Comparing Market Caps Of Advanced Gold-Silver Explorers and Developers

Excelsior Prosperity w/ Shad Marquitz (02-04-2025)

[Case Study #1] Rupert Resources Ltd. (TSX:RUP) (OTC: RUPRF) – Ikkari Deposit + Pahtavaara mine

Market Cap CAD ~984 Million

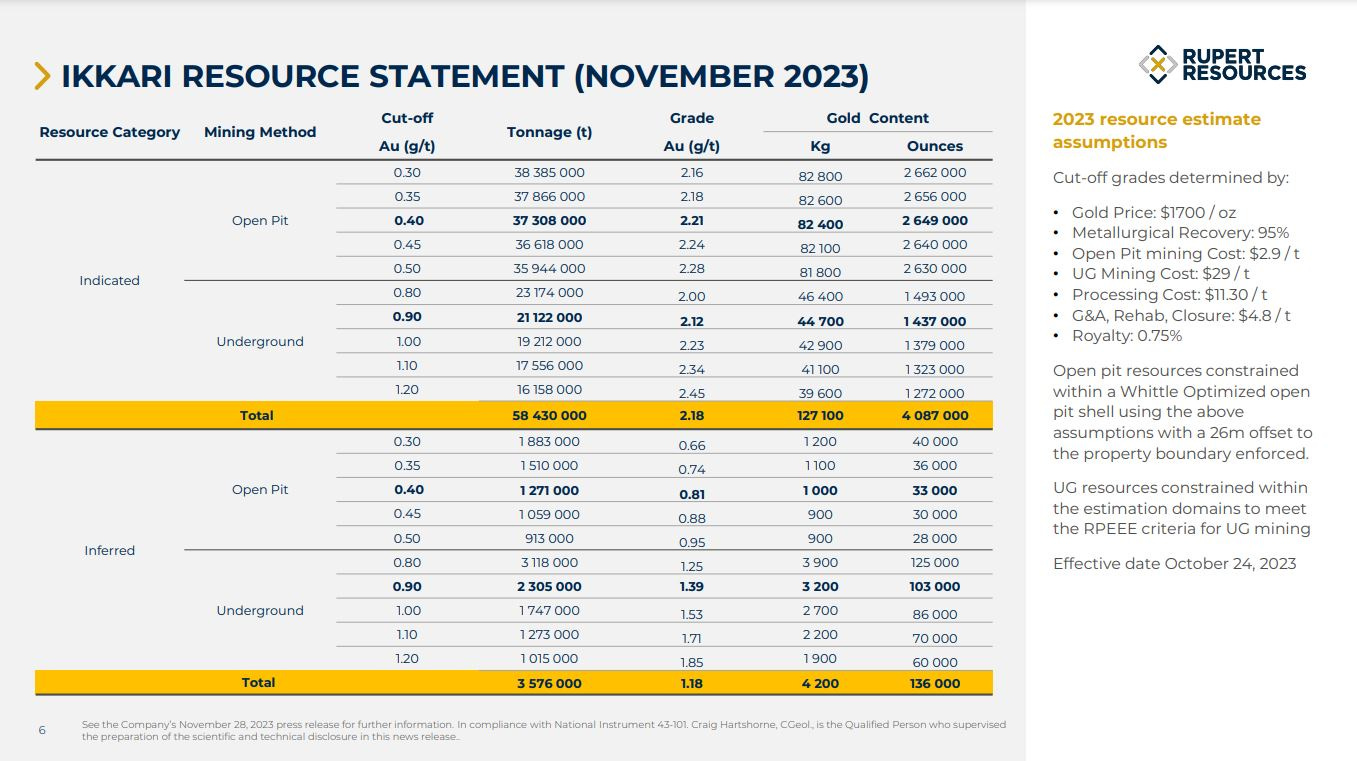

4.2 million ounces gold in all categories 58.4Mt of 2.18g/t Au (4.1Mozs) indicated + 3.6Mt of 1.18 (0.14Moz)

Ikkari is a world-class 4+ million ounce gold deposit located in the Central Lapland Greenstone Belt in Northern Finland. The next major milestone is a Pre-Feasibility Study (PFS) of the associated economics due out in the 1st Quarter of 2025. It currently has a healthy valuation at just under a billion dollars.

