Gold Heads To All-Time Highs, Gold Stocks Are Responding, Silver Is Acting Constructive

Excelsior Prosperity w/ Shad Marquitz 02-10-2025

This article is going to be a mash-up of key precious metals price action trends, thoughts on gold and silver from key KER interviews from this last week. It will also encapsulate a few broad reflections swirling around my mind on resource investing; after having just been at the World Outreach Conference in Vancouver; talking to fellow investors and resource companies and listening to keynote lectures over the weekend on Friday night and all day Saturday. (There will be more to say on that event in an upcoming mid-week update).

In general, most resource investors in private conversations, in public-facing interviews, and those folks barreling through the conference circuits are still mostly jacked up on the action in gold, and rightly so… with a typical honorable mention for silver. There has been very little interest in other commodity stocks like copper, uranium, and oil/gas stocks, but this may be presenting an opportunity for investors that pay attention to the quality companies in unloved segments of the market. There will be more to say on these other commodities in an upcoming update article on these other sectors, so stay tuned…

We have a lot to cover in this article just on the precious metals, and we’ll also bounce around to a few other thought leaders in the sector to get their perspectives.

So, let’s get into it…

As usual, we’ll kick things off with a daily chart of the monetary metal, Gold:

Once again, (and I hope people don’t tire of this trend), gold put in some more all-time highs on the chart.

This last week we saw the highest daily close on Wednesday February 5th at $2,893 (after going up and tagging $2,906 intraday).

Gold then proceeded to go up and make an even higher intraday level and all-time high in the yellow metal on Friday up to $2,910.60.

Pricing pulled back down to close on Friday at $2,887.60, which was an all-time high on the weekly chart.

What a strong week for gold – the first blast above $2,900 in history, the highest intraday level, the highest daily close, and the highest weekly close. That’s strong…

As a last minute update here is the 5 minute chart from overnight trading and Gold went up and tagged $2,929.49… as of the moment of writing these words. It is a fluid situation and happening in overseas trading, so at this point not really on the table in North American markets, but the key takeaway is that gold is continuing to plow up to new all-time highs once again…

To be clear, when we are seeing these new all-time highs in gold, this yellow metal isn’t doing anything specific…. it’s on the elemental table for goodness sakes. One ounce of gold never changes. What is on display, for the whole world to see, is the erosion in purchasing power of the fiat currencies. It now takes more and more of all the global currencies to buy just one ounce of gold, and so pricing goes up.

What is really happening is the value in fiat purchasing power continuing to go down over years and years. This is an insidious process which makes the most financially vulnerable segments of society suffer. Hopefully more citizens of each country will start considering this shift in thinking as to where the cost of living and price increase issues really are coming from, and the challenges in putting one’s faith in fiat, and the longer-term value of gold as a store of value. This same process is playing out in all the large global currencies, as they are all in a race to the bottom.

With that backdrop in mind, it is easy to understand why so many investors are becoming more and more captivated by gold’s role in diversifying their portfolio. It is a way to stem the bleeding from the loss of fiat purchasing power, as much as it is a hedge against financial and geopolitical uncertainty. Even if one decides to discard the rationale for why gold keeps moving higher, and strictly focus on the pricing moves on the chart; then it has been a technically strong momentum play for the last 2+ years; ever since the intermediate low at $1618,30 on Nov 3rd, 2022.

Most of the quality gold equities have been responding, from seniors to juniors, although it still hasn’t been a “rising tide lifting all boats” scenario.

What we have seen though, is that the quality lower-cost gold producers with growing production metrics have been ratcheting higher (some to new 52-week highs and a few to new all-time highs). In contrast, some of the higher cost producers with slipping production metrics have been more muted, disappointing in prior earnings quarters.

Sometimes PM stock investors miss the forest for the trees, getting tunnel-vision on only Newmont and Barrick, or the GDX. Or maybe some of their pet junior stocks haven’t moved much… yet.

Since both Newmont and Barrick are very heavily weighted in the GDX, it can give drive-by observers a certain impression that the gold stocks are just not responding to the higher moves in the precious metals.

