Commodity Global Expo - Gold, Silver, Copper, and Uranium

Excelsior Prosperity w/ Shad Marquitz (10/29/2024)

Finally, we are back together again here for a commodities update, after a wild and technically significant last couple weeks in the metals markets. In this article we’ll check in briefly on the technical pricing action for gold, GDX, silver, copper, and URNM as well as some informative takes from exclusive KER interviews.

Just a quick note: I’ve got a number of silver, gold, copper, and uranium stock updates and articles that will coming out over the days and weeks ahead that I’m very excited to be sharing with readers here in this channel. So stay tuned!

There has a been a bit of a lull in my article frequency lately, due to some traveling to a conference, work load, and personal items I needed to take care of. The good news is that there is a backlog of good news… and a number of company deep dives that have been piling up. As a result of this backlog, I may be posting a few more articles than usual in the near-term, to reward folks here for their patience and get a better cadence going in between articles.

To this very point… I would have loved to have put out an update 2 weekends ago recapping the big moves in gold, silver, and the PM mining stocks up through that Friday the 18th, (because that was a significant day in sector); but I had to leave at the crack of dawn that Saturday morning Oct 19th from Seattle to fly cross-country to Fort Lauderdale, FL for the Commodities Global Expo event.

From the moment check-in was completed at my hotel on the 19th, it was “go time.” Connections began with fellow resource investors and mining companies already in town and meeting up for pre-event dinners, mixers, and add-on meetings. Then the official company presentations, & conference lectures began, and then more meetings and mixers continued even after the official event had wrapped up; all the way through Wednesday of this last week.

During this period of time it was particularly vexing to see Silver keep punching higher the middle of last week up to $35 and to see so many PM companies having outsized moves higher, all while being physically trapped in a series of meetings. Again, it would have been great to have weighed in on all the action in updates, but each evening I was tapped out. We’ll definitely cover it all here shortly though…

We also saw all kinds of news that hit the wires the last couple of weeks with mega-tech companies announcing their plans to utilize small modular reactors. This has been a huge boon to the uranium stocks, and we’ll get into that down below as well.

There are some recent KER interviews that tap into some of these topics that I’ll share as we dig into various metals in this week’s commodities update together.

So as much as I really wanted to put out some updates on all the fundamental macro news, and technical setups on the charts, I was just totally tapped out. Any small amounts of free time I did have were invested in personal sanity time at the beach…

Just a few quick thoughts and takeaways from the Commodities Global Expo conference, which was literally a breath of fresh air in the conference space.

I liked that Day 1 was focused on mixers, networking, and an extended dinner of spirited conversations amongst all the attendees, but without a heavy slate of meetings. It really gave people a chance to catch up with old friends, make new acquaintances, and speak to other investors about what companies or emerging trends were on their radars. The mood was positive and more constructive, but never got to a euphoria phase. In general most companies and investors were noting the solid price action in the metals and many mining stocks, and felt the bull market move was well underway, but that better days were ahead of us.

Day 2 was 1-on-1 meetings much like the Beaver Creek and Energy Transition Metals Summit formats. Personally, I took a dozen official sit-down meetings with company management teams, and will be bringing some of those ideas to readers here in the fullness of time.

For now I’ll share a sneak preview of the companies I met with:

Amex Exploration, Denarius Metals, Sonoro Gold, Element79 Gold, PTX Metals, 1911 Gold, Golden Cariboo Resources, First Tellurium, iMetal Resources, Foran Mining, Peninsula Energy, Collective Mining.

Unofficially I also got brief updates on Dolly Varden Silver, Goliath Resources, Stillwater Critical Minerals, Metallic Minerals, Libero Copper, Strikepoint Gold, NexGold, Forum Energy, Vox Royalty, and AbraSilver since they were also attending the conference.

Day 3 was lectures for the first half of the day, ranging from gold/silver/uranium/critical minerals commentary to technical analysis and downstream industry talks. Then this was all followed by afternoon networking, more mixers, and breakout dinners that evening.

Over at the KE Report over the last week, I’ve conducted 2 interviews with sector friends and colleagues in the resource investing space, Robert Sinn (aka Goldfinger) and Erik Wetterling (aka The Hedgeless Horseman). We get deeper into some of our key takeaways from the events, and Robert and Erik also outline some key fundamental factors on their radars, and some resource company news that has their attention that may give readers here a few ideas on other companies to put onto watchlists.

Robert Sinn – Sentiment Is Bullish, But Not Euphoric In Gold, Silver, Copper, and Uranium - 10-24-2024

Erik Wetterling – Commodities Global Expo, Value Proposition in Golden Cariboo, Denarius, Sonoro, Amex - 10-29-2024

I would encourage readers to make it out to future sector conferences (there are tons of them in multiple countries now) from small boutique events all the way up through massive events. Sometimes just the scuttlebutt and gossip and breaking news on companies is really worth it’s weight in gold, and can give folks an edge on the masses.