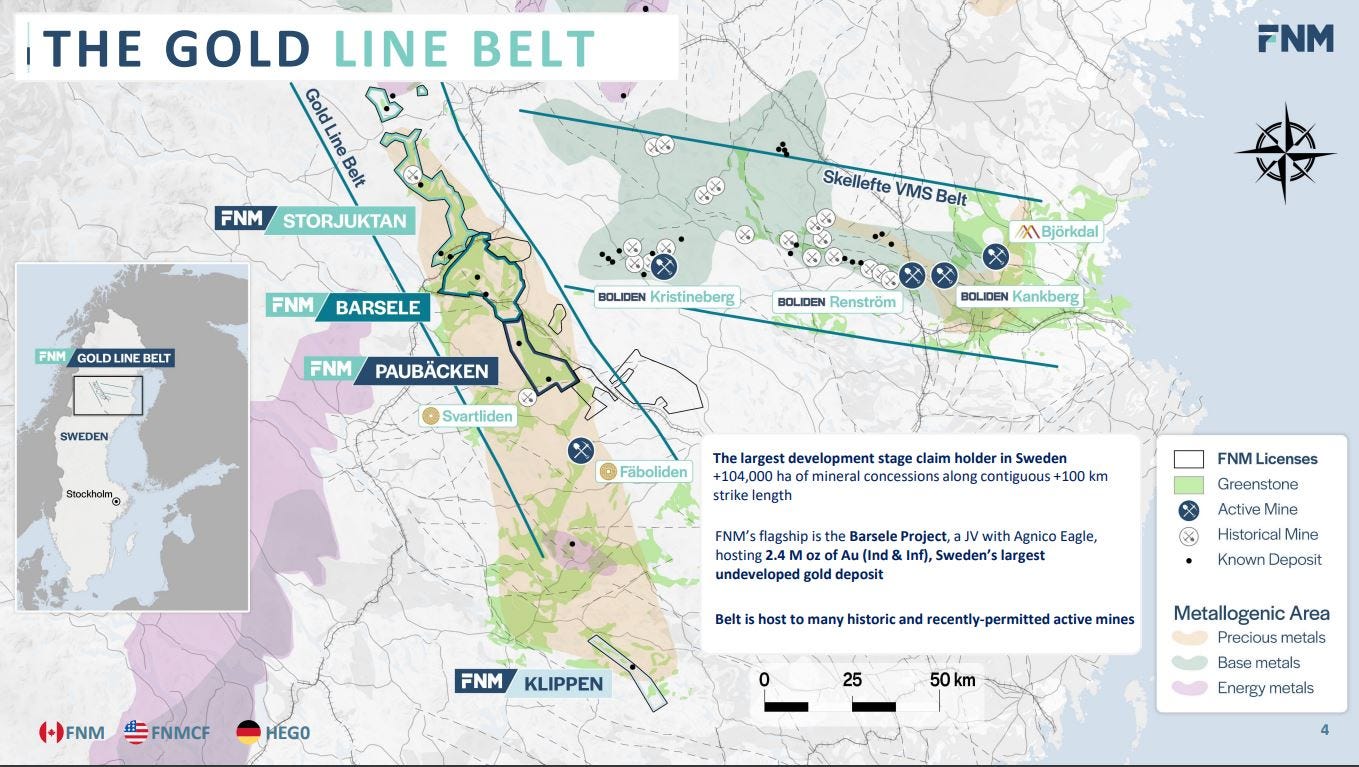

[Case Study #2] – First Nordic Metals Corp. (TSXV: FNM) (OTCQB: FNMCF) – Barsele Deposit JV with Agnico + 100% owned Paubäcken, Storjuktan, and Klippen Projects on Goldline Belt in Sweden + Oijärvi greenstone belt in Finland

Market Cap - CAD ~$117 Million

2.4 Million ounces gold at Barsele + rest of 100+ kms and 2 greenstone belts exploration upside

Barsele: 2.4 million ounces of Gold - JV: 55% Agnico / 45% FNM - Free Carried interest for FNM; Agnico can earn additional 15% through completion of a Pre-Feasibility Study (PFS).

2025 catalyst – 25,000 meter drill program along 100% owned Paubäcken, Storjuktan, and Klippen Projects on Goldline Belt. Their geophysical signatures are similar to Barsele. If they find another 1 or 2 Barsele look-a-like deposits, then they could quickly mass up in resource size and significance in Sweden and in Europe overall.

When considering the value proposition contrasting Rupert Resources here at a $983 million market cap for 4.2 million ounces of gold at Ikkari, or First Nordic Metals here at a $117 million market cap for 2.4 million ounces of gold at Barsele, but also with the potential for Paubäcken, Storjuktan, and Klippen to offer another opportunity for a discovery of Barsele 2.0 or 3.0 and other multi-million ounce deposits, then I like the potential upside in appreciation from (FNM) more, while conceding there are more risks and unknown questions to still answer.

In fairness, it is not really an apples to apples comparison, but the comparison of these 2 Scandinavian gold exploration/development companies with defined ounces in the ground is at least a revealing exercise to a degree, pointing out just how undervalued FNM is at present.

My personal investing thesis has been to get a position going in First Nordic Metals, for their potential to rerate on both their contained ounces in the ground (which will likely keep growing as Agnico Eagle continues working on Barsele in 2025), and their potential to hit and expand resources on their 100% owned projects with the 25,000 meter drill program this year.

First Nordic Metals – 2025 Exploration Strategy Across All Projects, And Addition Of Henrik Lundin To The Board - January 24, 2025

[Case Study #3] Great Bear Resources Ltd. (TSXV: GBR) (OTCQX: GTBAF) – Dixie/Great Bear Project

Acquisition price CAD $1.3 Billion was made at much lower gold prices

~ An estimated 3.5 – 4 million ounces of gold at the time of the transaction, pre-Kinross drilling

On Feb 24, 2022 - Kinross Gold Corporation (TSX: K) (NYSE: KGC) finalized the transaction to pay approximately C$1.35 billion, in cash and issue approximately 49.3 million Kinross shares and 59.3 million CVRs, to acquire Great Bear Resources (GBR.V).

A year later, and 250,000 meters in additional drilling later, in February 13, 2023, Kinross Gold announced a robust initial mineral resource of 2.7 Moz. indicated and 2.3 Moz. inferred for the Great Bear project.

This means that Kinross paid CAD $1.3 billion for a deposit that was clearly much smaller than 5 million ounces of gold at the time of the transaction, a full year earlier before their 250,000 meters of additional drilling (which was a LOT of extra drilling just to get the Great Bear deposit up to 5 million oz).

So did Great Bear have 3.5 million or 4 million ounces defined at the time of its takeover? Nobody but Kinross will ever know, but that seems like a generous assumption. Sadly, retail punters assumed they had 7-10 million already. Nope.