However, if one looks at the best run companies with lower costs and higher margins then the PM producers have been doing great. Documentation often beats conversation…

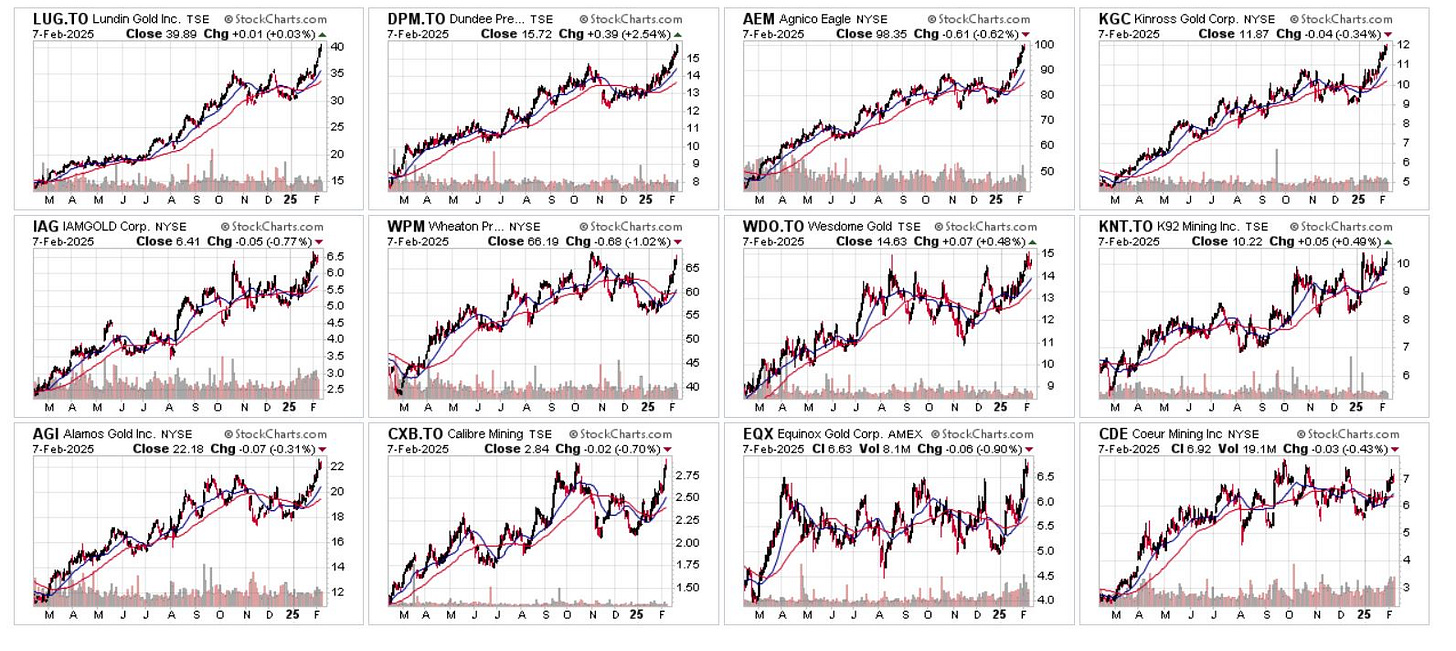

Here are a dirty dozen PM producers, that have been ripping higher over the last year, just as an example of stocks making solid runs.

There are plenty of PM junior stocks that have also been running hard over the last year, and we’ll continue to see more of them take a similar trajectory to the moves we’ve just seen from the quality producers. In bull markets the producers make the turn and run higher first, then the higher cost producers and developers start to play catch up as optionality plays to rising metals. The junior explorers will always be “lit matches,” that burn very brightly when a discovery is made.

Many of the better-known tier 1 developers, with solid ounces in the ground have been rewarded with shareprice appreciation, but only if they have a strong marketing presence and access to capital through activist or strategic shareholders. They need to tell their story and have the funds to execute.

The tier 2 and tier 3 developers with reasonable ounces in the ground, but that are failing to convey their value proposition to investors in a compelling way, or that aren’t getting that influx of new investment capital from vocal high-net-worth investors or larger producing companies as strategic investors, are not seeing as much pricing response.

Investors that assumed any penny stock dreadful with gold in their name (but not meaningful deposits yet defined in the ground) would simply scorch higher just because gold has moved higher have been sorely mistaken the last few years. True discoveries are still being rewarded though.

