Gold And Gold Stocks Update – The Eye Of The Storm

Excelsior Prosperity w/ Shad Marquitz – 12-07-2024

According to Wikipedia, the eye of the storm, is “a region of mostly calm weather at the center of a tropical cyclone (or hurricane).” This seems like an appropriate analogy to where we are in the gold sector in the here and now.

After a few years chock full of tailwinds blowing at the back of gold, we’ve seen it move from the false breakdown low of $1618.30 in November of 2022 (just over 2 years ago), to be followed by a gusty move higher adding almost $1,200 to that price getting up to the recent peak of $2801.80. The yellow monetary metal has seen quite a bullish storm indeed!

Gold has been back in vogue with the combination of central bank buying, geopolitical buying, a piling in of safe-haven investors in the East, and finally the momentum investors in the West joining in the movement.

The odd part about this mega-rally is that it blasted to all-time highs with very little fanfare or even much acknowledgment in the mainstream financial media. Part of the reason so few generalists noticed is that we’ve seen a corresponding melt-up rally to new all-time highs the last couple years in US equities, the cryptocurrencies, real estate, and really most asset classes; (barring some of the commodities, cannabis stocks, or solar stocks).

Ever since gold peaked out above $2,800, and silver peaked out above $35, in late October, the precious metals sector has rolled over. The corrective move really hit the brakes on investor sentiment, and the sector has gone eerily quiet. It has not been a harsh or damaging crash lower, but really more of a healthy consolidation – the calm in the middle of the storm…

So, if we see this pullback and consolidation of the big move last even longer, then where are some good support levels to expect buying to come back in?

Gold futures prices that closed on Friday at $2,659.60 have been flirting with the 50-day Exponential Moving Average (EMA), which is currently at $2,652.91. Below that there is the Fibonacci support at the 144-day EMA {which is very close to the 21-week, or 147-day support some technicians track}, currently at $2,535.13. Then the last line-in-the-sand support to keep a short-term bullish posture is at the 200-day EMA, currently at $2,466.76. The technical reality is that even if gold were to drop $100-$200 but still stay above the 200-day EMA at $2,647, then it would just be essentially taking a breather in a pattern that remains in a bullish posture. At this point there doesn’t seem to be any cause for alarm, but it needs to be monitored closely.

Currently, the overbought/oversold RSI signal is very neutral at right near 50 (49.52 on Friday to be exact), which lends even more credence to this backdrop of the calm in the eye of the storm.

Earlier this week at the KE Report we had a good discussion with our friend and colleague, Craig Hemke; where he weighed in on what the next potential fundamental macroeconomic catalysts could be the next factors to move the gold and silver prices. This episode covers the current sideways momentum affecting precious metals, impacted by both seasonal patterns and broader market sentiment.

Craig shares his insights on how the dollar index and euro movements are influencing gold prices, and what this means for precious metals investors. We also dive into the performance of mining shares, the importance of ETF investments versus individual stock picking, and the challenges and opportunities within the sector. Additionally, we speculate on potential economic and political factors that could change the narrative for precious metals as we approach 2025.

Craig Hemke - Gold & Silver Analysis: Catalysts That Will Determine The Next Move In Metals Prices - December 2, 2024

Moving along to gold equities, we can see by looking at last few years of price action on the VanEck Vectors Gold Miners ETF (GDX) that pricing likewise bottomed in late 2022 at $20.82; more in line with when silver bottomed in September of that year. As we’ve noted in this channel previously, GDX and the gold stocks as a group, often track the movements in silver much more so than gold. It is not a surprise to have seen GDX track silver’s movement by also more than doubling up to $44.22 by late October, just over 6 weeks ago.

Since then the gold stocks have rolled over much harder than the gold price, but even then haven’t totally fallen out of bed into a bearish posture. Yes, the close on Friday to end the week at $36.82 remained below the 50-day EMA (currently at $38.47), and has been mostly bouncing around on either side of the 144-day EMA (currently at $37.28). However, other than a very brief dip below the 200-day EMA (currently at $36.29) in mid-November, the GDX price has mostly stayed above that support level, remaining in a muted bullish posture.

Now if we see pricing dip below the 200-day EMA and stay there for days or weeks, then the posture will have shifted to bearish, but we aren’t at that point yet. So, for the time being, the bulls are still mildly in control; digesting the big surge higher off the $25.67 low in late February of this year to surge up to over $44. It makes sense to see a healthy consolidation after a move higher that was so strong. While this downward action is more concerning than what we saw in gold’s corrective move over the last month and half, the GDX still could be well within the calming lackluster winds in the eye of the storm.