Remember, that this acquisition by Kinross for $1.3 billion of GBR was at much lower gold prices in the low $1800s at the time. That deal looks better now…

[Case Study #4] –Thesis Gold Inc. (TSXV: TAU) (OTCQX: THSGF) – Lawyers + Ranch Projects

Market Cap CAD ~124 million

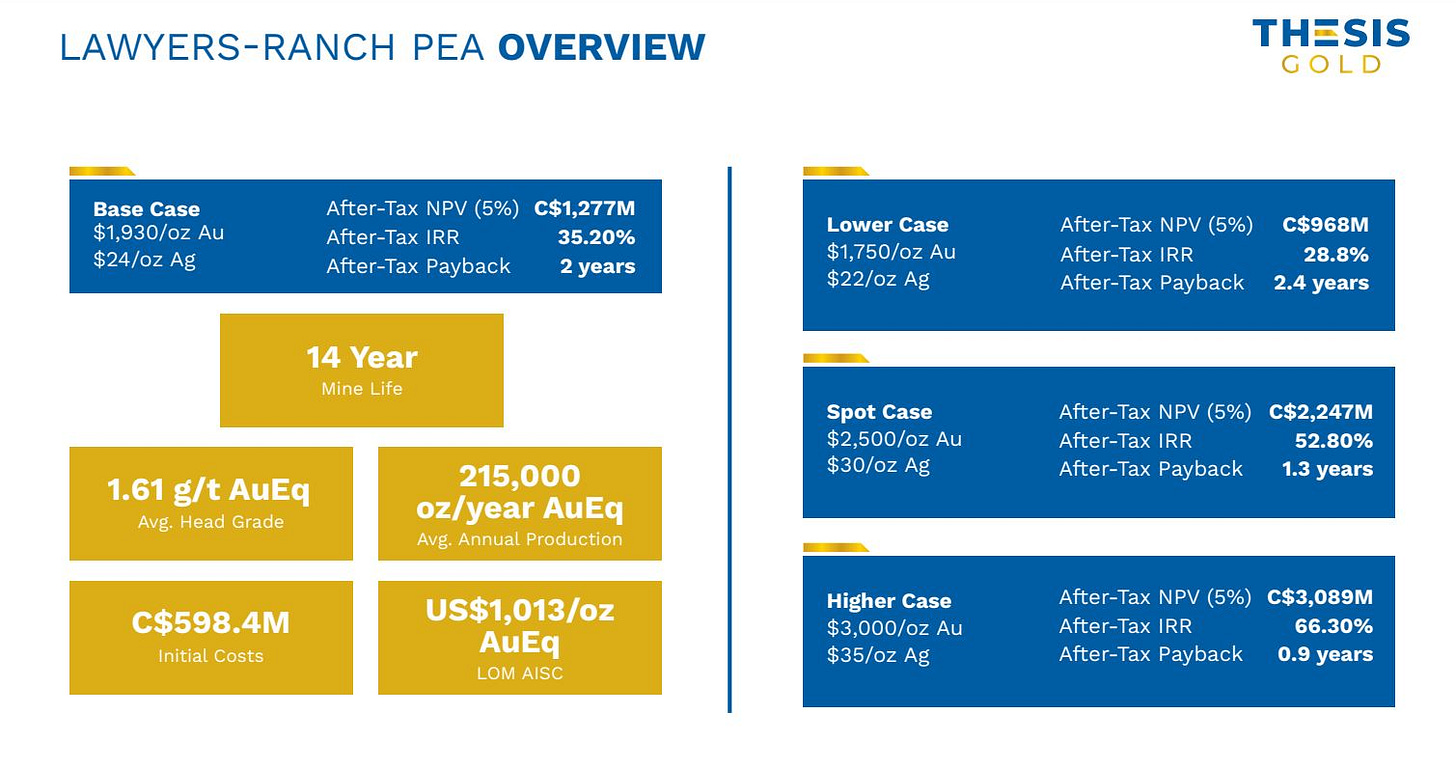

Total Mineral Resource of 4.727 million ounces of gold equivalent resources (4.0 Moz AuEq (M&I) at 1.51 g/t AuEq and 727 koz AuEq (Inf) at 1.82 g/t AuEq)

Currently the Thesis Gold project would be valued somewhere between the “Spot Case” using $2,500/oz Au and $30/oz Ag @ CAD $2.247 billion and the “Higher Case” using $3,000/oz Au and $35/oz Ag @ CAD $3.089 billion…. So let’s split the difference and say a CAD $2.5-$2.6 billion NPV at current metals prices.

This is WAY more data (a published resource estimate and PEA economics) that Thesis Gold has at present, than what Kinross had when it purchased a smaller gold deposit from Great Bear at about $1,000 lower gold prices.

So does their market cap at $124 million at 1/10th the valuation that Great Bear sold for really make sense? It is clearly deeply undervalued based on all the data.

