Brutal Close To The Week In Resource Stocks, After Starting The Week In Rarified Air

Excelsior Prosperity w/ Shad Marquitz (10-18-2025)

This was a really wild week in resource investing. The week started with surges to new heights on many commodity sector ETFs and individual equities. By Wednesday and Thursday many individual stocks topped out, then things got crushed on Friday.

In the first half of this last week gold was up at all-time highs in the upper $4,300s, silver was breaking up to new all-time highs at $53-$54, rare earth stocks were all the rage, and uranium stocks were surging again. It was a melt-up move in these markets, but then that was followed by a corrective move to end the week.

So, let’s get into it…

We all know that longer-term, and for many years now, gold’s trajectory higher has been a thing of beauty, and that larger trend is still very much intact. So big picture gold is solidly in the throws of a raging bull market.

If we zoom in on the very short-term hourly chart for gold, then we’ll have a look at pricing action over the last 2 weeks. Even over this period of time the yellow metal was also still in an overall bullish trend, up and to the right; that only reversed at the tail-end of last week on Friday.

After a blistering run higher where gold was up knocking on the $4,400 door on Oct 16th, (tagging $4,392 in extended market hours), it quickly reversed down on Friday Oct 17th getting briefly below $4,200 (hitting a low at $4,196 and then reversing back higher again).

It was a surreal way to end a week for this precious metal that had charged higher since Sunday night, but then ended the week on a sour note for Friday, and was accompanied by the whole PM complex correcting, along with many other sectors gapping down.

Pricing ended the week with the gold futures price below its 50-hour Exponential Moving Average, but pricing started clawing its way back up approaching that level again by the end of the session. It will be key to watch how markets behave Sunday evening, when trading begins overseas, and more importantly where they open and close on Monday to kick off this next week; and then where things close on Friday for the weekly close.

With regards to Silver - it had a legendary week, got to hero status, but then also ended in pricing weakness.

In the prior week, on Oct 9th and 10th, we had seen silver go up and tag the high $49s on the futures market, while silver spot prices did go up and tag $51, making a new all-time high, while also putting silver into backwardation between spot price and futures price.

Silver blasted above that 45-year high just under $50 on October 13th, plowing into the $50s, and then held onto these lofty all-time high levels all week long. This was much different that the fleeting prior 2 attempts at $50 made in 1980 and 2011. In those moves Silver was only up there for hours before retreating far lower.

Silver tagged an intraday high of $53.765 on Thursday October 16th, but then reversed down hard on the following trading session.

On Friday October 17th, silver sank back down briefly below $50, hitting an intraday low of $49.66, before bouncing back up to $50.62 to close up last week.

Pricing ended the week with the silver futures price below its 50-hour EMA, putting it in a short-term bearish posture. Just like gold, we’ll to need to see how silver starts up Sunday evening in overseas trading, and then how things open up and then close on Monday to kick off next week. Silver bulls will want to see pricing reclaim the 50-hour EMA as all breakouts start on the lessor charts first.