Alright, it’s time to get into the commodities charts and price action…

Let’s kick things off with the 15-minute chart of gold futures, that shows the yellow metal at $2,792 and some change… after just popping up over $2,794.

Gold is within range of breaking $2,800 here as I write this. Impressive!

Let’s now get into the daily chart for gold futures which has has continued plowing higher and higher, making a series of all-time highs for the last year or so. It has remained a thing of beauty…

When we look at the epic move gold pricing has made from it’s November 2022 bottom of $1618.30, up to yesterday’s intraday high of $2781.10, up over $1,162.80 from low to high (up 71.85%) it is hard not to be impressed.

Gold remains solidly above it’s 50 day Exponential Moving Average (EMA), and remains in a legitimate bullish posture on the daily chart, and is just now getting overbought with an RSI reading at 71.22.

The question comes down to what will sustain the move higher in gold?

Continued central bank buying?

Central banks easing monetary policy globally?

Geopolitical flare ups and tensions?

Eastern investment demand staying robust?

Western investment demand growth?

It is going to be instructive to see where gold closes this month of October on Thursday the 31st (Halloween). Will it be a trick or will it be a treat?

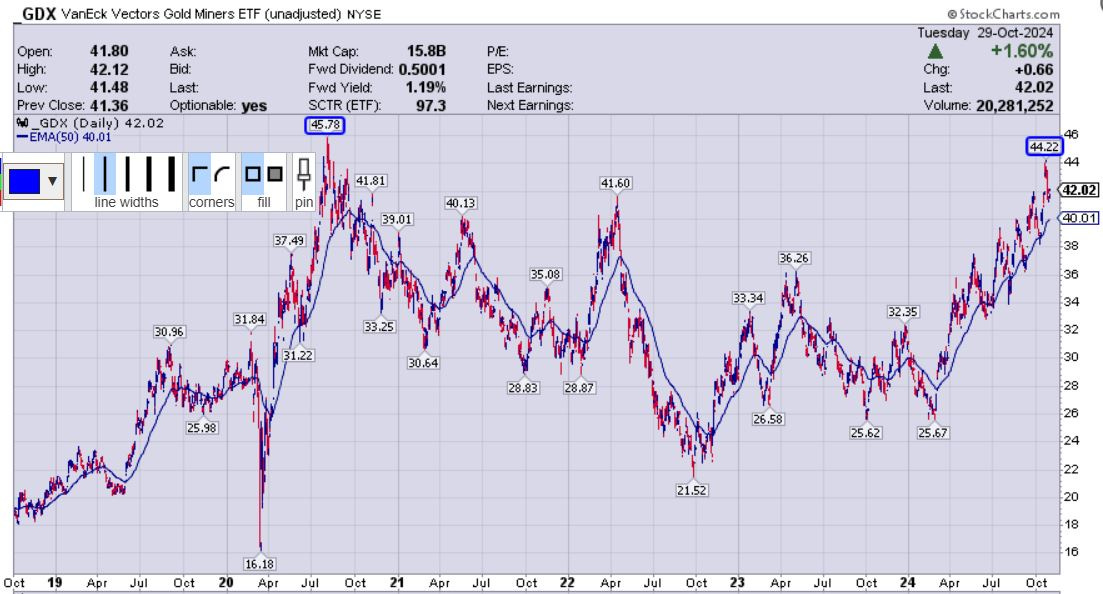

Now let’s have a look at the gold producers by way of the ETF (GDX). However, we must take into account that with Newmont Mining getting pummeled the end of last week on it missing earnings expectations, and with (NYSE: NEM) having an outsized 12.5% weighting inside of (GDX), it’s weakness clearly caused some sympathetic selling in other gold stocks held in the ETF, muting and masking the moves in the gold producers overall.

Over at the KE Report yesterday, on Monday Oct 28th, we spoke to Craig Hemke about GDX, and it’s heavy weighting to Newmont being a drag, but also the close correlation with silver and the constructive progress in the silver chart recently.

This is why I’ve been vocal in the past that “bigger isn’t always better” and that if Newmont can’t seem to meet or exceed market expectations, or control it’s costs, then maybe it should not receive such a large weighting inside the most followed gold producer fund on the planet. There are plenty of larger gold producers like Agnico Eagle, IAMGOLD, Alamos Gold, Wesdome, and even Kinross that are doing a far better job of executing than Newmont. Quality over quantity.

With the highest average margins on record in the gold producers (most well north of $1,000 margins), and gold continuing to make all-time highs, it is befuddling and disappointing to see that GDX can’t even seem to break above the 2020 peak of $45.78, much less the $55-$65 peak pricing zone the ETF hit back in 2010-2012.

