Investor Apathy Continues In The Precious Metals Sector – As Gold Makes New ATHs

Excelsior Prosperity w/ Shad Marquitz (02/22/2025)

Once again, gold futures went up to tag a new all-time intraday high last week of $2,973.40.

Gold closed on Friday at $2,953.20 marking another new all-time high weekly close.

This marks a series of 8 weeks in a row of bullish weekly candles for the yellow metal, and 5 weeks in a row of sequential new all-time high weekly closes. That has been extremely bullish action technically, and the reaction from North American generalist investors and even investors focused on the precious metals has been rather muted considering these technical accomplishments.

Sure, there were a few more western resource investors at conferences or on podcasts that perked up some when gold started accelerating to even higher levels last March. However, that is not really when or where this gold rally got started, and it is curious that it took that long to see even a small modicum of enthusiasm in this sector.

Here at this Substack channel, we’ve discussed over and over again the series of new all-time highs that gold has been making – actually since the end of 2023 on the daily, weekly, monthly, and annual charts. Those were the bells ringing that the ongoing bull market was continuing to expand, and yet so few could hear them. Technically, things have only accelerated in 2024 and into 2025, with even larger price levels achieved, and still it seems like hardly anybody cares…

We’ve also discussed (over and over again) that this next Intermediate leg higher, within the ongoing larger 9+ year secular bull market, really kicked off after the false breakdown / bear-trap / triple-bottoming back in Sep-Nov of 2022 at the $1,621-$1,618 zone. Ever since putting in the 3rd low, and Intermediate Low for this leg of the bull market at $1,618.30 on Nov 3rd, gold has gone up almost 84% to hit this last week’s peak at $2,973.40.

That has been a huge move where this “un-currency” has almost doubled in just a little over the last 2+ years.

That is also a stunning increase in value for something considered a “safe-haven – currency-of-last-resort” and alternative to other fiat currencies. Gold is supposed to be a “slow-and-steady-wins-the-race” type of asset class, that revalues against the diminishing purchasing power of fiat currencies over the fullness of time… and yet, it has turned into a momentum asset lately.

Gold never changes. It is a constant and is on the elemental table. All that changes is the amount of fiat currencies it takes to acquire an ounce of the yellow metal. The rise in gold merely highlights this loss of purchasing power.

Despite all these positive developments for gold, there is hardly any fanfare about these bullish technical pricing milestones in the mainstream media. Sure, a few outlets noted the new higher prices in gold as it gets closer and closer to approaching that round psychological $3,000 level, (it was less than 30 bucks away from it at one point just this last week); but it has not received even the normal coverage an asset class would receive when repeatedly breaking out to new highs.

There is not a serious buzz, or any discernable excitement, or even remote curiosity from most mainstream investors about these historic levels in this monetary metal, and we are definitely not seeing a barrage of “party hat” or “rocket ship” emojis circulating with “To the Moon!” proclamations on social media. Despite gold shining, it just doesn’t have that “Rizz.”

It also worth noting that there are not any new t-shirts and caps with Gold $3,000 being cranked out and paraded around in the financial media or Wall Street, like we witnessed when the S&P 500 or Bitcoin respectively made new all-time highs over the last couple years.

Unlike the excitement we saw in 2011 when gold first started approaching the $2,000 price level, there are not endless radio and television ads from precious metals dealers swarming the airwaves, nor are there sign-shakers standing on every street corner announcing “We’ll buy your Gold!”

Yes, there are plenty of articles out postulating that the US could or should revalue the gold assets on its balance sheet from $42 up to somewhere closer to present levels, and plenty of publications firing off opinion pieces on if the US gold horde in Fort Knox should be audited, etc… but hardly any articles out highlighting the technical breakouts that have been playing out on the charts for a long time now.

The issue for gaining new eyeballs to this space has been the strength of the US general equities and cryptos. Those more visible public investing sectors have also breaking out to new all-time highs, and so the move in gold to ATHs, thus far, has been lost in the shuffle.

This lack of excitement is actually a good thing. It indicates that we are far from the blow-off top euphoric “Mania Phase” in this asset class.