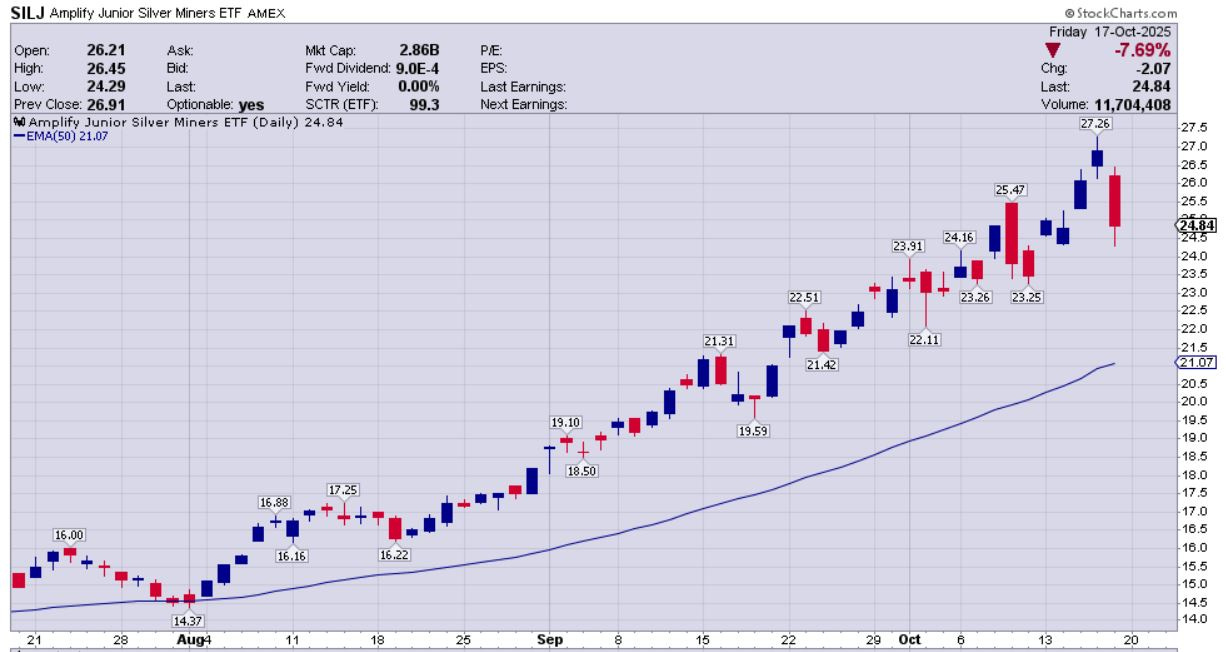

GDXJ was under pressure on Friday’s session, closing down 7.69%

Trade update: I added another tranche to a gold developer that I like on Friday’s corrective move -- Probe Gold Inc. (TSX: PRB) (OTCQB: PROBF)

This is an advanced gold explorer and earlier-stage developer that I’ve been in for a while but just haven’t worked it in yet for a featured write up. It’s a quality team/project, in a good jurisdiction, with good economics, and it’s likely a takeover candidate)

They doubled the resource from 5 Moz to 10 Moz of gold in the last 2 years. To my thinking, the rising resource paired with the rising price of gold is compelling value expansion, and yet their valuation doesn’t appear to pricing either factor in at anywhere close to where they should be valued at this point; especially in their prime location to infrastructure, labor, and part of a larger mining district.

The NPV at 5% discount rate at $3,500 gold sensitivity was worth $3.99 Billion, so what’s it worth now at $4,000 gold or $4,300 gold? Is that priced in? (nope)

The IRR at $3,500 gold was 80%, so what’s the internal rate of return now at $4,000 gold or $4,300 gold? Is that priced in? (nope)

The silver mining stocks really took it on the chin on Friday, with the Amplify Junior Silver Miners ETF (SILJ) down 7.69%

I added to 3 silver stock positions on Friday (Americas Gold and Silver, Santacruz Silver, and Aftermath Silver), into that market selling pressure. Those are some high-conviction positions that I had trimmed down some earlier in the week and decided to boost back up their weightings a bit more again.

When almost everything goes on sale, then I typically opt to buy quality while it is on the sale rack. While some may scoff at putting those companies in the “quality” bucket, they are likely working off an old model and dated understanding of those companies from years past. There has been good change.

These companies that admittedly struggled over the last few years have now each turned the corner in their respective business approaches; and all 3 will eventually be seen in about 12-18 months as quality. As a result, I still believe they have the most potential to rerate higher compared to peers, based on their growth initiatives and work plans.

They’ll have a combination of both alpha and beta torque into a rising bull market, and that is why they have been outperforming most of their peers and the ETFs in the sector. The converse is also true, and on pullbacks they’ll have some of the most exaggerated moves downwards to exploit through buying those dips.

The rare earths were absolutely the talk of the town and on everybody’s radar the last 2 weeks, due to the Chinese export controls and corresponding tariff response from the US.

