Commodities Remain Volatile – What’s New About That?

Excelsior Prosperity w/ Shad Marquitz (04-26-2025)

For the entire month of April, it seems like the vast majority of financial outlets, pundits, and investors have bemoaned the “volatility” and “uncertainty” in the markets. Sure, we’ve seen some outsized daily moves in many markets, but is there really a time where markets are not volatile? Are the markets ever certain? Clearly not, but good luck reminding people of that when (yet again) they think the sky is falling, and the end is near…

Even supposed “long-term investors”, “value investors,” and “set-it-and-forget-it” investors that boast about “being right and sitting tight,” have been doing anything but that lately. Investors have been running around with their hair on fire, gnashing their teeth about whatever their most important hot-button issue is at the moment.

We’ve been seeing capital leaving some sectors like tech / AI and being reallocated to different sectors that are more defensive or international.

We’ve seen all the press and proclamations all year, and especially this month, about selling America to buy Europe or China.

We see vocal bobble-heads on financial media foaming at the mouth about how this was all a deliberate takedown of the markets.

Many market participants have been yelling at the clouds in the sky blaming CEOs, companies, and countries for doing this to their portfolios.

Then the markets recently bounced back strong, and recovered some of the losses (in the exact same macro conditions) and suddenly investors were placated and happy to be buying the dip the end of last week… You gotta love it!

Look, it is a dynamic market that has always been in flux, and always will be. People need to take a collective breath, chill out, and zoom back from the daily noise to look at the larger trends in motion. Sure, some trends are changing, as they ALWAYS do. Things that go up to nosebleed valuations eventually correct and come back down to Earth; just like sectors in bear markets eventually bottom during peak pessimism, and then start new bull markets once again.

“The only constant is change.”

Just this month we’ve seen the general US equity markets sell down hard, then rebound strongly.

We’ve watched the S&P 500 volatility index (VIX) going up and down like a yo-yo, representing the extreme hedging moves in the options markets.

There has been a steady sell-down in the King Dollar, and lots of other currency market gyrations.

The bond market gyrations have been counterintuitive

Commodities prices have been jostling back and forth accordingly.

Obviously, this recent spate of volatility has been caused by a bevvy of macroeconomic factors from tariff wars, executive orders, export bans, geopolitical flare ups in multiple countries, coming elections in several countries, shifting alliances in global trade, and renewed calls for recessions or depressions in many countries.

There is repeated talk of unease under the breath of most market participants, and a lot of hand wringing. Some investors that are taking very defensive action converting some market positions to cash held in money markets or stored in gold as a refuge.

In the course of my work, I get the good fortune of talking with many fellow investors, financial influencers and investing thought leaders, newsletter writers, investing conference promoters, fund managers, company management teams, and economic pundits. My overall takeaway is that it seems like most of them are so consumed with the shock and awe of the daily newsflow, that they have a sort of tunnel-vision and recency bias to what just happened, but at the exclusion of what we should have learned from past cycles in history or just looking at the valuations and the charts.

There is never a completely safe time to invest.

There are always reasons to be concerned brewing under the surface, and nobody knows when one of them is going to rise up and cause market mayhem.

The markets are always a set of opportunities mixed with difficulties.

It is like people have amnesia that there is always some exogenous factor coming in to affect their imagined expectations of a smooth market (housing market crashes, pandemic crashes, geopolitical flare ups, banking crises, Fed policy surprises for hiking or cutting, the Yen carry-trade unwinding, Deepseek upending AI and the energy sector, and now tariff tantrums).

There have been consistent wars and geopolitical conflicts for all of human history - this is unlikely to change anytime soon. When new conflicts spring up, they may roil currencies, bonds, those domestic stock markets, commodities, and economies. While hot wars and proxy wars are both sad and disappointing, they have flared up over and over again in the post-WWII world and are always a part of navigating within the global financial markets.

We’ve seen a stream of banking and financial crises continually tear down and build up that sector for hundreds of years now. When these financial sectors are surging or crashing, there is always collateral damage to other sectors.

There has been a tug-of-war in bond markets versus central bank policies, ever since their creation, and in numerous countries. Bond vigilantes show up periodically to counterbalance central bank intervention in the free markets, and we as investors have to figure out how to adjust and act accordingly.

We saw the Great Financial Crisis in the US emerge from loose lending policies and mortgage defaults that blew up that sector, and that quickly became a contagion to other sectors and the broad market indexes. Really any student of history knows that every country has had real estate booms and then real estate crashes, both of the residential and commercial variety.

