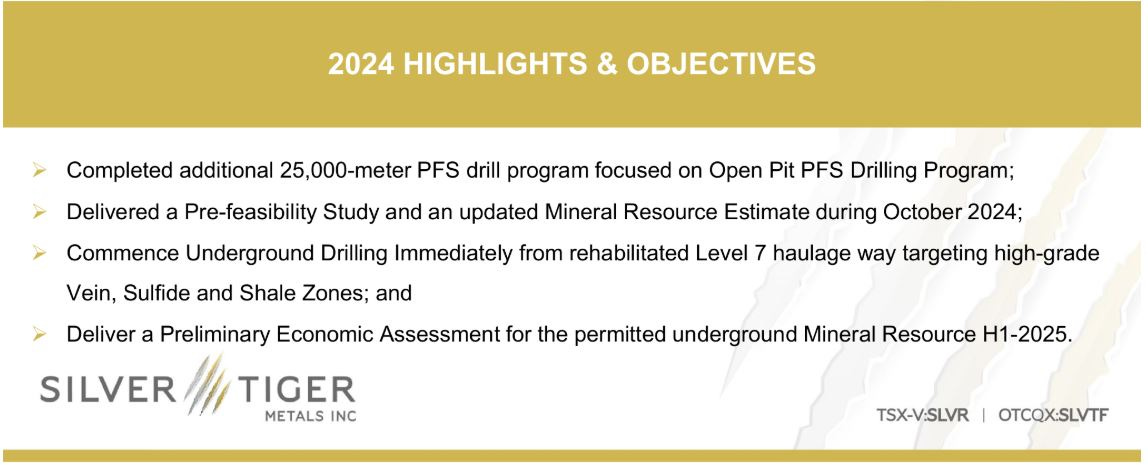

Earlier today, over at the KE Report, I had a nice conversation and interview with Glenn Jessome, President and CEO of Silver Tiger Metals (TSX.V:SLVR – OTCQX:SLVTF). We recapped the key milestones from 2024, and then looked ahead to all the work initiatives and company and sector catalysts on tap for 2025, at the El Tigre Silver-Gold Project in Mexico.

Silver Tiger Metals – 2024 Milestones, Resource Update and PFS For El Tigre Open Pit – 2025 Focus Shifting Exploration Deeper, Building Towards Underground Mining PEA

