Copper, And Silver, And Gold – Oh My!

Excelsior Prosperity w/ Shad Marquitz - (05/18/2024)

This was a particularly engaging and even exciting week to follow along with copper, silver, and gold and the related resources stocks in each sector. Quite frankly, it was a thrilling week in a number of commodities (uranium and nat gas also come to mind). As a result, I’m breaking down my typical weekly review of the resource sector into different articles – one on the trio of key metals, and then another on uranium, and after that a piece on oil & nat gas, and related energy stocks.

In conversations with investors and thought leaders in the sector most of this last week, it was really copper that stole the show by breaking out to a new all-time high mid-week… that is until we got to Friday’s trading action when silver not only finally pierced back up through the key $30 resistance level, but even shot through $31. When silver finally broke out at the end of this last week, it did so with gold also getting a bid, and the precious metals stocks really blasted higher. Wow!

There were a number of investors reaching out to me in the later part of last week genuinely enthusiastic about the moves in the related mining stocks, and all bulled up for the first time in quite a while. It was nice to see so much green on the screen and investors making money again in this sector, and the animal spirits returning to commodity stocks. So, when I was reflecting this morning, it just seemed appropriate to go with the title “Copper, and Silver, And Gold – Oh my!” (obviously playing off the famous Wizard Of Oz phrase).

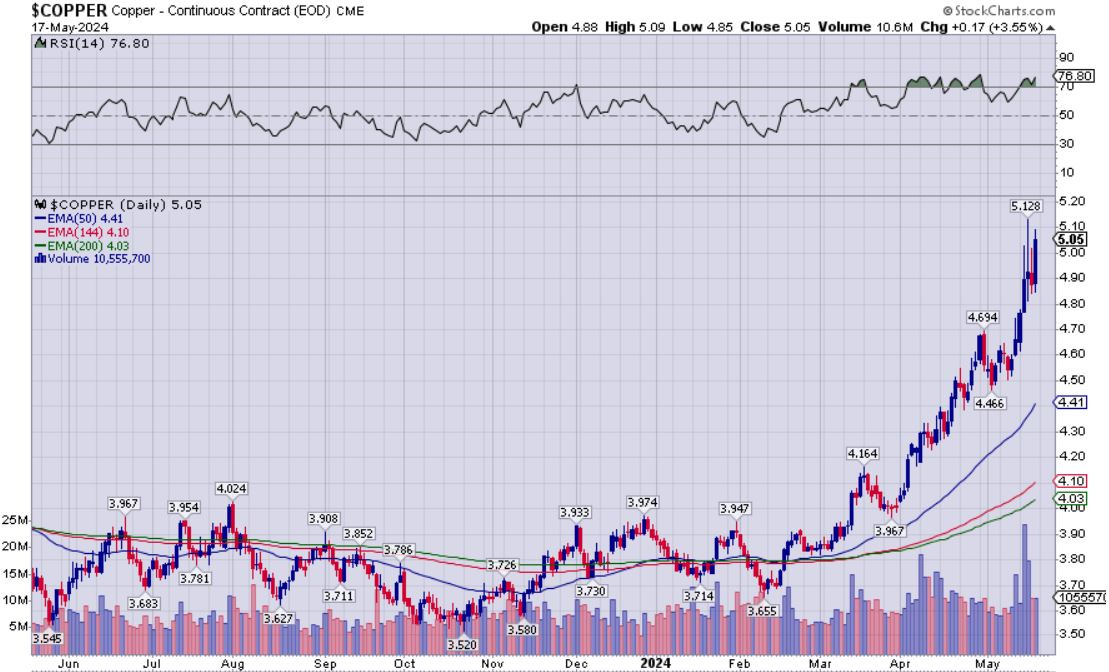

Let’s kick things off looking at a daily chart of Copper:

2 months ago, we had postulated that Dr. Copper had finally put on his dancing shoes, and the proceeding action the last 2 months has further confirmed that thesis; with copper making a new all-time intra-day and intra-week high at $5.128 per pound on Wednesday. If any chart or any commodity puts in a new high-water mark, it is always significant and worth paying attention to. Also notice the increased volume bars at the bottom of the chart for further confirmation of the strength and conviction of this move.

Yes, the daily copper price action is getting even more overbought, well above the key Exponential Moving Averages (EMAs) and with the Relative Strength Index (RSI) in overbought territory at 76.80. It is important to note that on really strong bullish impulse legs higher, on any equity or commodity chart, things can stay overbought for longer than people expect. So while the good doctor has danced his way right up a steeply vertical slope to new heights, and one would expect a resting period coming up soon, (it may be in a backdrop with RSI in the 80s or even low 90s). We’ll just need to follow along to see where the music stops playing here, but it has been stellar price action that is even starting to get the attention of generalist investors.