OPEC+ has roiled oil markets repeatedly for many decades. Likewise countries that are not part of OPEC+ have repeatedly surprised markets with too much or not enough supply.

We’ve seen tech bubbles that rise and pop, then rise again, then pop; rinse and repeat.

Tech is an interesting case study with regards to watching the investing cheese continually moving throughout the maze.

First it was computers, then it was software, then manufacturing automation through robotics, then the internet, then the internet-of-things and big data, then cloud platforms, smart phones and then smart phone apps, smart appliances and TVs, social media, cybersecurity, cryptocurrencies, NFTs, fintech, electric vehicles, virtual reality, augmented reality, artificial intelligence, quantum computing, and now even space stocks.

Most of those sectors are still with us, but there have been many flavor-of-the-day companies that rose with the hype from those emerging tech sectors became the new “must-own trade,” but then they were followed by epic implosions as the herd of companies was culled down to the few survivors.

Raw materials and resource markets are similar in that there always seems to be the same kind of flavor-of-the-day “hot commodity” that steals the headlines, and then the herd inevitably piles after most of the move has already played out. Out of the melt-up bubble only a few quality companies will actually win in the long-term. Most of the companies that were epic winning trades, then become epic losers crashing for months or years afterwards… until that commodity comes back into focus once again.

How many times have we heard over the last 3 decades that the world is getting rid of its dependence on coal?

Meanwhile coal power is still about 1/3 of the world’s energy production. Most investors completely missed out on the 9-fold increase in coal coming out of the 2020 pandemic and rising up into the height of the Ukraine war concerns, where Russia cut off the nat gas flows into Europe throughout 2022.

How many times have we heard that we were at peak oil and production would be crimped from now on, or that oil would be phased out by the year 2000, 2010, 2020, 2030….?

Meanwhile the US has been at record oil and natural gas production levels for the last few years, and clearly there has remained a very robust demand for fossil fuels globally. Oil prices have always been volatile…

How many times did we hear fossil fuels were yesterday’s news?

Meanwhile, natural gas power plants have now grown to 43% of the energy production in the US, and there are still over 2,000 uses for oil.

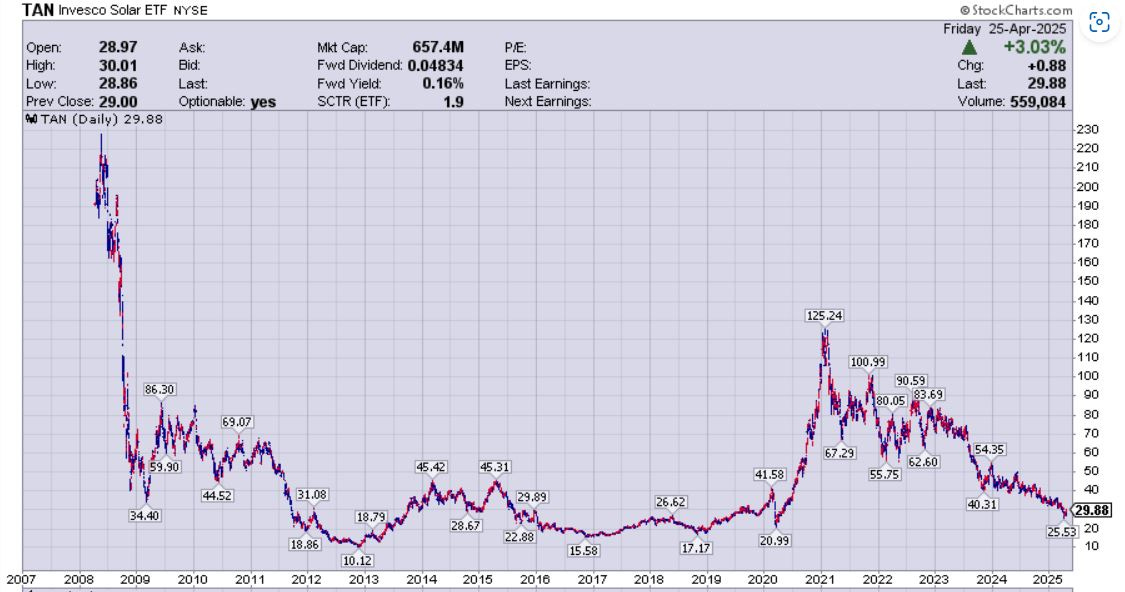

How many times have heard renewable energy sources like solar and wind were going to displace all of the fossil fuels to make way for the green new deal and energy transition? They’ve been cyclical like all other sectors and have not phased out all of the other more stable 24/7 baseload power inputs.

