Gold Tags $3,100 – Silver To New Recent Highs - GDX Close To Breaking Out

Excelsior Prosperity w/ Shad Marquitz (03-27-2025)

Well, it was another glorious day in the precious metals sector. PMs were breaking up higher, but it is important to also note that many futures contracts rolled over today on Thursday March 27th.

As a result, many platforms (like Yahoo Finance, Investing.com, and Bloomberg) rolled over to the June gold futures contract today, (but unfortunately Stockcharts did not make the switch yet and is stuck on the March contract still… I’ve noticed sometimes it is a laggard).

This can confuse investors seeing different prices displayed on different platforms. Then if people look at spot prices there is an even larger delta, and it’s hard to know “What is the gold price anyway?”

For better or worse, most of the trading universe does not use spot, (which is more relevant for purchasing physical metals from dealers). Most of the trading universe uses the futures contract. The accepted best practice is to use the forward months futures contracts, and that is why now that March is essentially over, that most platforms have switched over to the June contract.

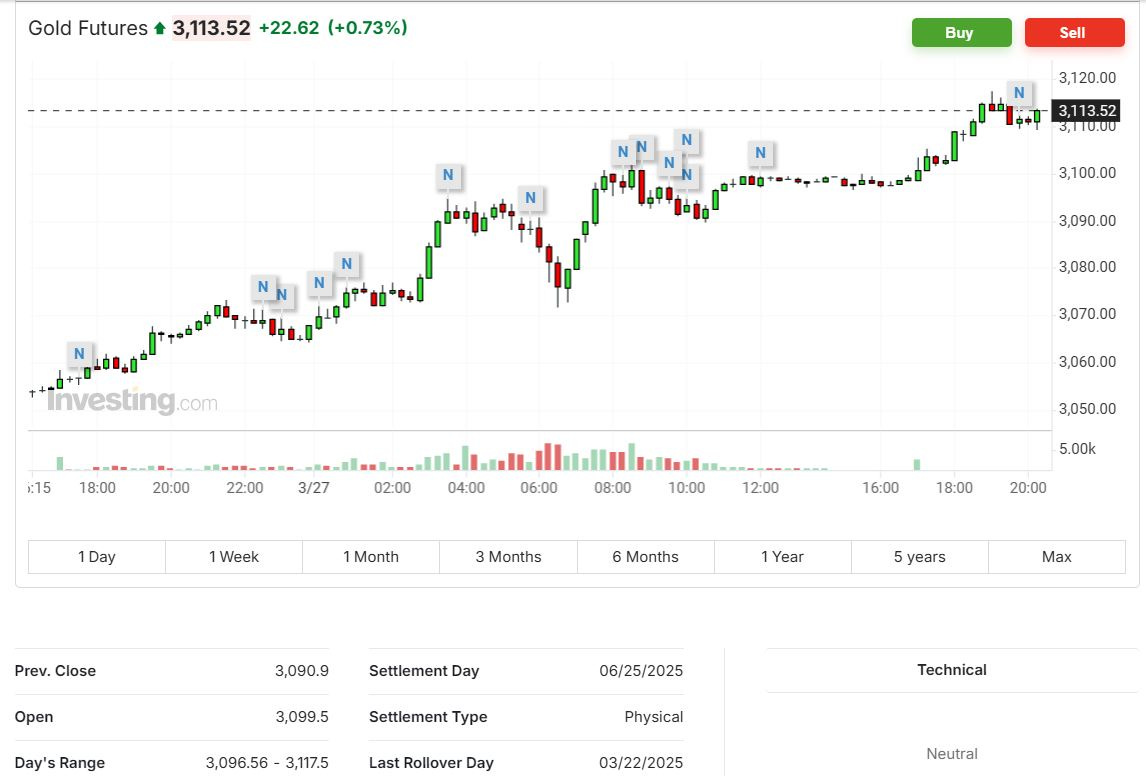

The June gold futures contract pierced the $3,100 level this afternoon so I’m posting the chart below from Investing.com.

(It’s at $3,113.52 at the time of this writing… Yes, it’s up at another all-time high!).

The close on Thursday’s regular trading session was at $3,090.90 which was also another all-time daily closing high.

I really hope Stockcharts migrates over to the June contract for Friday’s close, as we should be ending this week with a bang in the yellow metal.

Also consider that Monday is not just the end of March for the monthly close, but it is also the end of Q1, for what is setting up to be the biggest quarterly close on record.

Silver was in a similar situation making a new recent daily closing high today on March 27th at $35.08 (which was one penny higher than the October 2024 peak at $35.07). Yes, that technically still counts…

As of the time of this writing silver front month futures are trading at $35.24

I’m hoping we’ll see these prices carry over to tomorrow’s trading, and that we don’t see an overnight / early-morning monkey-hammer down in the price (as is all too common).

So with the metals continuing to break up to new levels, it is curious and yet somewhat frustrating that some of these ETFs can’t seem to kick it in gear in a bigger way.

If we look at where the GDX closed today at $45.76, it was 2 pennies lower than the August 2020 peak at $45.78.

I’ll be watching to see if GDX can “break out” of that rounded bottom, saucer-shaped pattern and get above that neckline at $45.78 to make a new daily/weekly closing high on Friday. It did break up to $45.90 intraday, so it’s still quite probable.

I mean, come on already! Gold is $1,000 higher than that prior post-pandemic-crash rally, and the industry margins are as fat as they’ve ever been, making the miners more profitable than they’ve ever been. Get on that horse and ride gold miners!

Why in the world is the GDX is not well above it’s 2011 all-time high at $66.98?

Gold is now well over $3,000 and yet the senior gold mining stocks making up GDX are still nowhere close to even making higher levels than back when gold made it up to $1,923 about 14 years ago. (and again it has nothing to do with margins, as they are substantially larger today than they were back in 2011).

Yes, there are some stocks that are at 52-week highs or all-time highs, but clearly it is not the broader group of stocks represented in the GDX. Maybe there should be someone else handling the weighting and composite of stocks inside of the GDX as it could look much different if the quality companies with low costs like Agnico Eagle, Lundin Gold, Kinross, Dundee Precious Metals, or Alamos Gold were weighted higher, and sector laggards like Newmont and Barrick were throttled down some. Just sayin’…

Let’s have a look at GDXJ chart:

The GDXJ would need to need to more than triple from where it closed today at $57.46 to get back up to that spike high in late 2010 up to $179.44.

Come on gold mid-tiers and small producers…. Let’s go!!

I’m not going to belabor the point any further… From a historical standpoint, the precious metals are doing fantastic, but the miners… meh… not so much. For this reason, it still seems like a massive catchup trade is possible in the PM equities. Let’s see where things close the week…

Thanks for reading and may you have prosperity in your trading and in life!

· Shad