Shifting over to the weekly chart of copper above, we see that copper closed this last Friday at $5.05, which just happens to be one copper penny higher than the $5.04 prior all-time intra-week high from early 2022 right after the Ukraine War broke out. So, if we are being technical here, that is a new all-time weekly closing high, that has now definitively cleared all prior peaks, and it did so on higher volume. That is stunning and significant. However, again note the RSI on the weekly is now up in the most overbought territory it’s been in years at 80.81. Could it keep running? Of course. Just pointing out that it’s already had one hell of a run and at one point will need to rest and consolidate for a bit.

Let’s take a look at the copper stocks via the EFT (COPX):

(COPX) has continued blasting up into new altitudes, putting in the all-time highest weekly close on Friday at $51.67. Senior copper producers have been exploiting the rising metals price, as it goes right to their margins and bottom line, so not a surprise to see them surge. Still, as noted earlier, when a chart puts in a new all-time high it is always significant, and it’s easy to get nonplussed about these moves when they just keep going and going… but this is history being made right in front of people’s own eyes.

My guess is that most investors (me included) have been underexposed to the moves we’ve just seen in the copper stocks, relative to their weightings within a given portfolio. I had unloaded most of my copper stocks (I used to hold about 8) back during the early 2021 surge, and since then have mostly just position-traded a few odd copper stocks and the (COPX) ETF up until late last year. More recently I transitioned over to trading the (COPJ) ETF for copper exposure on some of the larger juniors, and so it’s worth taking a look at that chart next for investors that may want a bit more upside torque.

As we’d noted in prior articles, we really hadn’t seen this action in copper and the larger copper stocks filter down into many of the true junior copper stocks, (until just more recently). I mentioned in last weekend’s update also starting to accumulate some of these true junior explorers and earlier stage developers over the last few weeks now that we are seeing the worm turn in this sector.

I had mentioned adding more to my growing position in Arizona Sonoran (TSX:ASCU | OTCQX:ASCUF) , and that I had added new positions in Surge Copper (TSXV: SURG) (OTCQB: SRGXF), and Faraday Copper (TSX:FDY)(OTCQX:CPPKF). Those stocks all had some nice rips over the last few weeks, and really they’ve been moving for the last few months.

I also have a position in Metallic Minerals (TSXV:MMG)(OTCQB:MMNGF), which has exposure to silver, copper, and gold at 3 different projects, but it is their La Plata copper project in Colorado that has me most intrigued. Apparently all that copper is still being shrugged off by the market at present, but certainly not by their strategic stakeholder Newmont mining.

My plan has been to add a position in Regulus Resources (TSXV:REG)(OTCQX:RGLSF) for a while now, but it has already run so high for so long that I just couldn’t make myself chase it higher, even though it looks ripe for being accumulated soon by a larger company. In that prior copper article from March, I’d mentioned the blast off in Regulus was likely an early shot across the bow in the junior sector. I met with the management team recently in Washington D.C., at the Energy Transition Metals Conference, and they also introduced me to their sister company Aldebaran Resources Inc. (TSXV:ALDE)(OTCQX:ADBRF), and as I debated positioning it also just took off like a scalded cat. As the old saying goes, “He who hesitates is lost.”

I’m still mulling over a dozen or so other copper juniors to pick out 2-3 more to add to the portfolio, and will likely ring the register soon on (COPJ) to transfer those funds over to some more smaller junior copper companies and will update folks here in this channel when I do so. Ideally, we’ll see a corrective move in the copper stocks where other investors pull profits on recent spikes higher, and that’s where I’ll be looking to accumulate.

Let’s shift over to Silver - the lessor precious metal, and hybrid metal (part precious & part industrial)

Silver was looking strong this week, but really was the dark horse that came from behind to win the race at the tail end of this last week, closing Friday at $31.26. This was the highest weekly close in many years, and higher than all the post-pandemic prior peaks, and even the #SilverSqueeze peak of $30.35 from that early 2021 mania. Investors have been waiting for years to see this happen, and most were worried about it only being an intraday blip or daily close. To see silver clear not just the $30 round psychological level, and the $30.35 #SilverSqueeze peak, but also clear $31, and do this on a weekly close at the high end of the weekly trading range was an incredibly bullish technical development and most impressive.

I had mentioned a few times, as have many other sharp technicians that I greatly respect, that this type of breakout, above that key line in the sand at $30, would set up a move in silver to $34-$35 in pretty short notice, because there isn’t a lot of resistance or price friction in between those areas.

For clarity, “short notice” means in a few weeks or a few months (although with the way silver is moving, maybe it could happen in a just a few days). However, it would be healthier to do the “2 steps forward – 1 step back” stair-step climb higher, rather than just vault up to $34-$35 in a couple of days, and then reverse direction taking the elevator right back down really hard. Silver is such a volatile market, and just got so many new eyeballs on it after Friday’s close, that it isn’t likely to get up there in a straight line. Additionally, since large financial institutions seem to love throwing their weight around to push prices in either direction, then I anticipate the shorts will be out in force early this next week to try and drive prices back down again in the near-term. If silver does defy expectations for a brief respite, and just keeps blasting higher in a short-squeeze, I doubt there will be many tears shed for the shorts.

