Flash Update: Nuclear Stocks and Uranium Stocks Got Crushed Today – Here’s Why:

Excelsior Prosperity w/ Shad Marquitz (01-27-2025)

Anybody with exposure to nuclear stocks or uranium stocks knows they were absolutely crushed today, on January 27th, 2025.

Sprott Uranium Miners ETF (NYSE: URNM) – closed down -10.3%

Sprott Junior Uranium Miners ETF (Nasdaq: URNJ) – closed down -10.8%

Global X Uranium ETF (NYSE: URA) – closed down -11.2%

The largest North American uranium producer, and sector bellwether, Cameco Corp (NYSE: CCJ) - closed down -15.1%

The US uranium producers also got hit today:

Uranium Energy Corp (NYSE American: UEC) – closed down -11.7%

Energy Fuels Inc (NYSE American: UUUU) – closed down -9.5%

enCore Energy Corp. (NASDAQ: EU) – closed down -8.15%

Ur-Energy Inc. (NYSE American:URG) – closed down -12.7%

Peninsula Energy Limited (OTCQB:PENMF) – closed down -10%

The larger uranium developers were also slammed down today:

Denison Mines Corp. (NYSE American: DNN) – closed down -14.5%

NexGen Energy Ltd. (NYSE: NXE) – closed down -15.9%

IsoEnergy Ltd. (OTCQX: ISENF) – closed down -9.95%

One contributing factor for the selloff in uranium stocks today was the news out of the largest uranium producer, Kazakhstan’s state run Kazatomprom, where they had improved 2025 production guidance while reporting their year-end operations.

Kazatomprom 4Q24 Operations, Trading and JV Inkai Production Update

- January 27, 2025

https://www.kazatomprom.kz/en/media/view/4q24_operations_trading_and_jv_inkai_production_update

“As of the publication date of this report, JV Inkai LLP has resolved the approval issue and has resumed its mining operations at block No. 1 of Inkai deposit. Potential impact of JV Inkai’s production suspension on Kazatomprom’s 2025 production plans is currently being assessed.”

“Kazatomprom remains fully committed to fulfilling contractual obligations towards all existing customers and has sufficient level of inventories to comfortably manage its deliveries throughout 2025.”

“Kazatomprom’s 2024 production results were within the guided ranges. Production volumes on a 100% basis and on attributable basis were slightly higher throughout 2024 compared to 2023 due to an increase in the production plan in accordance with the commitments under the Subsoil Use Agreements.”

“Kazatomprom’s 2025 uranium production volume is expected to be in the range of 25,000 – 26,500 tU” (compared to 2024’s uranium production of 23,270 tU)

While this improved production picture from Kazatomprom is a net negative for uranium prices and the sector, it doesn’t really explain the extreme price drops we saw across the board in uranium stocks. It’s not that much production growth, and doesn’t fix the supply deficit for the coming year.