How many times did we read or hear projections for the last 2 decades that electric vehicles would have totally displaced the internal combustion engine by now?

Still waiting on that mass adoption… Meanwhile many automotive companies are scaling back in a big way their EV production, preferring to focus on hybrid and standard ICE models instead. Yes, the internal combustion engine has still not gone the way of the dodo bird as of the year 2025, (despite prior models and projections to the contrary).

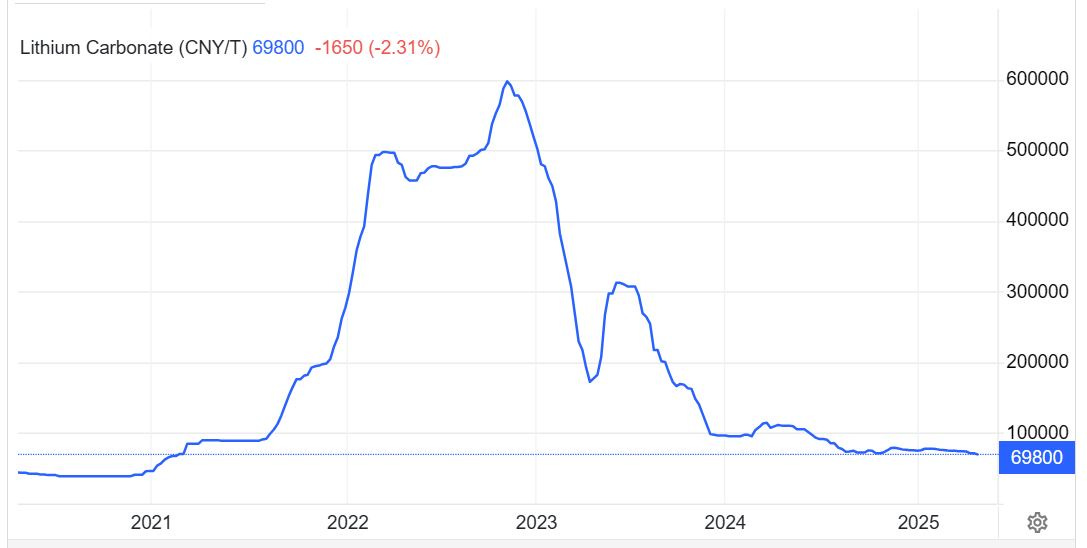

The resource space did not miss the opportunity on this narrative to send lithium and nickel prices up dramatically, in anticipation of the future demand for batteries. This was a trend that was easy to see coming at the time, but then a pattern we’ve seen so many times in the commodities space played out -- a glut of production supply was the cure to the high prices.

For decades now, we’ve heard that nuclear energy’s time was over?

Meanwhile, we see so many reactors getting restarts or life extensions, in addition to about 60 new reactors that are being built or nearing construction decisions in the next decade. Then add in small modular reactors as an emerging sector.

In the last 8 years the spot price of uranium went from $17 to $106 and investors went from despondent to uber-bullish, in a sector that pundits claimed was over.

Then over the last year, pricing has pulled back down to the low $60s; which is odd considering the strongest fundamental backdrop the sector has seen in decades.

Now only a year later after headlines were proclaiming the new “nuclear renaissance” nobody likes uranium stocks at all. This too shall pass…

Commodity investors that understand the cyclicality of these sectors and the larger fundamental story underpinning the growth of nuclear power know that it’s just a matter of time until we see triple digit uranium once again and the price of the uranium equities blast back higher once again.

Shifting over to the “red metal” we’ve heard for years a split narrative about the economic health of the US and China, and thus copper price projections (wildly bearish calls for a range of $1.50-$2.50 copper, contrasted against wildly bullish calls for $6-$10 copper targets). Supposed experts were trotted out on financial tv or internet forums that tossed out these uber-bearish and uber-bullish copper price targets like candy; with no real follow-up or accountability for these calls.

The price chart reflects a whipsaw nature where neither narrative or outlook has fully played out, and like markets do copper futures split the difference.