There have been pundits claiming that the reason for the underperformance of the gold stocks the last couple of years was “clearly due to margin contraction from rising input costs.” Well, for the most part, producers input costs have consolidated or reduced (unless they’re Newmont), and the metals prices have exploded higher, resulting in undeniable margin expansion.

OK, so where’s the outperformance of GDX? If one thesis is true, then the exact inverse scenario should also be conversely true. Here’s a clue: Margins alone are clearly not the answer. The answer for the underperformance is due to sentiment and a lack of trading momentum.

Yes, the generalists are sidetracked chasing the US equities higher, and have very little interest in gold equities at this time. However, there is still plenty of trading action in GDX every day, even if volumes are lower historically, for the ETF to break to new freakin’ highs…. The fact that GDX hasn’t broken to new highs yet with all the wind at the PM sector’s back is quite telling…. but it is getting close to breaking above that 2020 peak. Bulls will want to see a decisive close in (GDX) above $45.78 to get more momentum investors into the trade.

One encouraging area of the precious metals complex has been Silver over the last few weeks; finally breaking above that lateral price resistance at $32.50, punching up to $35.07. That’s a level it’s not seen since 2012… so very encouraging. But still, it stopped short of taking out the $35.44 prior peak in 2012. Come on’ - Let’s go silver…

It does appear that silver is continuing to make a large rounded bottom from it’s prior highs in 2011 of $49.82 up through current pricing, and also from that 2012 prior peak of $35.44 hit right before it fell out of bed in 2013 down into the teens. If silver pricing does keep riding the pricing curve higher then many technician’s targets of $38+ seem quite doable. It has been nice to see the strength in silver has brought back some animal spirits into the silver equities and even the quality gold stocks.

Now, let’s check in on Doctor Copper:

After some blistering runs higher off the 2020 pandemic crash low of $1.97 to the peaks in 2022 at $5.04, and then a new all-time high of $5.20 in May of 2024, we can see that copper has been in an overall uptrend the last few years.

However it has been whipsawing back and forth much of that time but still over the last 2 year years putting in a pattern of higher lows from $3.13, to $3.24, to $3.52, to $3.92, and now it has been up in the low $4’s which if it bottoms and turns higher here will be another higher low. We’ll need to see confirmation of that, but it is interesting that pricing closed today on Tuesday the 29th at $4.36, precisely at the 50-day EMA also currently at $4.36. Even if pricing breaks back below this support level briefly, if it puts in a new low anywhere above $3.92, (preferably in the low $4’s) then it will be a bullish signal for higher levels.

Now, let’s finish up with the uranium equities by way of the ETF (URNM).

By the way, the reason I don’t fool with posting the Uranium pricing chart is that it is a very opaque market, where different services may have differing spot values, or term prices, but the truth is that very few investors trade uranium anyway. If they investors do want to trade a rough equivalent to uranium spot prices then the Sprott Physical Uranium Trust (U-UN.TO) is the best way to do so. For everybody else, we play this sector through the uranium equities. (URNM) has a heavy allocation to the Sprott Physical Uranium Trust inside it as well, so this is why it is a superior ETF for tracking this sector. (Yes, even better than URA).

It is puzzling to me when people have all these crazy narratives and start dates from when the uranium equities bull market began or how long it’s been going on for. The clear Major Low in (URNM) was in the March 2020 pandemic crash like so many other sectors. That low in (URNM) was $6.87 and it rallied for the last 4 years up to a peak this summer at $60.17, for a roughly 876% gain… and that’s just the diversified ETF. Many individual stocks made 10x-20x moves!

Now understandably, after moves like that many resource investors would be thinking that maybe things are nearing the end of the road. The reality is that nuclear power fundamentals just keep getting better and better, providing even more tailwinds to the uranium equities. This bull could run for years…

Now sure, over the summer months there was a huge slide lower in U-stocks, with URNM cratering from $60.17 down to $37.00, before starting base and form an intermediate bottom.

However, we saw a very nice rally in September, that gave a little bit back throughout October, but pricing in URNM closed today at $48.82, above the 50-day EMA (currently at $46.90), so it’s regained and held onto a bullish posture the last 2 months.

A break below the 50-day EMA, will set up lower support levels at the 144-day and 200-day EMAs, but for now, bulls are still in control.

We saw a flurry of giant tech companies like Microsoft, Amazon, Google, and Databank come out and commit to powering their A.I. future through embracing nuclear power plants (either restarting old plants or planning for small modular reactors). Two weeks back on Oct 17th, I had a fantastic conversation with Fabi Lara, founder of The Next Big Rush. We dive into the nuclear power and uranium fundamentals, but then also review the opportunities in the uranium equities.

That’s it for this commodities update, but there will be a number of company deep dives and news updates in gold, silver, copper, and uranium stocks slated for upcoming articles, so stay tuned for more tantalizing trade ideas.

Thanks for reading and may you have prosperity in your trading and in life!

Shad