These 4.7 million ounces of gold equivalent (mostly gold & silver) that Thesis has defined, is also in the same area of the Toodoggone Mining District of BC, where breakout story Amarc Resources and nearology play TDG Gold have skyrocketed over the last month. We still have no idea what type of resources will be delineated at Amarc’s Joy Property or if TDG will find the continuation of the recent mineralization delineated at the AuRORA Deposit on their property. Meanwhile, there are nearly 5 million ounces of gold right next door, and hardly anybody is even discussing Thesis Gold. That is opportunity to my eyes…

My personal investing thesis is that Thesis Gold is very undervalued for the prior work completed and what they have delineated on their resource and in their initial economics from the PEA. If Great Bear can sell for CAD $1.3 billion for ~3.5-4 million ounces of gold pre-resource at much lower gold prices, and if their current sensitivities table illustrates that the project NPV is around CAD $2.5-$2.6 billion at current metals prices… then I believe that a rerating to a much higher valuation than the current market cap of CAD $124 million seems reasonable for Thesis Gold. (reminder: this is not investing advice; just a glaring valuation mismatch)

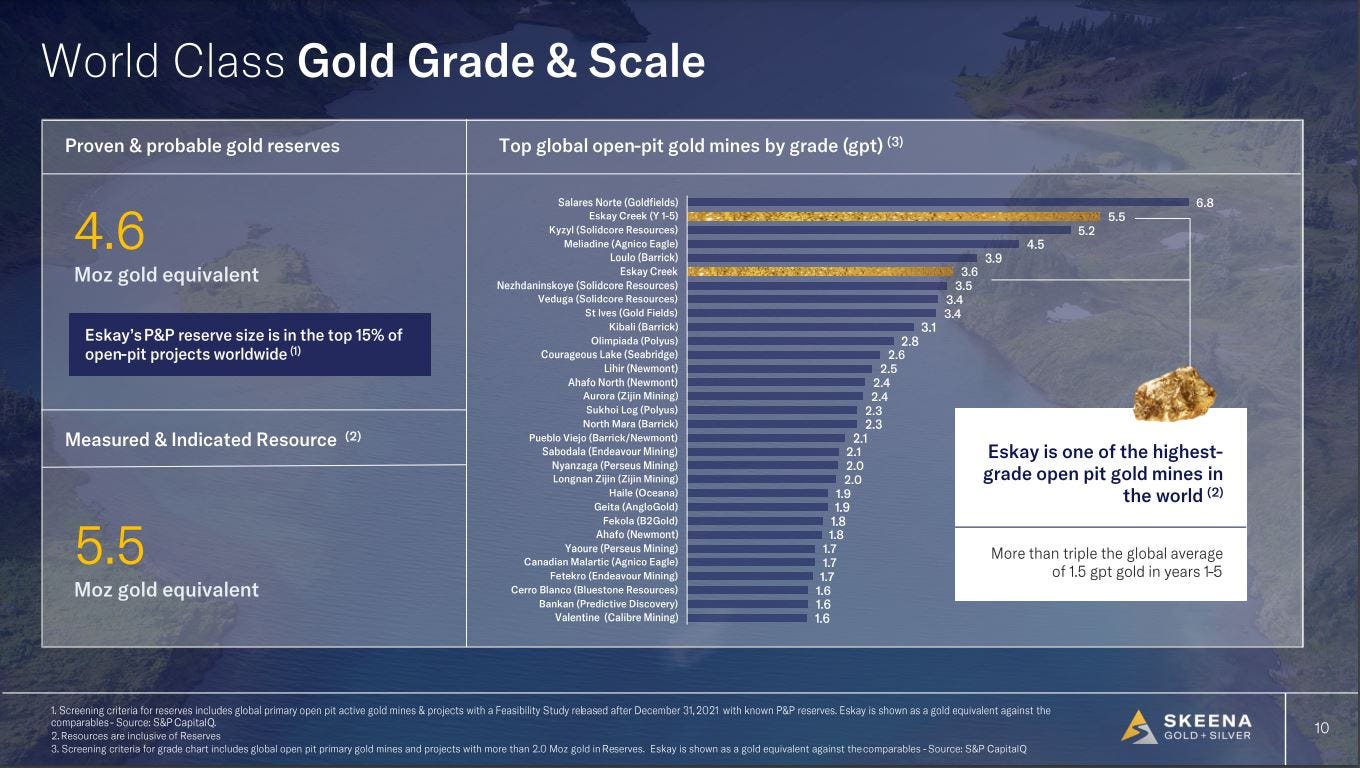

[Case Study #5] Skeena Gold and Silver (TSX:SKE)(NYSE:SKE) - Eskay Creek Gold-Silver Project + Snipp Project

Market Cap ~ CAD $1.55 billion

Total Mineral Resources - 5.9 ounces Au/Eq at Eskay + 937,000 ounces Au/Eq at Snipp = ~ 7 million ounces of gold across all projects

Eskay Creek: Total pit constrained Measured and Indicated Resource of 5.5 million ounces at 3.47 g/t gold equivalent including 4.1 Moz at 2.57 g/t Au and 102.5 Moz Ag at 63.63 g/t Ag + 353,000 ounces gold equivalent in the Inferred category

Snip Project - Updated MRE of 823,000 ounces grading 9.35 g/t Au in the Indicated category and 114,000 ounces grading 7.10 g/t Au in the Inferred category (937,000 ounces in all categories)

