Embracing Volatility Part 3 – Hitting The Bid As Critical Minerals Stocks Pull Back

Excelsior Prosperity w/ Shad Marquitz (10-28-2025)

We’re back with yet another technical and fundamental update on the select areas of the critical minerals sector. This article will focus in on even more potential emerging trading opportunities that are showing up in these associated resource stocks. We’ve seen blistering moves higher all year in critical minerals stocks, but then over the last few weeks corrective moves and the inevitable market pullbacks came for the rare earths, antimony, tungsten, and uranium stocks. This is actually a good time to embrace any extreme volatility looking for places to accumulate stocks in ones portfolio, or to initiate new positions.

Sudden drops lower in previously trending sectors, and shrinking valuations across the board are a great time to look for compelling risk/reward opportunities. When all the stocks in a given sector get hit by profit taking or souring sentiment, and then eventual distribution by the masses and momentum traders exiting; then it can be an opportune time pay attention and strike if one feels the setup is more advantageous.

We’ve been discussing this same topic in the prior 2 articles on volatility in the precious metals stocks and rare earth stocks, because they had huge moves higher and then got smashed back down over the last 2 weeks. We are going to continue on here in [Part 3], touching upon some of the other critical minerals stocks that have really fallen out of bed the last couple of weeks, after outsized moves to the upside, creating opportunities for accumulation.

So, let get into it…

I had updated the prior article after publishing, providing addition information, (as I often do). For the sake of readers here that likely missed those, we’ll briefly pick things back up here with those updates, and some additional trades and commentary.

Just a few minutes after I emailed out [Part 2] in this “Embracing Volatility” series yesterday, I saw this article in my newsfeed about the deal that Trump struck with 4 Asian countries with regards to supply chains on critical minerals.

Trump strikes deals on trade, critical minerals in Southeast Asia

Reuters - October 26, 2025

https://www.mining.com/web/trump-strikes-deals-on-trade-critical-minerals-in-southeast-asia/

“The United States signed a flurry of deals on trade and critical minerals with four Southeast Asian partners on Sunday, looking to address trade imbalances and diversify supply chains amid tighter export curbs on rare earths by China.”

Clearly since the US is working on striking deals with Malaysia, Cambodia, Thailand, and Vietnam and rare earths are once again in the crosshairs, it is obvious how important these REEs to global trade and national security.

This gave the markets more confidence that we’d see solutions to the pinch in supply of many different minerals, and so share prices pulled down in many critical minerals resource stocks on Monday to open up this week.

There are still plenty of specific questions that remain with regards to exactly which critical minerals and in what quantity that Vietnam, Thailand, Cambodia, or Malaysia have to provide to the US, along with what processing capacity they currently have.

I mentioned that one company that I’d just started a new position in last week, into the REE sector correction, was USA Rare Earth, Inc. (Nasdaq: USAR).

After publishing yesterday’s article, I had posted a technical update after the market open with regards to (USAR), but over a thousand people had already opened and read that article before I could even update it, so I’m reiterating some key points here.

USA Rare Earth further crashed down on Monday into the backdrop of all the positive news that built up over the weekend about potential solutions to the critical minerals pinch; with new US-China trade deals, US-Australia trade deals, along with the aforementioned 4 other deals being struck with Cambodia, Thailand, Malaysia, and Vietnam.

Most critical minerals stocks had downward pull into the deep red on Monday, and (USAR) was taken out to the woodshed and beaten once again…

I’m going to repost one passage from [Part 2] on (USAR) just to keep the trading approach in and prior comments in perspective, and to provide context to the trade I placed on Monday. Here’s that prior passage:

There was a ‘gap up’ created on the impulse leg higher in early October from around $23.50 up to around $25.50. Most gaps get filled. As a result, I accumulated some (USAR) on (10/22) at $24.44 and on (10/23) at $24.18, getting a starter position in place [as noted by the blue arrows and eclipses on the chart below]

This is the only portfolio position I have that is in the red at this point, but I literally just started it the middle to end of last week. I plan to keep accumulating as it corrects to average into a good cost basis over time.

As the downward side of the H&S pattern resolves it is still like catching a falling knife, so I might get cut. Technically it could fall all the way down to the $19s from where it broke out, but I’m not sure if it will do a complete round trip like that.