Week in and week out, I speak to precious metals company executives, fund managers, newsletter writers, resource investors, popular pundits, and thought leaders in this space. Getting this wide range of opinions and outlooks are enough to give me a general sense of the sentiment and psychological backdrop in the gold and silver sector. The current environment is one of the more unusual in memory.

Most people are cognizant of the meteoric rise in the gold price, as measured in all currencies on the planet, and yet they’ll shrug their shoulders and say:

“Yeah, but my gold stock is not responding and we just put out XYZ-news….” or “Yeah, gold is doing great, but look at silver, or GDX, or SILJ; they’re not performing like they should be.”

It is very strange. It would be like saying, “Hey look, it’s a beautiful sunny day outside,” and having the response be “Yeah, but it’s a bit cool here in my office.” (huh?) They are missing the major weather event, in lieu of a localized phenomenon, and failing to see the bigger picture. The sector has been in a bull for years now.

Or some may say, “Yeah, it is beautiful outside, and the sun is shining bright after a strong rainfall. I guess there are some green shoots out there in the farmers’ fields, but the crops in my garden out back still aren’t ready to harvest yet.” Do the crops need to be completely ready for harvest to acknowledge their growth? Can we just celebrate that those crops (mining stocks) are growing and the conditions are absolutely present with the sun (gold bull) following the rain for them to continue to grow? No, apparently all crops need to be harvest ready, and all stocks need to be going up to the moon before this sector can get excited.

Gold has been undeniably strong for many years now, and yet with the gold stocks, silver, and the silver stocks lagging so much over the last couple years, this has really put a wet blanket over the sentiment in the precious metals complex overall.

I completely understand that PM investors are disappointed that silver has still not followed gold to break out to new all-time highs, and is still nowhere close to breaking above its $50 ceiling from 1980 and 2011. However, at $32-$33 lately, silver is set up much better than it was when it was in the teens or low to mid-$20s for the prior decade. Silver is making progress, and is at a good price historically for the producers to generate good revenues.

Additionally, investors’ frustrations are justified when pointing out that the gold and silver mining stocks (as an overall group) have not leveraged the moves higher in the underlying metals on a roughly 3:1 ratio, like we’ve seen in prior cycles. However, there are plenty of gold and silver stocks up 50%, 100%, 200%, and even more, if we just look at the last year or two. Some of the quality stocks are up near 52-week highs or even all-time highs. That is continued bullish action…

It is clear that many resource investors are throwing out the pretty babies with the sour sector sentiment bathwater. They are simply ignoring the moves higher we’ve seen just over the last year or so in the price action of many of the quality gold and silver producers and developers.