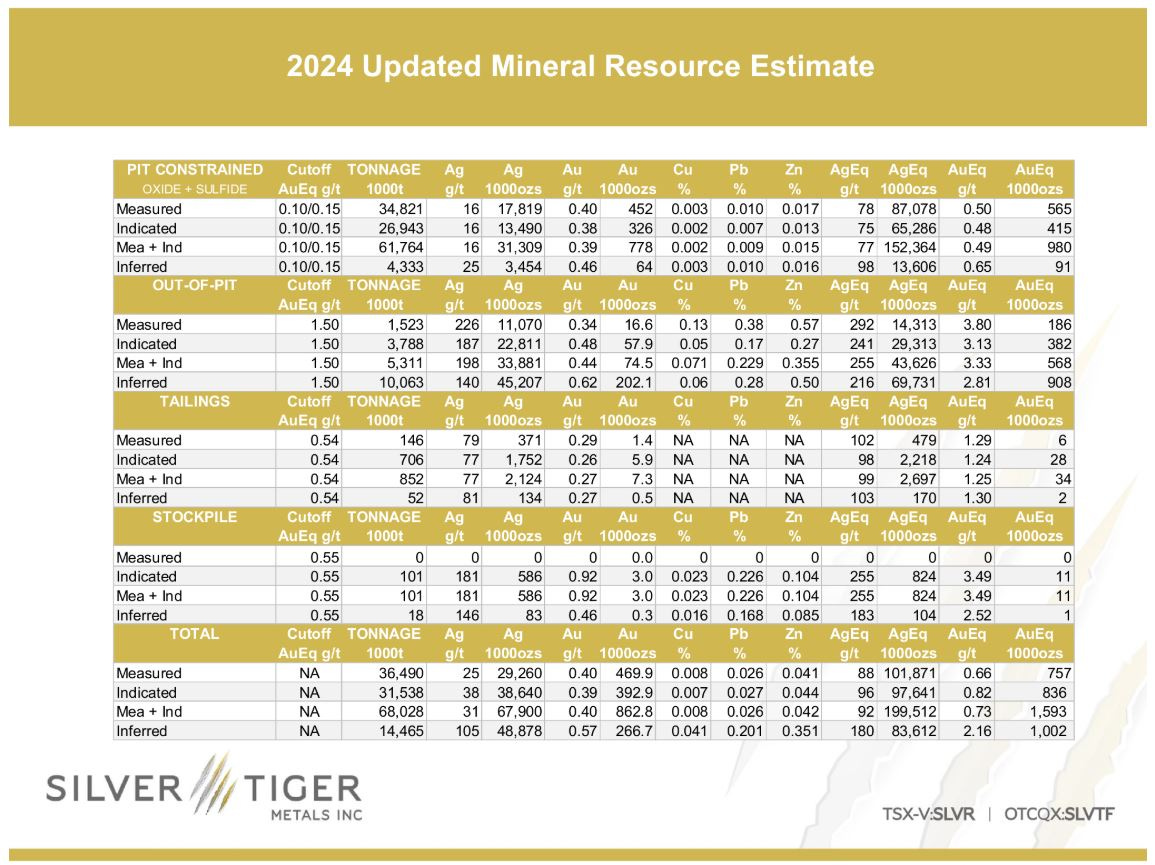

We start off with a brief review the key takeaways from the updated Resource Estimate and Pre-Feasibility Study (PFS) on the open-pit that were released to the market in 2024 as key company milestones. There has been a lot of drilling done to move categories from inferred into indicated, as well as metallurgical testing, preliminary engineering work, permitting, and social licensing.

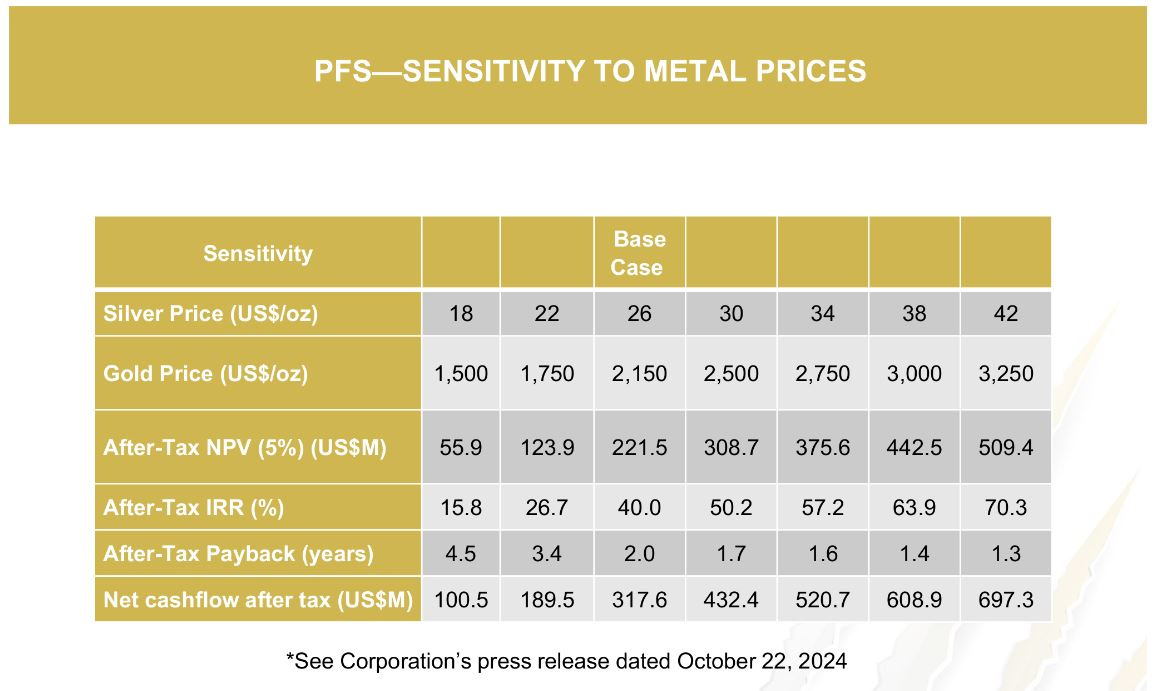

Glenn mentioned the metals sensitivities to this Open-Pit portion of the project, and I think the table below does a good job of showing the spectrum of potential on this first phase of the overall project.

