Commodities Update - Week In Review And The Week Ahead – Part 12

Excelsior Prosperity w/ Shad Marquitz - (05/11/2024)

Let’s do a comprehensive review of the pricing moves in the commodities sector and the related resource stocks for this last week. There won’t be a lot of preamble about the macroeconomics or geopolitics or hand-wringing about what the Fed may or may not do in this particular issue, as essentially there haven’t been any major changes in theme over the last few weeks since the last update. Sure, we’ll look ahead to the coming inflation readings, and then the jobs numbers after that, but overall the commodities have taken on a life of their own the last few months in a reflationary trade. There are a lot of constructive commodity charts to review together this week.

Let’s kick things off with looking at the weekly chart of gold:

Gold has predictably pulled back over the last month since putting it’s high-water mark of $2448.80 in early April. We had noted a few times in early April that the RSI on the gold futures had climbed up well over the 70 overbought reading on the weekly chart, something we’d not seen for years. Also, pricing was getting really stretched above the key exponential moving averages (EMAs). At the time, a few weeks back, considering the overbought conditions it was postulated that we needed a “pause that refreshes” to quote the old Coca Cola commercial.

While some prognosticators came out and said “that was it” for the yellow metal’s bull run (no surprise there, as we see those kinds of comments at almost every intermediate or short-term peak), it certainly seems like the larger move in gold and the larger precious metals sector is far from over on the longer term monthly or quarterly charts. When one considers gold is coming out of the very large basing pattern for the last 13 years or even the last 3.5 years, the probabilities still favor the bulls for the medium to longer-term. So while we may still see some weakness in price in the metal, it has also been encouraging to see silver and the precious metals resource stocks holding up better and gaining a little ground on gold. That is precisely the kind of confirming signal we want to see in the overall PM sector.

Let’s take a look at the action in gold stocks via the ETF GDX:

GDX: A few weeks back there was a concerning candle pattern developing, and after 2 weeks of weak muted action and I wrote that we could see a corrective move develop but that “I’d prefer to see a really strong bullish candle breakout here to keep seeing rerating in the mining stocks.” I’m happy to report that the very next week, we did see that long full-bodied blue bullish candle, that eclipsed the prior week’s close and GDX has kept moving up from there to close this week at $35.35. It is also nice to see the 50-week EMA continue to slope higher and put in more space between the longer-duration EMAs.

Let’s shift over to Silver - the lessor precious metal, and hybrid metal (part precious & part industrial)

There isn’t really much new to say for silver, other than it has been holding it’s own the last few weeks, and consolidating at higher levels. It was nice to see another weekly close come in above the $28 price level (closing Friday at $28.51), but really the comments with regards to overhead resistance remain the same. After going up to test the key resistance at $30 last month (getting up to $29.91 intra-week), it was quickly deflected back down all the way to near $28 right after that, and clawed it’s way back higher since then. I’ve stated publicly for years now (ever since the #SilverSqueeze of Feb 1st, 2021), that we aren’t going to see fireworks in silver, or the gold or silver mining stocks until we see that $30 level line in the sand cleared definitely, and shifted from resistance to support. Even that $29.91 level hit 4 weeks back in silver, was $0.01 lower than that prior peak from August of 2020 at $29.92, and 44 cents lower than the intra-week peak from Feb 2021 at $30.35. So those are the next over-head resistance levels to clear on a weekly closing basis, and then we’d want to see prices hold above $30.35+ for a few weeks.

This type of breakout would set up a move in silver to $34-$35 in pretty short notice, because there isn’t a lot of resistance or price friction in between those areas. So even if we see a short-term corrective move in silver, that may bring in the buying and the juice for it to finally blast up through $30 and towards $34-$35. That would be the move that would awaken the animal spirits in both the gold and silver equities, and would signal a stronger leg of the precious bull markets was on in force.