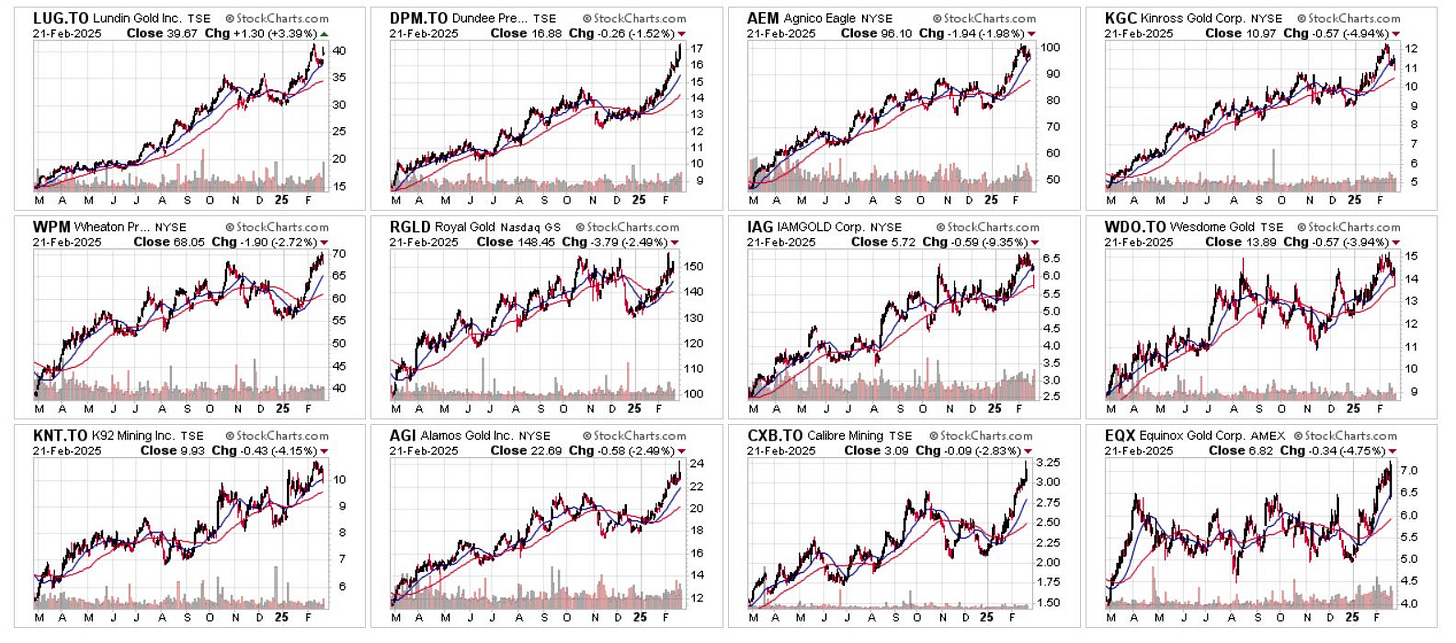

Just for a frame of reference for the prior comments above. Have a look at this 12-month candle-glance chart of some of the quality larger gold producers and precious metals royalty companies.

—> Companies featured: Lundin Gold, Dundee Precious Metals, Agnico Eagle, Kinross Gold, Wheaton Precious Metals, Royal Gold, IAMGOLD, Wesdome Gold, K92 Mining, Alamos Gold, Calibre Mining, Equinox Gold.*

* Update: After publishing, I saw the news hit that Calibre and Equinox are merging into a larger combined major gold producer. More to say on that later:

(in full disclosure: I’m a shareholder of both Calbre Mining and Equinox Gold)

One of the stocks we’ve covered on this channel a number of times, as a growth-oriented gold producer is Mako Mining Corp. (TSXV:MKO)(OTCQX:MAKOF). It has nearly moved up 4-fold from its $1.16 low in September of 2022 up to the recent high at $4.20 last week on Friday. There were solid fundamental reasons for this increase in shareprice and valuation. There was also plenty of time for investors to get positioned along the journey, and to catch a big chunk of the move thus far.