Look at that column utilizing a $30 silver price and $2,500 gold price, and it showcases an after-tax Net Present Value (NPV) using a 5% discount rate of $308million, a 50% Internal Rate of Return, 1.7 year payback period, and net cashflow of $432million.

Sure, I could understand where some investors would want to handicap the project more at an 8% or even 10% discount rate instead of 5%, but for whatever reason most of the precious metals economic reports all still use a 5% discount rate, so companies keep using them for comparative purposes. Even if one wants to use a larger discount rate, it is clear that this open pit portion stands on its own 2 feet as a very viable and economic gold-silver open pit.

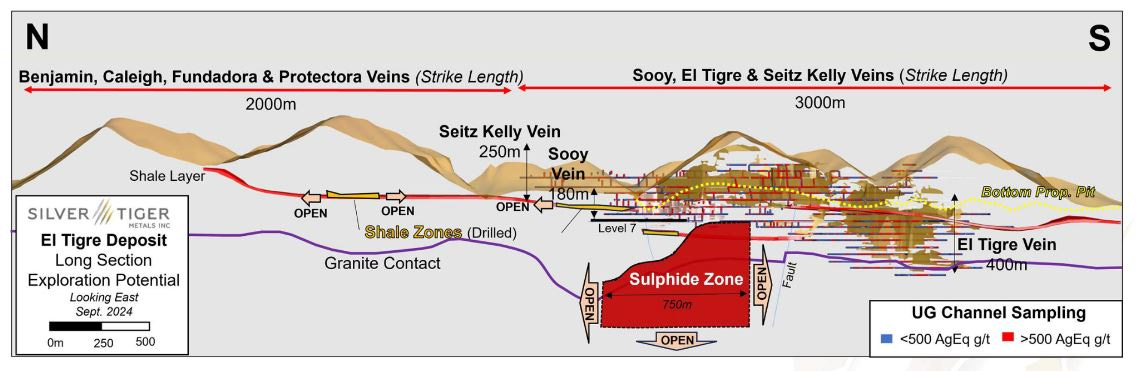

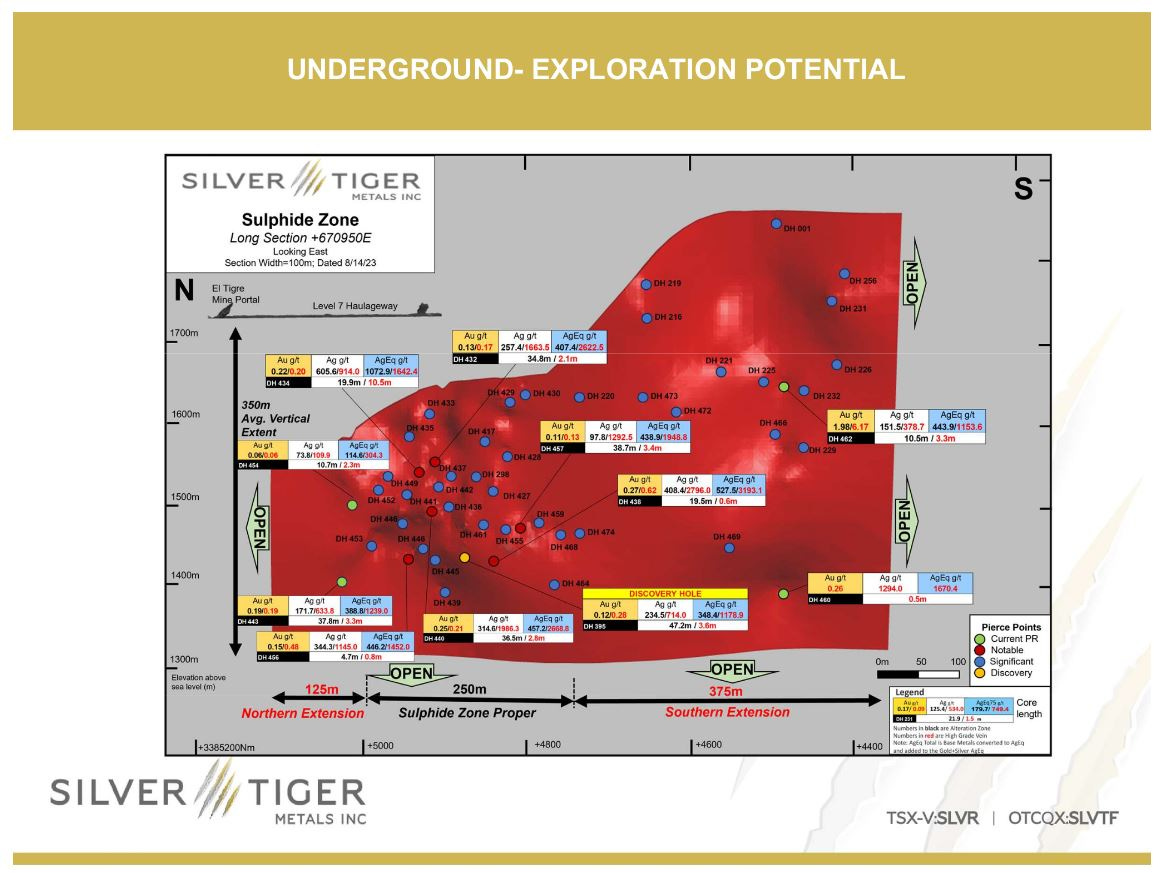

Then in the conversation we shift gears into the deeper drilling, from underground, that commenced at the end of last year and will be continuing into the first half of this year; testing the high-grade silver veins, sulphide zones, and shale areas, continuing to mass up underground resources. The strategy is then to compile that data with other ongoing derisking work into the Preliminary Economic Assessment (PEA) out on the underground mining second phase out in the first half of 2025.

One of the things I personally look for in a position that I hold within my portfolio of resource stocks, is a company that has enough catalysts in the foreseeable future to keep other investors engaged. There is nothing that drives me more crazy than to see a quality team and quality project just sitting there dead in the water with no newsflow. In the case of Silver Tiger, there is going to be a steady stream of newsflow emanating from the Company over the next few months with regards to both exploration and development.

Nobody, including the company staff, has any clue what results will come back from the underground drilling. My thesis is that based on prior year’s results, that new results from the Sulphide Zone, Shale Zone, and high-grade vein zones should bring in some eyebrow raising intercepts to keep things interesting and expand these underground resources.