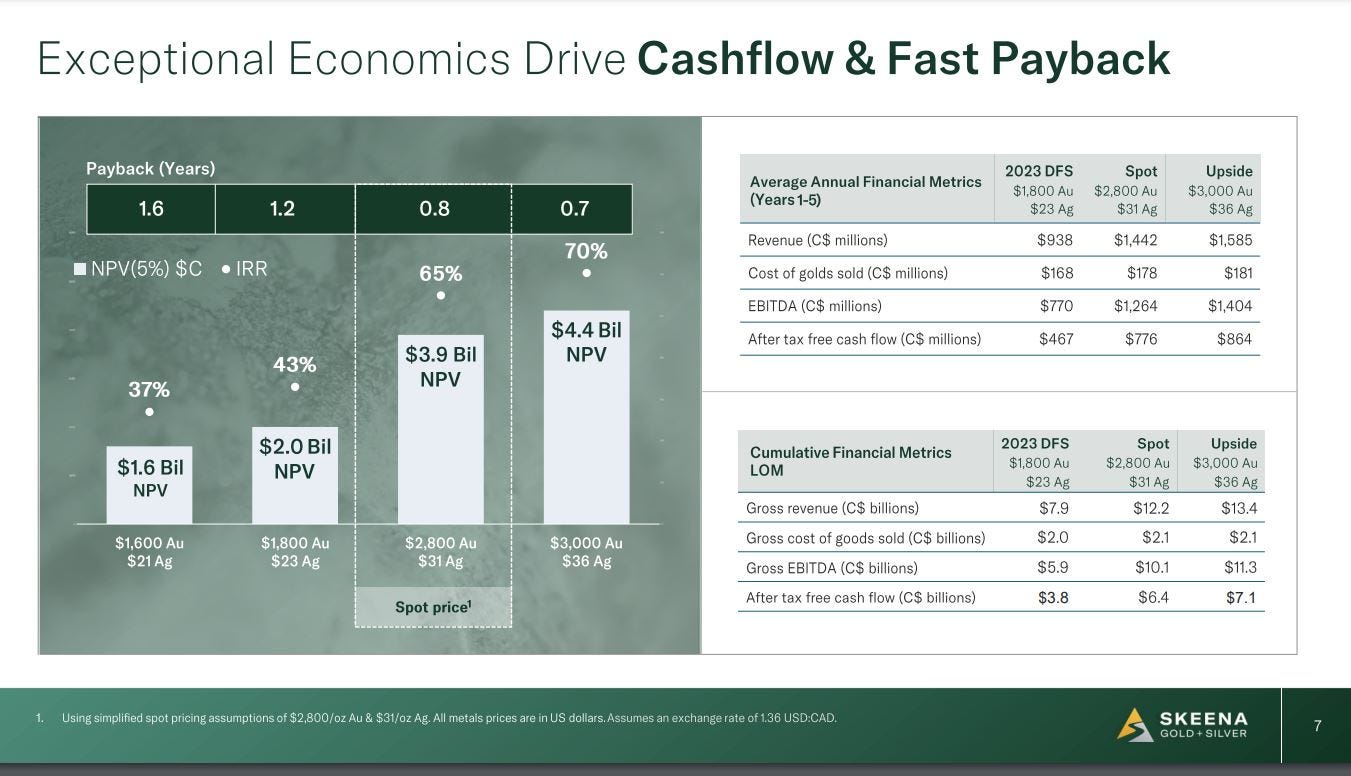

The Company released a Definitive Feasibility Study for Eskay Creek in November 2023 which highlights an after-tax NPV5% of C$2B, 43% IRR, and a 1.2-year payback at US$1,800/oz Au and US$23/oz Ag.

Years 1-5: Average annual production of 450,000 oz at 5.5 g/t AuEq and average annual after-tax free cashflow of C$467 million

Years 1-10: Average annual production of 366,000 oz at 4.1 g/t AuEq and average annual after-tax free cashflow of C$361 million

At current spot prices of $2,800 gold and $31 silver on the sensitivities table, then the NPV of the project swells up to CAD $3.9 billion. So from that standpoint, the CAD $1.55 billion market cap in (SKE.TO) is still very undervalued, and ascribes no value to their Snip project at all.

In full disclosure, I am a shareholder of Skeena Resources and feel it is a fantastic deposit, management team, and is a future world-class mine waiting to be built.

They have raised their capital stack to be able to proceed, and either they will build this Eskay Creek project or they will be taken out by a larger producer for a premium somewhere between where they are valued now and where the project is valued on paper 150% higher.

[Case Study # 6] - Troilus Gold Corp. (TSX: TLG; OTCQX: CHXMF) – Troilus Gold Project