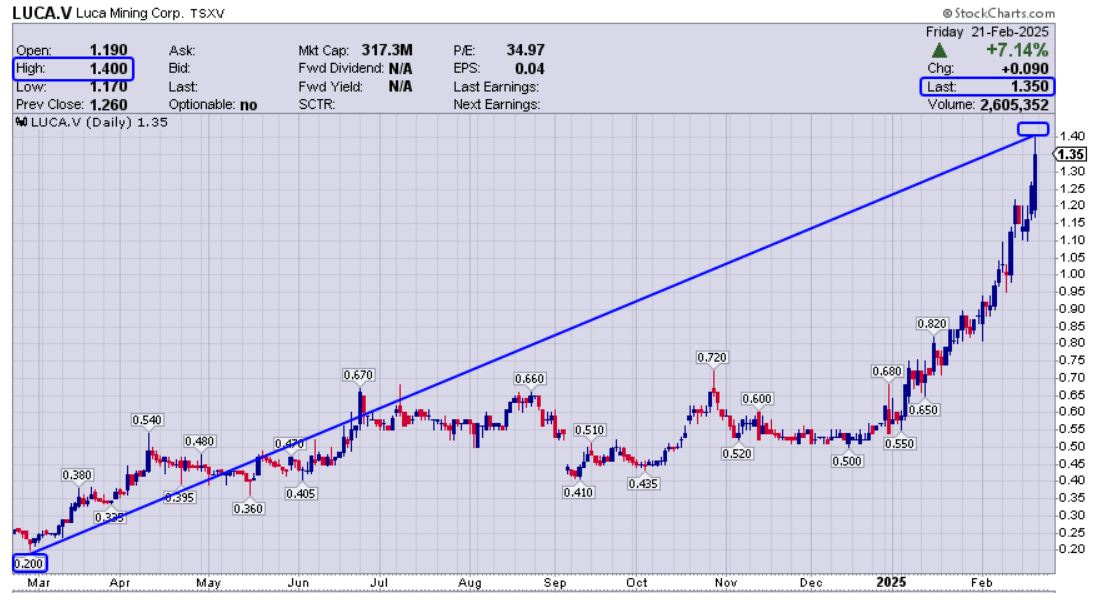

How about this 1-year daily chart for Luca Mining Corp. (TSXV: LUCA) (OTCQX: LUCMF) where it is up 7-fold from the $0.20 low a year ago, to the recent peak of $1.40. Again there are fundamental reasons why this stock has been on a tear; because it has been ramping up gold & silver & base metals production and exploration around both of it’s mines.

I didn’t catch anywhere near all of that move personally, but I did eventually get positioned in Luca Mining in late September 2024 (right after meeting with management in Beaver Creek). Then I added another tranche to that starter position in mid-December of last year, and am up well over 250% on the overall position in the last 5 months. Luca has demonstrated really solid price appreciation, as another quality growth-oriented gold/silver/base metals producer.

Those quality gold producer charts are up and to the right, where their share-price has gained substantially over the last year, because of their improving margins and/or new mines that came into production giving them solid growth. This is evidence, of where the money flowed when the worm turned higher in the gold price. This data should not be a surprise for any student of this sector over the last couple decades, and it begs the question: Were investors properly positioned to capture the move higher in gold? (Sadly, most were not, but that is what makes a market).

• Do you think stock pickers that placed these quality gold producers in their portfolios are griping about the action in the PM sector over the last year? (nope)

• Have those quality companies outperformed the moves in gold? (yes, they have)

• Do their charts look better than the chart of GDX or GDXJ? (yes, because they are not dragged down by the laggards inside of those ETFs)

How about the flows of capital into the quality gold developers? One of my larger positions has been the gold/silver developer Skeena Resources Ltd (TSX:SKE)(NYSE:SKE). Just over the last year we’ve see this stock move up over 350% from a low of $3.29 a year ago in late February 2024, to a recent peak of $11.74 in early February 2025. We’ve covered Skeena a few times in prior articles on this channel, and reviewed some of the fundamental milestones and reason why this stock has been ripping higher in valuation over the last year. I’ve trimmed back my position-sizing some as it has climbed higher, but still have a core position left in place for the potential move into production, or a takeover by a larger producer.

We’ve talked a few different times about how well the quality silver producers like Gatos Silver and SilverCrest Metals did in share price appreciation, before it was even announced that they were being recently taken over (which was the final icing on the cake). Those were my 2 heaviest weighted silver positions for the last couple of years, strictly because they were quality growth-oriented mid-tier producers that I knew would get capital inflows as the precious metals prices rose.

The reason I keep bringing those up is because they were examples of stocks that were set up to be clear winners this cycle, and those are the kinds of companies where investors can feel more confident taking a larger position-sizing. They may not have shown up on the lists of most newsletter writers trying persuade investors to go in big on swing- for-the-fences drillplays, but you can bet they were on the radar screens of institutions and investment funds.

Most precious metals investors were well aware of Gatos and SilverCrest, and yet they passed on getting into positions in their portfolio; preferring instead to be off chasing supposedly shinier objects. It is difficult to find stocks like that in the silver sector with low costs, good balance sheets, and solid exploration upside. Why would someone wanting leverage to quality silver price moves, elect to be in most of the pre-discovery drill plays, when they could have taken on far less risk just being positioned in the best quality growth-oriented silver producers?

Two weeks back I shared a 12-month candle-glance chart of some of the key silver stock positions currently in my portfolio. I included those as a snapshot of how most of them shot up double or even close to triple off their lows from last February over the course of the last year.

Featured stocks: Coeur Mining, Avino Silver & Gold, Americas Gold & Silver, Sierra Madre Gold & Silver, Santacruz Silver, GoGold Resources, Silvercorp Metals, Dolly Varden Silver, Vizsla Silver, Aftermath Silver, AbraSilver Resource, Silver Tiger Metals.