Earlier this week on December 3rd, over at the KE Report, Dave Erfle, Editor of the Junior Miner Junky, joined us to discuss the recent trends in gold, silver and the underlying PM stocks. Despite a lackluster past month and a half for gold and silver stocks, Tuesday’s rebound was showing promise. Dave provided an in-depth analysis of the recent price movements, the significant role of geopolitical events, and prevailing investment narratives. We discussed the consolidation patterns in gold and silver prices, and the critical levels needed to confirm a bullish uptrend. Additionally, we explored how AI and crypto are drawing speculative investment away from junior miners. We also asked Dave about the small silver miners which have not seen the inflow of money some of the bulls expected.

Dave Erfle - Gold & Silver Analysis: Gold Stocks & Silver Leading, Upside Targets For GDX and GDXJ

Then closing up with week on Friday December 6th, I had an engaging discussion with my friend and colleague, Robert Sinn (aka Goldfinger on CEO.ca and CeoTechnican on X) and publisher of Goldfinger Capital on YouTube and Substack, joins me to share his pricing and sentiment reflections on gold, silver, copper this year, and the opportunities in related resource stocks that we are seeing in tax loss selling silly season. We start off discussing the corrective move in the precious metals that we’ve seen in since they peaked out in October, and how this has affected pricing trends in PM mining stocks and thus sector sentiment.

This is a longer-format conversation with Robert that really covers a lot of ground. We get into the overall good year that gold, silver, and copper have had, and the profitability of the metal’s producers, but also contrasted across a fair bit of negativity towards the overall junior mining stocks. We discuss the Newmont earnings miss as one of the triggers of the correction; as the largest and most followed gold stock, but also with an outsized weighting and effect on the GDX.

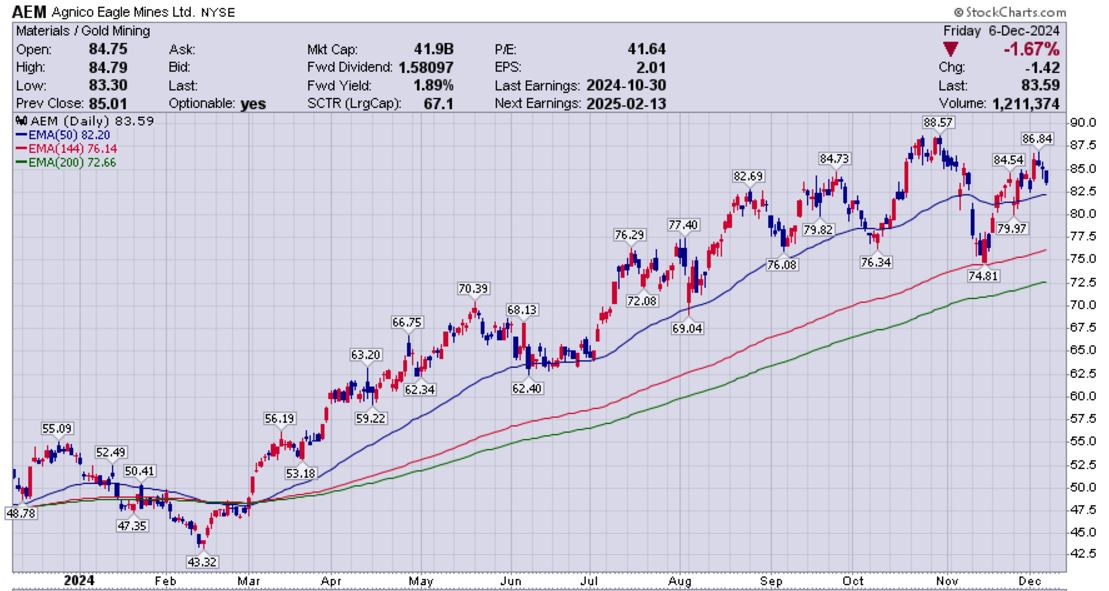

Then we compare that muted to negative reaction with some of the other larger gold producers that in contrast have had much more constructive fundamental results and pricing charts, like Kinross, Agnico Eagle, IAMGold, Wesdome, and Alamos Gold.

Rounding it out, we get into investor psychology around trading during pullbacks, the recurring seasonality of tax loss selling, and some of the opportunities that Robert see’s at present. He also highlights the fundamental value proposition of 2 specific companies he is animated by in Barksdale Resources Corp. (TSXV: BRO) (OTCQX: BRKCF) and Endurance Gold Corp. (TSXV: EDG) (OTC Pink: ENDGF).

Robert Sinn – Sentiment Swings And Resource Stock Opportunities In Tax Loss Selling Silly Season

That wraps us up for this update on gold and the gold stocks, but we’ll continue to analyze more opportunities in individual companies in our series on opportunities in growth-oriented gold producers, opportunities in gold explorers and developers, and the series on mergers and acquisitions. We’ll also do the same thing in the silver, uranium, and copper stocks in coming future articles, so stay tuned for more tantalizing trade ideas and value arbitrage setups as we continue to trudge our way through this bull market.

Thanks for reading and may you have prosperity in your trading and in life!

Shad