Personally, I’m more animated by the potential here with underground than the near-surface open-pit part of the project. Having said that, the open-pit is great for what it is and more than underpins the current valuation of the whole company (and then some). What is wild is that there is currently no value being given at all to the high-grade underground silver areas… which is a big market disconnect, that will adjust over time.

Back to our discussion in the interview: We also expanded the conversation to touch upon the political change in administrations in Mexico in October and what it means for the mining sector. As underground and open-pit permits start getting granted in Mexico in the first half of 2025, Glenn points out that this permitting visibility will be a very meaningful catalyst for Mexican mining projects across the board to get rerated significantly higher.

I agree with Glenn here, and believe in Sep/Oct that we already saw the first shot-across-the-bow as far as those kinds of rerating events, when the new administration simply removed “ban open-pit mining” from #87 on the list of 100 initiatives.

As an aside: I remember being at the Beaver Creek PM Summit in September and hearing all the scuttlebutt about silver stocks starting to take off simply because Discovery Silver had announced from the stage that #87 had been removed from that list of 100 policy initiatives for the incoming administration in Mexico. There was an immediate uproar of excitement at that event afterwards.

So, think about how the market could and likely will react once we start seeing permits issued in Mexico… (This is definitely not investment advice, there are no guarantees, and nobody has a crystal ball…. just thinking about probabilities here).

Glenn has also been working hard all of last year getting financial term-sheets in place with financial institutions. This will allow them to hit the ground running once they receive their open-pit permit. He claimed in today’s conversation that they can get the open-pit mine constructed and producing roughly 18 months after getting the green light to move ahead. This is based on their internal scoping studies and coming from a collective effort from an experienced team that has successfully built mines before. Who knows, but anything under 2 years is fast in mining terms.

Well, I got off that call feeling pretty good about my position in Silver Tiger and all the catalysts in place, and was proud to have them as sponsors on the KE Report… [So I’m biased in those regards].