As some of these stocks have rolled over I’ve been adding to them into the weakness as well as other silver stocks I hold that are more in the optionality camp, and have yet to run. As mentioned in a prior article, I believe we are entering the phase where the optionality stocks will make the next big run. So again, to be totally out of position in the producers, developers, or optionality plays in one’s portfolio for the next 12-18 months will likely be a large error in judgement. {This is not investment advice, I’m simply sharing my personal investing thesis, and what I’m doing with my own investment capital.}

I’m continually stunned, surprised, shocked and dismayed when speaking to precious metals investors or pundits when they claim to be “longer-term bullish” but are clearly apathetic or even cynical on the actual bull market that has been playing out for many years now.

I’ll list off how well so many of these aforementioned quality gold and silver producers have performed, or look at the big runs the quality advanced explorers and developers. They’ll nod in agreement, but then go right back to: “Yeah, but my portfolio of juniors is not up like that, or look at GDX - it isn’t up like that.”

I want to snap back, “Well, maybe you have been positioned in the wrong stocks then!”

“Why are you positioned exclusively in penny dreadful explorers that don’t have any gold or silver defined in the ground? Why would those companies with no proven gold or silver have any optionality to higher metals prices?”

“Why are you positioned in GDX in the first place if it continually underperforms?” Why would you not instead construct your own portfolio of properly weighted quality stocks?

“Why did you not accumulate the heaviest weighted positions in the quality growth-oriented gold and silver producers or developers when they were on sale the last couple of years?” Quality was on sale for a long time, without the need to take huge risks, and quality is where the capital flows first in a rising metals price environment.

If these market realities are true, and yet someone has no exposure to where the money is going to flow for the action in the first few legs of the bull market, then it isn’t really the sector that is to blame is it? It is really their own poor choice of portfolio construction, or weighting too heavily segments of the sector that were not ready to move, and skipping out on adding in quality picks.

People don’t want to hear that though… it is much more comfortable not to do any introspection, and instead to point the finger of blame at the sector, on short-sellers, on the evil CEOs, on idiot newsletter writers, or “it’s different this time” mantras; rather than to take personal accountability for the decisions they made.

Everyone knows that when money does come back into this sector at key turns from bearish to bullish, then it always flows into quality production and resource growth stories first... but not necessarily into speculative penny stocks raising money and diluting existing shareholders to poke holes in the ground hoping to find economic mineralization.

So, if you haven’t been positioned in the quality gold and silver producers, or solid development projects with good economics and optionality to rising metals prices, then you’ve missed out on how well those segments of the sector have been performing; and thus, may have developed a glass-is-half-empty mindset.

Sure, amazing new exploration discoveries can be richly rewarded, but they are like “lit matches,” and often they will crash right back down again if they can’t sustain a string of continued drilling success. The few out of a thousand exploration companies that can actually execute like that (and also have luck on their sides) can be amazing rides to be a part of. The truth though, is that Las Vegas has much better odds.

Considering the very poor odds that 1 in 3000 drill targets actually end up turning into an economically viable mine, then it is best to only spread small capital exposures around to those greenfields explorers. This is much like taking on multiple lottery tickets knowing there is only a slim chance of winning the mega-prize.

Don’t misunderstand the point I’m making: I love speculating on the gold and silver and copper and uranium drill plays and potential greenfields discovery stories just as much as any punter does; but I have their position-size at an accordingly small amount relative to my overall portfolio amount.

Most of my “lottery ticket” pre-discovery positions are at 1%-2% of my portfolio size, and if they suddenly gap up multiple-fold to 5%-10% of my portfolio, then I typically will ring the register on those trades.

The sad truth, (that few will discuss honestly with resource investors), is that MOST hot drill plays will do return trips right back down again, once gravity sets in and the next sets of drill results don’t keep blowing investor’s minds. This means it is typically better to take multi-bagger gains when they present themselves, and not get married to the stock. There are exceptions though…

Very, very, very few new explorers can keep that kind of exploration momentum going and going building into larger development projects. The ones that do keep hitting like Great Bear, Filo, New Found Gold, Snowline, and it seems like what Goliath Resources or Collective Mining are currently doing, are the companies that become legend… but sadly, that is not the trajectory of 99% of exploration stocks.

However, to have only played the whole sector through the vantage point of pre-discovery stories, at the exclusion of being positioned in the quality producers and developers has been the wrong call for many years now, (unless someone got lucky and went in big on the very rare success story. Sure, that can happen, but clearly that is not the norm for most companies or for most investors.)