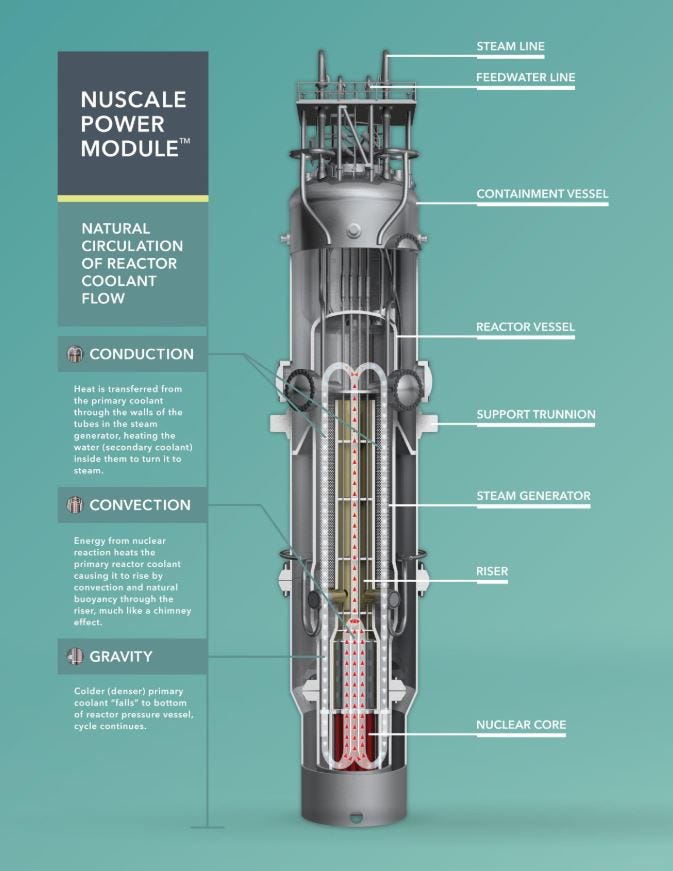

When we look at the small modular reactor (SMR) stocks , they were really monkey-hammered down the hardest into the close. If anything, lower uranium prices and more U308 supply should be a net positive for the SMRs, but they were all down over 25% today. It was clear earlier on this morning that something else was going on today in the markets.

NuScale Power Corporation (NYSE: SMR) – closed down -27.5%

Nano Nuclear Energy Inc (NYSE: NNE) – closed down -25.3%

Oklo Inc (NYSE: OKLO) – closed down -25.6%

The diversified Range Nuclear Renaissance Index ETF (NYSE: NUKZ) – closed down -13.6%

This is a newer ETF just launched in January of 2024, and is really more geared to the North American buildout of both traditional nuclear reactors and SMR reactors, but still has meaningful exposure to utility companies using nuclear power and uranium mining and enrichment companies.

Top 10 holdings: Cameco Corp (CCJ), Oklo Inc Class A Shares (OKLO), Constellation Energy Corp (CEG), NuScale Power Corp Class A (SMR), Centrus Energy Corp Class A (LEU), GE Vernova Inc (GEV), Vistra Corp (VST), Silex Systems Ltd, Shanghai Electric Group Co Ltd Class H, Honeywell International Inc (HON)

The VanEck Uranium+Nuclear Energy ETF (NYSE: NLR) – closed down -11.1%

This is the most established and highly liquid nuclear ETF in the market, with a fairly balanced mix of holdings but most heavily weighted to utility companies, energy and nuclear fuel enrichment companies, uranium companies, and with some exposure to both traditional and SMR reactor builders.

The top 10 holdings are: Public Service Enterprise Group Inc (PEG), Constellation Energy Corp (CEG), Pg&E Corp (PCG) Cameco Corp (CCJ), Bwx Technologies Inc (BWXT), Endesa Sa (ELE.SM), Cez (CEZ.CP), Cgn Power Co Ltd (1816.HK), Fortum Oyj (FORTUM.FH), Nac Kazatomprom Jsc (KAP.LI), and Oklo Inc (OKLO).

Sure, these ETFs have exposure to uranium miners, but they also have exposure to utility companies and manufacturers of nuclear reactor technology, so again, lower uranium prices and more supply from Kazatomprom should have been good news, and not a selling event for many of those stocks in these ETFS. So what gives?

Well, it didn’t take long for the panicked financial reports to start rolling in today on why the Artificial Intelligence (A.I.) stocks and chip makers were also tanking….

DeepSeek, the Chinese AI platform is said to rival US-based mega-cap tech companies AI platforms, but at a much less expensive $6 million development cost. It is a true disruptive technology that made huge market waves today…

Anybody with exposure to NVIDIA Corp (Nasdaq: NVDA) got spanked hard today, with the leader of the semiconductor chip makers and one of the Magnificent 7 closing down -16.97%. There were market concerns that Nvidia chips may now be in less demand, with DeepSeek flipping the A.I. script.

Nvidia was not alone…

Oracle Corp (NYSE: ORCL) – closed down -13.79%

Super Micro Computer Inc (Nasdaq: SMCI) – closed down -12.62%

VanEck Semiconductor ETF (SMH) - closed down -9.83%

Stock Market News, Jan. 27, 2025: Nvidia Stock Sinks in AI Rout Sparked by China's DeepSeek

Wall Street Journal - Jan. 27, 2025

“Technology stocks tumbled Monday on news that China’s DeepSeek had trained a sophisticated artificial-intelligence model at a fraction of the cost of its Silicon Valley rivals, triggering a sudden reversal of the recent AI rally.”

