I Sold My JDST Position This Morning

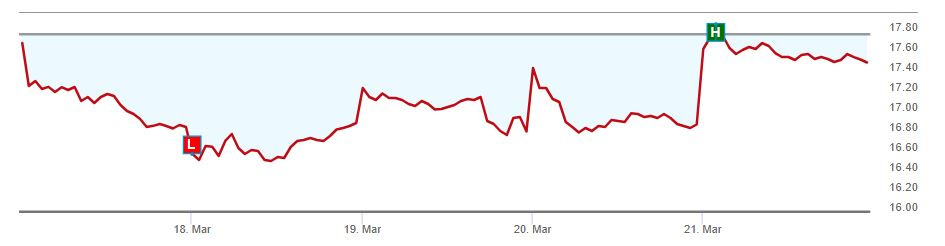

Just a quick heads up, that I mentioned taking out a small position in Direxion Shares ETF Daily Jr Gold Miners Index Bear 2X (NYSE: JDST) last Wednesday March 19th.

In this morning’s trading I just sold my JDST for a tiny profit.

The gold future’s price looks energetic this morning in the $3054 -$3066 range, and this could encourage some buying in the gold equities.

I feel the potential for an upside surprise is still there bubbling under the surface with such a strong gold price, and don’t feel like being short the gold equities today.

Just passing along this quick trading update, as I’m out in the green on the JDST position. This may be premature to sell it, but I’m not going to get hurt on the trade moving against me either. The PM markets can always get that Monday morning monkey-hammer down as things progress, where it would be better to keep the position on, but the resilience of the gold price is stronger than I was expecting.

I would have thought the gold futures price would have struggled more in the $3,000 area than it did last week or coming into this week. When the gold price approached the $1,000 and $2,000 round price levels in the past there was more market trading friction.

I was anticipating more of a break in the yellow metal’s advance last week and a move back into the upper $2900s to cool off for a bit, but it is staying well bid about $30-$60 above the $3,000 mark. With gold pricing showing more strength than anticipated, it’s not as attractive for shorting the gold equities at present.

That’s it - just a quick note that I’m closing the loop on this trade. If things look like they could be turning lower in severe fashion, then I can always put the JDST trade right back on again. For now, I want to see how this week starts to unfold first.

May you have prosperity in your trading and in life!

Shad