People love to bang on their chests about those early exploration winners. It makes for quite entertaining “bar talk,” but they rarely recount how most of those early-stage exploration positions were actually utter failures and disasters, now down 70%, 80%, 90%, or even unlisted from the exchange, or used as a shell to launch a totally different company…

Experience has taught me that, in the rare occurrence where a company really starts hitting consistently and truly expanding their resources post-discovery, then that can be the advantageous time to press one’s bets into a larger position size. Sure, the initial discovery pops may have already happened, but if it really is a quality project as evidenced by the follow up drilling continuing to hit over and over again, then it will still have a long way to run in value creation for years to come.

One of the biggest problems in the resource sector (whether it is gold, silver, copper, uranium, lithium, oil, natural gas, or specialty metals), is that people get married to their positions or sectors, and won’t let go. The time to buy is when things are unloved, and the time to sell is when they are dear. As we’ve discussed in the past most investors don’t really like buying low, but even when they do, they refuse to sell when they have big paper gains.

Many resource investors have been hoodwinked by other pundits extoling the Jesse Livermore adage to “Buy right, and then sit tight.” The point Jesse was making was about longer-term value investing in the blue-chip US equities, which do have a tendency to go higher over long periods of time. To be clear, he was not talking about the very cyclical commodity sector, and especially not volatile junior mining stocks. Sure, we need to “let our winners run,” and not get too trigger-happy on pulling gains, as most times they’ll run longer and go much higher than even makes sense logically.

This is why selling is more an art than a science, as it gets into the “irrational exuberance” from human emotion and the “madness of crowds.” Make no mistake about it though; there is eventually a time to sell any resource stock, inside of the very cyclical commodity sector. Personally, it is always a struggle for me to sell into that strength, because that is when it feels so good to be invested. My rule of thumb is to always take some off the table when everyone is giving each other high-fives and discussing their big outsized gains, with little consideration of any reason to stall these price advances.

• There was a time to buy and then a time to sell many of the oil or lithium or uranium or copper stocks over the last couple years. Then there were times or still are opportunities to pick those positions right back up again at a much lower cost basis, when they roll over. It’s like a big game of whack-a-mole… You sell the outperformance, and buy it back on big corrective moves, then rinse and repeat.

• It is no different with gold or silver stocks, and people should not be camping out in these things for many years or even decades, like they would a DOW or S&P 500 index fund.

• Having said that, we likely have entered a window where holding the quality stocks for 12-24 months, into the final blow-off top in the PM sector may result in large outsized gains.

• There are also nuances to consider. After the quality stocks have made their initial moves and outperformed the rest of the sector, then there is less of a value proposition in some of those stocks, compared to many of the optionality plays or smaller juniors that may not have run as much. So there is the case to be made for eventually taking gains in some of the best performing companies, that have become more widely-followed and are more properly valued, and then rotating those funds down into companies that have a more compelling risk-reward setup, both fundamentally and technically.

• It does seem we are entering into that window of time where some of the best quality stocks have become more fairly valued compared to their lessor quality peers. Because metals prices have remained historically high, there is now the arbitrage to capture as the higher-cost producers or developers eventually get their overdue rerating higher to get their valuations more in alignment with their improving economics.

With regards to selling, there are only a few lucky scenarios with easier and clearer liquidity events like a takeover or sale of an asset for a big win. Most times, it comes down to having a rough strategy from the onset about what kind of gain you believe is realistic over what kind of a time period. It is wise to have a general level where you’ll start scaling out of a position in tranches, while being somewhat flexible to the larger macro backdrop, sector specifics, and company fundamentals.

Sometimes there is a valid reason why pricing is going to eclipse one’s initial sell targets, especially if the sector becomes suddenly hot for a fundamental reason, or if the company provides newsflow and value creation that surprises everyone to the upside. Having said all that, it is still best to take the clear wins when you have them on paper, not get too greedy, and avoid the proverbial “round-trip trade.”