I was interviewed on 3 different investing and trading podcast shows over the last few weeks, and there there was keen interest in the rare earths sector from producers and listeners of the shows, and the questions that were submitted live during those shows. Even generalist investors, that are not inclined to typically invest in resource stocks are aware of how the governments around the world are highlighting the strategic importance for many of these critical minerals.

🚨Over a Dozen Trades for Top Commodities

Grey Swan Live - September 25th - Call transcript

Andrew and Shad covered the gamut in commodities...

Stock Trader Network Podcast: Shad Marquitz - Oct 16, 2025

The VanEck Rare Earth and Strategic Metals ETF (NYSE: REMX) will be used as a proxy for this sector.

While it’s been in a steady uptrend for months, the month of October has been explosive, and some of the daily moves the last 2 weeks have been highly volatile in both directions.

From Friday Oct 10th to Friday Oct 17th, these rare earth stocks inside of (REMX) were all over the place, with wild whipsaw moves and far larger daily price ranges that is typical for this ETF.

It will be curious to see where pricing direction goes in (REMX) this next week, to either keep breaking out and test that upward limit at $81.71, or if pricing goes down to test the 50-day EMA (currently at $64.42). On that note, pricing is still currently well above the 50-day EMA, which keeps it in a bullish posture.

I added to my positions in 2 rare earth stocks on Friday; (Neo Performance Materials & Energy Fuels). We’ve talked a lot about those in a few different recent articles, so for those that missed the prior update on rare earths, here’s that link:

https://excelsiorprosperity.substack.com/p/opportunities-in-rare-earth-elements-55b

The uranium stocks have in a stealth rally ever since the April tariff tantrum lows, and have continued to gradually head higher for the last handful of months.

We did see some high-wicked long-bodied candles this last week that signaled a short-term top, and we saw the reversal in trend from the middle to end of last week.

We’ll look at the Sprott Junior Uranium Miners ETF (Nasdaq: URNJ) as a proxy for the uranium equities.

Uranium stocks topped out on October 15th & 16th, and reversed down hard on Thursday, and then followed that up with big gap lower on October 17th.

The gap down move on Friday was too attractive to pass up for me. I used some newly harvested dry powder to add to some existing uranium positions… and also to initiate a new position.

If we see even more weakness in URNJ down to the 50-day EMA, then I plan to add even more to current U-stock positions at that point.

I added to my positions in Energy Fuels, enCore Energy, and initiated a new position in Uranium Royalty Corp). More on 2 of those trades shortly….

As a personal anecdote and to set up some points to expand on: My diversified trading account in dozens of positions went from having one of its biggest up days on Monday on the US traded tickers (with exasperated moves higher in stocks possibly enabled by Canadian markets being closed while metals prices were surging), to the portfolio going up to its pinnacle height in gains and valuation mid-week on Wednesday, to then turn around and sell down harshly by nearly 11% overall towards the end of the week on Thursday and Friday.

My portfolio was down 8% alone just on Friday, which is a really big move in either direction across a larger basket of stocks. So that really stung…

Every position except 1 was down in the red on Friday - (which is very rare).

course, a high-torque portfolio cuts in both directions, with outperformance to the upside and the downside.

Despite a very rough end of this last week, the overall portfolio is still up 219% year-to-date, outperforming most key sector ETFs as benchmarks. This is my primary investing goal… otherwise it would be way easier to just buy the ETFs.

By the beginning of this last week I had finally built up to a 10% cash position for dry powder in my trading account. I wrote on this channel about having a goal to get that done by the end of September, but in reality it took me until Tuesday Oct 14th to finally achieve this, by lightening up on about a dozen of the larger and more liquid stocks over the last few weeks.

By Friday October 17th, (only 3 days later), I was redeploying some of those dry powder funds right back into the market carnage and blood in the streets, adding to positions as the tickers all flashed red in deep sell-downs.