Market Cap ~ CAD $135 million

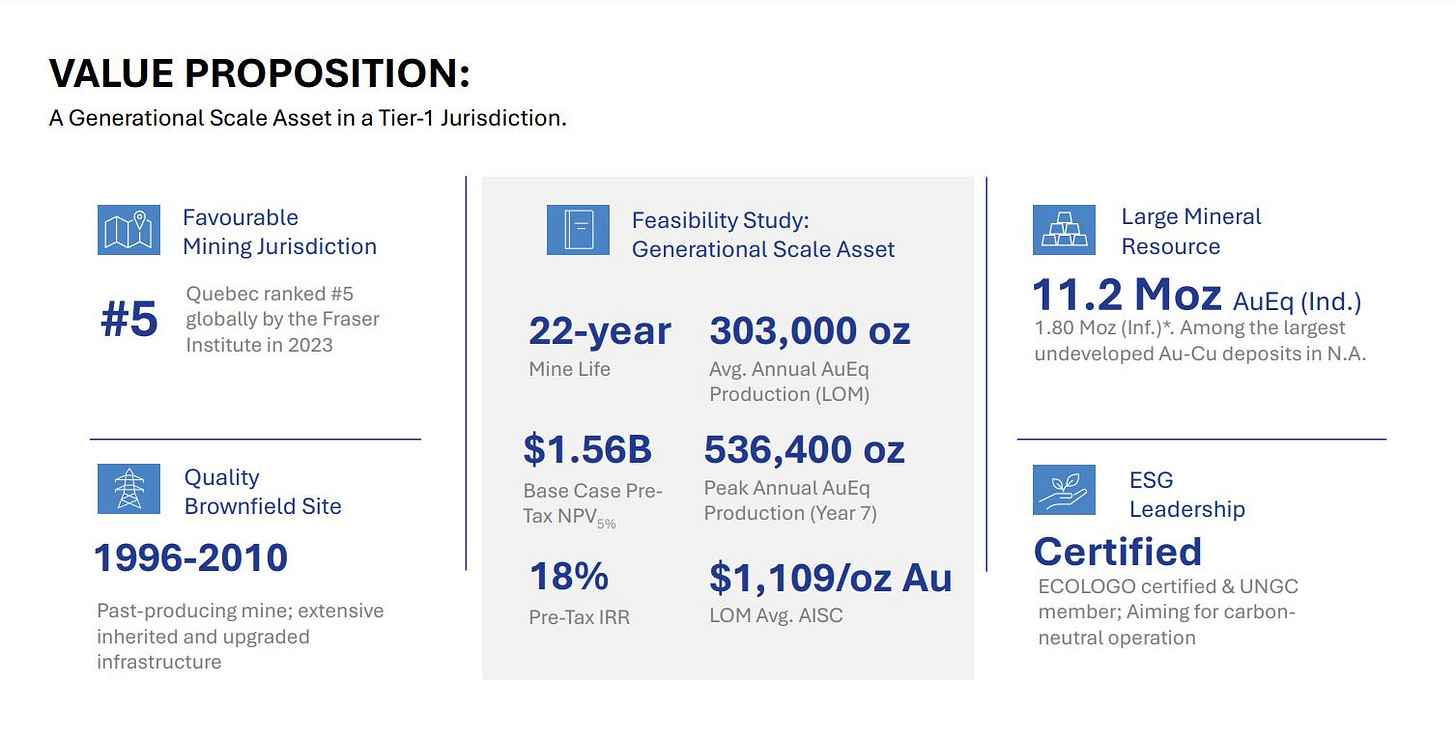

Total Mineral Resources – 11.2 million gold equivalent (gold/copper/silver) For the economic studies there is a contained 7.26Moz AuEq (6.02 Moz Au, 484 Mlbs Cu and 12.2 Moz Ag).

The Feasibility Study was released in May of 2024. The study outlined a 22-year open-pit operation projected to produce an average LOM production of 303,000 gold-equivalent ounces annually, with 17.3 million pounds of copper and 446,700 ounces of silver annually. Peak annual payable gold production of 536,400 ounces, 31.8 million pounds of copper and 613,600 ounces of silver in year 7.

So, when comparing the market cap valuations of Skeena and Troilus, they are both undervalued, but Troilus is trading at a fraction of Skeena, and there are a lot of reasonably close comparables that make this juxtaposition a real head scratcher.

Again, Skeena is going to average 366,000 gold eq. oz per year, with peak production at around 450,000 oz of gold per year. Troilus is going to average 303,000 gold eq. oz per year, with peak production at 536,400 oz of gold eq. oz per year. That’s a fairly similar production profile.

Skeena has a Measured and Indicated resource of 5.5 million AuEq ounces and Troilus has a 7.26Moz AuEq contained resource.

Skeena has released their fully funded capital stack in 2024, but notably Troilus released 4 combined, LOIs from ECAs that represent a total of US$1.3 billion, and that doesn’t even include the potentials for debt and royalty/stream components that Troilus could utilize in their capital stack.

Troilus Gold – Project Derisking Work, Reviewing The Feasibility Study, $1.3 Billion In Project Funding LOIs From 4 ECAs, And The Permitting Timeline

Skeena is valued at CAD $1.55 billion and Troilus is valued at $135 million. That is a huge gap in value for projects that are fair comparables and at a similar point of delineation and derisking. So one question to consider: Based on current market caps, would you rather have 1 Skeena or 11 Troilus’s for $1.55 billion?

There is clearly room for a larger re-rating higher in Troilus’s market cap on a percentage basis to get up closer to peer comparison valuations.