One thing 26 years of investing has taught me (with my initial foray into stock investing starting in 1999 right as the dot com bubble was preparing to make its final blow-off top and burst), is that for most people “It is never enough.” Investors always want even higher levels…

We’ve seen this ever-greedy investor posture in the general equities play out when the tech stock bubble was burgeoning to insane valuations in 1999, or when most sectors were swelling back up to frothy levels in 2007-2008 right before the Great Financial Crisis, or the crypto sector during the Nov/Dec holiday period in 2017 right before the 85% corrective crash, or in late 2021 when the “stay-at-home stocks,” “reopening stocks,” SPACs, IPO unicorns, “meme-stonks,” cryptos, NFTs, and garbage “fin-tech” stocks got up into nosebleed territory before rolling over hard in Q3/Q4 of 2021 and following through for most of the corrective move in 2022.

Bagholders always get created when herd investors and momentum investors pile into overbought sectors or individual equities pushing them higher and higher beyond any reasonable valuations.

These Johnny-come-lately speculators “just know” that pricing and valuations haven’t gone high enough yet and they want to keep riding the gravy train. Well, as we know, that gravy train eventually smashes into the side of a mountain as the greater fools finish purchasing shares from the patient smart money investors.

When longer-term shareholders with big gains begin to finally exit positions and ring the register on their winning trades, it is usually with the backdrop of recent upward price spikes that have hit an area of indecision where pricing temporarily plateaus.

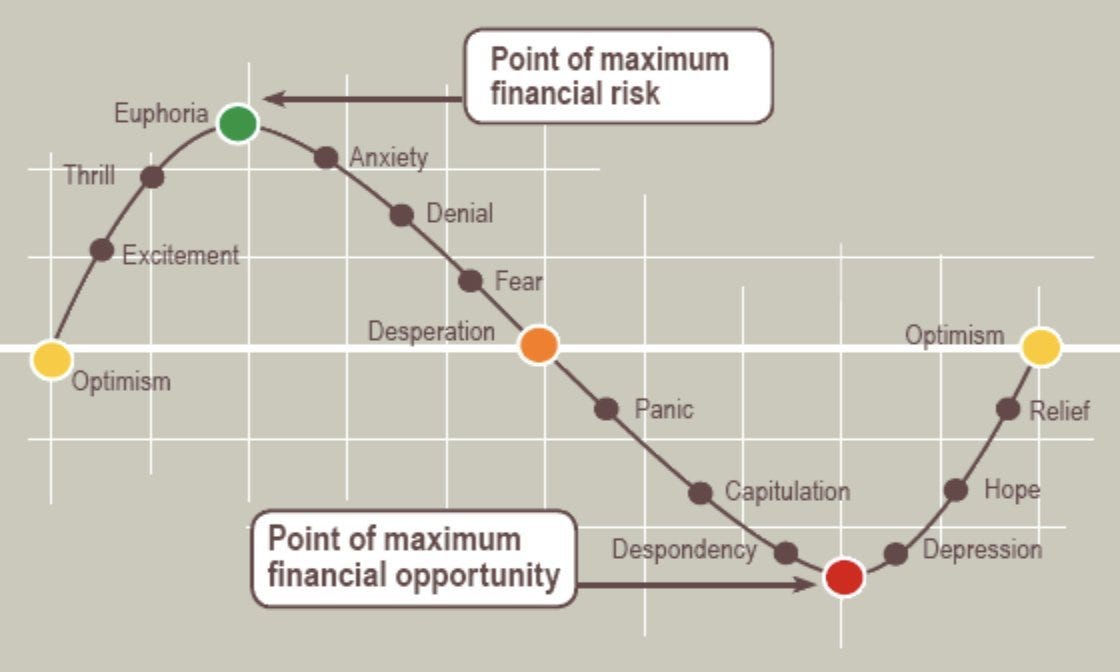

The process accelerates as more funds and investors start to take chips off the casino table and cash in on wins, causing prices start sinking lower week after week, as traders head for the exit doors. This further selling causes flickers of nervous doubt (anxiety) in the psyche of other investors, and so they also decide to trim back or sell positions. The die-hard believers proclaim that it still has room to run (denial), and the people selling are idiots and beat their chests that they are “buying the dip,” and trying to influence others to do the same (desperation). Maybe there is that proverbial “dead cat bounce” where a little optimism shows back up, but all it does is sucks the dumb money right back in again.