Pricing is just now approaching the 50-day EMA, (currently at $21.82), and so I’ll be watching for pricing to approach that level before adding the next tranche. {that is not investment advice, and I’m just sharing what I’m doing with my own capital in my own portfolio for entertainment purposes}

OK with that backdrop, here is what happened technically on Monday Oct 27th on a zoomed in 1-month daily chart of (USAR):

I had posted this update on the prior article in real time, but I know many people missed this, so here it is again.

UPDATE: On Monday (USAR) has stayed under pressure and is actually down below the 50-day EMA, so I picked up another tranche down at $20.70.

Just like we had a ‘gap up’ in early October, now we’ve seen a ‘gap down’ to kick off this week, and again, most gaps get filled. I’m betting on the scenario that eventually we’ll see that ‘gap down’ between the $23.57 close on Friday the 24th and the open today on Monday the 27th at $21.35 get filled; even if there is still more short-term carnage down to the lateral price support in the high $19s.

Now, that catches everyone up for these new comments around the rationale behind these recent trades.

I stand by my decision to have initiated a new position on 10/22 and 10/23 last week at $24.44 and $24.18 respectively, because those prices were smack in the middle of the first ‘gap up’ that was formed. It was quite possible that USAR would see a bounce from that level, but that’s not what played out.

When the pricing did a ‘gap down’ on Monday below the 50-day EMA (currently at $21.81), then I took the riskier bet of buying another tranche below that level at $20.70. The rationale here is that it is probable that the gap down also gets filled when pricing moves back up. Price doesn’t have to move back up to fill that gap immediately, but over the short to medium-term, it is more probable that it does.

My combined cost-basis for the whole position (after all 3 tranches) is at $23.48, and pricing closed at $21.60 on Monday. That means that overall I’m down in the red about 9.2% on the trade. I’m not thrilled about being underwater on this trade thus far, but this is only one position in a large diversified portfolio and I think it could pop.

I’m prepared that it could get worse before it gets better, because this stock is still completing the bearish “head and shoulders” pattern. I’ll add more in $19’s.

The price close at $21.60 on Monday was also below the 50-day EMA at $21.81, so the stock is still in a bearish posture, but just barely so. (URAR) did go down much further earlier in the trading session, all the way to $20.15 before recovering back higher into the close, so it did recover nicely throughout the day.

UPDATE: (URAR) was all over the map today in a range between $20.03 - $22.17. I added another small tranche near the end of the trading session at $20.08.

I realize this is “inside baseball” and a very granular play-by-play of the trading, and that it may not be of interest for everyone. However, I also thought it may be helpful to expand this out some for people interested in examples of how to marry the technicals with trading. That does not mean I’ll be successful in this USAR trade, and thus far I’m down 9%, but I hope the process is helpful for readers here as they consider their own future portfolio trading.

OK. Let’s move on now to other critical minerals sectors and more specific stocks that have likewise been very volatile, and where new positions were recently initiated with the goal of embracing the volatility.

Tungsten is another critical mineral that has been getting a lot of attention lately, and rightly so. It is a key strategic mineral that makes metals harder and thus it is a defense metal, that is used in armor-piercing ammunition, tanks, turbines, etc… It also has seen export controls out of China, and keen interest from governments to increase domestic supplies.

Tungsten has also been specifically highlighted in a number of executive orders from the Trump administration, which has caused more investor interest into companies operating in this niche commodity space.

Personally, I’ve been speaking with 2 different US-focused tungsten companies at resource conferences and also over on our KE Report podcast show:

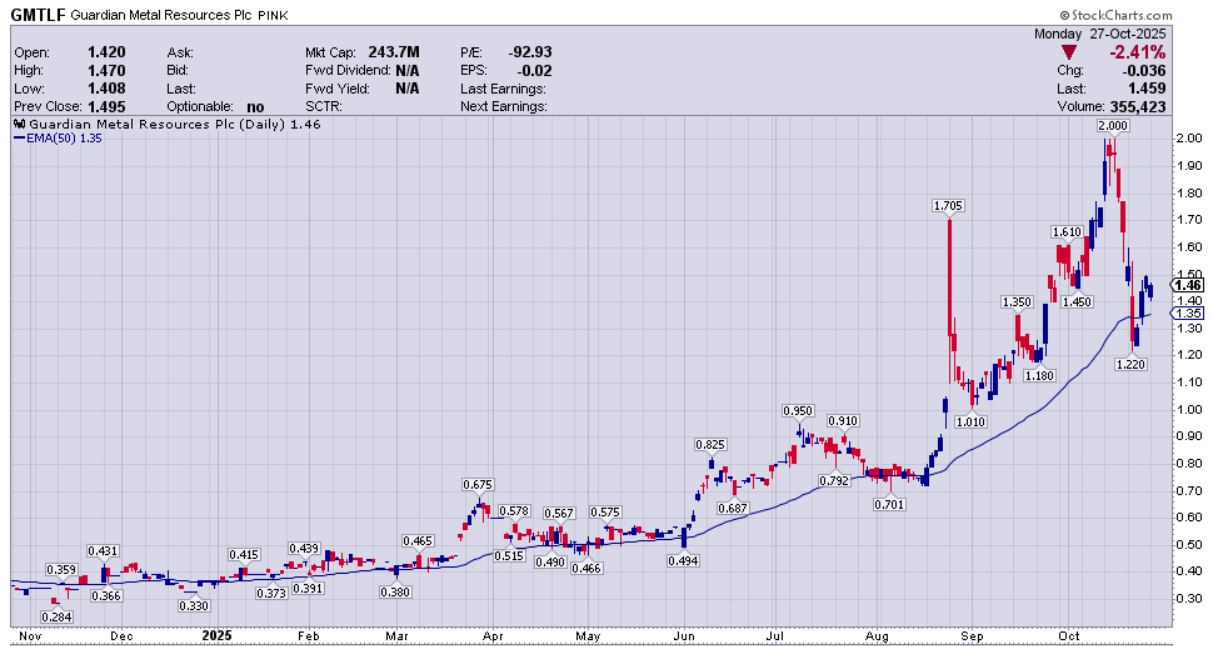

Guardian Metal Resources plc (LON:GMET, OTCQX:GMTLF)

American Tungsten Corp. (CSE: TUNG) (OTCQB: TUNGF)

Guardian Metal Resources – Department Of Defense Awards $6.2Million In Funds To Advance The Pilot Mountain Tungsten Project In Nevada

On August 11th, Oliver Friesen, CEO of Guardian Metal Resources (LON:GMET, OTCQX:GMTLF), joined me for an exploration and development update at their 2 key projects focused on tungsten and critical minerals in Nevada, USA.

We also review that the US government, through the Department of Defense (DoD) has awarded the Company $6.2Million in funds under Title III of the Defense Production Act of 1950 (“DPA Title III”) to support the rapid advancement and pre-feasibility study for the Pilot Mountain Tungsten Project.

We start off discussing how these incoming DoD funds through DPA Title III, in concert with the recent capital raise of approximately US$21.0 million, will be utilized at their 100% owned Pilot Mountain Tungsten Project. This is a skarn-type deposit which hosts a Mineral Resource Estimate (MRE) of 12.53Mt at 0.27% tungsten with significant copper, silver, zinc, and gallium credits. This project is located on BLM Land, which is advantageous for expedited permitting and development work. The next key milestone will be incorporating some of their recent engineering and geotechnical drilling work into a coming Pre-Feasibility Study (PFS) later this year. Additionally, the exploration team will be drilling a satellite target and other regional targets, which could expand and compliment the known resources in a meaningful way.

Next we discuss the other dual-flagship Tempiute Tungsten Project, which is a past-producing skarn-type tungsten-zinc-copper-silver mine and processing center, with valuable existing infrastructure in place. In addition to more drilling underway this year to produce and updated Resource Estimate by early 2026, the company has been sampling and drilling the historic tailings and at surface stockpiles with an eye towards getting those processed in a nearby toll-milling scenario to expedite domestic production of tungsten in the US.