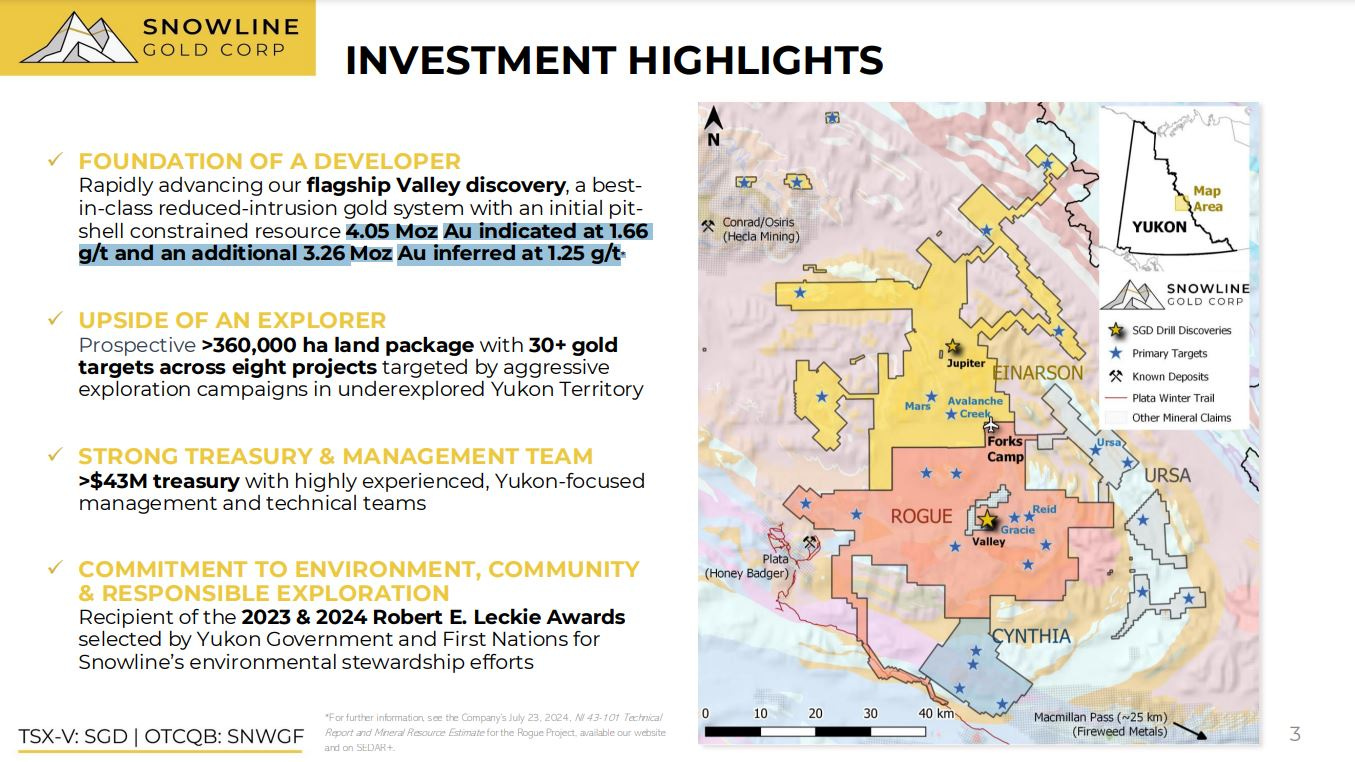

[Case Study #7] Snowline Gold Corp (TSX-V:SGD)(OTCQB:SNWGF) – Valley discovery at the Rogue Project + Jupiter discovery at the Einarson Project

Market Cap ~ CAD $880 million

Total mineral resources: 7.31 million ounces gold in all categories - 4.05 Moz Au indicated at 1.66 g/t and an additional 3.26 Moz Au inferred at 1.25 g/t

No economic studies at present

Snowline Gold has done an excellent job delineating 7.3 million ounces of gold in a very short time, and it has been hands down, one of the best discoveries in the gold sector over the last few years.

However, it is also valued accordingly at their current CAD $880 million market cap; especially considering there are no economic studies in place at this point in time, and its location in the jurisdiction of the Yukon is a bit remote. The Valley Deposit will have some serious infrastructure considerations to be addressed by any company that would want to develop this project.

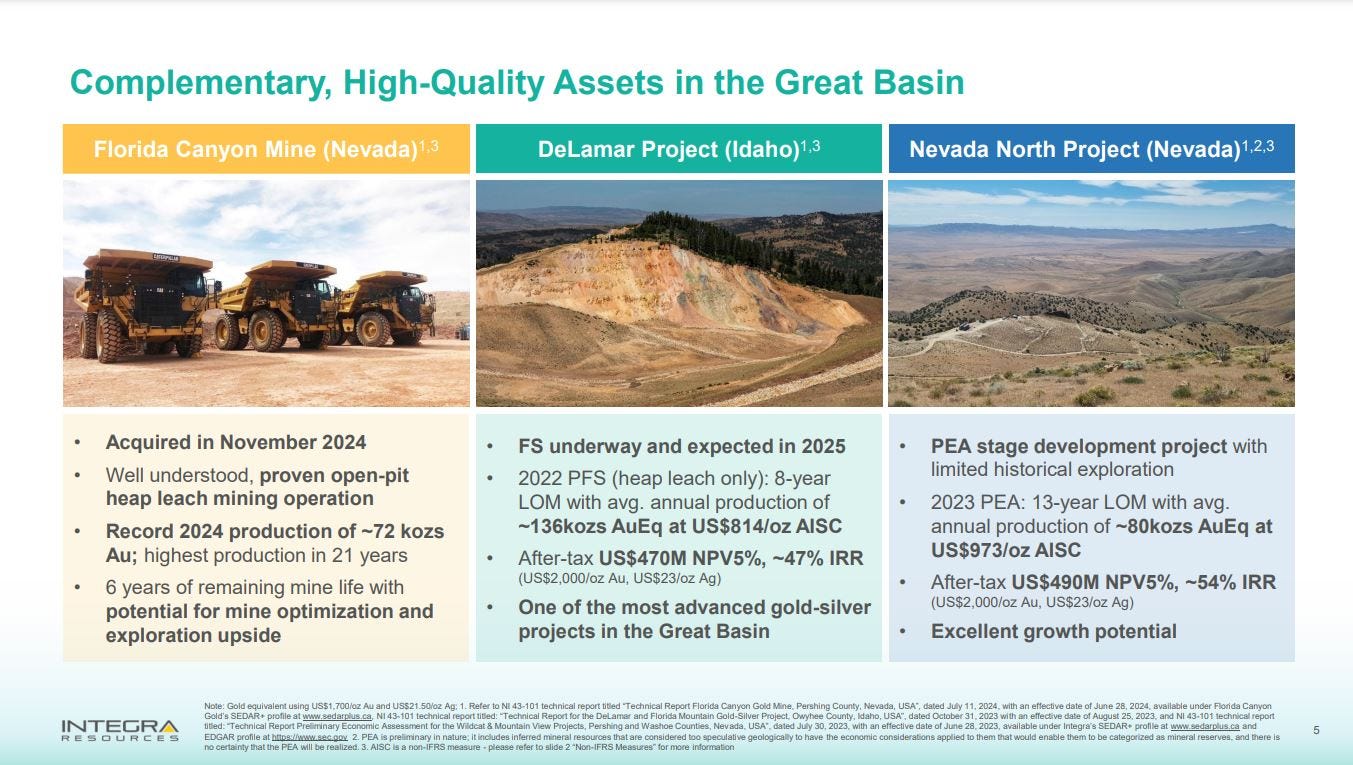

[Case Study #8] Integra Resources Corp. (TSXV: ITR) (NYSE American: ITRG) – Florida Canyon (operating mine) + Delemar & Nevada North (development projects)