This dead-cat-bounce period is usually short-lived and runs out of greater fools much quicker this time, and then more buyer exhaustion sets in and the next wave of selling hits. Then the scary headlines hit the financial media platforms and the high-volume cascade of (panic) selling starts, leaving those investors that positioned at much higher levels stuck in underwater positions. Then the knives come out… with investor temperament’s shifting to anger, outbursts, and finger pointing in a total (capitulation). Then comes the waving of the white flag where people either quit looking at their investments and following the headlines (despondency) or they go into a deep (depression) and decide “investing is just not for me” or “investing in this sector or company just doesn’t work.”

After this bear cycle has run it’s course all the way down to rock bottom, then the next cycle can begin. Out of those financial ashes of devastation, and exhaustion of sellers, the next phoenix can rise and then start the next bullish cycle.

As we know, buying at peak pessimism “when there is blood in the streets,” is the point of maximum financial opportunity. This is the time when investors can actually “buy low,” but it is simultaneously the hardest time psychologically and emotionally to push the buy button. That is why the vast majority of investors fail to do so, in the converse fashion to why most investors also fail to “sell high.”

• Instead, of “buy low and sell high,” most investors prefer to “buy high and cry low.”

The challenge with buying low is that there clearly is not herd consensus at bottoming periods of fantastic valuations. Most peer investors or “normies” on the outside looking in will scrunch up their faces and offer warnings to others to “be cautious.” Advice will be echoed: “Don’t try to catch the falling knife,” by the lemming investors that actually abhor buying low. Again, most investors feel much safer and more enthusiastic about buying once a stock or sector is up multiple-fold. This has always been the case and will always be the case. This time is not different in general equities, in cryptos, or in commodities.

In the investing world and charting world there is never 100% consensus. This is no different that the sum of human behavior we see in the political, moral, or religious segments of the world. There is no one-size-fits-all answer that everyone is going to be content with or agree to. There are always some people drawing lines in the sand at various points, measuring different periods of times for trends that suit their biases, and using a number of different systems, technical criteria, pattern definitions, and vocabulary and terms important to them in their own thesis. That’s what makes a market, where there are bulls and bears over long periods of time, medium-term outlooks, and short-term forecasts, based on a myriad of information.

In gold, one of the most hotly debated topics is “When and where did the bull market begin?” We’ve covered this point in detail in prior articles, and so we aren’t going to camp out here very long, but we’ll look at the pricing chart of gold for data and factual guidance, as to where we are in this PM cycle.

We keep hearing trite statements like “This is the worst sentiment I can remember in the PM sector,” almost ever year, even as recently as last December 2024.

These people proclaiming this forget just how dire things were back in late 2015; (when gold did end it’s bear market and started the new bull market).

—> I sure haven’t forgotten… That was the worst sentiment. Period.

• Unlike the environment over the last few years; back then at $1,200 - $1,045 gold prices, the vast majority of gold producers and gold development projects were uneconomic and had no real pathway forward.

• To add insult to injury, many technicians were calling for $900 gold or even $600 gold, and the “pet rock” and “barbarous relic” comments were relentless from the haters of the yellow metal.

• Well, gold has come a long way since then baby…. It has been quite telling that we no longer hear or read comments about gold’s “lack of utility” or that it is a “barbarous relic” as it has kept making new all-time highs for the last couple years.

• There has been record central bank buying all over the globe. Clearly they are not hording it as the #2 asset on their balance sheets (right behind US dollars) because they feel it is a “pet rock.”

• Now with gold at record all-time highs, and silver, and PM stocks starting to respond, we are at a much different point in the cycle than we were coming into 2016. It is obviously not the first few innings, but the game is far from over.

• Most ounces in the ground are still at historically low valuations, and those in-situ reserves for producers, or estimated resources for developers still have a long way to go with compelling value propositions. Those are the types of companies we have been exploring in this channel, and we will continue to do so.

• As noted previously, we are clearly not in the final stages of the euphoria or the mania stage of of the bull market, and if anything we have merely transitioned from the (Hope) and (Relief) phases and have only recently been moving into legitimate (Optimism).

• We still have ways to go before we see (Excitement) (Thrill) and (Euphoria), so buying companies with future torque into their corrections and pullbacks will still be my preferred strategy.

Thanks for reading and may you have prosperity in your trading and in life!

Shad