Click here to follow the latest news from Guardian Metal Resources

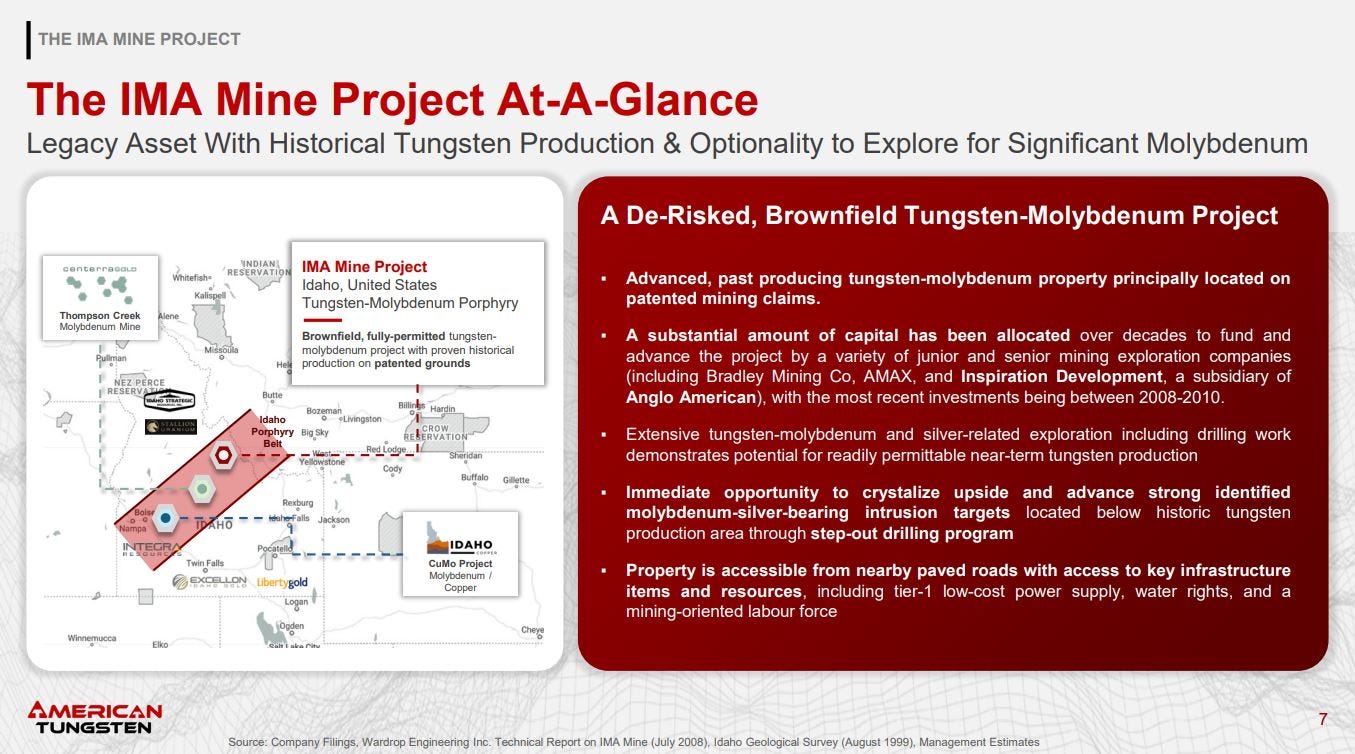

American Tungsten – Unpacking The Financing, Offtake LOI Signed With GTP, Ongoing Rehabilitation And Development Work At The IMA Tungsten-Moly-Silver Mine In Idaho

Ali Haji, CEO of American Tungsten Corp. (CSE:TUNG) (OTCQB:DEMRF) (FSE:RK9), joins me to for a financial and operations update on all the exploration, development, and rehabilitation initiatives underway; focused on bringing onshore tungsten mining and production capabilities to the United States through its derisked past-producing IMA Mine in Idaho.

On October 22, American Tungsten announced that, further to its press releases dated October 14th, 15th, and 20th, that it completed the first tranche of its non-brokered private placement for gross proceeds of C$16,770,510 from the sale of 6,500,198 common shares of the Company at a price of C$2.58 per Share (the “LIFE Offering”) under the Listed Issuer Financing Exemption.

We start off discussing this financing, the rationale for both the timing of it, and the subsequent repricing of it lower to gain better traction and confidence with incoming institutional investors. Most importantly, we get into what these funds will enable in terms of future value creation through the ongoing rehabilitation and development work at the IMA Mine.

Next, we discussed the Letter of Intent (“LOI”) signed back on September 20th with a prominent U.S-based offtake partner, Global Tungsten & Powders (“GTP”). Ali highlights that their agreement with GTP marks a pivotal milestone in their emergence as a leading domestic supplier of high-grade tungsten, now vetted by one of the largest tungsten processors in the world. This LOI not only affirms the robust market demand for more domestic supplies of tungsten, but also reflects the deep confidence their partners have in their technical capabilities and long-term vision to move from development into near-term production.

Then Ali expanded the ongoing IMA Mine Rehabilitation Progress:

A total of 115 feet of the Zero Level access tunnel has now been successfully rehabilitated, measured from the portal entrance; with anticipated work on the zero level tunnel approximately 80% complete.