I’ve also mentioned for several years now with regards to the PM stocks when silver finally broke $30: “That would be the move that would awaken the animal spirits in both the gold and silver equities, and would signal a stronger leg of the precious bull markets was on in force.” So, it looks like we have arrived, and again, all week long there were some wild double-digit or high single-digit blasts higher almost daily in many of the gold and silver equities. We’ve not seen this kind of interest, volume, and price action in quite a while and it does warm the cockles of one’s heart (and help out the value of ones resource stock portfolio).

Now let’s check in on the most speculative side of the precious metals complex – the silver miners, by way of (SILJ), the Amplify Junior Silver Miners ETF:

(SILJ) still has a lot of work to do, but is finally starting to play catch up to the gold equities and moves in gold and silver for that matter. It remains in a bullish posture, with pricing well above the key exponential moving averages. (SILJ) just put in it’s highest weekly close in 2 years, to close on Friday at $12.74. Quite notably, it also definitively cleared that overhead resistance zone from the prior series of peaks/troughs and pricing congestion in the $12.02-$12.19 zone, (as noted by the levels highlighted in blue rectangles on the chart above). This sets up a move in the mid $13’s and low $14s in fairly short order, now that silver finally broke above $30. Of course, if silver corrects hard in the near-term [as shorts try to monkey-hammer it back down], then SILJ will respond in kind.

Regardless, I continue to see the most opportunity in the silver junior stocks, to really start to move and outperform the rest of the precious metals and larger commodities sector in the medium term. I pulled profits on one silver junior this last week on Thursday morning, Defiance Silver (TSXV: DEF) (OTCQX: DNCVF), when it just shot up so much more than all the other silver stocks; however, I noticed it corrected down hard on Thursday afternoon and again on Friday, so I bought it right back for a nice swing trade, capturing the pop, and avoiding most of the drop. That takes me back to 20 silver positions in my portfolio, and I’ve been fully allocated since the end of last year.

Some may wonder why I have held off writing about the silver stocks if I’m so heavily weighted to them? Well, frankly for a long time they’ve been outperforming to the downside, and I was waiting until I felt the time was right for more sustained upside momentum period and a break above $30. In my estimation, that time has arrived, so stay tuned for my upcoming series on the silver stocks.

Let’s also review the pricing action in Gold on the weekly chart:

Gold predictably pulled back since putting it’s high-water mark of $2,448.80 in early April, but then reversed back up at $2,285.20 3 weeks ago, and has climbed up higher again with bullish candles the last 2 weeks, closing on Friday at $2,417.40. No doubt, gold has performed great and has a solid bullish posture, still well above all the key EMAs, and has been up in mostly uncharted territory for March-May. Personally, I have a more short-term neutral disposition on gold prices, as they are just consolidating here in the mid $2300s to $2400s, with the potential of breaking hard either direction. Regardless of short-term action over the next few months, in the medium-term to longer-term I still expect much higher prices. (Remember years back when investors only dreamed of seeing those kinds of numbers $2300 or $2400 in front of the gold price? Did you ever think investors would be so complacent about all-time high gold prices like these?)

Sentiment is more tied to the gold stocks, so let’s take a look at the ETF (GDX):

GDX: Since bottoming in late February at $25.67, (GDX), consisting of the larger gold producers and royalty companies, has kept moving up from there to close this week at $36.87. Friday’s close was key because it was a new 52-week high, and the highest weekly close since April 2022. It is also nice to see the 50-week EMA continue to slope higher and put in more space between the longer-duration EMAs. Next lateral price resistance to clear on the upside is the prior peak at $38.95, and the big line in the sand is that $40.42 prior peak from April of 2022 (noted in blue rectangles).

As for the gold juniors, many of them sprang to life over the last few months, and especially over this last week. There are too many to mention, and there is not really a great way of demonstrating it, as GDXJ really is mostly mid-tier larger cap gold stocks. There is no true gold junior mining ETF that accurately reflects the moves in the micro-cap juniors, so as always, I encourage folks to #BuildYourOwnETF with a basket of quality juniors. I’ll have more to say on the gold juniors as we continue forward with future updates on this channel.

Let’s wrap it up with some big picture PM sector thinking from my friend and colleague Jordan Roy-Byrne. (FYI - this is the most bullish I’ve ever heard him)

Jordan Roy-Byrne – Key MIF Presentation Takeaways – The Biggest Gold Breakout In 50 Years Is Here - May 15, 2024

That’s it for today and thanks for reading. May you have prosperity in your trading and in life!

- Shad