“Nvidia, whose chips have been used to power many of the leading AI models, sank 17%. The move wiped out more than $590 billion from the company’s market value and tarnished one of the stock market’s brightest stars.”

https://www.wsj.com/livecoverage/stock-market-today-dow-sp500-nasdaq-live-01-27-2025

Stocks en route to a $1 Trillion+ loss at market open

Thomas Monteiro – Investing.com - 01/27/2025

“The financial world awoke this morning to find US stocks en route to a more than $1 trillion wipeout at market open. The upheaval followed news that Chinese artificial intelligence (AI) startup DeepSeek's latest model has developed a cost-effective, high-performing solution to AI processing, calling into question the rich valuations of high-flying AI tech companies.”

So you see, with the future of A.I. up for debate, there was a whirlwind of market reactions in the wake of the realization that DeepSeek could unseat domestic tech companies. This also impacted the future anticipated buildout of domestic A.I. datacenters. As a spillover effect, there were ramifications in the potential impact to expected electricity demand… and yes, this hit nuclear power square on the nose.

This is why the 3 most followed small modular reactor stocks were down over 25% today even though improved uranium supply should be a positive.

This is also why utilities like Constellation Energy Corp (Nasdaq: CEG) got hit by over 20% in massive corrections today. (less expected electricity demand)

Even energy-technology companies and enrichers like BWX Technologies Inc (NYSE: BWXT) closed down -12.68% today.

With SMRs, Utilities, and nuclear reactor builders all getting smashed today, this bled over into the aforementioned ETFs like (NLR) and (NUKZ), which then hit the uranium stocks held in those exchange-traded funds. As those uranium stocks got hit in those ETFs, it caused sympathetic selling in other ETFs like (URNM) and (URNJ), which then created a “selling begets more selling” situation in the uranium stocks across the board. It was a compounded fly-wheel effect of selling pressure.

While some uranium investors blamed the whole sell-off in uranium stocks on the improved supply picture from Kazatomprom, we can see that it was actually a perfect storm of contributing factors.

Clearly the prime market mover today was the DeepSeek factor seeming to crush the A.I. revolution in a single morning. As the wind came out of the A.I. trade, it spilled over into the utility and nuclear stocks, then the nuclear ETFs, and then the uranium ETFs…

I reached out to a handful of generalist and technical traders I respect, and they agreed that DeepSeek was the culprit, but that it really did seem like a huge market tantrum and overreaction on the whole.

As the old adage so wisely states: “One day doesn’t make a market.”

We’ll need to see what kind of follow through we see tomorrow and for the balance of this week, and if there is a return to the mean in many different affected sectors.

Personally, I trimmed back some positions in a few royalty companies today, and raised cash to add a little to some of my uranium stock positions like Energy Fuels, UEC, Ur-Energy, enCore Energy, and Denison Mines into the carnage.

Mercifully I had already pulled profits in my NuScale Power and Oklo positions back in Q4 of last year, and I have been waiting for an opportunity to get back into positions on a pullback; thinking they had become a bit technically overbought. With the shellacking they took today, I’m very curious about how the technical picture will unfold in the near-term, and will be looking for opportunities to poach the SMR stocks as they are being thrown out with the A.I. bathwater.

It is also significant that the chip stocks, A.I. stocks, and a number of large US tech stocks had such an upheaval day to kick off this week. This was one of those significant days in the market, that we may very well be pointing back to down the road as a “tipping point.” If nothing else, it was a very volatile day in the markets, and hence this flash report being sent out to readers here.

Let’s see how the rest of this week settles out, and if we get continuation patterns to the downside, snapback rallies to the upside, or whipsaw tug-of-war trading from here on out. We’ll regroup after the weekly closes to assess how things shake out.

Thanks for reading and may you have prosperity in your trading and in life!

- Shad