Now I’m back down to 7% dry powder again, after deploying some funds to fortify a half dozen positions with another tranche, at much lower levels than I recently trimmed them at. I didn’t expect to be deploying those reserves so soon, but that is the way markets can move sometimes.

{That is not investing or financial advice, and I am not a financial advisor. This is strictly me sharing what I’m doing with my own capital in my own portfolio, strictly for entertainment purposes.}

This brings up the whole point of investing… you know, the adage about “buying low and selling high,” right? The whole point of trimming back small 10-20% tranches from the overall positions in some gold, silver, uranium, rare earth, and specialty metals winners over the last few weeks was to raise funds for a rainy day.

Despite this being heresy to some people’s thought process (where they never want to sell anything and berate anyone that does mention trimming or selling), that prior trimming was the source of those funds. That is the method behind the madness.

Utilizing the prudent portfolio management and risk management strategy of trimming back winners at overbought levels or at portfolio weighting limits, was precisely what provided the actual capital to deploy when opportunities like what happened on Friday’s big sell-off occurred.

Trade update: On Oct 13th I sold a 17% tranche of Energy Fuels (UUUU) at $24.04, from an overall multi-tranche consolidated position.

I bought that same tranche right back on Oct 17th at $20.44 for 15% less.

Even if the stock keeps correcting, skipping that 15% drop on that 17% tranche was preserved using a trimming strategy.

No, that’s not a huge win, but it happened in just 3 days, and is just a simple recent example of the kind of trading strategy I like to deploy; but across multiple positions and in the same positions, but multiple times in sequence.

Energy Fuels has received a lot of attention lately due to its domestic dual production of both uranium and rare earths, so it also seemed like a topical stock to discuss here in this article because it checks both boxes.

Also there was that gap up from the 12th to the 13th, and then retest of that gap area on the 16th, and then a further plunge on the 17th, so I decided to bite…

If the stock stays in trouble and goes more bearish, then it could go all the way down to the 50-day Exponential Moving Average (EMA), [the blue line], currently at $15.38.

If that played out, then I’d add another tranche at wherever pricing met the 50-day EMA as the next accumulation point. Having said that, I am back to fully-allocated in that position at this point; and hope it doesn’t come to that. The point being… that there is a trading strategy in place, in advance, for if that happens.

If I had to add yet another tranche at that 50-day EMA then the position would switch to temporarily “overweight,” and I’d look to take that tranche back off again on the first meaningful rally, to get back to just “fully allocated” once again.

On Oct 17th I took some of the dry powder raised on the sidelines and deployed it into a new starter position in Uranium Royalty Corp (Nasdaq: UROY) at $4.10.

This was just a straight-forward acquisition of a stock I’ve been following on my watchlist for a long time, and came onto my top-of-mind awareness this week.

This highlights the reason it is good to have your own watchlist already developed. That way, during outsized market down days, you are not scrambling around wondering what to buy. Instead one’s watchlist may present compelling trade setups.