What we can say is that overall “quality” has been outperforming “optionality” thus far in this cycle the last couple years.

However, many experts believe we are entering the next phase of this bull market where “even the turkeys will fly.”

This means that a number of companies that are higher cost producers, or developers, that have done good work defining solid ounces in the ground on tier 2 and tier 3 deposits, will start catching up as the laggard trades.

The next 12-18 months will likely be the period when the “optionality” bets pay off in a bigger way. Precious metals companies will continue getting that outperformance leverage because of how much more their margins or project economics will improve on a percentage basis.

The most impactful interview for me personally last week, over at the KE Report, was with Christopher Aaron, Founder of iGold Advisor and Senior Editor at the Gold Eagle website. Over the years, Christopher has been bullish on the PMs, but still measured and with the note of caution of waiting to see how the DOW:Gold ratio will resolve: either in favor of US equities or in favor of gold. A few articles back, when discussing the VRIC conference, I pointed out how he was really one of the only speakers there at least entertaining the possibility of a contrarian viewpoint.

In the form of this update, he has considered the data coming in during January and thus far in February, and sees it as highly constructive. He believes that it is looking more and more like things could be breaking in favor of gold for the longer-term. Regardless, there is at least enough technical momentum setting up on longer term charts to see one more blow-off 5th wave higher in this 9+ year bull market over the next 1-2 years. Christopher was in RARE FORM in our conversation the end of last week. This is the most bullish I’ve ever heard him in years, and it is a “must listen” episode.

Christopher Aaron – The Precious Metals Sector – This is It and IT IS NOW

Here are the accompanying charts that go along with Christopher’s interview:

For people that want to follow Christopher’s analysis, please check out his site at iGold Advisor:

On our KE Report weekend show, we featured Jordan Roy-Byrne, CMT, MFTA, Editor of The Daily Gold, who discussed his new book, “Gold & Silver – The Greatest Bull Market Has Begun – A Once In A Lifetime Investment Opportunity”. We discuss the main drivers behind the gold price, silver’s outlook, and how he sees gold stocks performing over the next 10-15 years. He brings up the potential of $20,000 gold and $1,000 silver in a strong secular bull, and he is not prone hyperbolic statements or calling for outrageous price targets, so it is hard-hitting commentary coming from a solid technician. {This is also the most bullish I’ve ever heard Jordan after following his work and speaking with him for many years.}

Weekend Show – Rick Bensignor & Jordan Roy-Byrne – How Stable Are US Markets? How High Can Gold & Gold Stocks Go?

(this should hotlink listeners to the 2nd half of the episode for Jordan’s interview)

A third conversation that really sticks out to me from last week, out of the various guests we speak with over at the KE Report, was with Nick Hodge, Co-Owner of Digest Publishing and editor of Foundational Profits and Hodge Family Office. Nick joined us for a longer-format discussion on and the macro and micro themes that feed into investing in precious metals equities. We cover gold, silver, platinum, and palladium stocks and Nick shares a number of stocks he is animated by in each category.

Nick Hodge – Investment Themes In Gold, Silver, Platinum, and Palladium Resource Stocks

We start off with some higher-level observations on the recent market volatility from the Trump tariffs, DeepSeek impacts to the tech sector, and breakout to all-time highs in gold as investors diversify some out of the uncertainty. Within the gold and silver equities we note the expanded participation from the juniors, and discuss topics like jurisdiction, permitting, bringing in strategic partnerships at both the project and equity level, merger and acquisition transactions, and the revaluation of ounces in the ground. Nick explains why it is finally the time to start considering quality silver, platinum, and palladium stocks at this point in the market cycle.

As a heads up to readers here: Nick Hodge and Gerardo Del Real are holding a FREE informational webinar about investing via private placement, or "Direct Investing."

Event Title: "Direct Investing: Buying Shares Privately."

Event Time: Wednesday, February 12th, 12pm ET

Registration Link: https://bit.ly/4jQtYU9

You’re buying shares the wrong way. Time to start direct investing.

When and how to purchase these shares directly from companies; How you can qualify to do so; and Our track record investing this way, including prior examples.

Christopher, Jordan, and Nick all brought up silver as an improving asset class, where they felt it could and should start outperforming gold. We should see a catchup rally in silver, along with the PM equities, that will provide some of the leverage investors have been looking for relative to gold.