However, even if I wasn’t a shareholder or following them as closely as I have been the last few years, their resource estimate update and PFS released last year were legit milestones. Additionally, the underground drilling and plan to put out a PEA on the underground mining phase this year are real catalysts; not just the background tinkering or marketing fluff we see from many companies.

These are the kinds of studies and documents that only more advanced explorers moving into developers are even working on, so in my mind, that separates them from a lot of the silver exploration riff-raff. At least this company is doing what investors claim they want to see companies doing: “building value.”

Then I go and pull up a pricing chart for (SLVR) and look at the lack of pricing support over the last couple of years and just scratch my head wondering – “What do people want to see here?”

Yeah, I know there is an overhang on the open-pit UNTIL they get their permit, but come on… I’ve also watched garbage companies with a few flashy drill results that don’t hang together in any meaningful way launch up far more on hype and speculation than companies like this, that are actually doing real work on projects that are on track to become real new mines.

Can people not separate companies that are going to build actual mines, from the ones that are mining the capital markets for projects that are never going to fly in the real world? Apparently not.

Let’s deal in the real here: This company closed today on the TSX.V with a market cap of CAD$82Million and OTCQX market cap of US$60Million. Silver Tiger has a 2-part project where just the open pit is worth about US$300million +/- depending on how metals prices move in the next couple years. The larger prize will be the underground phase, and I don’t know exactly what it will be valued at initially in the upcoming PEA, but it will likely come in at multiples of the current market cap, and keep growing and expanding over time.

Does a US$60million market cap really make sense for a company that has open-pit + underground projects that combined are likely worth somewhere between half a billion and billion dollars? No, it really makes no logical sense.

Look, I don’t expect any company to have all or even most of their NPV factored in until they get acquired or go into production, but there really is a wide gap in valuation here. It does seem that there is plenty of room for this company to at least double or triple from where it is currently valued without seeming in the remotest sense stretched at current metals prices.

Would US$120million or US$180million market cap really be pushing it for a valuation on the OTCQX? No way -- just the open-pit alone is still worth far more than that and again, it is anyone’s guess where the underground economics are going to come in at.

The reason I shake my head when looking at their pricing chart and market cap is that right now someone buying shares in Silver Tiger is getting all of that upside on their underground resources and potential second phase of mining totally for free in my opinion… at least that is the thesis I have for holding it in my portfolio. Eventually “Truth will out.”

When looking at a 5-year daily price chart of Silver Tiger (SLVR), it is interesting to me how the stock is trading at 1/3 the price it was back in 2021 and 2022, when it got up to $0.79 and $0.78, but back then it didn’t have the robust defined resources it has now released in 2024, or the Pre-Feasibility Study on the open-pit portion that it released later last year. Even more so this current pricing is factoring in the ongoing drilling this year to further define the underground and then put out a PEA on that 2nd phase of development in the first half of 2025.

The company has grown, improved, and derisked its resources and economics FAR more than back in 2021 over the last few years, and it closed today at $0.22. Talk about a price to value disconnect… If people loved it back in 2021 then why don’t they really love it today when so much more value has been created (even in light of any dilution over that period of time)? Silver and gold prices are far more stable and hanging up at higher levels than back then as another mismatch.

The (SLVR) pricing seems to respect the 200-day Exponential Moving Average (EMA), as to whether it is in a more bullish or bearish posture. Back in 2020, and 2021, and early 2022 the bullish posture was on with pricing well above the 200-day EMA. Once it was lost in early 2022, it was in a bearish posture for the remainder of 2022, 2023, and early 2024. Then in April of last year, SLVR pricing regained the 200-day EMA and was mostly above it for the balance of last year with 2 smaller dips below it. More recently it has been whipsawing around on either side of this level, with the current 200-day EMA coming in around $0.23.

If pricing can get back up above this level for a few weeks, then I could see a nice sustained upside rally in this stock based on the combination of technical setup paired with a series of constructive fundamental factors on tap for the first half of 2025.

I’ve already written up Silver Tiger in the past in the series on “Opportunities In Silver Explorers and Developers” but I had this conversation with the company today, and was looking at the chart this afternoon, and just thought I’d publish an article on how I was looking at the value proposition here and now.

Even if people reading this are not interested in this company, hopefully the various points made and process used can be helpful in screening through other positions that investors hold in their own respective portfolios.

Thanks for reading and may you have prosperity in your trading and in life!

- Shad