Now let’s check in on the most speculative side of the precious metals complex – the silver miners, by way of (SILJ), the Amplify Junior Silver Miners ETF:

(SILJ) still has a lot of work to do to play catch up to the gold equities and moves in gold and silver for that matter, but remains in a bullish posture, with pricing well above the key exponential moving averages, and it just put in a solid bullish weekly candle to close on Friday at $11.87. The overhead resistance remains that series of prior peaks/troughs and pricing congestion in the $12.02-$12.19 zone, (as noted by the levels highlighted in blue rectangles on the chart above). Once we see that pricing resistance area cleared, it sets up a move in the mid $13’s and low $14s in fairly short order. My hunch is that this will correlate with the move in Silver finally breaking above $30. As a result, I continue to see the most opportunity in the silver junior stocks, to really start to move and outperform the rest of the sector in the medium term.

Over at the KE Report on Thursday this last week, we had a good conversation with our friend Brien Lundin, where he pointed out that same thing with regards to the historical propensity for silver to eventually outperform gold, and the silver stocks traditionally outperforming the gold stocks on bullish impulse moves higher in the precious metals complex. That section begins at the (7min:21sec) mark, and the link below should jump right to that point in the conversation.

Brien Lundin - Gold and Silver Equities Bull Market Playbook - May 9, 2024

Another great discussion we had over at the KE Report this last week was with our buddy and very sharp technical analyst, Jordan Roy-Byrne. He lays out the thesis very clearly that the longer-term setup in the precious metals complex remains quite bullish. After following Jordan’s work for nearly a decade now and knowing him for a number of years, this is possibly the most bullish I’ve ever heard him speak about gold, silver, and the precious metals stocks in a public interview; and well worth the brief listen, for those still hesitant about the longevity of the PM bull cycle still in front of us.

Jordan Roy-Byrne - Gold & Silver Stocks Outperforming Gold & Silver, Early Stage Bull Market Action - May 8, 2024

Let’s take a look at the weekly chart for Copper:

2 months ago we had postulated that Dr. Copper had finally put on his dancing shoes, and proceeding action the last 2 months has further confirmed that thesis; with a solid close to end last week at $4.66. We need to point out here that not only has the good doctor now definitively cleared last year’s January peak at $4.355, but it has cleared that whole slew of prior peaks back from 2021 and 2022 at $4.628, $4.471, $4.511, $4.601, and $4.577. Yes, things are getting a bit overbought now on copper futures with the RSI up to 74.52 on Friday’s close, (a level not seen since mid-2021), but still, this has been an impressive rally in copper any way one slices it. Even copper bears would have to admit this move has been strong with the force…

Let’s take a look at the copper stocks via the EFT (COPX):

(COPX) did break out to new highs over the last month, and putting in the highest weekly close on Friday to close at $47.98. Senior copper producers have been exploiting the rising metals price, as it goes right to their margins and bottom line, so not a surprise to see them surge. This strength has not filtered down into many of the junior copper stocks yet though, so like most of these commodities, it has been the senior producers garnering the investment capital inflows… which is what we typically see at sector turns, from bearish to bullish. I am getting more and more bullish on the copper juniors though and have been adding to positions in Arizona Sonoran (TSX:ASCU | OTCQX:ASCUF) , Surge Copper (TSXV: SURG) (OTCQB: SRGXF), and Faraday Copper (TSX:FDY)(OTCQX:CPPKF) over this last week.

Now, let’s take a look at some of the energy commodities, staring with Oil.

Light Crude Oil WTI pricing has been correcting for the last month, as geopolitical tensions eased a bit and there has been an inventory build in the US and Canada and in the Middle East. After oil futures prices got up to $87.67 in early April, a level not seen since last October, things have been correcting down, but not really falling out of bed closing at $78.26 on Friday. Pricing did break down through the 50-week EMA (currently at $79.44) so that is a slightly bearish posture. Overall though oil is still stuck in that larger trading range, and not really breaking out or breaking down. If we do see the further corrective move that some analysts are calling for, then I will personally be accumulating more oil & gas companies.

When looking at the larger oil & gas producers in (XLE) Energy Select Sector SPDR Fund, they’ve been correcting down with the oil price, but have had a epic run most of this year, and were a bit overcooked and an in need of cooling down some on the charts anyway. For the last few years the 50-week EMA has been strong support, and I’d anticipate that to remain the case on any further weakness and good area to be accumulating the energy stocks.