Market Cap ~ CAD $258 million

Total mineral resources: 10.4 million ounces of gold equivalent ounces - 7.1Moz AuEq Measured & Indicated and 3.1Moz AuEq Inferred

- At the operating Florida Canyon Mine in Nevada, there was a record 2024 production of ~72,000 ounces of gold, which was the highest production in 21 years at this mine. There are 6 years of remaining mine life, with the potential for mine optimization and mineral expansion through exploration.

- At the DeLamar Project: There is a Feasibility Study underway and expected in 2025 as a key milestone for this year. The 2022 PFS (heap leach only): 8-year LOM with avg. annual production of ~136kozs AuEq at US$814/oz AISC • After-tax US$470 Million NPV5%, ~47% IRR (using US$2,000/oz Au, US$23/oz Ag price assumptions)

- At the Nevada North Project: There 2023 PEA: 13-year LOM with avg. annual production of ~80kozs AuEq at US$973/oz AISC • After-tax US$490 Million NPV5%, ~54% IRR (using US$2,000/oz Au, US$23/oz Ag price assumptions)

That is $960 Million in NPV between Delamar and Nevada North just for the 2 development projects, {only using their base metals assumptions}. At spot prices it would be much higher combined NPV ($1.2-$1.4 Billion?)

Then one would need to add to that whatever value one would like to ascribe to the remaining 6(+) years of mine production out of Florida Canyon.

Let’s make the assumption that the team optimizes Florida Canyon to keep producing around 70,000 ounces per year over 6 years for 420,000 gold.

During the acquisition of Florida Canyon they mentioned initially seeing higher costs somewhere around $1,700-$1,900 AISC per ounce the first couple years and then seeing it dropping down lower in the following 4 years.

I couldn’t find the most recent All-In Sustaining Costs figures (they may not be out yet) but at one point they were estimating a $1,550 LOM AISC. {now that has been removed from the slide deck}. Let’s just estimate that it is even higher at ~$1,800 per ounce to be conservative, and assume ~$900 per ounce margins at $2700 gold. 420,000 ounces at $900 per ounce margins would be $378 Million over the next 6 years. Obviously, at a lower average AISC over the 6 years or at higher gold prices then that figure would go up handsomely.

Let’s say though that someone wants to really discount that down substantially lower. OK, let’s say $240 million and add that to the $960 million in NPV of the other 2 projects (which used $2,000 gold and $23 silver price assumptions), then that is still a $1.2 Billion valuation potential. Again, that should likely be much higher using current metals sensitivities on Delamar and Nevada North... so possibly $1.5 Billion or $1.7 Billion at current spot prices?

I don’t know where the total valuation for Integra should come in at for it’s 10.4 million ounces of gold, 6 year production profile at Florida Canyon, and 2 development projects, but it seems like it should be multiples of the CAD $258 million it is currently trading at.

When contrasted against the $880 million market cap that Snowline Gold is already garnering for 7.3 million ounces of gold, with no economic studies, and in a more remote jurisdiction; then it seems like there is more upside potential for a re-rating higher in Integra Resources to me.

That doesn’t mean I don’t think Snowline has a valuable project with the resources they’ve already defined. (7+ million ounces is nothing to sneeze at). It just seems like Snowline Gold is more fairly valued at present in comparison to the larger assets and mineral reserves of Integra Resources, that do have economic studies in place, and they already have one producing gold mine.

If anything Integra should have the larger premium based on being more advanced and a producer, so there is a real valuation mismatch going on here.

Oddly, the market has been asleep on the valuation in Integra (considering the sum of its parts at all 3 projects), but just recently it has jumped up some in value over the last 2 weeks. (ITR was down below CAD $200 million just a few weeks ago which was a wild disconnect).

All of the companies mentioned above have solid projects. I’m not saying any of them are overvalued nor am I picking on any of the projects. The point I was trying to make in contrasting some of the projects against one another was just how undervalued many of these solid development projects are with serious ounces in the ground. That just looks like an opportunity to my eyes.

Most resource investors that have followed this sector for a decade or more would have expected to see better performance for the companies that have spent many prior years drilling, derisking, and massing up their mineral inventories to multi-million ounce gold resources in place. Many of them are being ignored…

While certain, higher profile companies have garnered enough of an investor bid to take them up to near-billion or over a billion dollar valuations, there are still a number of projects trading for a fraction of that, which also have compelling projects and economics in place. Eventually truth will out.

Will 2025 be the year where some of these projects finally get more traction and catch up closer to their intrinsic values?

Who knows? All we can do is try and identify valuation arbitrages that seem compelling, and position accordingly. I’m just sharing a few examples that have caught my attention lately and were brought up in conversations with other investors whose opinions I respect. These are not buy recommendations, and this is not investment advice. I’m just sharing my own personal observations and reflections.

Thanks for reading and may you have prosperity in your trading and in life!

Shad