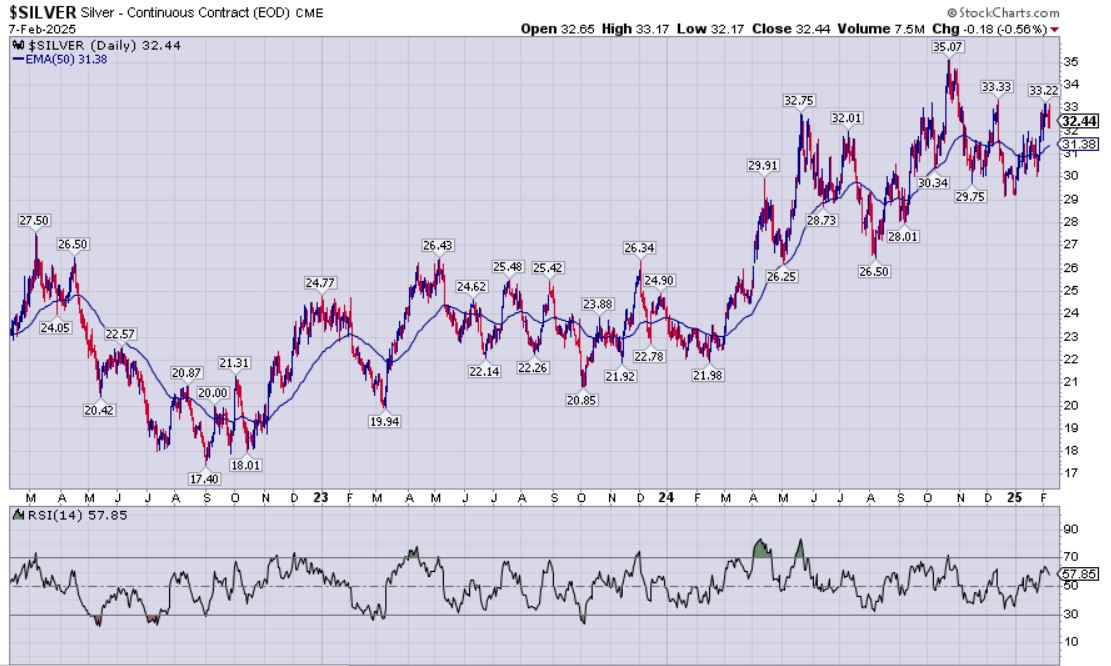

Let’s have a look at Silver technically on the daily chart:

Silver has been in a gradual uptrend since putting in it’s intermediate bottom at $17.40 in September of 2022. It has essentially doubled in price and put in a recent peak just 4 months ago at $35.07 in October of 2024.

Silver futures prices closed at $32.44 last week on Friday, which was still in a somewhat bullish posture above the 50-day Exponential Moving Average (EMA).

Silver likes to whipsaw above and below the 50-day EMA, but doesn’t respect it as support as often as the gold futures price does on its respective chart. Still, this 50-day EMA level has been gradually sloping higher and so seeing the pricing above it is encouraging in the short-term.

Silver has been essentially channeling sideways since the middle of last year starting in May 2024 around $32.75, and hanging out mostly in the $29-$33 range for the last 9 months.

At the time of writing this silver futures are at $32.72 early in the morning on February 10th. It can feel like time is standing still, as silver hasn’t made the big progress that gold has, but it is backing and filling and has retested the base it has built here on either side of $30; likely getting ready for a larger move higher.

If gold keeps trekking higher, then most analysts and technicians believe that will drag silver back higher, along with it.

The RSI has mostly been in neutral territory for the last 9 months; since peaking out in May of last year, and closed last Friday at a reading of 57.85.

Near-term resistance will be lateral pricing resistance at those 2 recent peaks at $33.33 and $33.22. After that, the May peak at $35.07 will be the next line in the sand to cross definitively, on a daily and weekly closing basis.

I think we’ll wrap it up there for today on the precious metals sector, and we’ll get an update soon on how some of the other commodities are faring like copper, oil, natural gas, and uranium, and their related resource stocks.

Thanks for reading and may you have prosperity in your trading and in life!

Shad