Rehabilitation efforts are now within the heart of the main collapsed zone, currently estimated to span approximately 50 feet.

At a September site visit the management team reviewed the Zero Level rehab work, the D Level underground workings, the historic tailings area across the road from the canyon, and the broader site area.

The MSHA inspector expressed confidence in the site’s progress and praised the quality of work completed. A Radon measurement taken within the tunnel yielded a zero reading, affirming a safe working environment.

Zooming back to the project level, we shifted over to the tungsten, molybdenum, and silver resources in place and the infrastructure advantages of the IMA Mine as an advanced, past producing brownfields site, located on patented mining claims in Idaho. There has been a substantial amount of capital spent over many years to advance and build the project by various mining companies, including the Bradley Mining Company, Inspiration Development Co. (subsidiary of Anglo American PLC), and American Metal Climax. There is solid infrastructure including roads, tier-1 low-cost power supply, water rights, and a mining-oriented labor force nearby, which can help fast-track this project back into production, with a low capex anticipated to be ~$20 Million.

Ali reiterated that they are continuing to work closely with government agencies to build partnerships seeking to secure funding. He believes there is the opportunity to secure key strategic partnerships and non-dilutive financing with the U.S. Department of Defense, Department of Energy, and Defense Advanced Research Projects Agency, and mentioned that those discussions are underway and applications were previously filed.

There is planned drill program to expand the known tungsten, molybdenum, and silver mineral resources, and this will be utilized for an updated Resource Estimate, and the upcoming Preliminary Economic Assessment (PEA). The company will also be conducting a trial mining and bulk sample exercise, more metallurgical tests, and the company is now working towards the construction decision on a processing plant on-site, which is a change and upgrade to the previously envisioned direct ship ore (DSO) business model.

Click here to follow the latest news from American Tungsten

I got positioned in American Tungsten at $0.3719 and sold out at $2.133 for a 573% gain, but after trading fees it was really more like a 567% gain.

While I was thrilled with those gains in just 3 months’ time, it pained me to see how much higher the stock ran after selling it (which is the 2-way street of selling any position). I could have had almost a 10-bagger, but settled for a 5.6-bagger.

Normally I do not buy or sell in just one tranche, but this was a smaller speculative position (around 1% of the portfolio, and then it quickly moved up to almost a 4% position, and really stuck out even as my overall portfolio was also moving higher in tandem).

The stock was also trading at all-time highs at that point, and was up in rarified air, so there was no technical data for resistance. Even technicians using Fibonacci extensions or Elliot Wave projections would not have had targets up at the lofty heights it achieved just days later, as it would have already have achieved most of those targets after crossing up into the $2’s. That was a pure momentum blow-off top in the making….

So, I rang the register, expecting a parabolic move back down, (like we eventually just witnessed), but had no idea it would run as high as it did [up to US$3.48] before coming down the other side of the parabola.

This may seem like I’m highlighting a poorly-executed trade here, because I left so much money on the table, but my perspective is that I still had a really great trade and ROI in a short time period, and also sold at a higher level than where pricing is today. If I had just done a “buy right and sit tight” mantra like so many investors love to parrot, and taken no action, then I’d have also left money on the table.

I bought back in today at $1.68, after a substantial correction in this stock has played out. My rationale was that a 50% pullback off the high of $3.48 had been achieved when the stock price got to $1.74, so anything below there was a good place to start building a new position.

I like the fundamentals here of this company, because they have a couple of value levers to pull; with the upcoming drill program, Resource Estimate, PEA, and wildcard of any potential government funding.

Once again, the article is out of space to get this sent out through email, so we’ll likely do one more [Part 4] this week to round out the commodity sectors experiencing this outsized turbulence. I really wanted to get to the volatility and sector pullbacks in both the antimony and uranium stocks the last couple weeks, and unpack some trades that were executed there today in the portfolio.

I’ll just state briefly that I took action into Monday’s volatility to add another tranche to my already heavily-weighted Energy Fuels Inc. (NYSE American: UUUU) position at $19.09, and also started a brand new position in United States Antimony Corp (NYSE:UAMY) at $9.41.

UPDATE: I also added another tranche of (UAMY) at $9.11 on Tuesday’s trading session. {more on those trades in the next update}

Thanks for reading and may you have prosperity in your trading and in life!

Shad