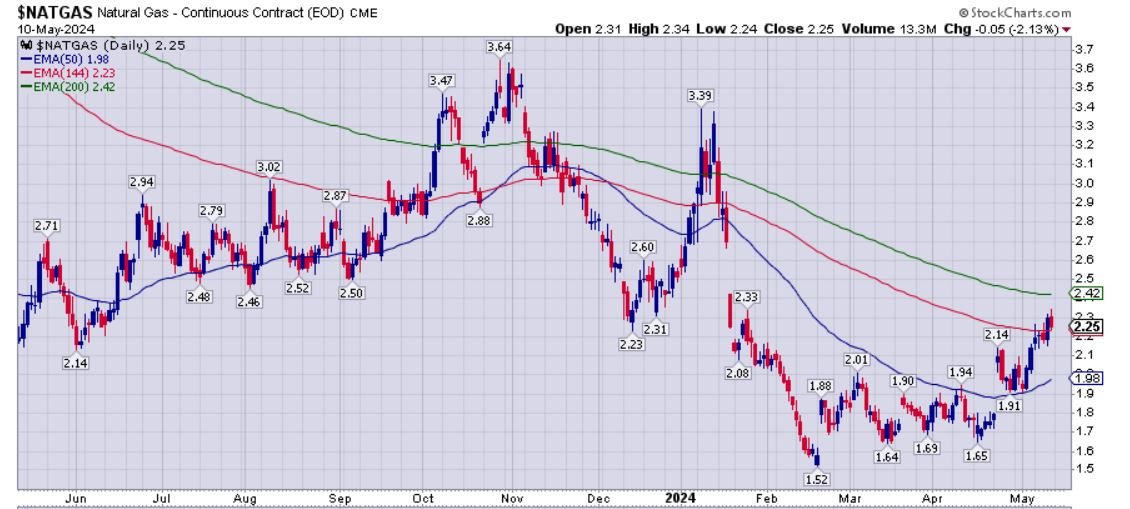

Let’s check in on Nat Gas:

Nat Gas: Well look at that chart above…. I provided a daily chart to hone in on the action from the last few weeks in more detail. The methane gas is finally flaring higher… This has the speculators in this sector getting more animated, and it is encouraging to have seen futures pricing close on Friday at $2.25, up above both the 50-week EMA (currently at $1.98) and the 144-week EMA (currently at $2.23). It’s a little early to get too excited, but this action on the short term has been bullish, and we’ll want to see that translate over to the weekly chart (which is still in a more bearish posture) over the fullness of time.

Over the last 2 months I’ve been positioning in Birchcliff Energy (BIR.TO) (BIREF) as an early entry into this sector. I have on my radar a few other companies like Antero (AR), EQT Corp (EQT), and Comstock (CRK) as a few other nat gas companies that I may start positioning in. There are also few other oil stocks with nice gas exposure that I’ll circle back around to in future updates.

Let’s wrap things up with a quick look at the Uranium stocks via URNM for a sense of how things are trending in the sector.

(URNM) has seen pricing break higher after consolidating at the 50-day exponential moving average and many different technicians are pointing to what looks like a bullish “cup & handle” pattern playing out in URNM and URA. I had mentioned 2-3 months ago, that I had started pulling partial profits in late January and early February, and that a corrective move in the sector was long overdue. We’ve now seen that corrective digestion period, and it is looking like the uranium sector could be setting up for another pop higher. I’ve maintained my core positions in 7 of the more established uranium producers and near-term producers/developers (enCore Energy, Energy Fuels, Uranium Energy Corp, Ur-Energy, Peninsula Energy, Denison Mines, and NexGen Energy), and anticipate that they will still have nice torque to the upside in any further bull market moves in the sector.

However, now that we are potentially getting ready for a less extreme but more measured move higher for the longer term in the Uranium stocks, I am starting to get interested in positioning in the uranium exploration companies. Recently I’ve started accumulating Standard Uranium (TSX-V: STND) (OTCQB: STTDF), after meeting with the management team at the Energy Transition Metals Summit the prior week in Washington D.C. There are a handful of other junior uranium exploration companies that I’m considering like Cosa Resources, Forum Energy, Stallion Uranium, and Baselode Energy. I’ll have more to say on that in an upcoming uranium article this next week, so stay tuned for that.

That’s it for today and thanks for reading. May you have prosperity in your trading and in life!

- Shad