1. The bearish copper camp has repeatedly warned investors about an imminent recession ever since the yield curve inverted in 2022 and the Fed started hiking rates. Then in 2022 we saw 2 negative quarters of GDP, a spike in oil prices, and inflation turned out not to be “transitory.” The calls for a recession having commenced came out of the woodwork, but eventually improving economic data and strong jobs markets ruled out a recession.

Then there was a regional banking crisis in early 2023 that was surely going to be the harbinger of a recession, but it never came.

Then the 2024 un-inverting of the yield curve meant a recession was going to show up in 60-90 days… but it still never came.

We’ve had repeated calls for recession all of 2022, 2023, 2024, and now with the tariffs we’ve seen calls the last few months for a recession again in 2025. Hey, maybe we do eventually get a recession, but if commodities investors were avoiding copper this whole time, then they’ve missed a series of repeated trade setups to buy low and sell high. Focus on the chart setups and not the noisy narratives.

2. Conversely, there have been calls for copper to rally up to the high single-digits or even double-digits every year because of the continuous supply deficit.

Copper perma-bulls point to the aging copper mines on the planet depleting their reserves, and that there are not enough big mines coming online to bring on production quick enough to meet the blossoming demand.

It is true that emerging nations continue to electrify, and we’ve been told we’ll need more copper wiring for all the electric vehicles and the infrastructure for charging stations, all the electric wiring of solar and wind farms to the power grid, the crypto-mining energy hogs, and now the growing need for more copper for AI datacenters.

While all these points are valid, the copper price has mostly channeled between the low $3’s to the low $5s. Correspondingly, there were periods of big outperformance and then severe underperformance in the copper equities.

Then the commodity that has been picked on the most, being categorized as a “pet rock,” “boomer rock,” and “barbarous relic” of the past, has been gold.

Despite its illustrious 5,000 year history as money, a store of value, and a safe haven, it was declared by so many media publications all through 2022 and 2023 that “gold was no longer a safe haven.” Not only that, but gold was “too boring” to attract a bid from investors that wanted a return on their capital.

Looking at the price chart from late 2022 to present, it would seem that gold did offer investors more than a double on their capital invested. The precious metal was far from boring, and it absolutely has acted as a safe haven from both financial and geopolitical chaos.

Here in the wild month of April 2025, gold has acted as the sole safe haven.

Turning to silver, it may rival all the other commodities for having the most competing narratives going on the last few years:

It’s “poor man’s gold” and it will always rally along with gold as a precious metal.

It’s no longer a precious metal or money, and it truly is an industrial metal now.

Silver has always been suppressed by nefarious financial institutions and will never be allowed to really break higher in a meaningful way.

There is an imminent #SilverSqueeze that is going to push it to $50 next month (proclaimed in 2021, 2023, 2024, 2025)

Again, so many narratives, but it is best to just watch the price chart for clues.

It appears that in reality, silver has been in a gradual march higher for the last decade, with a brief drop during the pandemic crash of 2020, but blasting up to higher and higher levels the last few years.

The silver futures price, in the dirty paper markets, was not prevented from getting to $35.05 in October of 2024, or the recent high water mark just last month on March 3rd 2025 at $35.495.

Silver has been making a series of higher highs and higher lows since the last PM intermediate bottom in late 2022. That is overall bullish action, despite the despondency from many PM investors.

While the trend has been upwared, silver has not broken out to new all-time highs above $50 over the last few years, and it did not really follow gold’s lead to new all-time highs since late 2023 to present.

Silver is the “heart breaker” metal, but it has been making steady progress higher in the big picture. Unless something drastically changes, the odds are this trend higher will continue into the high $30s and low $40s over the next year or so. That should could continue to lift the margins, earnings, and valuations for silver producers and developers.

Heck, one of these days we will likely see silver break out of that huge cup and handle from 1980 to 2011, and pricing finally break north of that $50 lateral price resistance. When and if that level is eclipsed, it will sure bring out the animal spirits in the precious metals complex.

So, while we continue to hear about these volatile markets - for commodity investors this is old hat. Generalist investors may get their knickers in a twist because US equities pulled back by 10-20%, but for commodities investors this volatility is a regular occurrence.

Commodities are always cyclical, always volatile, and individual resource stocks can surge higher or drop lower by double-digits just in a day or week. When you put it in context, then all this media fuss and investor outcry about volatility in the general markets in April has really become overblown. So yeah… Commodities remain volatile. What’s new about that?

Thanks for reading and may you have prosperity in your trading and in life!

· Shad