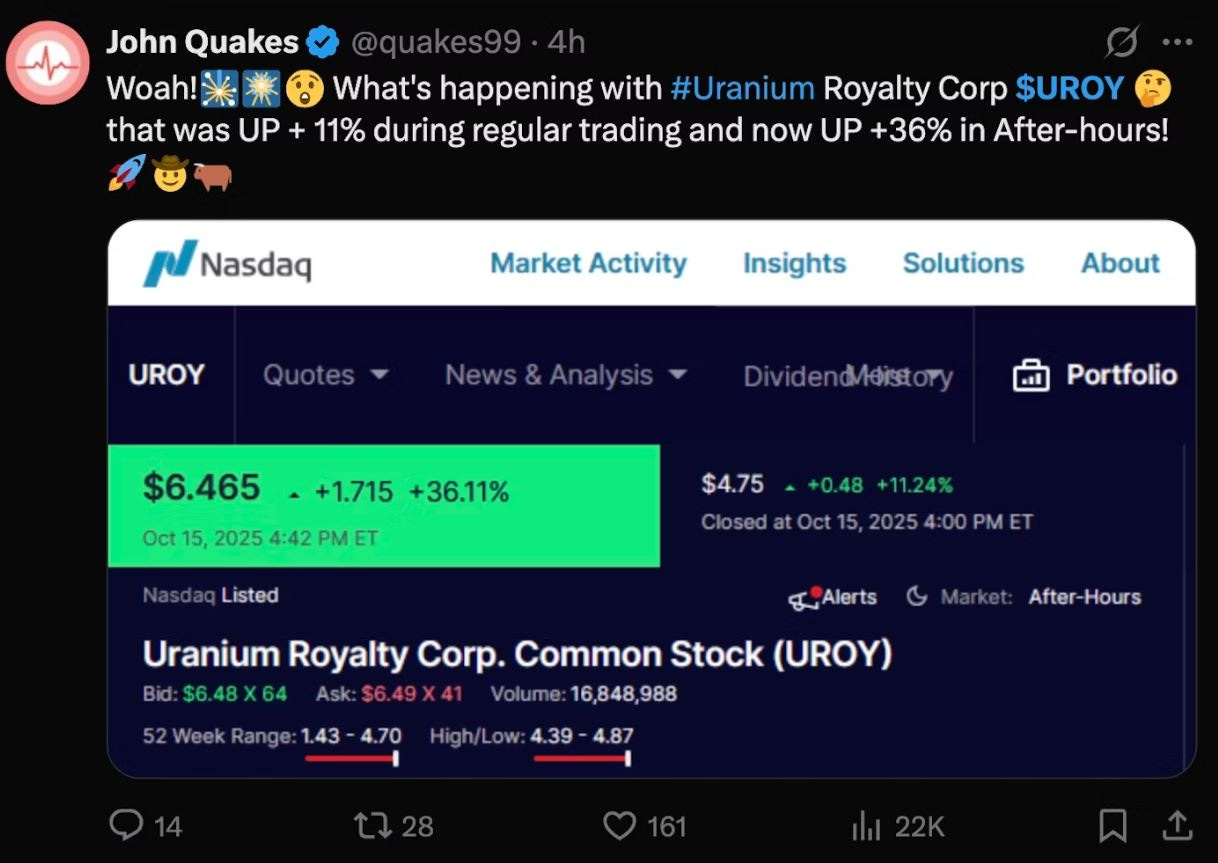

There had been a lot of strange trading behavior in (UROY) during the regular sessions and also in the afterhours trading mid-week. Several other platforms or commentators picked up on this, when it shot up an additional 36% to $6.46 in extended after-hours trading session on Oct 15th. Wild!

When one sees that kind of extreme trading, there is something profound happening, and its time to sit up and pay closer attention. Either the stock is racing higher based on some fundamental news factor, or it’s an outsized technical momentum move. Whatever is happening one needs watch out.

Some people attributed the steep rise afterhours to Reddit meme stock gangsters, but I cannot verify that and quite honestly don’t care why it happened. The point is that it DID happen and those kinds of moves rarely stick.

Apparently other trading services then recommended to their subscribers that they sell half their positions to lock in gains. This sent (UROY) cratering right from the open the following day on Oct 16th, downwards in a big red bearish candle.

When the stock remained under pressure and got down near the bottom part of a sideways consolidation zone (shown in the box on the chart below), then I decided to deploy some dry powder to get an initial tranche in place.

If UROY keeps dropping then I’ll look towards the 50-day EMA, currently at $3.70, as the next accumulation point to add another tranche.

That is more granular than I normally get here in these articles on some active trading, but just felt that may make for a fun segment. Hopefully some enjoyed peeling back the layers and getting into some actual trades and real-world price levels.

From time to time I may share some of my trades, clearly not as investment advice, but merely to share what I’m doing in my own portfolio and the rationale behind them for entertainment purposes. If nothing else, it may encourage readers to look at positions within their own portfolios more closely, and potentially spot their own compelling risk/reward trade setups.

Thanks for reading and may you have prosperity in your trading and in life!

Shad